Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

-

Aug.2015

- Hard Copy

- USD

$2,200

-

- Pages:90

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

BXM082

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,200

-

- Hard Copy + Single User License

- USD

$2,400

-

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great upsurge in substitution of aluminum alloy automotive sheet for the traditional sheet materials like steel products has been gradually on the rise.

At present, automotive covering parts including engine hood and luggage-boot lid mostly adopt aluminum sheets. Meanwhile, more and more auto markers developed all-aluminum car bodies and applied then in, say, Audi A2 / A8 R8, Range Rover, BMW Z8, Jaguar XJ/XK/XE, Tesla Model S, Ford F-150, Honda NSX, etc.

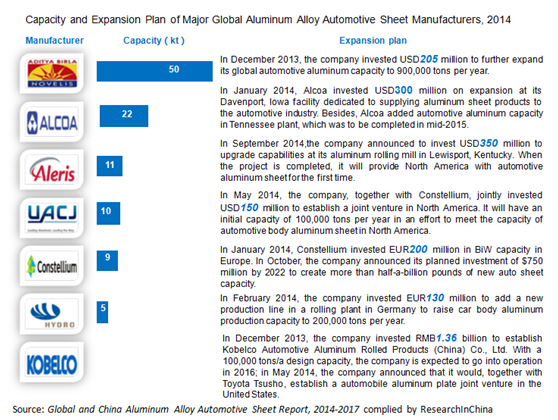

To meet the increasing market demand, some international aluminum giants such as Novelis, Kobe Steel, Constellium, Aleris, and ALCOA have expanded the production of aluminum alloy automotive sheet and are involved in auto markers’ development of aluminum alloy car body.

By contrast, restricted by high threshold in technological development, China has presented a gap in production of aluminum alloy automotive sheet, especially that for car body. At the end of 2009, however, Southwest Aluminum constructed the first car body aluminum alloy sheet production line in China, and achieved small-batch trial production. Nevertheless, no domestic company can systematically grasp the technologies for mass producing aluminum alloy automotive sheet, let alone the application in car body with the independent brands.

China, though the world's largest car producer, has a substantial gap with international markets in aluminum alloy automotive sheet, a situation that reflects that the country has a great market potential. In addition, China required that by 2020 the average fuel consumption will fall to 5.0 liters / 100 km, which will further stimulate the growth of its aluminum alloy automotive sheet market. It is projected that China’s growth in the demand for aluminum alloy automotive sheet will stand at over 20% in 2015-2020.

The report highlights the followings:

Market supply & demand and enterprise pattern of global aluminum alloy automotive sheet as well as the development of Japan, the United States, and Europe.

Market supply & demand and enterprise pattern of global aluminum alloy automotive sheet as well as the development of Japan, the United States, and Europe.

Policies, market supply & demand, enterprise pattern, key projects, etc. of aluminum alloy automotive sheet in China;

Policies, market supply & demand, enterprise pattern, key projects, etc. of aluminum alloy automotive sheet in China;

Operation, aluminum alloy automotive sheet business, key projects, etc. of 7 global and 7 Chinese enterprises.

Operation, aluminum alloy automotive sheet business, key projects, etc. of 7 global and 7 Chinese enterprises.

