An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupant protection information for a very brief period of time before, during and after a crash.

EDR gets compulsorily installed to new passenger cars starting from 2022

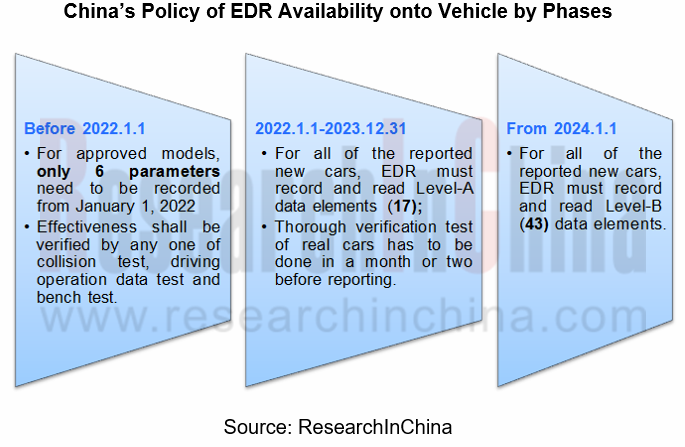

In December 2020, China publicized GB39732-2020 Vehicle Event Data Recorder System to replace GB39732-2017, requiring passenger cars be equipped with EDR from January 1, 2022.

Abide by the new national standards, some requirements are posed on EDR to record crashes, i.e., 1) have certain trigger threshold; 2) the recorded data will be locked automatically and cannot be modified; 3) the system can record data of at least three consecutive collision events.

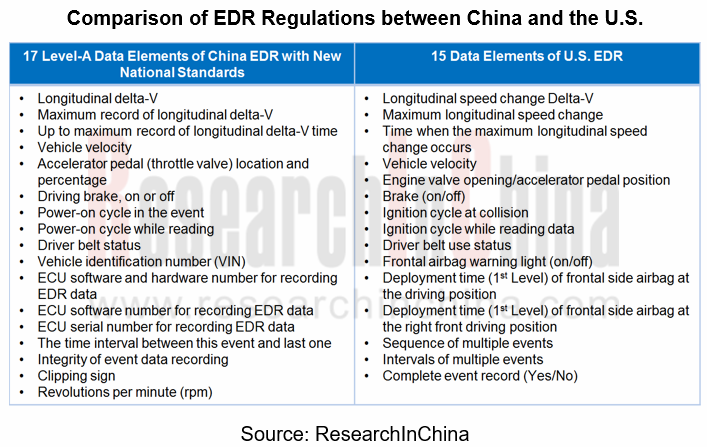

The data recorded by EDR is divided into Level-A and Level-B, including 17 Level-A data and 43 Level-B data, effective from January 1, 2022 and January 1, 2024 respectively.

It is in 2006 that the U.S. formulated regulations concerning EDR, and it is clearly stipulated in NHTSA CFR regulations in 2012 that all vehicles sold after September 2014 need to be equipped with EDR.

In Europe, EDR is compulsory in all new cars from March 2022 on (pursuant to the general safety regulation issued in March 2019), and corresponding CDR must be purchased on the market. By March 2024, stock vehicles require to be installed with EDR as well.

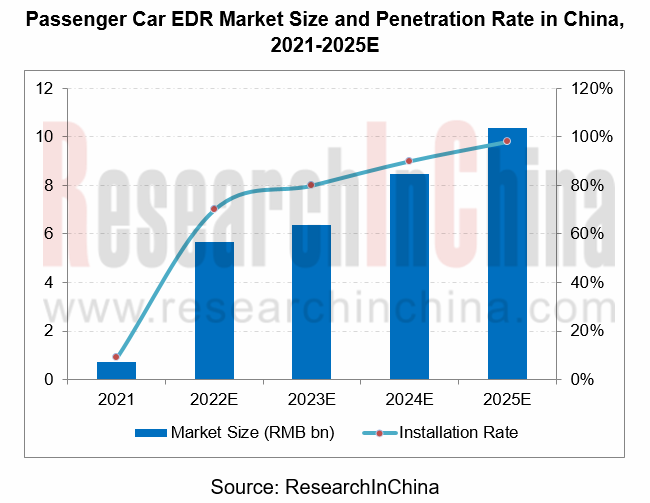

The incremental market size of passenger car EDR will surpass RMB5 billion in 2022

