Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,400

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LMX071

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industry has operated under pressure on the whole. In 2014, China’s output of sawing machine fell for three consecutive years to about 50,480 sets, and the sales volume of corresponding bi-metal band saw blade approximated 48.708 million meters, edging down 1.5% from 2013.

Compared with sluggish domestic demand, China’s bi-metal band saw blade exports continue to expand, largely thanks to better quality of products and improvement in competitiveness of local companies. The country’s export value of bi-metal band saw blade was USD16.714 million in 2014 and USD8.061 million in the first half of 2015, representing a year-on-year surge of 51.34% and 16.22%, respectively.

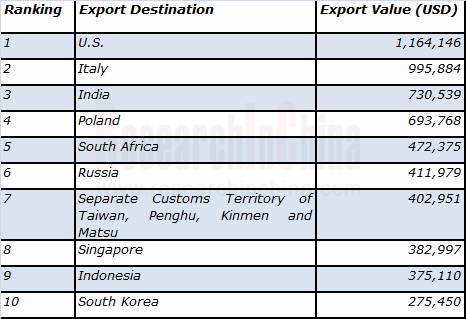

Top 3 importers of Chinese bi-metal band saw blade are U.S., Italy, and India, which together imported about USD2.8906 million worth of bi-metal band saw blade from China in the first seven months of 2015, making up 35.86% of China’s total export value of such product.

Top10 Export Destinations of Bi-metal Band Saw Blade from China, Jan-Jul 2015

Source: China Customs; ResearchInChina

From the perspective of competitive landscape of the Chinese bi-metal band saw blade, in 2014, local brands, focusing on middle and low-end products, took more than 60% of the market with representative companies being Bichamp Cutting Technology and Benxi Tool; foreign brands aim at high-end products market, and representative players include U.S. LENOX, Japanese Amada, and Swedish Bahco, with the latter two having established factories separately in Lianyungang (Jiangsu) and Kunshan to manufacture bi-metal band saw blade.

Among local brands, Benxi Tool has the largest production capacity, manufacturing 15 million meters of bi-metal band saw blade annually. The company’s brands are primarily middle and low-end ones, including LIONS, FORK, SHARE, and ROMANCE. The second largest company in terms of capacity is Bichamp Cutting Technology, which produces 11.72 million meters of bi-metal band saw blade annually and has its products in full range of brands.

In terms of comprehensive strength, Bichamp Cutting Technology enjoys obvious superiority over other local brands. The company reported revenue of RMB277 million and net income of RMB53.81 million in 2013, up 11.08% and 7.86% over the previous year respectively. The revenue for 2014 was RMB350 million, rising by roughly 26.25% year on year.

Among foreign brands, American DoALL and Japanese Amada are the two companies capable of providing full sawing services. Amada has four bi-metal band saw blade manufacturing bases around the world, separately located in Japan (one), Austria (one), and Lianyungang, China (two). In the first quarter of FY2015, the Amada Group made revenue of JPY7.571 billion from Bandsaws Division, 8.4% higher than that in the same period of FY2014, accounting for 13.3% of its total revenue.

Global and China Bi-metal Band Saw Blade Industry Report, 2015-2018 focuses on the followings:

High-speed steel, an upstream raw material of bi-metal band saw blade, and top3 companies;

High-speed steel, an upstream raw material of bi-metal band saw blade, and top3 companies;

Operation, output, import & export volume, development trends of sawing machine industry, a sector served by bi-metal band saw blade, and 7 key companies;

Operation, output, import & export volume, development trends of sawing machine industry, a sector served by bi-metal band saw blade, and 7 key companies;

Development and competitive landscape of global bi-metal band saw blade market;

Development and competitive landscape of global bi-metal band saw blade market;

Policy climate, sales volume, import & export volume, and competitive landscape of bi-metal band saw blade industry in China;

Policy climate, sales volume, import & export volume, and competitive landscape of bi-metal band saw blade industry in China;

Analysis of 8 global and 6 Chinese bi-metal band saw blade companies;

Analysis of 8 global and 6 Chinese bi-metal band saw blade companies;

Market summary and industry forecasts for 2015-2018.