1 Overview of Aluminum Alloy Automotive Sheet

1.1 Product Introduction

1.2 Classification and Application

1.3 Industry Chain

2 Development of Global Aluminum Alloy Automotive Sheet Industry

2.1 Overview

2.2 Production

2.3 Demand

2.3.1 Demand Volume

2.3.2 Demand Structure

2.3.3 Major Customers

2.4 Major Countries/Regions

2.4.1 USA

2.4.2 Europe

2.4.3 Japan

2.5 Enterprise Pattern

3 Development of China Aluminum Alloy Automotive Sheet Industry

3.1 Development Environment

3.1.1 Policy Environment

3.1.2 Industrial Environment

3.2 Production

3.2.1 Capacity

3.2.2 Production Structure

3.3 Demand

3.3.1 Application

3.3.2 Quantity Demanded

3.4 Competition

3.4.1 Enterprise Competition

3.4.2 Market Competition

3.5 Key Projects Planned and under Construction

4 Major Global Aluminum Alloy Automotive Sheet Manufacturers

4.1 ALCOA

4.1.1 Profile

4.1.2 Operation

4.1.3 Aluminum Alloy Automotive Sheet Business

4.1.4 Development in China

4.2 Constellium

4.2.1 Profile

4.2.2 Operation

4.2.3 Aluminum Alloy Automotive Sheet Business

4.2.4 Development in China

4.3 Norsk Hydro

4.3.1 Profile

4.3.2 Operation

4.3.3 Aluminum Alloy Automotive Sheet Business

4.3.4 Development in China

4.4 Aleris

4.4.1 Profile

4.4.2 Operation

4.4.3 Aluminum Alloy Automotive Sheet Business

4.4.4 Development in China

4.5 Novelis

4.5.1 Profile

4.5.2 Operation

4.5.3 Aluminum Alloy Automotive Sheet Business

4.6 Kobe Steel

4.6.1 Profile

4.6.2 Operation

4.6.3 Aluminum Alloy Automotive Sheet Business

4.6.4 Development in China

4.7 UACJ

4.7.1 Profile

4.7.2 Operation

4.7.3 Aluminum Alloy Automotive Sheet Business

5 Key Chinese Aluminum Alloy Automotive Sheet Manufacturers

5.1 Weifang Sanyuan Aluminum Co., Ltd.

5.1.1 Profile

5.1.2 Aluminum Alloy Automotive Sheet Projects

5.2 Northeast Light Alloy Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Aluminum Alloy Automotive Sheet Business

5.3 Southwest Aluminum (Group)Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Aluminum Alloy Automotive Sheet Business

5.4 Jiangsu CAIFA Aluminum Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Aluminum Alloy Automotive Sheet Business

5.5 Jiangsu Alcha Aluminum Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Aluminum Alloy Automotive Sheet Business

5.6 China Zhongwang Holdings Limited

5.6.1 Profile

5.6.2 Operation

5.6.3 Aluminum Alloy Automotive Sheet Business

5.7 Mingtai Aluminum Industry Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Aluminum Alloy Automotive Sheet Business

6 Summary and Forecast

6.1 Market

6.2 Enterprise

Aluminum Alloy Automotive Sheet Products (Auto Parts)

Application of Aluminum Alloy on Auto Cover

Aluminum Alloy Automotive Sheet Industry Chain

History of Aluminum Alloy Application in Automotive Industry

Weight Comparison among Aluminum, Cast Iron and Steel Auto Parts

Main Applications of Aluminum Alloy Automotive Sheet

Forming Performance Comparison between Car Body Aluminum Alloy Plate and Steel Plate

Proposed/Ongoing Aluminum Alloy Automotive Sheet Projects of Major Global Enterprises, 2015-2016E

Global Aluminum Alloy Automotive Sheet Capacity, 2010-2017E

Global Automobile Output, 2008-2017E

Automotive Emission Reduction Targets by Countries

Unit Usage of Aluminum Alloy in Global Vehicle Products, 2009-2020E

Global Demand for Aluminum Alloy Automotive Sheet, 2006-2020E

Global Demand for Aluminum Alloy Automotive Sheet by Region, 2011-2015

Global Demand for Aluminum Alloy Automotive Sheet for Car Body, 2011-2017E

Car Body Aluminum Alloy Parts Developed by Automakers Worldwide, 2000-2015

Unit Usage of Aluminum Alloy in Vehicle Products in the U.S., 2008-2015

Structure for Automotive Aluminum Alloy Products in the U.S., 2014

Vehicle Production and Automotive Aluminum Alloy Sheet Demand in the U.S., 2011-2015

Unit Usage of Aluminum Alloy in Vehicle Products in Europe, 2008-2015

Structure for Automotive Aluminum Alloy Products in Europe, 2014

Vehicle Production and Automotive Aluminum Alloy Sheet Demand in Europe, 2011-2015

Unit Usage of Aluminum Alloy in Vehicle Products in Japan, 2008-2015

Structure for Automotive Aluminum Alloy Products in Japan, 2014

Vehicle Production and Automotive Aluminum Alloy Sheet Demand in Japan, 2011-2015

Capacity and Customers of Major Global Automotive Aluminum Alloy Sheet Manufacturers, 2014

Policies on Aluminum Alloy Automotive Sheet Industry in China, 2010-2015

Average Fuel Consumption Limit for Passenger Vehicles in China, 2015-2020E

China’s Vehicle Output by Product, 2008-2017E

Aluminum Processing Product Output in China, 2008-2017E

China’s Rolled Aluminum Output by Product, 2008-2015

Capacity of Aluminum Alloy Automotive Sheet in China, 2009-2017E

Unit Usage of Aluminum Alloy in Vehicle Products in China, 2006-2017E

Demand for Aluminum Alloy Automotive Sheet in China, 2010-2017E

Capacity of Major Chinese Aluminum Alloy Automotive Sheet Manufacturers, 2014

Key Proposed/Ongoing Aluminum Alloy Automotive Sheet Projects in China, 2014-2015

