Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

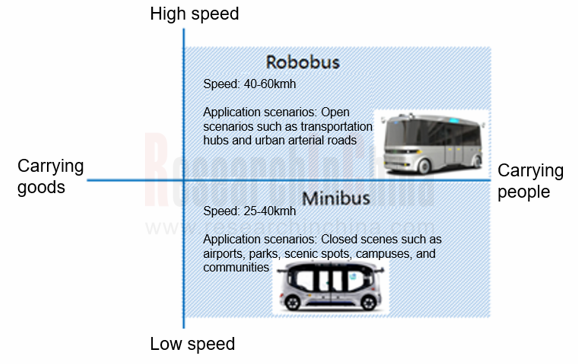

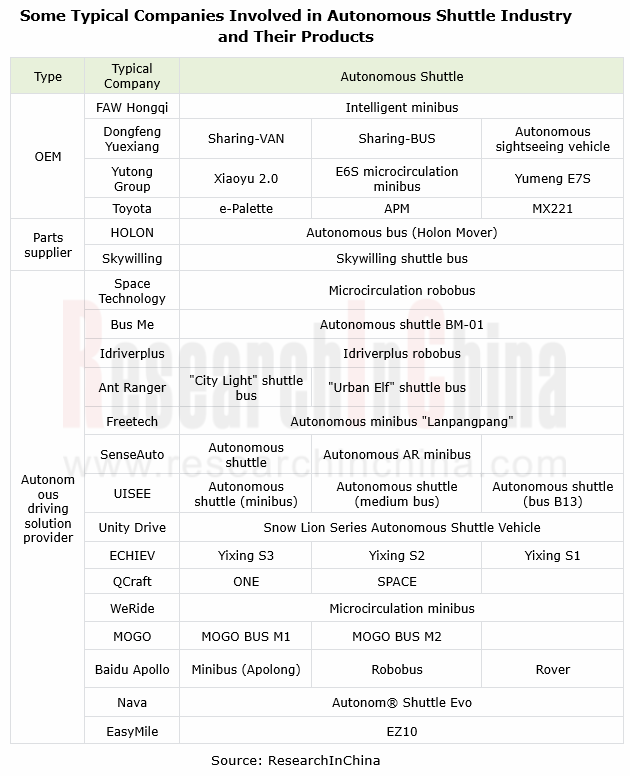

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuses, namely micro-circulation shuttle buses, mostly work in airports, parks, scenic spots, campuses, communities and other scenarios at speeds of 25-45km/h. Typical minibuses are offered by FAW Hongqi, Baidu Apollo and UISEE.

Robobuses are autonomous minibuses running at 40-60 km/h under the control of software. They are often seen in open scenarios such as transportation hubs and urban trunk roads, and provide urban public transport services. Representative robobuses include Qcraft ONE and MOGO BUS M2.

I. Autonomous driving solution providers flood into the arena of shuttle buses.

In the arena of shuttle buses, main players embrace OEMs, auto parts companies and autonomous driving solution providers, among which L4 autonomous driving technology providers perform stunningly. For example, the robobus co-built by Shanghai Space and PIX Moving was delivered offline in March 2022, and officially began to provide short-distance shuttle services between Wangjiazhuang Subway Station and Xiantao Big Data Valley, Yubei District, Chongqing in June 2022. In July 2022, the driverless buses from Idriverplus landed in Beijing Dongsheng Science and Technology Park to start the normal operation and serve commuters in the park. In September 2022, MOGO officially released the autonomous OEM production buses - MOGO BUS M1 (autonomous minibus) and MOGO BUS M2 (autonomous bus), both equipped with the "vehicle-road-cloud integration" system.

As well robotaxises that adopt L4 technology, autonomous shuttles boast sensors such as LiDAR, radar and cameras, and combine cloud software and sensors to enable vehicle positioning, environmental perception, path planning & decision, and vehicle control & actuation. At present, many L4 technical solution providers like QCraft, UISEE, MOGO, WeRide and Baidu Apollo have laid out technology routes for both robotaxis and robobuses.

II. The operation scenarios of autonomous shuttles are extending from designated areas and low-speed scenarios to open environments and complex scenarios.

At present, autonomous shuttles are running from closed and semi-closed designated areas (parks, scenic spots, factories, communities, campuses, airports, etc.) to urban public roads as subway shuttle buses, urban microcirculation buses, and autonomous buses for ride-hailing services.

III. The current growth of the autonomous shuttle market is mainly driven by policies and smart road upgrades.

1. China, the United States, Japan, and South Korea have issued favorable policies for autonomous buses.

Japan, the United States and South Korea among other foreign countries have introduced policies to encourage the commercial operation of autonomous vehicles like autonomous shuttles.

