Global and China Cobalt Industry Report, 2018-2023

-

Oct.2018

- Hard Copy

- USD

$3,200

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

BXM116

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

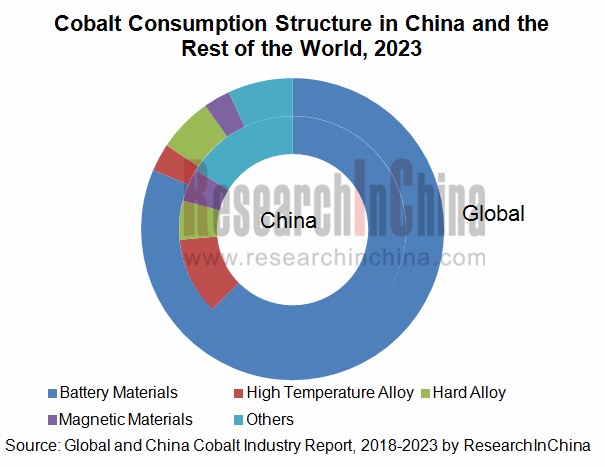

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery globally and even up to 77.4% in China in 2017. The cobalt for the battery will see a rising proportion in future, expected to surpass 62% globally and 81% in China in 2023.

Due to an upsurge in the demand from downstream sectors like smartphone and electric vehicle (EV), global cobalt prices has been on the rise since 2016, doubling in 2017 and peaking at USD43.7/pound in late April 2018. Despite a decline in the second quarter of 2018, the cobalt prices are more likely to climb in the future, as the demand remains strong while the supply is limited.

Cobalt metal is derived from cobalt ore and refined cobalt. Nearly 60% of cobalt ore is contributed by Democratic Republic of the Congo, a country that promulgated new mining law in March 2018 in which cobalt is classified as strategic metal and windfall profits tax and royalties are planned to be imposed on enterprises. The measures will affect the global supply of cobalt and the price trend.

Nearly 98% of cobalt needs to be imported in China. Chinese enterprises invest in cobalt mines and participate in cobalt smelting projects in Democratic Republic of the Congo so as to obtain stable cobalt resources. For example, China Molybdenum now is the world’s second largest cobalt ore producer, only second to Glencore, by acquiring Freeport cobalt ore resources.

China is a major cobalt smelting country in the world with refined cobalt output of 70kt in 2017, 59.5% of the global total, nearly 80kt in 2018 and estimated over 110kt in 2023. At the same time, the country’s cobalt consumption will increase from 59kt in 2017 to around 98kt in 2023.

Global and China Cobalt Industry Report, 2018-2023 highlights the following:

Cobalt ore resources distribution, cobalt ore production & smelting, cobalt consumption & structure, price trend, corporate competition, and development trends worldwide;

Cobalt ore resources distribution, cobalt ore production & smelting, cobalt consumption & structure, price trend, corporate competition, and development trends worldwide;

Cobalt ore resources distribution, cobalt ore production & smelting, cobalt consumption & structure, price trend, product mix, corporate competition, and development trends in China;

Cobalt ore resources distribution, cobalt ore production & smelting, cobalt consumption & structure, price trend, product mix, corporate competition, and development trends in China;

Import and export of main cobalt products (cobalt concentrate, cobalt chloride, cobalt carbonate, cobalt nitrate, and cobalt oxalate) in China;

Import and export of main cobalt products (cobalt concentrate, cobalt chloride, cobalt carbonate, cobalt nitrate, and cobalt oxalate) in China;

Status quo of and demand for cobalt from the downstream industries (battery, hard alloy, high-temperature alloy, rare-earth permanent magnet);

Status quo of and demand for cobalt from the downstream industries (battery, hard alloy, high-temperature alloy, rare-earth permanent magnet);

Five global and fourteen cobalt producers (operation, cobalt business, development strategy, etc.)

Five global and fourteen cobalt producers (operation, cobalt business, development strategy, etc.)

