Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of national economic development. China is currently the world's largest single market for commercial vehicle sales, contributing nearly half of global sales each year. In 2022, Scania held the launching ceremony for the construction of the manufacturing base in Rugao, Jiangsu Province, and the launch of heavy truck joint venture between Daimler Benz and BAIC Foton, opening a new prelude to the industry.

With the technological revolution of "electrification and intelligence" of automobiles, commercial vehicle chassis also ushered in the technological change from conventional chassis, electric chassis to intelligent chassis. The future development of intelligent chassis technology, the construction of the industry chain and the layout of the supply chain will have a profound impact on the development trend of commercial vehicles.

As an important intersection of electrification and intelligence, the intelligent chassis has been highly valued by automotive industry and strongly sought after by capital in recent years, with a large number of companies entering and laying out a strong position to carry out related core technology.

The intelligent chassis for commercial vehicles is moving in step with "electrification, intelligence, software and sharing" and is showing the following trends:

Trend 1: Technological changes and business model changes to support the sharing of intelligent chassis for commercial vehicles

The efficient operation of logistics needs to be based on specialization of commercial vehicles, but the challenge of generalization in turn limits the ability to apply vehicles across industries, or will have an impact on vehicle utilization. The contradiction between specialization and versatility can be balanced in the future by the intelligent chassis installation and the separation of chassis, and the design of scenario-based installations and chassis standardization. Scenario-based installation, which can meet the professional requirements of each scenario in a differentiated way and maximize the use efficiency in the scenario; Chassis standardization meets the requirements of mass production for product standardization, thereby reducing production costs. The development of new energy and autonomous driving technology will accelerate the landing of standard chassis and provide technical support for the sharing development of commercial vehicle chassis.

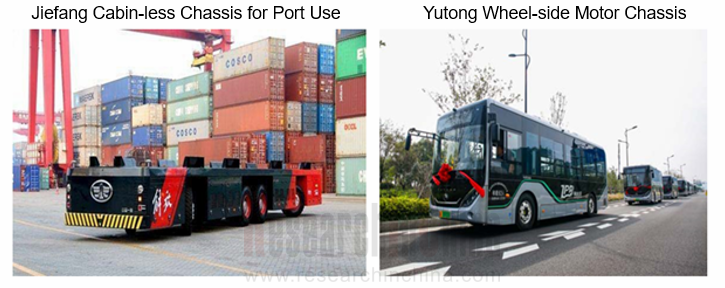

The skateboard chassis highly concerned by the industry is expected to be implemented firstly in commercial vehicle field. The "wire-controlled technology, cell to chassis (CTC), casting of large chassis parts, corner module, battery replacement" promoted by the intelligent chassis of passenger cars or various application scenarios of commercial vehicles have been realized one by one.

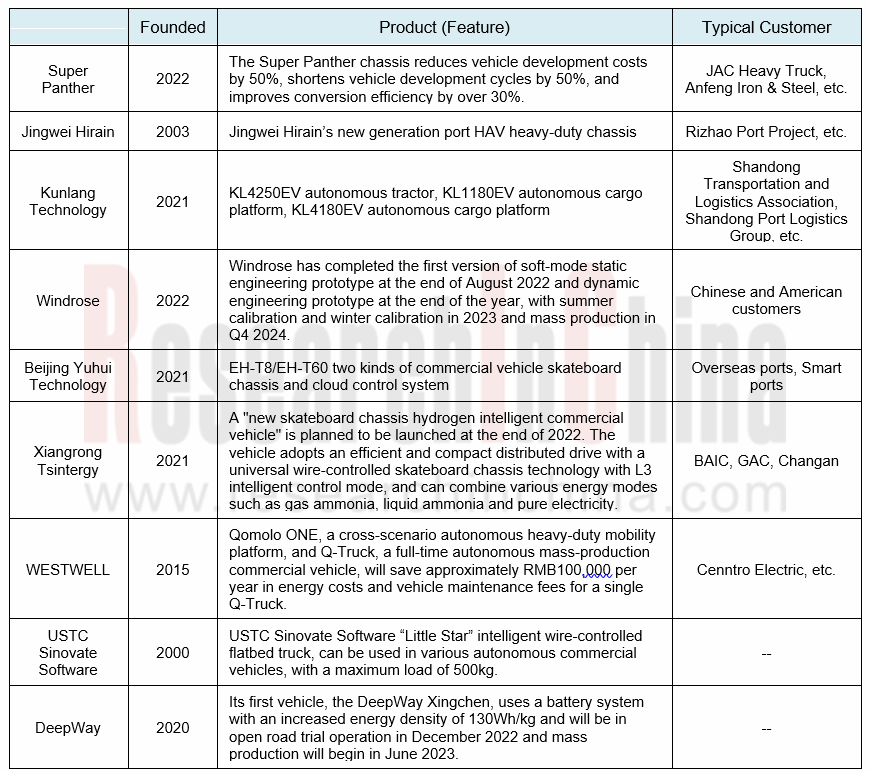

Trend 2: More and more start-ups focus on commercial vehicle chassis industry

Several domestic and foreign companies have already entered the commercial vehicle intelligent chassis track, including Gaussin, which has set up its headquarters in China to bring its latest pure electric and hydrogen truck technologies and products to the Chinese market in the form of a next-generation Skateboard Truck Platform.

