China Electric Vehicle Industry Report, 2014-2015

-

Apr.2015

- Hard Copy

- USD

$2,500

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,350

-

- Code:

YSJ085

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

2014 may be called the “first year” of the development of Chinese electric vehicles, with annual sales reaching 74,763, 3.2 times higher than in 2013. With the ascent in the global electric vehicle market, China becomes the second largest market in the world after the United States, eyeing 23.5% market share. Among the top 20 most popular models in 2014, BYD Qin, Kandi K10, Chery QQ3 EV, Zotye E20, BAIC E150 EV and BYD e6 came from China, representing a combined 15.3% share of total sales in the global market.?

In terms of market segments:

Almost 34,000 Chinese BEV passenger cars were sold in 2014, surging by 190% year on year; popular models were, in order, Chery QQ3EV, Zotye E20, BAIC E150 EV, BYD E6, JAC iEV4, and Zotye Cloud 100 with their market share totaling as high as 85%. BEV as the ultimate goal of China’s new energy vehicle development will still see new models launched by companies for participation in market competition.

In 2014, China recorded PHEV passenger car sales of 17,500, 123 times that in 2013. In today’s Chinese PHEV passenger car market, there are mainly BYD Qin and Roewe 550 plug-in with the former holding a dominant position with sales of 14,747. In 2015, Chang’an Automobile, Dongfeng Motor, GAC, Volvo, etc. are planning to launch PHEV models, which will intensify market competition. At the same time, companies affected by the policy are expected to turn to the development of EREV (extended range electric vehicle) models.

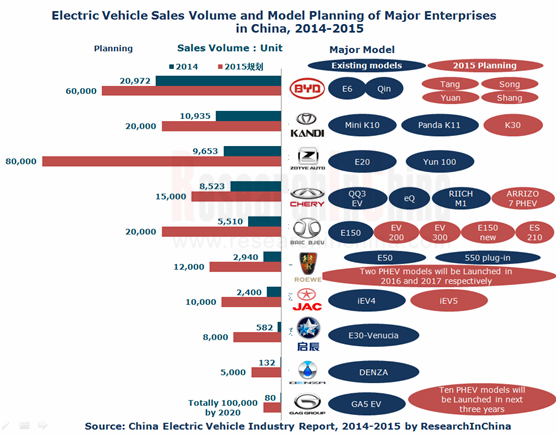

In the aspect of corporate development, Zotye, BYD, BAIC, Kandi, etc. have made plans for electric car sales target and models in 2015. Among them, Zotye shows the highest target of 80,000 in sales by continuing to rely on its two main models i.e. E20 and Cloud 100 with 50,000 and 30,000, respectively.

?

As the biggest winner in China’s EV market, BYD sold an accumulative of 20,972 electric cars in 2014, with its market share rising to 28.05%; there are mainly Qin (plug-in), E6 (BEV) and DENZA (BEV, a joint venture brand) in passenger vehicle market, K9 (battery-electric bus) and J9 (heavy battery-electric truck) in commercial vehicle market. In 2015, BYD continues to focus on the passenger vehicle market by launching Tang (Q1, mid-size SUV), Shang (Q2, MPV), Song (Q3, compact SUV) and Yuan (Q4, small SUV) quarter by quarter.

Kandi, a dark horse in China’s EV market, obtained the qualification for producing electric cars with the help of Geely Automobile. In 2014, it posted sales of 10,935, second only to BYD. Concerning its two EV models i.e. Mini K10 and Panda K11, the former is self-produced by Kandi while the latter in the light of Geely Panda. In July 2013, Kandi and Geely were pioneered in China’s “micro-bus” mode in Hangzhou and promoted the business model of by-hour lease which was later copied to Shanghai, Chengdu, Nanjing, Guangzhou, Wuhan, Changsha, Changzhou, etc. in succession. By the end of 2014, Kandi’s micro-bus project has launched a total of 14,398 electric cars.

The New BEV Passenger Car Production Enterprise Investment Projects and Rules on the Production Admission Administration has completed opinion collection in March 2015 and is expected to be introduced within the year. In accordance with the opinion draft, there is hope of loosening electric car production qualification in China, Then parts manufacturing firms (e.g. Wanxiang), internet companies (e.g. Letv), low-speed electric car companies (e.g. Yogomo) and other non-traditional car companies are likely to get the electric car production license, and Chinese electric vehicle market will present the characteristics of diversification.

