China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

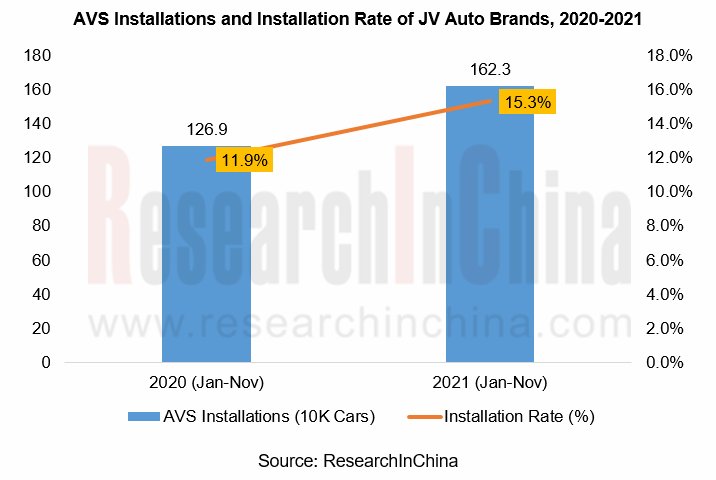

During January to November of 2021, a total of 4.266 million vehicles were installed with around view system (AVS) in China, a year-on-year upsurge of 49.2%, including AVS installations onto 1.623 million cars of joint-venture brands, sharing as high as 38.0% and a year-on-year increase of 27.9%; the installation rate was 15.3%, a rise of 3.4 percentage points on an annualized basis. Noticeably, the JV brands’ cars priced between RMB400,000 and RMB500,000 and installed with AVS constitute the largest portion 22.4% (364,000 units) of the total, according to ResearchInChina.

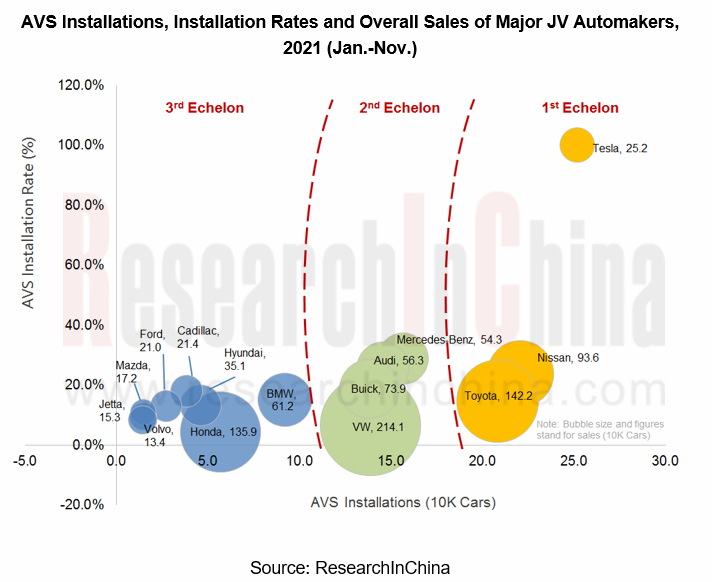

By brands, Tesla, Nissan and Toyota are in the first echelon as concerns AVS installations (onto more than 200,000 cars apiece), which is largely boosted by the best-selling models like Model Y, Model 3, RAV4 and QASHQAUI. The second echelon is home to Mercedes-Benz, Audi, Volkswagen and BUICK, with AVS installed to 100,000 to 200,000 cars each. In the third hierarchy, 92,000 BMW cars are configured with AVS, hopefully striding towards the second echelon. Concerning vehicle models, during 2021 (Jan.-Nov.), the top five vehicle models of joint venture automakers by AVS installations are RAV4 (133,000 units), Model Y (130,000 units) & Model3 (121,000 units), Mercedes-Benz E Class (100,000 units), and Qashqai (99,000 units).

AVP is on the cusp of massive implementation, and Tier1 suppliers are promoting the parking fusion solution earnestly.

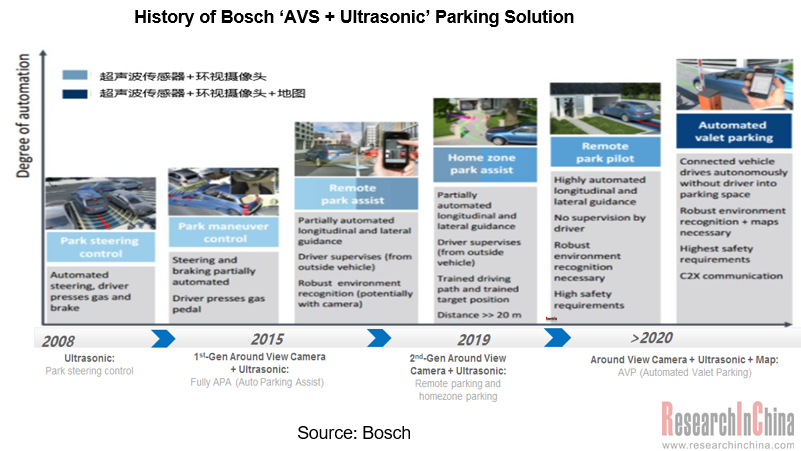

The parking system is evolving apace, amid the previous reversing camera system being increasingly replaced by AVS. The parking solution integrating AVS with ultrasonic sensors grows a popular trend. At the same time, the suppliers are forging partnerships with OEMs on faster mass production of AVP.