Market summary and industry forecasts for 2015-2018.

Preface

1. Overview of Bi-Metal Band Saw Blade Industry

1.1 Definition

1.2 Upstream and Downstream

1.3 Industry Features

1.4 Entry Barriers

2 Chinese High Speed Steel Industry Development

2.1 Overview of High Speed Steel

2.2 Market Analysis

2.3 Major Producers

2.3.1 Tiangong International Co., Ltd.

2.3.2 Heye Special Steel Co., Ltd.

2.3.3 Jiangsu Feida Group

3 Chinese Saw Machine Industry

3.1 Definition and Classification

3.2 Operation

3.3 Output

3.4 Import and Export

3.5 Development Trend

4 Global Bi-Metal Band Saw Blade Industry

4.1 Development History

4.2 Market Size

4.2.1 Machine Tool

4.2.2 Bi-Metal Band Saw Blade

4.3 Competition Pattern

5 Chinese Bi-Metal Band Saw Blade Industry

5.1 Policy

5.2 Development Course

5.3 Sales Volume

5.4 Import & Export

5.5 Competition Pattern

5.5.1 Regional Competition

5.5.2 Competition between Local Brands and Foreign Brands

5.5.3 Product Competition

5.5.4 Competition among Chinese Local Brands

5.6 Problems

6 Key Bi-Metal Band Saw Blade Companies Worldwide

6.1 DoALL Company

6.1.1 Profile

6.1.2 Development Course

6.1.3 Products

6.2 Lenox Tools

6.2.1 Profile

6.2.2 Products

6.2.3 Dynamics

6.3 Starrett

6.3.1 Profile

6.3.2 Products

6.3.3 Operation

6.3.4 Development in China

6.4 Amada

6.4.1 Profile

6.4.2 Development Course

6.4.3 Amada Machine Tools

6.4.4 Operation

6.4.5 Development Planning

6.4.6 Development in China

6.5 BAHCO

6.5.1 Profile

6.5.2 Development Course

6.5.3 Products

6.6 WIKUS

6.6.1 Profile

6.6.2 Development Course

6.6.3 Products

6.6.4 Dynamics

6.7 EBERLE

6.7.1 Profile

6.7.2 Development Course

6.7.3 Products

6.7.4 Operation

6.8 RONTGEN

6.8.1 Profile

6.8.2 Products

7 Key Companies of Bi-Metal Band Saw Blades in China

7.1 Bichamp Cutting Technology (Hunan) Co., Ltd.

7.1.1 Profile

7.1.2 Development Course

7.1.3 Products

7.1.4 Operation

7.1.5 Competitive Advantages

7.1.6 IPO Process

7.2 Benxi Tool (Group) Limited Liability Company

7.2.1 Profile

7.2.2 Products

7.2.3 Capacity

7.3 Hunan Techamp Saw & Manufacture Co., Ltd.

7.4 Benxi Bi-Metal Saw Co., Ltd.

7.5 Dalian Bi-Metal S&T Co., Ltd.

7.6 Dalian Special Steel Product Co., Ltd.

7.6.1 Profile

7.6.2 Products

8 Key Companies of Saw Machine in China

8.1 Zhejiang Julihuang Sawing Machine Group Co., Ltd.

8.1.1 Profile

8.1.2 Development Course

8.1.3 Operation

8.1.4 Suppliers and Customers

8.2 WinFox Machinery Inc.

8.3 Zhejiang Weiye Sawing Machine Co., Ltd.

8.4 Zhejiang Chendiao Machinery Co., Ltd.

8.5 Zhejiang Aolinfa Machine Co., Ltd.

8.6 Zhejiang Hujin Sawing Machine Co., Ltd.

8.7 Zhejiang Hengyu Sawing Machine Co., Ltd.

9. Market Overview and Development Forecast

9.1 Market Overview

9.2 Development Forecast

9.2.1 Trends

9.2.2 Output Forecast of Saw Machine

9.2.3 Sales Volume Forecast of Bi-Metal Band Saw Blades

Comparison of Three Major Metal Cutting Ways

Upstream and Downstream of Bi-Metal Band Saw Blade Industry

GDP Growth in China, 1990-2015

Classification of HSS

HSS Market Share in China, 2014

Major Chinese HSS Producers and Operation

Development Course of Tiangong International

Revenue of Tiangong International, 2011-2014

Financials of Tiangong International, 2014-2015

Revenue Breakdown of Tiangong International by Business, 2014-2015