1. Cobalt Overview

1.1 Definition

1.2 Industry Chain

2. Status Quo of Global Cobalt Market

2.1 Cobalt Ore Reserves

2.2 Market Supply

2.2.1 Production of Cobalt Ores

2.2.2 Cobalt Recycling

2.2.3 Cobalt Smelting

2.3 Demand

2.4 Price

2.5 Competition Pattern

2.5.1 Cobalt Ore Enterprises

2.5.2 Refined Cobalt Enterprises

2.6 Development Trend

3. Cobalt Market Development in China

3.1 Overview

3.2 Policy

3.3 Cobalt Ore Resources

3.4 Market Supply and Demand

3.4.1 Supply

3.4.2 Demand

3.4.3 Structure of Supply and Demand

3.5 Price

3.6 Product Structure

3.7 Competition Pattern

3.8 Development Trend

4. China’s Import and Export of Cobalt by Product

4.1 Cobalt Ores and Concentrates

4.1.1 Import

4.1.2 Regional Structure

4.2 Cobaltosic Oxide

4.2.1 Import

4.2.2 Export

4.3 Cobalt Chloride

4.3.1 Import and Export

4.3.2 Regional Structure

4.4 Cobalt Carbonate

4.4.1 Import and Export

4.4.2 Regional Structure

4.5 Cobalt Nitrate

4.5.1 Import and Export

4.5.2 Regional Structure

4.6 Cobalt Oxalate

5. Demand of Main Cobalt Downstream Industries

5.1 Battery Materials

5.1.1 Market Development

5.1.2 Demand for Cobalt

5.2 Hard Alloy

5.2.1 Market Development

5.2.2 Demand for Cobalt

5.3 Magnetic Materials

5.3.1 Market Development

5.3.2 Demand for Cobalt

5.4 Superalloy

5.4.1 Market Development

5.4.2 Demand for Cobalt

6. Major Global Cobalt Manufacturers

6.1 Umicore

6.1.1 Profile

6.1.2 Operation

6.1.3 Cobalt Business (Cobalt Specialty Materials)

6.1.4 Business in China

6.1.5 Development Prospect

6.2 Glencore Xstrata

6.2.1 Profile

6.2.2 Operation

6.2.3 Cobalt Business

6.3 Vale

6.3.1 Profile

6.3.2 Operation

6.3.3 Cobalt Business

6.3.4 Business in China

6.4 Freeport

6.4.1 Profile

6.4.2 Operation

6.4.3 Cobalt Business

6.4.4 Business in China

6.5 Sherritt International

6.5.1 Profile

6.5.2 Operation

6.5.3 Cobalt Business

7. Major Chinese Cobalt Producers

7.1 Shenzhen Green Eco-manufacture Hi-tech

7.1.1 Profile

7.1.2 Operation

7.1.3 Cobalt Business

7.1.4 Development Prospect

7.2 Huayou Cobalt

7.2.1 Profile

7.2.2 Operation

7.2.3 Cobalt Business

7.2.4 Development Strategy

7.3 Jinchuan Group Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Cobalt Business

7.3.4 Development Strategy

7.4 Shandong Jinling Mining

7.4.1 Profile

7.4.2 Operation

7.4.3 Cobalt Business

7.5 Beijing Easpring Material Technology

7.5.1 Profile

7.5.2 Operation

7.5.3 Cobalt Business

7.6 Hanrui Cobalt

7.6.1 Profile

7.6.2 Operation

7.6.3 Cobalt Business

7.6.4 Development Strategy

7.7 China Molybdenum Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Cobalt Business

7.8 Guangdong Silver

7.8.1 Profile

7.8.2 Operation

7.8.3 Cobalt Business

7.9 Ganzhou Tengyun Cobalt New Material Co.,Ltd

7.9.1 Profile

7.9.2 Operation

7.9.3 Cobalt Business

7.10 Ramu Nico Management (Mcc) Limited