On March 10, 2022, the National Highway Traffic Safety Administration (NHTSA) of the United States issued a first-of-its-kind final rule, the Occupant Protection Safety Standards for Vehicles Without Driving Controls, no longer requiring automated vehicle manufacturers to equip their ADS-enabled vehicles with traditional manual controls to meet crash standards.

On March 10, 2022, the National Highway Traffic Safety Administration (NHTSA) of the United States issued a first-of-its-kind final rule, the Occupant Protection Safety Standards for Vehicles Without Driving Controls, no longer requiring automated vehicle manufacturers to equip their ADS-enabled vehicles with traditional manual controls to meet crash standards.

Japan decided to allow for use of L4 autonomous vehicles (controlled by system) in transit and delivery services from April 1, 2023.

Japan decided to allow for use of L4 autonomous vehicles (controlled by system) in transit and delivery services from April 1, 2023.

South Korea proposed a goal of commercializing L4 (highly automated) autonomous buses and shuttle buses by 2025 under its “Mobility Innovation Roadmap”. On November 25, 2022, Seoul, capital of South Korea, opened the first autonomous bus line with a total mileage of about 3.4 kilometers, marking South Korea’s first step to commercialize autonomous shuttles.

South Korea proposed a goal of commercializing L4 (highly automated) autonomous buses and shuttle buses by 2025 under its “Mobility Innovation Roadmap”. On November 25, 2022, Seoul, capital of South Korea, opened the first autonomous bus line with a total mileage of about 3.4 kilometers, marking South Korea’s first step to commercialize autonomous shuttles.

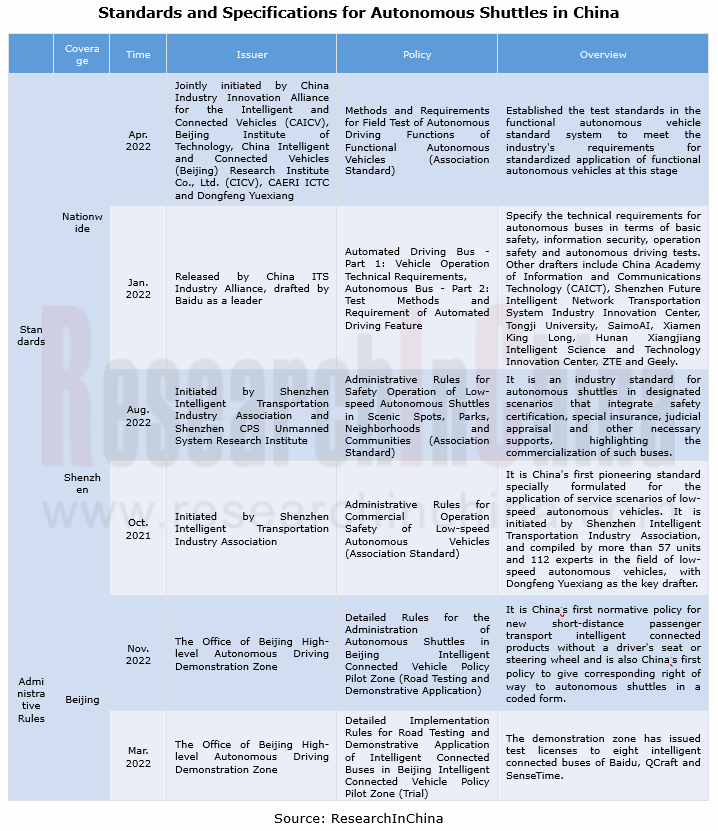

In China, Beijing, Shenzhen and other cities have standardized autonomous shuttles in terms of product standards and administration, setting an example for the development of the industry.

In January 2022, the "Automated Driving Bus” association standard jointly drafted by Baidu, China Academy of Information and Communications Technology (CAICT), ZTE and Geely was officially released. This standard covers two parts: Automated Driving Bus - Part 1: Vehicle Operation Technical Requirements, and Autonomous Bus - Part 2: Test Methods and Requirement of Automated Driving Feature. They specify the technical requirements for autonomous buses in terms of basic safety, information security, operation safety and autonomous driving tests.

In January 2022, the "Automated Driving Bus” association standard jointly drafted by Baidu, China Academy of Information and Communications Technology (CAICT), ZTE and Geely was officially released. This standard covers two parts: Automated Driving Bus - Part 1: Vehicle Operation Technical Requirements, and Autonomous Bus - Part 2: Test Methods and Requirement of Automated Driving Feature. They specify the technical requirements for autonomous buses in terms of basic safety, information security, operation safety and autonomous driving tests.

In March 2022, Beijing High-level Autonomous Driving Demonstration Zone issued the Detailed Implementation Rules for Road Testing and Demonstrative Application of Intelligent Connected Buses in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Trial), posing specific administrative requirements for in-vehicle management, vehicle operation, road test, insurance and technical parameters.

