Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.

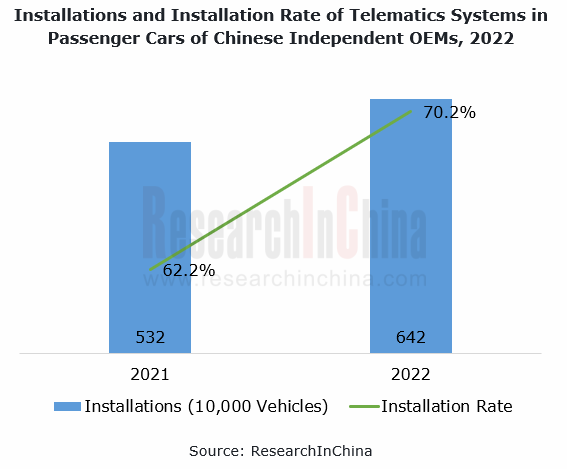

From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million vehicles, surging by 20.6% on the previous year, with the installation rate higher than 70%, up 8 percentage points from the prior-year period.

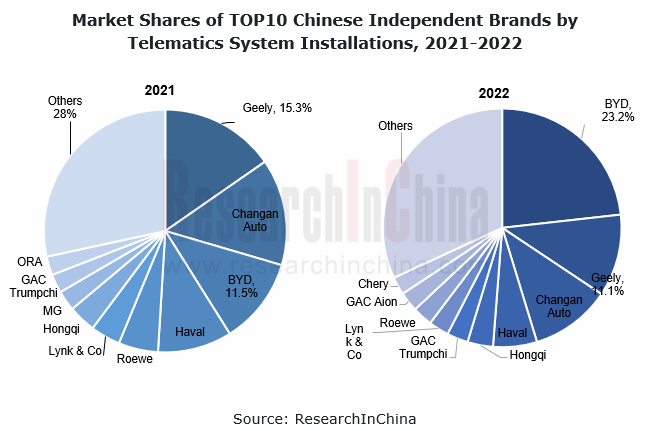

By brand, in 2022, driven by the new energy market (from January to December 2022, BYD’s new energy vehicle sales exceeded 2.2 million units), BYD installed the most telematics systems in the market, accounting for more than 23%, 11.7 percentage points higher than the same period last year; Geely followed, with its share down 4.2 percentage points year on year.

In 2022, the development of Chinese independent brands in telematics systems highlights the following:

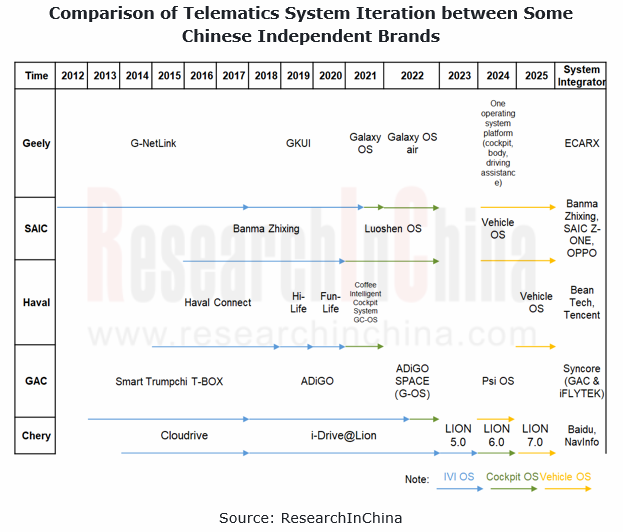

1. Starting from 2024, the control scope of telematics systems is expected to expand to the entire vehicle.

In 2022, the control scope of telematics systems expanded to the whole cockpit. According to the plans of OEMs, from 2024 onwards, they will expand the control scope of their telematics systems to AD/ADAS, body and other domains, that is, the entire vehicle.

Geely’s telematics system has gone through four development phases: G-NetLink, GKUI, Galaxy OS, and Galaxy OS Air. In 2024, its telematics system will realize control over the entire vehicle.

G-NetLink: during 2012-2017, based on Android, and equipped with mainstream functions, e.g., Carlife/Carplay, voice, and remote control

GKUI Era: during 2018-2021, built by ECARX on the E01 platform, introduce WeChat and Alipay account login, and support car-home interconnection, watch control car and other functions

Galaxy OS: applied in vehicles in 2021, built by ECARX on the E02 platform, open more than 1,800 car control signal interfaces, and enable control on more than 200 vehicle functions, ensuring that users can "control what they see" in the car

Galaxy OS Air: seen in vehicles in 2022, add the speech chip-based V01+5G communication on the basis of Galaxy OS. The speech data processing speed is increased by 13 times, and such functions as “see and speak” and sound localization in four sound zones are supported.

According to ECARX’s R&D plan, in 2024 Geely will launch a vehicle operating system platform that integrates cockpit, body, and driving assistance domains.

