Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakers

With the development of intelligent connectivity, the interaction of vehicles with people, other vehicles, and roads during driving will generate massive data which need be stored, calculated and analyzed before decisions are made and output. The IT architecture of traditional automakers is not enough to support complex data computing and network, so the cloud is the only solution.

The digital transformation of automakers refers to cloud transformation

Based on 5ABCD (5G, artificial intelligence, blockchain, cloud computing, big data) and other technologies, cloud service platforms run through the research and development, production, sale, management, services and other links of automakers to effectively help them improve automotive products, user experience and service ecosystem as the core and basic platforms for the digital transformation of automakers. It can be said that the digital transformation of automakers is virtually cloud transformation.

For automakers, the significance of moving to the cloud lies in:

1. Lower IT costs. Cloud platforms can save IT resource budgets and improve productivity. FAW Hongqi has slashed the construction cost by 40% after using HUAWEI CLOUD Stack to build an information infrastructure platform.

2. Higher business efficiency. In product research and development, cloud platforms enable timely computing power. CAE and CAD scenarios have begun to see cloud-based applications, especially the construction of HPC hybrid cloud models. In terms of marketing, E-commerce websites, CDP, CRM, etc. have deployed in the cloud to better integrate with third-party data for the purpose of applications and responses. For the IoV business, cloud platforms can meet the demand of high-concurrency connectivity, business peaks and valleys, and multi-ecological construction, so more than 90% of automakers have make a layout of IoV services in the cloud. As for scenarios such as big data and AI, cloud-based models (public cloud, private cloud, and hybrid cloud) can reduce O&M and usage costs.

3. Further software innovation. Under the software-defined vehicle architecture, vehicles can be continuously upgraded through the OTA services, so that they keep evolving. The decoupled development of software and hardware and the continuous services of the back-end cloud platform empower the innovative ecology of automotive development.

4. Product differentiation. OEMs can use hundreds of perception algorithms to create personalized upper-layer applications, while new entrants can establish differentiated advantages with new cloud services and the ability to adjust automotive software on demand.

The functions of automotive cloud services are continuously subdivided, and applications are gradually deepened

As new energy vehicles become more intelligent, automotive cloud services are constantly being segmented, wherein autonomous driving, IoV, "electric drive, battery, electric control", HD maps, V2X, etc. account for higher proportions. In addition, simulation, OTA and other applications have rising demand for the cloud.

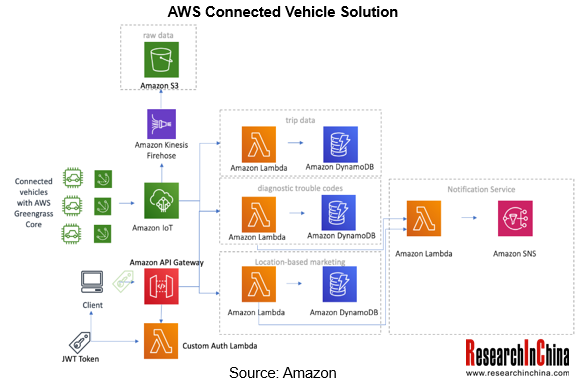

Amazon Web Services (AWS) was renamed as Amazon Cloud Technology in 2021 to provide digital transformation and service solutions for automakers in China. With AWS IoT, customers can connect vehicles and devices to the AWS Cloud securely, with low latency and with low overhead. To help customers more easily develop and deploy a wide range of innovative connected vehicle services, AWS offers a framework that helps customers integrate AWS IoT and AWS Greengrass into the Automotive Grade Linux (AGL) software stack.

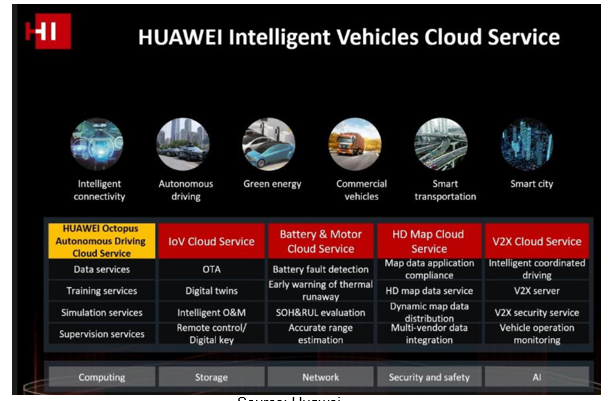

HUAWEI CLOUD has a relatively comprehensive coverage, including Autonomous Driving Cloud Service, IoV Cloud Service, OBC/BMS/MCU Cloud Service, HD Map Cloud Service (HDMC) and V2X Cloud Service. HUAWEI CLOUD services have covered 80% of domestic leading automakers.