The report highlights the followings:

Policy environment for China’s electric vehicle market;

Policy environment for China’s electric vehicle market;

Global and China’s electric vehicle market sales, and sales of main models;

Global and China’s electric vehicle market sales, and sales of main models;

China’s electric vehicle market structure and competition pattern;

China’s electric vehicle market structure and competition pattern;

Sales, main models, and import market of two segments i.e. BEV passenger car and PHEV passenger car in China;

Sales, main models, and import market of two segments i.e. BEV passenger car and PHEV passenger car in China;

Major companies in China’s electric car infrastructure and key components;

Major companies in China’s electric car infrastructure and key components;

Development of electric vehicle demonstration cities in China;

Development of electric vehicle demonstration cities in China;

EV development, products, sales, development strategy, etc. of major companies in China.

EV development, products, sales, development strategy, etc. of major companies in China.

1. Overview of Electric Vehicle Industry

1.1 Introduction and Classification of Electric Vehicle

1.1.1 Introduction

1.1.2 Classification

1.1.3 Technology Roadmap

1.2 Industry Chain

2. Policy Environment for Electric Vehicle Industry

2.1 Fiscal Subsidy Policy

2.2 Demonstration & Promotion Policy

2.3 Preferential Tax Policy

2.4 Production Permission Policy

3. Electric Vehicle Market

3.1 Sales Volume

3.1.1 Global

3.1.2 China

3.1.3 Comparison between China and Foreign Countries

3.2 Competition Pattern

3.3 Market Structure

3.4 Import Market

3.4.1 BEV

3.4.2 PHEV

3.5 Infrastructure

3.5.1 Charging Station

3.5.2 Charging Pile

3.5.3 Development Planning

3.6 Key Parts

3.6.1 Battery

3.6.2 Motor

3.6.3 Inverter

3.6.4 IGBT

4. China Electric Passenger Vehicle Market

4.1 BEV Passenger Car

4.1.1 Sales Volume

4.1.2 Release

4.1.3 Competition Pattern

4.2 PHEV Passenger Car

4.2.1 Sales Volume

4.2.2 Release

4.2.3 Competition Pattern

5. Electric Vehicle Demonstration City

5.1 Municipality

5.1.1 Beijing

5.1.2 Tianjin

5.1.3 Shanghai

5.1.4 Chongqing

5.2 Urban Agglomeration

5.2.1 Hebei Urban Agglomeration

5.2.2 Zhejiang Urban Agglomeration

5.2.3 Fujian Urban Agglomeration

5.2.4 Jiangxi Urban Agglomeration

5.2.5 Guangdong Urban Agglomeration

5.2.6 Guizhou Urban Agglomeration

5.2.7 Yunnan Urban Agglomeration

5.2.8 Inner Mongolia Urban Agglomeration

5.2.9 Jiangsu Urban Agglomeration

5.2.10 Chang-Zhu-Tan Region

5.3 Other Cities

5.3.1 Hefei (Anhui Province)

5.3.2 Wuhu (Anhui Province)

5.3.3 Taiyuan (Shanxi Province)

5.3.4 Jincheng (Shanxi Province)

5.3.5 Zhengzhou (Henan Province)

5.3.6 Xinxiang (Henan Province)

5.3.7 Wuhan (Hubei Province)

5.3.8 Xiangyang (Hubei Province)

5.3.9 Guangzhou (Guangdong Province)

5.3.10 Shenzhen (Guangdong Province)

5.3.11 Qingdao (Shandong Province)

5.3.12 Zibo (Shandong Province)

5.3.13 Linyi (Shandong Province)

5.3.14 Weifang (Shandong Province)

5.3.15 Liaocheng (Shandong Province)

5.3.16 Dalian (Liaoning Province)

5.3.17 Shenyang (Liaoning Province)

5.3.18 Changchun (Jilin Province)

5.3.19 Harbin (Heilongjiang Province)

5.3.20 Haikou (Hainan Province)

5.3.21 Chengdu (Sichuan Province)

5.3.22 Luzhou (Sichuan Province)

5.3.23 Xi'an (Shaanxi Province)

5.3.24 Lanzhou (Gansu Province)

5.3.25 Kunming (Yunnan Province)

5.3.26 Ningbo (Zhejiang Province)

6. Major Electric Vehicles Manufacturers in China

6.1 SAIC Motor

6.1.1 Profile

6.1.2 Operation

6.1.3 Electric Vehicle Products

6.1.4 Electric Vehicle Sales

6.1.5 Strategy for Electric Vehicle Development

6.2 FAW Group

6.2.1 Profile

6.2.2 Operation

6.2.3 Electric Vehicle Products

6.2.4 Strategy for Electric Vehicle Development

6.2.5 FAW Car

6.2.6 FAW Haima

6.2.7 FAW Toyota