ALCOA’s Employees Worldwide, 2012-2014

Revenue and Net Income of ALCOA, 2010-2015

ALCOA’s Revenue by Country, 2012-2014

Revenue and After-tax Profit of ALCOA by Business, 2011-2014

ALCOA’s Rolled Aluminum Manufacturing Plants and Their Products, 2014

Major Clients and Products of ALCOA’s Aluminum Alloy Automotive Sheet Business

ALCOA’s Revenue from Aluminum Alloy Automotive Sheet, 2013-2018E

ALCOA’s Plants and Business in China, 2014

ALCOA’s Revenue in China, 2009-2014

Constellium’s Production Bases

Constellium’s Revenue, 2010-2016E

Constellium’s Revenue by Business, 2012-2014

Constellium’s Aluminum Alloy Automotive Sheet Products

Constellium’s Investment in Aluminum Alloy Automotive Sheet, 2014

Constellium’s Production Bases in China

Revenue and Net Income of Hydro, 2009-2014

Revenue Structure of Norsk Hydro by Region, 2014

Norsk Hydro’s Main Product Sales Volume, 2011-2014

Norsk Hydro’s Major Rolled Aluminum Production Bases and Capacity, 2014

Output of Norsk Hydro’s Aluminum Alloy Automotive Sheet Production Bases, 2013-2014

Application of Hydro’s Aluminum Alloy Automotive Sheet Products by Model

Norsk Hydro’s Plants in China, 2014

Aleris’ Production Bases Worldwide

Aleris’ Revenue and Net Income, 2010-2014

Aleris’ Revenue by Region, 2012-2014

Aleris’ Revenue Structure by Application, 2014

Aleris’ Major Clients and Competitors in Aluminum Alloy Automotive Sheet Business, 2014

Novelis’ Competitive Edge, 2014

Distribution of Novelis’ Production Bases, 2014

Novelis’ Revenue and Net Income, FY2010-FY2015

Novelis’ Rolled Aluminum Product Shipments by Region, FY2013-FY2015

Novelis Rolled Aluminum Product Shipment Structure by Business, FY2014-FY2015

Application of Novelis’ Aluminum Alloy Automotive Sheet Products

Novelis’ Aluminum Alloy Automotive Sheet Production Bases and Major Customers, 2015

Novelis’ Global Aluminum Alloy Automotive Sheet Capacity, 2015

Kobe Steel’s Revenue and Net Income, FY2009-FY2014

Kobe Steel’s Revenue by Business, FY2013-FY2014

Kobe Steel’s Aluminum Bronze \Production Bases in China, 2014

UACJ’s Business and Products

UACJ’s Main Economic Indicators, FY2013-FY2014

Performance Index for Furukawa-sky’s Aluminum Alloy Automotive Sheet

Performance Index for Sumitomo Light Metal’s Aluminum Alloy Automotive Sheet

Hardness Comparison of SG112-T4A Automotive Aluminum Sheet of Sumitomo Light Metal with Ordinary Aluminum Sheet

Key Aluminum Alloy Automotive Sheet Projects of Weifang Sanyuan Aluminum

Capacity of Main Products of Northeast Light Alloy, 2014

Applications and Customers of Main Products of Northeast Light Alloy

Affiliated Enterprises and Their Business of Northeast Light Alloy, 2014

Revenue and Total Profits of Northeast Light Alloy, 2009-2014

Performance Comparison between Northeast Light Alloy’s Products and Foreign Products

Aluminum Alloy Plate and Strip Projects of Northeast Light Alloy

Revenue and Net Income of CAIFA Aluminum, 2011-2014

Revenue and Net Income of Alcha Aluminum, 2009-2015

Alcha Aluminum’s Projects under Construction, 2015

Sales Volume and Revenue of Zhongwang Holdings by Business, 2012-2014

Aluminum Plate & Strip Foil Capacity of Zhongwang Holdings, 2015-2018

Revenue and Net Income of Mingtai Aluminum, 2010-2015

Mingtai Aluminum’s 200,000 Tons/a High-precision Traffic-dedicated Aluminum Plate and Strip Project

Capacity and Demand of Aluminum Alloy Automotive Sheet in China, 2010-2017E

Revenue and YoY Growth Rate of Main Aluminum Alloy Automotive Sheet Manufacturers Worldwide, 2014

Global and China Rare Earth Permanent Magnet Industry Report, 2018-2023

Rare earth permanent magnets consist of SmCo permanent magnet and NdFeB permanent magnet among which NdFeB as a kind of 3rd-Gen rare earth permanent magnetic material takes a lion’s share of the marke...

Global and China NdFeB Industry Report, 2018-2023

Featured with strong magnetic energy product and high compacted density, NdFeB is widely used in various fields. The NdFeB industry over the recent years has characterized the following:

First, the N...

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Rare Earth Industry Report, 2014-2018

Rare earth, also known as rare earth metal or rare earth element, collectively refers to lanthanides (including fifteen elements) and closely-related scandium and yttrium. As a crucial strategic resou...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Vanadium Industry Report, 2014-2017

The world’s recoverable vanadium reserves so far has been recorded at 14 million tons, mainly found in China, Russia, South Africa and other countries. In 2013, roughly 151,000 tons of vanadium (V2O5 ...

Global and China Silica(White Carbon Black) Industry Report, 2014-2017

China, the world’s largest silica producer, had silica capacity of 2.20 million tons in 2013, slowing to a year-on-year increase of 8.1% and accounting for 60% of global capacity, of which 2.079 milli...