The HUAWEI CLOUD Autonomous Driving Cloud Service (Octopus) provides driving data, training, and simulation services that can support petabyte-level data storage and millions of data retrieval in seconds. Through the self-developed Ascend 910 AI chip and MindSpore AI framework, it can improve training efficiency by nearly twofold, and provide more than 10,000 simulation scenarios, covering most road conditions such as intelligent driving, active safety, and dangerous scenarios.

Huawei's IoV Cloud Service covers four major sectors: OTA, digital twins, intelligent operation and maintenance, and remote control/digital key. Referring to ICT industry, Huawei has proposed the concept of VHR (Vehicle History Record), which realizes the visibility, maintainability, user care, and efficient operation of vehicles on the basis of a large amount of data. VHR covers multiple links like data collection, data governance, data analysis, vehicle status visualization, vehicle fault diagnosis, trend analysis, prediction, improvement, etc. to form a vehicle operation and maintenance closed-loop system. VHR-based application scenarios include vehicle digital twins, remote diagnosis, intelligent guard, quality prediction, vehicle portrait, etc.

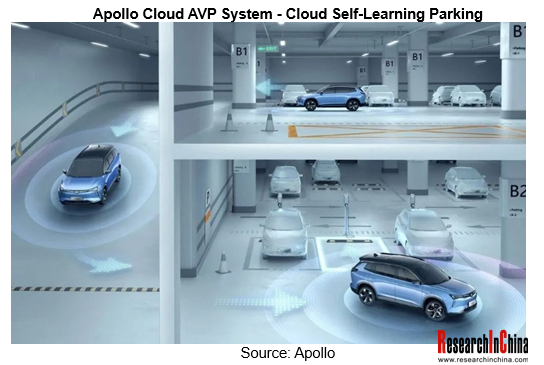

Baidu Apollo's "Cloud Intelligent Unmanned Parking System" (CLOUD AVP) has been mass-produced and mounted on the WM W6, enabling autonomous driving in high-frequency scenarios. Users can make the Apollo system quickly memorize and recognize roads and upload them to the cloud through UI touch interface, and complete calculation and delivery through the cloud, so as to realize autonomous driving, obstacle avoidance, intelligent parking space search, autonomous parking and other functions. At the entrance of a parking lot, the vehicle can automatically drive into the parking lot, find a parking space and park itself without human intervention. The cloud platform helps WM Motor complete line analysis and decision-making in the cloud.

Under the rigid demand of the automotive cloud market, a number of new automotive cloud platform suppliers have emerged in China, such as ByteDance and PATEO.

ByteDance launched its automotive cloud business in September 2021, providing three types of services:

①IaaS Volcano Engine public cloud, with three major capabilities: computing, network, and storage;

②PaaS, namely Volcano Engine-autonomous driving cloud service, including simulation platforms, data annotation, image rendering, and data unpacking;

③SaaS, including service management, vehicle management, after-sales data, production data and other capabilities.

In the field of automotive cloud, ByteDance has developed the automotive APP "Volcano Car Entertainment”, which integrates TikTok, Xigua Video, Toutiao, dongchedi.com and so on. Through it, users can watch videos, listen to audiobooks, and read news. Through the AI text-to-speech (TTS) technology, any text can be automatically converted into speech for playback. Users can also quickly shoot videos, take pictures, and share them on TikTok. Volcano Car Entertainment has been available in models such as Geely and Changan.

ByteDance will advance its Auto Cloud Plan in two stages. In the first stage (2021-2022), ByteDance will start from incremental cloud services, including the IoV cloud (IoV operation, scenario engines), the autonomous driving cloud (data labeling, cost-effective GPU clusters, etc.), business strategy cloud, Volcano Car Entertainment (annual fee model + cloud), and advertising cloud. In the second stage (2023-2025), ByteDance aims to gradually cover more than 50% of the cloud business of customers and catch up with Tencent in revenue.