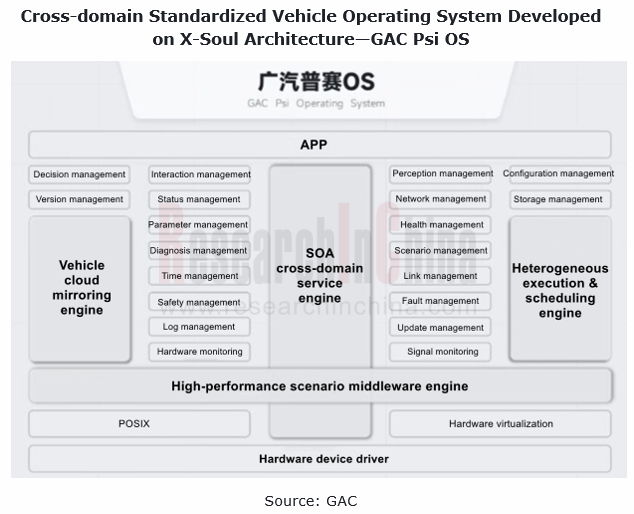

GAC has experienced the three phases: Smart Trumpchi, ADiGO, and ADiGO SPACE. In 2024, it will enable the cross-domain vehicle operating system - GAC Psi OS.

Smart Trumpchi: during 2013-2017, based on WinCE, and equipped with mainstream functions, e.g., 3G and remote control.

ADiGO: during 2018-2022, based on Android, upgrade 4G networks, online navigation, online entertainment, voice and other mainstream functions in deep cooperation with Tencent Auto Intelligence (TAI), and work with Syncore to create G-OS operating system.

ADiGO SPACE: used in vehicles in 2022, enhance voice interaction, and add user-defined voice command and “see and speak” functions; enrich the car entertainment ecosystem by introducing applications, e.g., Mango TV, Kugou and Car Vinyl Music.

Psi OS: expected to be available on vehicles in 2024. It will control the three major domains of driving assistance, infotainment, and smart car control in a unified way to improve software development efficiency and iteration speed, enabling software iteration in a minute compared with previous iteration every month.

2. Supported by hardware such as AR/VR and holographic projector, cockpit games and metaverse will become a new trend for vehicle applications.

By the end of 2022, the difference between vehicle application ecosystems among brands has been narrowing, and software such as social contact, map, audio and video has found massive application in vehicles. Meanwhile, as technologies like powerful chips, holographic projection, and AR/VR, vehicle games have begun to be available on vehicles. Vehicle games are expected to become a next development direction for vehicle applications.

In December 2022, GAC announced the ADiGO SPACE Intelligent Cockpit Upgrade Plan, and introduced two products: ADiGO PARK Metaverse and ADiGO SOUND, an all-scenario sound interaction ecosystem. Wherein, ADiGO PARK Metaverse carries a VR head-mounted display jointly developed by GAC Group and iQIYI Qiyu VR. This device features 5K-level binocular display resolution, and 16MP exterior stereo camera, an equivalent to a 130-inch display, meeting display requirements of 3A games.

In October 2022, Chery released the Lion Ecosystem 2023, according to which Lion 6.0 (2024) will highlight a "third-space" intelligent cockpit and expansion of scenarios (e.g., game/KTV/video office); Lion 7.0 (2025) will feature "space + metaverse", and enable cockpit connection to AR/VR devices.

3. Powerful chips will further enhance the capabilities of telematics systems.

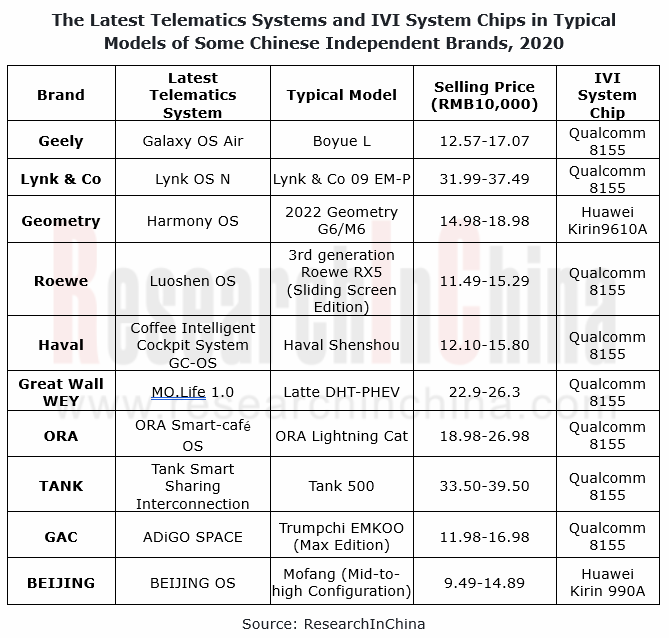

The rapid iteration of telematics systems and the development of vehicle application ecosystems are inseparable from IVI system chips. In 2022, multiple models of Chinese independent brands used high computing power chips like Qualcomm 8155 and Huawei Kirin 990A. Among them, Geely Boyue L, Lynk & Co 09 EM-P and 3rd-generation Roewe RX5 (Sliding Screen Edition) were equipped with Qualcomm 8155 as a standard configuration.

Among the current mainstream cockpit chips, Qualcomm 8155, a 7nm SoC with 1000GFLOPS GPU and 8TOPS NPU, supports up to 6 cameras, 4 2K screens or 3 4K screens. Also it allows different displays to use different operating systems, and supports passenger capacity/passenger recognition, and face recognition & classification/behavior analysis.

The performance of the next-generation cockpit chips will be still ever higher. For example, Qualcomm 8295, a 5nm chip with 30TOPS AI computing power, supports the integration of multiple ECUs and domains, covering dashboard, AR-HUD, center console screen, rear seat displays, electronic rearview mirror, and in-vehicle monitoring. In addition, the chip provides video processing capabilities and supports integration of driving recording function. Higher-performance chips will make telematics systems more capable.

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...