Super Panther is the first technology company in China to focus on intelligent chassis for new energy commercial vehicles. It is different from the "skateboard chassis" technology company for passenger cars, and will combine the ecological needs of logistics by creating a new chassis system to help transform the logistics industry in the new energy trend.

Trend 3: Intelligent chassis design for commercial vehicles is gradually becoming passenger car-oriented

The commercial vehicle chassis needs to be deeply integrated with intelligent cockpit, autonomous driving and powertrain in order to become a true intelligent chassis, which can actively control, adaptive and self-learning and can be OTA upgraded according to the user preferences to decide the character of the vehicle.

Trend 4: Intelligent chassis for commercial vehicles enables diversified fuel platforms

Daimler Benz GenH2 liquid hydrogen heavy truck chassis comes with two tanks for storing liquid hydrogen, each holding around 40kg of liquid hydrogen, and is matched with two 150kW fuel cell systems. The intensive test scenarios for Mercedes-Benz hydrogen fuel cell prototype are said to include internal test lanes and public roads, with the development goal of achieving a range of over 1,000km and being able to cope with flexible and demanding road conditions in heavy long-distance transport. Daimler Trucks plans to have hydrogen fuel cell trucks join the production model line-up in the next 5-10 years as well.

Due to the impact of technology and cost, trunk logistics vehicles are the short board of new energy development. How can we use mature technology and lower costs to help trunk logistics achieve low-carbon green transport? Geely's new energy commercial vehicles have undergone 17 years of R&D and have released a multi-motor central drive power chain and a new energy green methanol powered solution - the remote G2M methanol tractor.

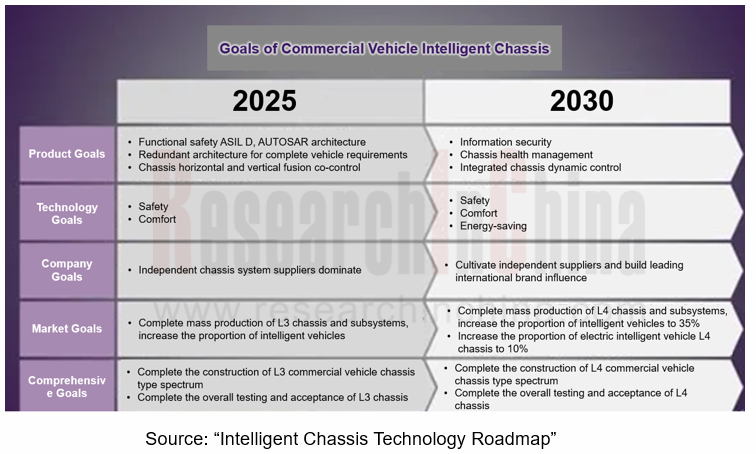

Trend 5: Goals and technical paths for development of intelligent chassis

According to the “Intelligent Chassis Technology Roadmap” published by the Electric Vehicle Alliance Wire-Controlled Working Group in 2021, the goals for the development of intelligent chassis for commercial vehicles are shown in the following diagram:

Goals in 2025: The intelligent chassis equipped with independent brands of braking-by-wire and steering -by-wire will be applied in batches in influential enterprises in the industry; The key technical indicators of the intelligent chassis have reached the international advanced level; The industrial chain of key components is independent and controllable.

Goals in 2025: The intelligent chassis equipped with independent brands of braking-by-wire and steering -by-wire will be applied in batches in influential enterprises in the industry; The key technical indicators of the intelligent chassis have reached the international advanced level; The industrial chain of key components is independent and controllable.

Goals in 2030: The initial formation of the brand effect of independent intelligent chassis and wire-controlled actuation of the automakers and parts enterprises; intelligent chassis in general to reach the international advanced level, key technical indicators to reach the international leading level; intelligent chassis to form a complete independent controllable industrial chain; cultivate internationally competitive enterprises.

Goals in 2030: The initial formation of the brand effect of independent intelligent chassis and wire-controlled actuation of the automakers and parts enterprises; intelligent chassis in general to reach the international advanced level, key technical indicators to reach the international leading level; intelligent chassis to form a complete independent controllable industrial chain; cultivate internationally competitive enterprises.

The key technology path for the intelligent chassis of commercial vehicles is: to cope with the demand of L3 autonomous driving, the chassis realizes subsystem redundancy, adopts distributed control structure, independent longitudinal and horizontal active control, and system health alarm; to cope with the demand of L4 autonomous driving, the chassis domain control realizes minimal backup of autonomous driving and collaborative longitudinal and horizontal control; to cope with the demand of L5 autonomous driving, the chassis domain control realizes full functional backup of autonomous driving and integrated longitudinal and horizontal collaborative control.

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...