Take example for Bosch’s Home Zone Park Assist system exhibited during 2021 BOSCH Automobile & Intelligent Transportation Technology Innovation Experience Day, it does data fusion through 12 Bosch ultrasonic sensors together with an around view camera system made up of 4 near-range cameras, coupled with the reuse of 4 corner radars (driving assistance function), and successfully enables HPP (Homezone Parking Pilot) by software upgrades and without additional hardware sensors. Such parking solution has been available onto GAC AION V.

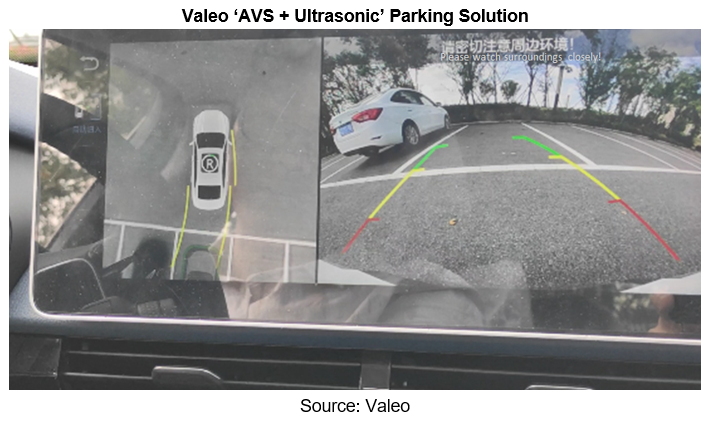

At the IAA Mobility held in Frankfurt in September 2021, Valeo and its partners NTT DATA and Embotech unveiled their joint AVP (Automated Valet Parking) solution that encompasses ECU, ultrasonic, radar and around view cameras, and dispenses with the costly LiDAR.

Progress of autonomous driving facilitates the around view camera market, and foreign parts suppliers beef up local cooperation.

The advances in autonomous driving technology come with the growing number of varied perception sensors in vehicle. Every car carries ten to fifteen cameras rather than one to five ones in the past, and even more in the future. Besides, the automotive CMOS image sensors get ever improved in pixel, from VGA to 1-megapixel, 2-megapixel and to date 8-megapixel.

To meet the market demand for around view cameras, ON Semiconductor as a leading supplier of automotive cameras CMOS image sensors has been in cooperation with many Chinese autonomous driving companies. In July 2021, the fifth-generation driverless system – AutoX Gen5, the outcome of joint efforts by ON Semiconductor and AutoX was launched, for which ON Semiconductor offered a total of 28 high-definition 8-megapixel image sensors AR0820AT and 4 LiDAR SiPM matrices, thus enabling 360-degree reversing image without any blind spots. Concurrently, ON Semiconductor also deepened its collaboration with Baidu Apollo and established a joint studio for image development with the latter, focusing on self-driving image perception solutions.

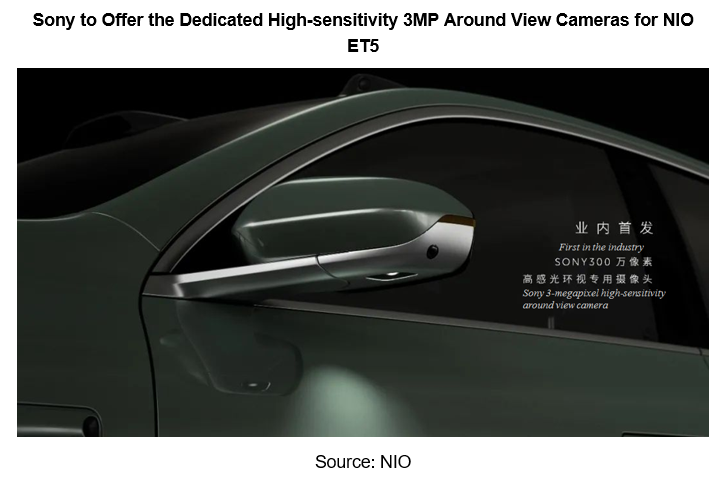

Sony, another leading supplier of image sensors, will provide NIO ET7 (to be delivered in March 2022, built on NT2.0 technology platform) and ET5 (to be delivered in September 2022) with the dedicated 3-megapixel high-sensitivity around view cameras. Compared with the 8-megapixel cameras previously used in ET7, this 3MP camera outperforms in dim light and the exterior rearview mirror is also added with ambient light compensation lamp that acts as a better enabler for 360-degree panorama imaging, transparent chassis, guard mode, park assist, etc.

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...