7.10.1 Profile

7.10.2 Operation

7.11 Jiangxi Rare Metal Tungsten Industry Holding Group Co., Ltd.

7.11.1 Profile

7.11.2 Jiangxi Jiangwu Cobalt Co., Ltd.

7.11.3 Jiangxi Jiangwu Nickel and Cobalt New Materials Co., Ltd.

7.11.4 Jiangxi Jiangwu International Nickel and Cobalt New Materials Co., Ltd.

7.12 Nantong Xinwei Nickel & Cobalt Hightech Development Co., Ltd.

7.12.1 Profile

7.12.2 Operation

7.13 Guangdong Jiana Energy Technology Co., Ltd.

7.13.1 Profile

7.13.2 Operation

7.13.3 Cobalt Business

7.14 Tianjin Maolian Technology Co.,Ltd

7.14.1 Profile

7.14.2 Cobalt Business

Cobalt Production Process

Cobalt Product Process

Cobalt Industry Chain

Products of Major Cobalt Downstream Industries

Cobalt Reserves in Major Countries, 2017

Cobalt Output in Democratic Republic of the Congo, 2015-2018

Global Cobalt Resources by Form

Global Cobalt Reserves by Company, 2017

Cobalt Reserves of Glencore

Global Cobalt Ore Output by Country, 2016-2017

Cobalt Mine Capacity to be Newly Constructed or Resumed Worldwide

Output Growth of Main Cobalt Mines Worldwide, 2018-2020E

Quarterly Cobalt Output of Glencore, 2016-2018

Recycling Period and Rate of Cobalt Products

Global Refined Cobalt Output, 2011-2018

Global Cobalt Consumption, 2010-2017

Cobalt Demand Structure Worldwide, 2017

Global Cobalt Price, 1989-2017

Global MB Cobalt Price, 2016-2018

Changes in Global Cobalt Inventory by Region, 2011-2018

Changes in Global Cobalt Inventory and Price, 2013-2018

Supply of Main Cobalt Ore Companies Worldwide, 2017-2018

Output of Refined Cobalt Companies Worldwide, 2011-2017

Global Cobalt Supply and Demand Structure, 2011-2023E

Cobalt Demand Structure in Worldwide, 2016-2023E

Chinese Companies’ Layout of Cobalt Industry Chain

Policies on Cobalt Industry in China, 2011-2018

Cobalt Reserves Distribution in China (By Province)

Cobalt Mines Invested by Chinese Companies in Democratic Republic of the Congo

Cobalt Mines Invested by Chinese Companies in Australia and Other Places

China’s Refined Cobalt Output, 2008-2018

Sources of China’s Refined Cobalt Raw Materials, 2015-2017

Capacity Expansion of Main Cobalt Smelting Companies in China, Since 2017

China’s Refined Cobalt Consumption, 2008-2018

Cobalt Demand Structure in China, 2017

Supply and Demand Balance in Chinese Cobalt Market, 2011-2017

Cobalt Price Trend in China, 2010-2018

Cobalt Price by Product in China, 2016-2018

Cobalt Prices at Home and Abroad, 2016-2018

China’s Refined Cobalt Output by Product, 2015-2017

Output of Main Refined Cobalt Companies in China, 2015-2017

Revenue and Gross Margin of China’s Major Cobalt Producers, 2017

China’s Refined Cobalt Output, 2017-2023E

China’s Refined Cobalt Consumption, 2017-2023E

Cobalt Demand Structure China, 2016-2023E

Import Volume and Import Value of Cobalt Ores and Concentrates in China, 2008 -2017