6.2.8 FAW-Volkswagen

6.3 Dongfeng Motor Corporation

6.3.1 Profile

6.3.2 Operation

6.3.3 Electric Vehicle Products

6.3.4 Strategy for Electric Vehicle Development

6.4 BYD

6.4.1 Profile

6.4.2 Operation

6.4.3 Electric Vehicle Products

6.4.4 Electric Vehicle Sales

6.4.5 Model Planning

6.4.6 Strategic Layout

6.4.7 Overseas Market

6.4.8 DENZA

6.5 Chang’an Automobile

6.5.1 Profile

6.5.2 Operation

6.5.3 Electric Vehicle Products

6.5.4 Strategy for Electric Vehicle Development

6.6 Chery Automobile

6.6.1 Profile

6.6.2 Operation

6.6.3 Electric Vehicle Products

6.6.4 Strategy for Electric Vehicle Development

6.6.5 by iVokaOS

6.7 Geely Automobile

6.7.1 Profile

6.7.2 Operation

6.7.3 Electric Vehicle Products

6.7.4 Joint Ventures

6.7.5 Strategy for Electric Vehicle Development

6.8 BAIC Group

6.8.1 Profile

6.8.2 Operation

6.8.3 Electric Vehicle Products

6.8.4 Electric Vehicle Sales

6.8.5 Planning for Electric Vehicle Development

6.8.6 Joint Ventures

6.9 GAC Group

6.9.1 Profile

6.9.2 Operation

6.9.3 Electric Vehicle Products

6.9.4 Strategy for Electric Vehicle Development

6.10 Brilliance Auto

6.10.1 Profile

6.10.2 Operation

6.10.3 Electric Vehicle Products

6.10.4 Strategy for Electric Vehicle Development

6.11 Great Wall Motors

6.11.1 Profile

6.11.2 Operation

6.11.3 Electric Vehicle Products

6.11.4 Strategy for Electric Vehicle Development

6.12 JAC Motors

6.12.1 Profile

6.12.2 Operation

6.12.3 Electric Vehicle Products

6.12.4 Strategy for Electric Vehicle Development

6.13 Kandi

6.13.1 Profile

6.13.2 Operation

6.13.3 Electric Vehicle Products

6.13.4 Strategy for Electric Vehicle Development

6.14 Zotye

6.14.1 Profile

6.14.2 Electric Vehicle Products

6.14.3 Strategy for Electric Vehicle Development

7. Market Summary

7.1 BYD Occupying the First Position

7.2 2015 Sales Target and Model Planning Released by Companies

7.3 Leasing Model Increasingly Popular

7.4 Joint-Venture Independent Brands Continuously Launched

Main Types of New Energy Vehicle

Classification of Hybrid Electric Vehicle

Technical Focal Points for Electric Vehicle in Major Countries or Regions

Technology Roadmap of New Energy Vehicle in China

Electric Vehicle Industry Chain

Comparison between China's New and Old Electric Vehicle Subsidy Policies

Public Subsidy Standards for Electric Passenger Vehicle in China, 2013-2015

Public Subsidy Standards for Electric Bus in China, 2013-2015

Public Subsidy Standards for Electric Passenger Vehicle in China, 2016

Public Subsidy Standards for Electric Bus in China, 2016

List of First-Batch New Energy Vehicle Promotion & Application Cities/Regions

List of Second-Batch New Energy Vehicle Promotion & Application Cities/Regions

China's New Energy Vehicle Demonstration City Promotion Plan, 2014-2015

Comparison between ICE and EV Taxes in China

Catalogue of First-Batch New-energy Vehicles Exempt from Purchase Tax

Catalogue of Second-Batch New-energy Vehicles Exempt from Purchase Tax

Catalogue of Third-Batch New-energy Vehicles Exempt from Purchase Tax

Global Electric Vehicle Sales, 2011-2018E

Top 20 Global Electric Vehicle Sales, 2014

China’s Electric Vehicle Sales, 2011-2018E

% of China’s Electric Vehicle in, 2011-2014

Proportion of China’s Electric Vehicle in Auto Market, 2011-2014

Proportion of American Electric Vehicle in Auto Market, 2011-2013

Comparison between Chinese and American Electric Vehicle Sales, 2011-2014

China’s Mainstream Electric Vehicle Sales Ranking, 2014

China’s Electric Vehicle Market Structure by Power Type, 2011-2018E

China’s Electric Vehicle Market Structure by Model, 2011-2018E

Import Volume of China’s Main BEV Passenger Cars, 2014-2015

Imported BEV Planned to Enter the Chinese Market (Including Those Launched)

Imported PHEV (Including Range-extended) Planned to Enter the Chinese Market (Including Those Launched)