Revenue Breakdown of Tiangong International by Region, 2014-2015

Gross Margin of Tiangong International by Business, 2014-2015

HSS Products of Tiangong International

HSS Revenue Structure of Tiangong International, 2014-2015

HSS Output of Heye Special Steel Co., Ltd., 2011-2015

HSS Products of Heye Special Steel Co., Ltd.

Operating Indicators of Heye Special Steel Co., Ltd., 2009-2015

Marketing Network of Jiangsu Feida Group

Business Units of Jiangsu Feida Group

Development Course of Jiangsu Feida Group

HSS Products of Jiangsu Feida Group

Classification of Saw Machine

Major Economic Indicators of China Metal Saw Machine Industry, 2009-2014

Output of Metal Saw Machine in China, 2008-2014

Export Volume of Saw Machine in China, 2005-2015

Import Volume of Saw Machine in China, 2005-2015

Import and Export Value of Saw Machine in China, 2005-2015

Development History of Global Bi-Metal Band Saw Blade Industry

Global Market Size of Bi-Metal Band Saw Blade, 2006-2014

Global Bi-Metal Band Saw Blade Manufacturers

Chinese Policies on Bi-Metal Band Saw Blade Industry

Development History of Chinese Bi-Metal Band Saw Blade Industry

Sales Volume of Bi-Metal Band Saw Blades in China, 2006-2014

Sales Volume of Bi-Metal Band Saw Blades for Metal Cutting in China, 2006-2014

Import and Export Value of Bi-Metal Band Saw Blades in China, 2013-2015

Import and Export Volume of Bi-Metal Band Saw Blades in China, 2013-2015

Top 20 Countries (Destinations) of Bi-Metal Band Saw Blade Export from China, Jan.-Jul. 2015

Major Import Countries of Bi-Metal Band Saw Blade in China, Jan.-Jul. 2015

Market Share of Local Brands of Bi-Metal Band Saw Blade in China, 1985-2015

Capacity of Chinese Bi-Metal Band Saw Blade Manufacturers, 2014

Marketing Network of DoALL Company in USA

Marketing Network of DoALL Company Worldwide

Development Course of DoALL Company

Bi-Metal Band Saw Blades of DoALL Company

Bi-Metal Band Saw Blades of Lenox Tools

Major Production Bases of Starrett Worldwide

Bi-Metal Band Saw Blades of Starrett

Operating Performance of Starrett, FY2011-FY2015

Profile of Starrett (Suzhou)

Profile of Starrett (Shanghai)

Regulation of Primalloy Band Saw Blade of Starrett

Business Structure of Amada

Subsidiaries of Amada

Business Distribution of Amada

Development Course of Amada

Overview of AMADA Machine Tools

Development Course of AMADA Machine Tools

Major Production Bases of AMADA Machine Tools

Bi-Metal Band Saw Blades of Amada

Net Sales and Operating Income of AMADA, FY2011- FY2015

Revenue Structure of AMADA, FY2011-FY2015

Revenue Structure of AMADA, FY2014

Medium and Long-term Development Target of AMADA

Production Bases Distribution of AMADA in China

Development Course of Amada in China

Shanghai Facility of Amada

Development Course of BAHCO

Bi-Metal Band Saw Blade of BAHCO

Business Distribution of WIKUS Worldwide

Development Course of WIKUS

Bi-Metal Band Saw Blade Products of WIKUS

Business Distribution of EBERLE Worldwide

Development Course of EBERLE

Bi-Metal Band Saw Blades of EBERLE

Operating Performance of Greiffenberger Group, 2014-2015

Operating Performance of Greiffenberger Group, 2009-2014

Bi-Metal Band Saw Blades of RONTGEN

Development Course of Bichamp Cutting Technology (Hunan) Co., Ltd.