China’s Import Volume of Cobalt Ores and Concentrates by Country, 2015-2016

China’s Export Volume and Export Value of Cobaltosic Oxide, 2006 -2017

China’s Import Volume and Import Value of Cobalt Chloride, 2006 -2016

China’s Export Volume and Export Value of Cobalt Chloride, 2006 -2016

Structure (%) of China’s Export Volume of Cobaltosic Oxide by Country, 2016

China’s Import Volume and Import Value of Cobalt Carbonate, 2006-2016

China’s Export Volume and Export Value of Cobalt Carbonate, 2006-2016

Structure (%) of China’s Export Volume of Cobalt Carbonate by Country, 2016

China’s Import Volume and Import Value of Cobalt Nitrate, 2006 -2015

China’s Export Volume and Export Value of Cobalt Nitrate, 2006 -2016

Structure (%) of China’s Export Volume of Cobalt Nitrate by Country, 2015-2016

China’s Export Volume and Export Value of Cobalt Oxalate, 2006 -2016

Global Lithium Battery Shipments by Type, 2011-2017

Small Lithium Cobalt Demand Structure of Global 3C Digital Consumer Goods, 2016

China’s Lithium Battery Shipments by Type, 2011-2017

Global TOP10 Power Lithium Battery Companies by Shipment/Market Share, 2017

China’s Lithium Battery Cathode Material Sales, 2011-2017

Competitive Pattern of Chinese Lithium Battery Cathode Material Market, 2017

Capacity of Main Ternary Precursor Companies in China, 2017-2018

Capacity of Main Ternary Material and Lithium Cobalt Oxide Companies in China, 2017-2018

Amount of Cobalt Consumed by Different Ternary Cathode Materials

Cobalt Demand Structure in Battery Industry

Metal Demand from Different Cathode Materials (Per Ton)

Demand for Cobalt from New Energy Vehicles

Demand for Cobalt from Battery Industry in China, 2016-2023E

Battery Cobalt Demand Structure in China, 2017-2023E

Global Demand for Cobalt from Battery Industry, 2016-2023E

Classification of Hard Alloy (by Component)

Global Hard Alloy Output, 2011-2017

Global Hard Alloy Output Distribution by Region, 2017

China’s Hard Alloy Output, 2011-2023E

Output and Market Share of Key Hard Alloy Companies in China, 2017

China’s Hard Alloy-use Cobalt Demand, 2011-2023E

Classification of Magnetic Materials

Global Rare Earth Permanent Magnet Output and Growth Rate, 2011-2023E

China’s Rare Earth Permanent Magnet Output and Growth Rate, 2010-2023E

Global Magnetic Materials-use Cobalt Demand, 2017-2023E

China’s Magnetic Materials-use Cobalt Demand, 2016-2023E

Main Applications of Superalloy

Global Superalloy Consumption Structure by Application

Application of Superalloy in Aerospace Engine Thermal End Bearing Parts

Main Structure of Aerospace Engine

Superalloy Development Course in China

China’s Superalloy Output, 2012-2020E

Global Superalloy-use Cobalt Demand, 2012-2023E

China’s Superalloy-use Cobalt Demand, 2009-2023E

Distribution of Umicore’s Factories, 2017

Revenue and Net income of Umicore, 2008-2018

Revenue of Umicore by Business, 2011-2018

Energy & Surface Technologies Business Group Profile

Growth and Profitability Drivers of Energy & Surface Technologies Business Group

Total Revenue Structure (%) of Umicore by Region, 2012-2017

R&D Costs and % of Total Revenue of Umicore, 2008-2018

Revenue and Profit from Energy & Surface Technologies Business of Umicore, 2013-2018

Output and YoY Growth of Refined Cobalt of Umicore, 2001-2016

Umicore’s Subsidiaries in China, by the End of 2017

Status Quo of Umicore’s Business in China

Outlook of Umicore, 2018

Glencore Fact

Financial Highlights of Glencore, 2017

Revenue and Net income of Glencore Xstrata, 2012-2018

Revenue Structure (%) of Glencore Xstrata by Business, 2015-2018

Revenue Structure (%) of Glencore Xstrata by region, 2014-2017

Cobalt Output of Glencore Xstrata by Mine Area, 2013-2018

Principal Subsidiaries engaged in Cobalt Production of Glencore Xstrata

Global Presence of Vale

Revenue and Net Income of VALE, 2009-2018

Revenue Structure of VALE by Business, 2016-2018

Revenue Structure of VALE by Region, 2017

Revenue Breakdown of Vale by Region, 2016-2018

Cobalt Output of Vale, 2015-2018

Cobalt Output of Vale by Mine Area, 2010-2018

Cobalt Product Sales Volume and Revenue of Vale, 2013-2018

Cobalt Ore Reserves and Grades of Vale, 2016-2017

Cobalt Ore Mines of Vale, 2017

Vale in China

Vale’s Revenue and YoY Growth in China, 2010-2018

Vale’s Annual Cash Break-Even Cost Landed in China for Iron Ore and Pellets, 2016-2018