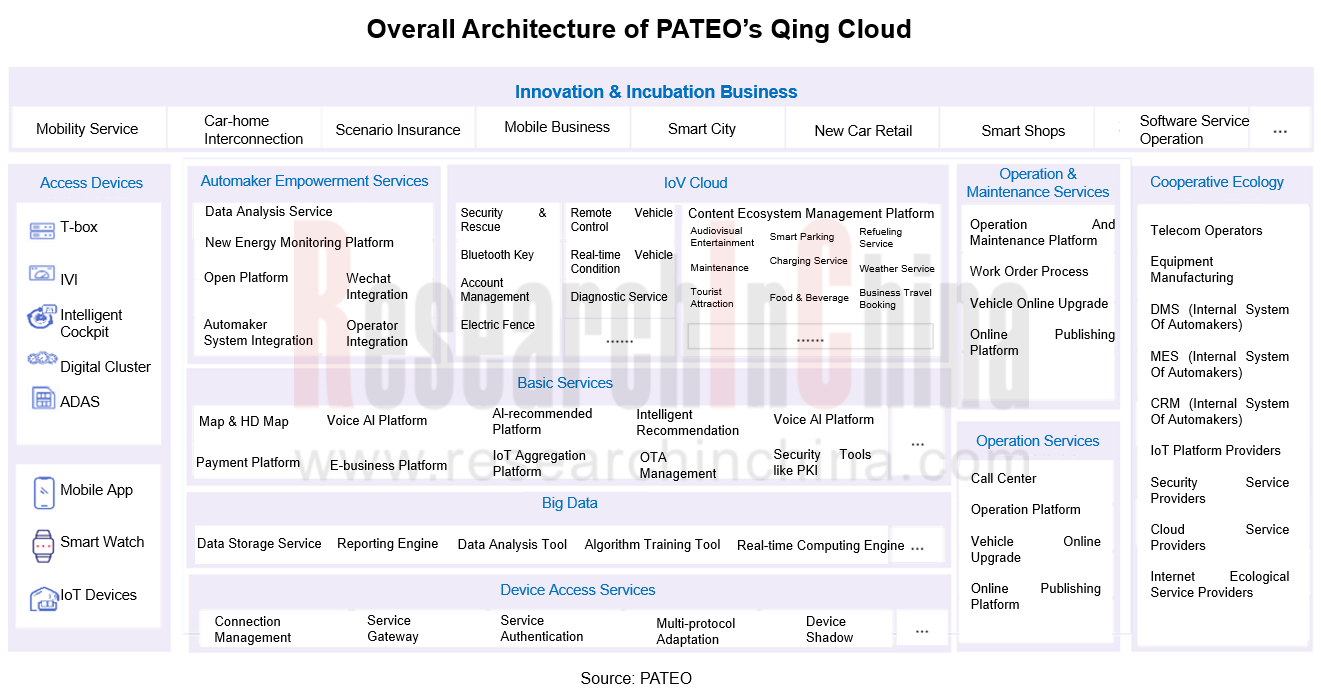

PATEO has focused on the core technology of IoV for more than ten years, and boasts five core technology platforms: operating system, intelligent voice, hardware, HD map and cloud platform. For the cloud platform, PATEO has established a new PAAS platform, equipment access platform, big data platform, basic service platform, automaker empowerment platform, IoV service platform, operation and maintenance management platform, innovation & incubation business, etc. on the basis of the public cloud IaaS structure.

PATEO's IoV cloud platform has experienced six generations and established a mature IoV service system integrating product R&D, project delivery, platform operation and maintenance, and service operation. PATEO builds its core advantages around service integration, content integration, user insight, product innovation, and in-depth industrial cultivation. PATEO breaks through the barriers of R&D and marketing to offer scenario-based services for users in the full life cycle and establish a new business model for user service operations. The platform dabbles in wearable devices, smart cities, smart transportation, smart homes, smart home appliances and other IoT fields; through large-scale automotive user scenarios, it covers cities, transportation, and home environments, so as to better serve users.

At present, PATEO serves more than 30 car brands, nearly 100 models and over 200 model iterations. It has had almost 1,000 projects mass-produce. With business spreading over more than 30 countries and regions, PATEO has become an emerging local IoV leader.