Millions of passenger cars and light-duty trucks worldwide are equipped with EDR, as is revealed by Bosch data, and a total of more than 200 million vehicles are installed with EDR in the U.S. and Canada where roughly 98% of the new cars on the market carry EDR.

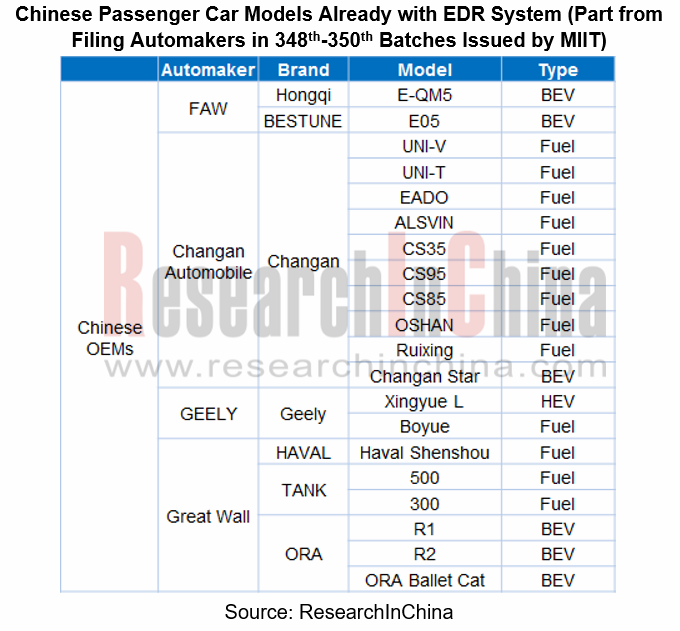

The brands like BMW, Mercedes-Benz, Lexus, Tesla, Toyota, BYD, XPENG and Haval first employ EDR. Through our analysis of the motor vehicle filing enterprises in 348th-350th batches issued (from Sept.2021 to Dec.2021) by the Ministry of Industry and Information Technology (MIIT), the passenger cars reported are all nearly with EDR, indicating the readiness of Chinese automakers for the policy about compulsory installation of EDR, and thus ushering in the explosive EDR market in 2022.

In 2021, the rate of EDR installations onto passenger cars in China remained low, about 9%, a figure projected to climb over 70% in 2022 along with compulsory installation of EDR, and even surge to at least 90% in 2024, according to ResearchInChina.

If with EDR data retrieval tools unconsidered, EDR hardware alone is priced between RMB300 and RMB500, and then the market in 2022 is valued at RMB4.85 billion to RMB8.03 billion.

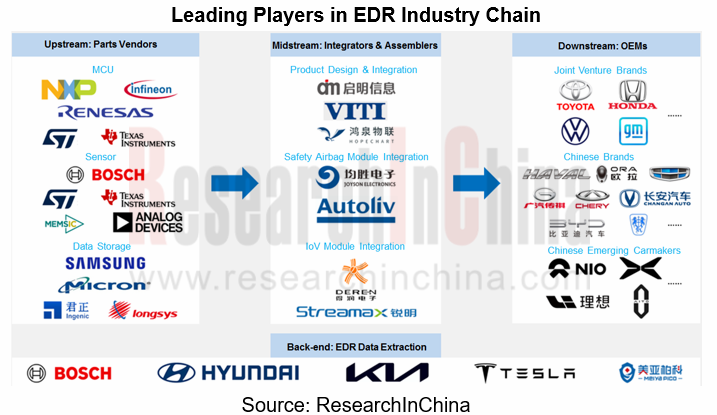

The players in the industrial chain are scrambling for EDR market dividends

EDR market ushers in explosive growth from 2022 when the new national standards for EDR take effect, and the players in the EDR industry chain are stepping up efforts in this lucrative segment.