Mineral Distribution of Freeport

Highlight of Freeport, 2017

Revenue and Net income of Freeport, 2008-2018

Revenue Structure of Freeport by Product, 2015-2017

Revenue Breakdown of Freeport by Country/Region, 2015-2017

Sales of Freeport by Region, 2017

Cobalt Business Revenue and Gross Profit of Freeport, 2010-2016

Cobalt Output and Sales Volume and Average Price of Freeport, 2010-2016

Revenue and YoY Growth of Freeport in China, 2008-2017

Sherritt’s Main Subsidiaries

Sherritt’s Key Operational Indicators, 2016-2017

Sherritt’s Development Strategy, 2018

Sherritt’s Cobalt Output and Sales, 2016-2017

Sherritt’s Cobalt Output by Source, 2015-2017

Sherritt’s Cobalt Sales, 2016-2017

Revenue and Net income of Shenzhen Green Eco-Manufacture, 2010-2018

Revenue of Shenzhen Green Eco-Manufacture by Product, 2017-2018

Revenue of Shenzhen Green Eco-Manufacture by Region, 2010-2018

Procurement from Top 5 Suppliers of Shenzhen Green Eco-Manufacture, 2013-2017

R&D Costs and % of Total Revenue of Shenzhen Green Eco-Manufacture, 2010-2018

Production Capacity of Shenzhen Green Eco-Manufacture by Product, by June 2018

Cobalt Industry Recycling Production Mode of Shenzhen Green Eco-Manufacture

Downstream Customers for Cobalt Lithium Battery Materials of Shenzhen Green Eco-Manufacture

Production Capacity, Sales Volume and Revenue of Shenzhen Green Eco-Manufacture by Product, 2015-2020E

Production Capacity and Sales Volume of Battery Materials of Shenzhen Green Eco-Manufacture, 2015-2020E

Revenue and Net income of Huayou Cobalt, 2010-2018

Revenue and Net income of Huayou Cobalt’s Main Subsidiaries, 2015-2017

Operating Revenue of Huayou Cobalt by Product, 2014-2018

Operating Revenue of Huayou Cobalt by Region, 2012-2017

Gross Margin of Huayou Cobalt by Product, 2014-2018

Major Customers of Huayou Cobalt

Production and Sales Volume of Cobalt Products of Huayou Cobalt, 2016-2018

Cobalt Product Cost Structure of Huayou Cobalt, 2015-2017

Revenue and Net income of Jinchuan Group, 2009-2018

Revenue and Proportion of Jinchuan Group by Product, 2014-2017

Gross Margin of Jinchuan Group by Product, 2014-2017

Cobalt Production Capacity of Jinchuan Group, 2015-2018

Concentrates Output of Jinchuan Group, 2015-2018

Sources of Cobalt Raw Materials Purchased by Jinchuan Group, 2015-2018

Jinchuan Group’s Procurement of Cobalt Raw Materials from Its Top 5 Suppliers, 2017

Key Operational Indicators of Jinchuan Technology, 2016-2017

Electrolytic Cobalt Production and Sales of Jinchuan Group, 2010-2018

Cobalt Product Revenue of Jinchuan Group, 2010-2017

Jinchuan Group’s Revenue from Top 5 Cobalt Product Customers, 2017

Proposed Project of Jinchuan Group, 2018

Revenue and Net income of Shandong Jinling Mining, 2007-2018

Revenue Structure of Shandong Jinling Mining by Product, 2012-2018

Revenue of Shandong Jinling Mining by Region, 2008-2018

Gross Margin of Shandong Jinling Mining by Product, 2008-2018

Cobalt Production and Sales and Sales-Output Ratio of Shandong Jinling Mining, 2009-2017