Bi-Metal Band Saw Blades of Bichamp Cutting Technology (Hunan) Co., Ltd.

Brand Target and Application of Bichamp Cutting Technology (Hunan) Co., Ltd.

Sales Volume of Bi-Metal Band Saw Blade of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2015

Capacity, Output and Sales Volume of Bi-Metal Band Saw Blade of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2013

Revenue and Net Income of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2015

Bi-Metal Band Saw Blades of Benxi Tool (Group) Limited Liability Company

Bi-Metal Band Saw Blade Capacity of Benxi Tool (Group) Limited Liability Company, 2010-2014

Profile of Hunan Techamp Saw & Manufacture Co., Ltd

Profile of Dalian Bi-Metal S&T Co., Ltd

Bi-Metal Band Saw Blades of Dalian Bi-Metal S&T Co., Ltd.

Profile of Dalian Special Steel Product Co., Ltd.

Specifications of Bi-Metal Band Saw Blades of Dalian Special Steel Product Co., Ltd.

Profile of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Marketing Network of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Band Saw Machine Products of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Major Events of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Operation of Zhejiang Julihuang Sawing Machine Group Co., Ltd., 2013-2015

Zhejiang Julihuang Sawing Machine Group Co., Ltd.’s Revenue from Top 5 Clients and % of Total Revenue, 2014

Zhejiang Julihuang Sawing Machine Group Co., Ltd. ’s Procurement from Top 5 Suppliers and % of Total Procurement, 2014

Profile of WinFox Machinery Inc.

Band Saw Machine Products of WinFox Machinery Inc.

Profile of Zhejiang Weiye Sawing Machine Co., Ltd.

Marketing Network of Zhejiang Weiye Sawing Machine Co., Ltd.

Band Saw Machine Products of Zhejiang Weiye Sawing Machine Co., Ltd.

Profile of Zhejiang Chendiao Machinery Co., Ltd.

Band Saw Machine Products of Zhejiang Chendiao Machinery Co., Ltd.

Marketing Network of Zhejiang Chendiao Machinery Co., Ltd.

Band Saw Machine Products of Zhejiang Aolinfa Machine Co., Ltd.

Profile of Zhejiang Hujin Sawing Machine Co., Ltd.

Profile of Zhejiang Hengyu Sawing Machine Co., Ltd.

Marketing Network of Zhejiang Hengyu Sawing Machine Co., Ltd.

Output of Saw Machines in China, 2014-2018E

China PMI Index, 2011-2015

Sales Volume of Bi-Metal Band Saw Blades in China, 2015E-2018E

Sales Volume of Bi-Metal Band Saw Blades for Metal Cutting in China, 2015E-2018E

Global and China Rare Earth Permanent Magnet Industry Report, 2018-2023

Rare earth permanent magnets consist of SmCo permanent magnet and NdFeB permanent magnet among which NdFeB as a kind of 3rd-Gen rare earth permanent magnetic material takes a lion’s share of the marke...

Global and China NdFeB Industry Report, 2018-2023

Featured with strong magnetic energy product and high compacted density, NdFeB is widely used in various fields. The NdFeB industry over the recent years has characterized the following:

First, the N...

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Rare Earth Industry Report, 2014-2018

Rare earth, also known as rare earth metal or rare earth element, collectively refers to lanthanides (including fifteen elements) and closely-related scandium and yttrium. As a crucial strategic resou...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Vanadium Industry Report, 2014-2017

The world’s recoverable vanadium reserves so far has been recorded at 14 million tons, mainly found in China, Russia, South Africa and other countries. In 2013, roughly 151,000 tons of vanadium (V2O5 ...

Global and China Silica(White Carbon Black) Industry Report, 2014-2017

China, the world’s largest silica producer, had silica capacity of 2.20 million tons in 2013, slowing to a year-on-year increase of 8.1% and accounting for 60% of global capacity, of which 2.079 milli...