In March 2022, Beijing High-level Autonomous Driving Demonstration Zone issued the Detailed Implementation Rules for Road Testing and Demonstrative Application of Intelligent Connected Buses in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Trial), posing specific administrative requirements for in-vehicle management, vehicle operation, road test, insurance and technical parameters.

In November, 2022, Beijing High-level autonomous driving Demonstration Zone issued the "Detailed Rules for the Administration of Autonomous Shuttles in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Road Testing and Demonstrative Application)". It is China’s first normative policy for new short-distance passenger transport intelligent connected products without a driver's seat or steering wheel and is also China’s first policy to give corresponding right of way to autonomous shuttles in a coded form.

In November, 2022, Beijing High-level autonomous driving Demonstration Zone issued the "Detailed Rules for the Administration of Autonomous Shuttles in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Road Testing and Demonstrative Application)". It is China’s first normative policy for new short-distance passenger transport intelligent connected products without a driver's seat or steering wheel and is also China’s first policy to give corresponding right of way to autonomous shuttles in a coded form.

2. The construction and upgrading of smart roads accelerate the large-scale application of autonomous shuttles.

The construction of smart roads is the premise for operating autonomous shuttles. In particular, the planning of smart bus lines in various urban demonstration areas has favored the application of robobuses. So far, Beijing, Xiong'an New Area, Guangzhou, Ezhou, Zibo, Changsha, Wuxi, Zhengzhou, Chongqing, Hainan and the like have taken the lead in introducing autonomous shuttles on the basis of smart roads.

As of September 2022, Wuhan Economic & Technological Development Zone had opened 321km test roads in total for intelligent connected vehicles, of which 106km is fully covered by 5G and CVIS. It had deployed more than 1,800 intelligent roadside units such as cameras, LiDARs, radars and edge computing servers at 96 smart intersections to support real-time information exchange between vehicles, between vehicles and roads, between vehicles and the Internet. Among the autonomous shuttles landing in Wuhan Economic & Technological Development Zone, more than 30 Sharing-VANs from Dongfeng Yuexiang have come into normal operation, travelling a total of over 209,000 kilometers.

Guangzhou has opened a total of 353 test sections for intelligent connected vehicles, with a cumulative one-way mileage of 654.451 kilometers and a two-way mileage of 1,308.902 kilometers. From August 2022 to December 2023, Guangzhou starts an autonomous driving pilot project for urban mobility, and introduces 50 autonomous buses from different companies on the loop lines around Canton Tower and Guangzhou International Bio Island, providing at least 1 million rides for passengers.

Accompanied by the construction and upgrading of smart roads as well as the promotion of seamless mobility services, autonomous shuttles and robotaxi will be integrated into intelligent city transportation systems together to offer diversified smart mobility services.

IV. Autonomous shuttle companies are exploring new business models such as PRT

Autonomous shuttles are a solution to “first-mile and last-mile" mobility. As autonomous shuttles penetrate into urban communities, subway stations, etc., how to activate the "peripheral nerves" of urban traffic on large scale is one of the issues that need urgent consideration in urban governance.

For seamless mobility services, some companies are exploring new business models.

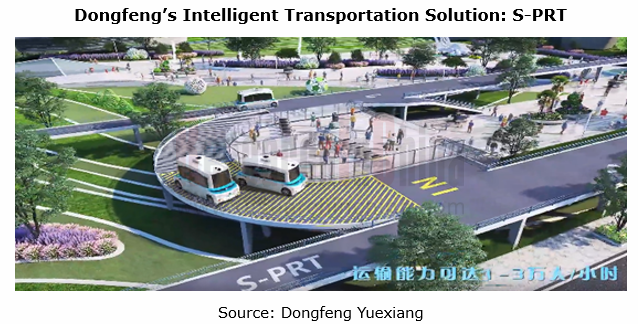

For example, Dongfeng Yuexiang's S-PRT (Sharing-Personal Rapid Transit) is a shared novel autonomous public transportation system composed of fully autonomous small vehicles and dedicated road networks. As a rapid nonstop public transportation tool with low construction cost (one-fifteenth of subways), it can transport an average of 10,000 to 30,000 people per hour at the average speed of 40-60km/h, and allows users to reserve without needing to wait. Dongfeng Yuexiang aims for test and demonstration of an operating mileage of more than 10 million kilometers in the Xiong'an New Area within three years, and promotes the "Xiong'an Solution" with partners in no less than 30 cities.

At the beginning of 2023, PIX Moving signed a strategic agreement with Common Rail (Hangzhou) Intelligent Industry Development Co., Ltd. on joint construction of a common rail project in Xiaoshan, Hangzhou. They will provide autonomous shuttles based on PIX’s chassis technology to solve the problems of large-scale commercialization of autonomous driving technology and urban traffic congestion.

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...