Revenue from Cobalt Concentrate Powder of Shandong Jinling Mining, 2008-2018

Joint-stock and Shareholding Companies of Beijing Easpring Material Technology

Development Course of Beijing Easpring Material Technology, 1992-2017

Revenue and Net Income of Beijing Easpring Material, 2007-2018

Revenue of Beijing Easpring Material by Business, 2010-2018

Revenue of Beijing Easpring Material by Region, 2008-2018

Gross Margin of Beijing Easpring Material by Quarter, 2008-2018H1

Gross Margin of Beijing Easpring Material by Business, 2015-2018

Key Lithium Battery Materials of Beijing Easpring Material

Development History of Lithium Battery Cathode Materials of Beijing Easpring Material

Mineral Resources of Syerston

Key Projects of Beijing Easpring Material in Recent Years

Capacity and Sales Volume of Cathode Materials of Beijing Easpring Material, 2015-2020E

Revenue and Net income of Hanrui Cobalt, 2014-2018

Revenue Breakdown of Hanrui Cobalt by Product, 2014-2018

Gross Margin of Hanrui Cobalt by Product, 2014-2018

Output of Hanrui Cobalt by Product, 2014-2017

Capacity of Major Products and Capacity Planning of Hanrui Cobalt, 2017

Output of Hanrui Cobalt by Product, 2016-2020E

Cobalt Powder Market Share and Export Share of Hanrui Cobalt in China, 2013-2015

Capacity Planning of Hanrui Cobalt

Revenue and Net income of China Molybdenum, 2014-2018

Revenue and Gross Margin of China Molybdenum by Product, 2016-2018

Revenue and Gross Margin of China Molybdenum by Region, 2016-2018

Cobalt Metal Sales Volume of China Molybdenum’s Tenke Mine, 2017-2020E

Revenue of China Molybdenum’s Tenke Mine, 2017-2020E

Revenue and Net income of Guangdong Silver, 2014-2018

Operating Revenue and Gross Margin of Guangdong Silver by Product, 2017-2018

Proposed Cobalt Project of Guangdong Silver, 2018

Revenue and Net income of Ganzhou Tengyuan Cobalt New Material, 2014-2017

Capacity and Output of Ganzhou Tengyuan Cobalt New Material, 2014-2017

Proposed Project of Ganzhou Tengyuan Cobalt New Material, 2018

Shareholding Structure of Projects of Ramu Nico Management Limited, 2017

Nickel Cobalt Companies of Jiangxi Rare Metal Tungsten Industry Holding Group

Major Subsidiaries of Guangdong Jiana Energy Technology

Revenue and Net Income of Guangdong Jiana Energy Technology, 2016-2018

Revenue of Guangdong Jiana Energy Technology by Region, 2016-2018

Production Capacity and Sales Volume of Guangdong Jiana Energy Technology by Product, 2016-2018

Revenue Structure (%) and Gross Margin of Guangdong Jiana Energy Technology by Product, 2016-2018

Revenue, Sales Volume and Gross Margin of Guangdong Jiana Energy Technology by Product, 2016-2018

Global and China Rare Earth Permanent Magnet Industry Report, 2018-2023

Rare earth permanent magnets consist of SmCo permanent magnet and NdFeB permanent magnet among which NdFeB as a kind of 3rd-Gen rare earth permanent magnetic material takes a lion’s share of the marke...

Global and China NdFeB Industry Report, 2018-2023

Featured with strong magnetic energy product and high compacted density, NdFeB is widely used in various fields. The NdFeB industry over the recent years has characterized the following:

First, the N...

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Rare Earth Industry Report, 2014-2018

Rare earth, also known as rare earth metal or rare earth element, collectively refers to lanthanides (including fifteen elements) and closely-related scandium and yttrium. As a crucial strategic resou...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Vanadium Industry Report, 2014-2017

The world’s recoverable vanadium reserves so far has been recorded at 14 million tons, mainly found in China, Russia, South Africa and other countries. In 2013, roughly 151,000 tons of vanadium (V2O5 ...

Global and China Silica(White Carbon Black) Industry Report, 2014-2017

China, the world’s largest silica producer, had silica capacity of 2.20 million tons in 2013, slowing to a year-on-year increase of 8.1% and accounting for 60% of global capacity, of which 2.079 milli...