Foreign PHEV Planned to Be Made in China

Number of EV Charging Stations in China, 2010-2014

Number of EV Charging Stations in Major Cities of China, 2014

Number of EV Charging Piles in China, 2010-2014

Number of EV Charging Piles in Major Cities of China, 2014

Planning for State Grid EV Charging Station Construction, 2009-2020

Major Power Lithium Battery Companies in China

Major Drive Motor Companies in China and Their Customers

Major EV Inverter Companies in China

Major EV IGBT Companies Worldwide

China’s BEV Passenger Car Sales, 2013-2018E

Release of Major Chinese BEV Passenger Cars

China’s BEV Passenger Car Sales by Model, 2012

China’s BEV Passenger Car Sales by Model, 2013

China’s BEV Passenger Car Sales by Model, 2014

China’s PHEV Passenger Car Sales, 2013-2018E

Release of Major Chinese BEV Passenger Cars

China’s PHEV Passenger Car Sales by Model, 2013

China’s PHEV Passenger Car Sales by Model, 2014

Automobile Production and Sales of SAIC Motor, 2010-2015E

Revenue and Net Income of SAIC Motor, 2010-2014

Gross Margin of SAIC Motor, 2010-2014

Revenue of SAIC Motor by Product, 2010-2014

Gross Margin of SAIC Motor by Product, 2010-2014

Main Electric Vehicle Products of SAIC Motor and Its Joint Ventures

Electric Vehicle Production and Sales of SAIC Motor, 2012-2015E

Planning for SAIC Roewe Electric Vehicles

Automobile Production and Sales of FAW Group, 2010-2015E

Revenue of FAW Group, 2009-2013

Main Electric Vehicle Products of FAW Group and Its Joint Ventures

Production and Sales of Dongfeng Motor, 2010-2015E

Revenue and Net Income of Dongfeng Motor, 2010-2014

Gross Margin of Dongfeng Motor, 2010-2014

Revenue of Dongfeng Motor by Product, 2010-2014

Gross Margin of Dongfeng Motor by Product, 2010-2014

Main Electric Vehicle Products of Dongfeng Motor and Its Joint Ventures

Automobile Production and Sales of BYD, 2010-2015E

Revenue, Net Income and Gross Margin of BYD, 2010-2014

Gross Margin of BYD, 2010-2014

Revenue of BYD by Product, 2010-2014

Gross Margin of BYD by Product, 2010-2014

Main Electric Vehicle Products of BYD

Electric Vehicle Sales of BYD, 2013-2018E

Electric Vehicle Sales Structure of BYD, 2014

Supply Chain of Core Parts for BYD Electric Vehicle

Planning for BYD Electric Vehicle Model, 2015

Production and Sales of Chang’an Automobile, 2010-2015E

Revenue and Net Income of Chang’an Automobile, 2010-2014

Net Income of Chang’an Automobile, 2010-2014

Total Assets, Revenue and Net Income of Chongqing Changan New Energy Automobile, 2009-2013

Main Electric Vehicle Products of Chang’an Automobile

Production and Sales of Chery Automobile, 2010-2015E

Main Electric Vehicle Products of Chery Automobile

Electric Vehicle Production and Sales of Chery Automobile, 2011-2015E

Automobile Production and Sales of Geely, 2010-2015E

Revenue and Net Income of Geely, 2009-2014

Main Electric Vehicle Products of Geely

Automobile Production and Sales of BAIC Group, 2010-2015E

Revenue and Total Profit of BAIC Group, 2009-2014

Main Electric Vehicle Products of BAIC Group

Production and Sales of BAIC E150 EV, 2012-2015E

Joint Ventures of BAIC BJEV

Automobile Production and Sales of GAC Group, 2010-2015E

Revenue and Net Income of GAC Group, 2011-2014

Gross Margin of GAC Group, 2011-2014

Main Electric Vehicle Products of GAC Group

Production and Sales of Brilliance Auto, 2010-2015E

Revenue of Brilliance Auto, 2012-2014

Main Electric Vehicle Models of Brilliance Auto

Production and Sales of Great Wall Motors, 2010-2015E

Revenue and Net Income of Great Wall Motors, 2010-2014

Gross Margin of Great Wall Motors, 2010-2014

Main Electric Vehicle Models of Great Wall Motors

Production and Sales Volume of JAC Motors, 2010-2015E

Revenue and Net Income of JAC Motors, 2010-2014

Gross Margin of JAC Motors, 2010-2014

Main Electric Vehicle Products of JAC Motors

Ownership Structure of Kandi

Financial Indicators of Kandi, 2012-2014

Automobile Sales of Kandi, 2010-2014

Main Electric Vehicle Products of Kandi

Kandi Electric Micro-bus Layout in China

Automobile Production and Sales of Zotye, 2010-2015E

Electric Vehicle Market Share of Major Companies in China, 2014

Electric Vehicle Sales and Model Planning of Major Companies in China, 2015

Major Electric Vehicle Rental Cases in China

Joint-Venture Independent Electric Vehicle Brands in China

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...