EDR gets increasingly used onto passenger cars besides commercial vehicle.

The providers of data storage, chips, data retrieval tool, etc. race to beef up production lines and technology input.

OEMs expedite the testing and verification of their products and make them available onto cars.

Qiming Information Technology: It started in 2020 to develop products in line with national standards for EDR, has boasted a rich portfolio of EDR related data storage products and got them used in commercial vehicle.

Bosch: a world-renowned provider of EDR data retrieval tools has got its CDR (crash data retrieval) available for information acquisition of EDR on passenger cars and light-duty trucks since 2000.

As of January 2022, Bosch CDR has been iterated to the version 21.4, which fully supports a multitude of vehicle models (2022) in China such as Bentley, Maserati, Ferrari, Chrysler, Fiat, Jeep, and Toyota Corolla.

GigaDevice Semiconductor (Beijing) Inc.: MCUs have been used in EDR devices and shipped massively, particularly the MCUs like 105 and 305 with handsome deliveries; wherein, GD32F105 is the EDR used for commercial vehicle.

Ingenic Semiconductor Co., Ltd.: It grows into a leading supplier of automotive memories through acquisition of ISSI (Beijing) in 2019. For automotive sector, the company delivers FLASH memory for EDR.

On the whole, it takes quite a period of time for independent suppliers’ products to be verified for access to the OEM passenger car market although without a high technical barrier for EDR. The technology provider, by contrast, is faced with more opportunities. No matter which side it is, overall competence is vital in competition.

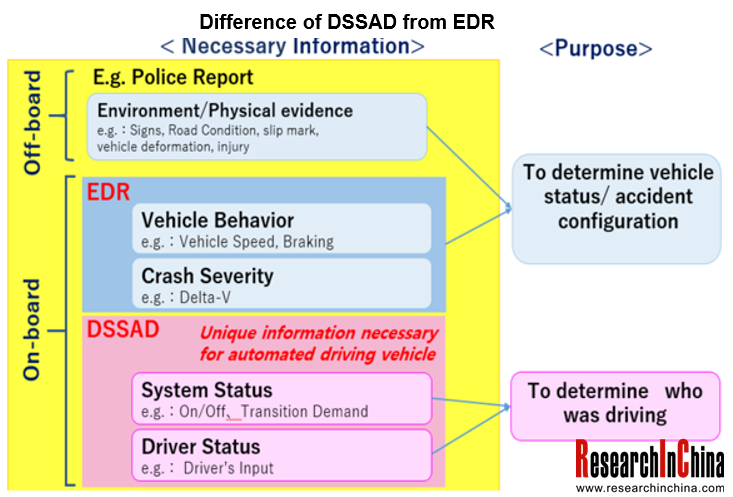

For autonomous driving, EDR is gearing towards DSSAD.

EDR alone can no longer meet the future market demand amid the prevailing autonomous vehicle. With a focus on recording information about vehicle and the driver when an accident occurs, EDR is unable to record whether the driver or the automated driving system is held accountable. To that end, DSSAD, short for data storage system for automated driving, is needed.

It is clearly required in the world’s first international regulations in June 2020 on L3 autonomous vehicle that autonomous vehicle must be equipped with DSSAD. The Chinese DSSAD standards is still being formulated.

In the DSSAD market, the competitors such as CalmCar and Duvonn Electronic Technology have made preemptive moves and rolled out DSSAD products. Noticeably, CalmCar DSSAD system suited for more than a dozen vehicle models in 2021.

Hopefully, DSSAD system will be popularized as the policy on L3 autonomy gets enforced and advanced autonomous vehicle is produced on a large scale.

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...