The Qing AI3.0 voice cloud platform developed by PATEO independently enables full-duplex voice interaction, multi-round dialogue, deep contextual memory and understanding, wake-up-free, what you see is what you can say, sound source localization, and multi-screen interaction, voiceprint recognition and other functions. The cloud-based semantic control can recognize many high-level natural expressions without consuming the computing power of the IVI, but with saving costs and greatly improving the user experience.

PATEO AI3.0 has been mass-produced and landed on BAIC BJEV, BAW, Dongfeng, Geely, Great Wall, SAIC-GM-Wuling, New Baojun, Hongqi, Voyah, Volkswagen and other models. Besides, it will be available on the upcoming production models of Hyundai, Changan and Besturn.

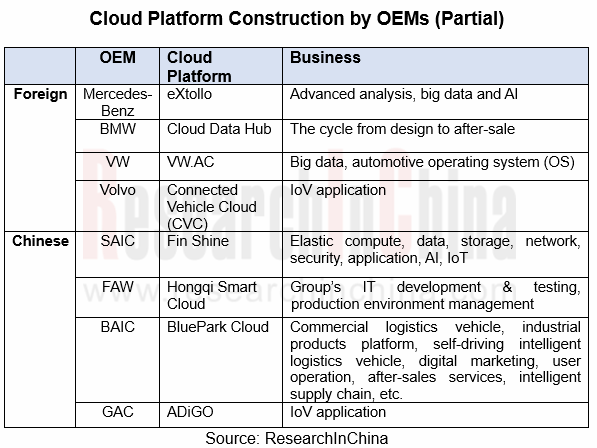

In addition to connecting to public cloud platforms, OEMs have also begun to deploy their own private cloud platforms so as to master core data and improve security while weakening the "supply relationship" with major players.

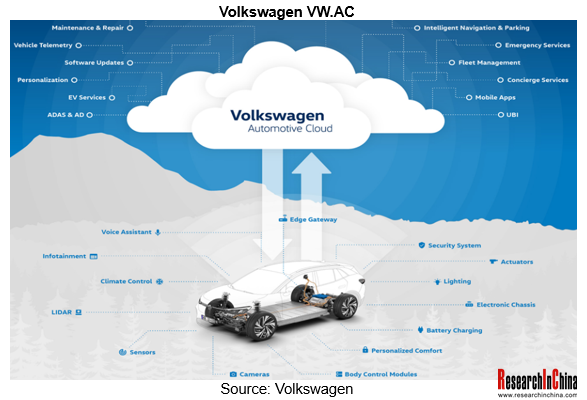

Given the consideration of mastering core data, improving data security, and providing better services for their own car owners, automakers have begun to the deployment of private cloud or hybrid cloud platforms dominated by themselves and assisted by cloud platform providers. For example, Volkswagen has established CARIAD, an independent automotive software company. By 2030, up to 40 million vehicles from all Volkswagen brands should be operating on VW Automotive Cloud.

SAIC Group established Fin-Shine in 2017, a cloud computing subsidiary providing cloud services such as elastic compute, data, storage, network security, application, AI and IoT. Having built a total of three centers in three cities Shanghai, Nanjing and Zhengzhou in 2021, Fin-Shine is in possession of over 4,000 cloud hosts and more than 10,000 containers/virtual machines as well as 30PB storage.

To date, Fin-Shine has provided cloud products, services and solutions to SAIC Group and at least sixty subordinates under SAIC such as SAIC Motor Passenger Vehicle, SAIC MAXUS, Banma, SAIC Mobility, Global Car Sharing.

When it comes to intelligent connectivity, ADAS has an extremely high demanding on fast response and safety, it is still impossible to migrate compute altogether to the cloud. For smart cockpit, cloud computing can be applicable to some functions without quite high safety and real-time requirements, such as map & navigation, voice control and OTA.

With advances in such technologies as 5G, AI, big data and cloud computing, the automakers turn to more operations going to the cloud, and the application scenario with high data density and time delay sensitivity from the edge of enterprises are constantly increasing. Automotive cloud platform is gearing from simplification to multi-cloud development whilst distributed edge cloud get increasingly used and AI-enabled smart cloud and V2X cloud-managed platform will play a bigger role.