Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables.

Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product competitive edges. After de-stocking by "steep price cut" and "huge discount sale", how to find powerful leverages to turn the corner has posed a big challenge to the company. The Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023 released by ResearchInChina analyzes and studies automation, connectivity, electrification, sharing and digitization.

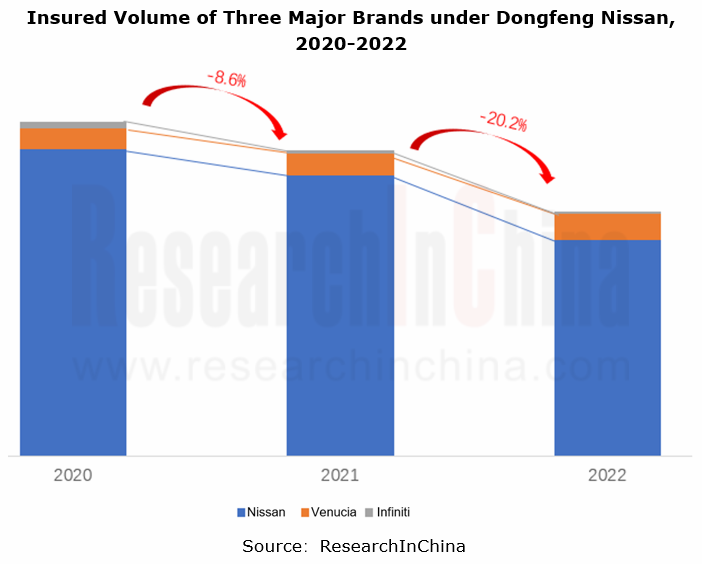

Dongfeng Nissan, a 50:50 joint venture between Nissan China and Dongfeng Motor Group, operates three brands: Nissan, Venucia and Infiniti. In recent three years, except for Venucia, both Nissan and Infiniti have suffered from declining sales.

1.Nissan’s intelligent connection functions are relatively conservative.

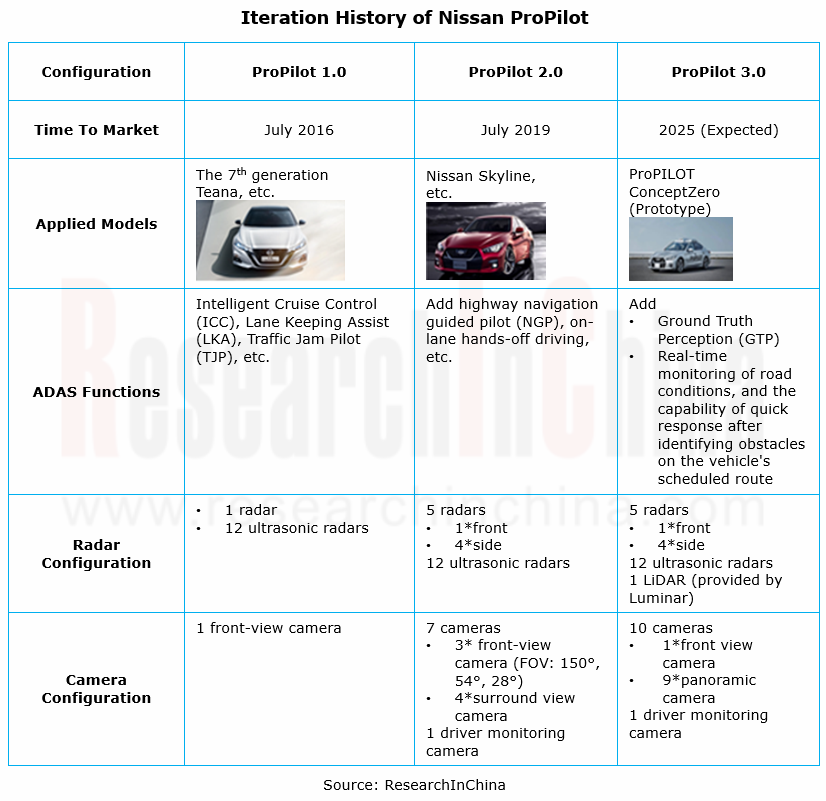

Nissan now implements a conservative strategy on ADAS and telematics functions, but keeps upgrading and iterating.

ProPilot 2.0, an ADAS system currently used by Nissan, was released as early as 2019 and was introduced to China in 2021. By the end of 2022, Dongfeng Nissan’s ADAS installation rate reached 32.1%, of which the installation of L2 ADAS was 9.3%, and L2.5 ADAS, 0.1%, much lower than the average of passenger cars in China.

Nissan's latest IVI system, Nissan Connect 2.0+, completed upgrade in September 2022. Based on the previous-generation system, it adds functions from 12.3-inch dual display, HUD, AR navigation, four-zone voice interaction and IVI theme mall, to voice control, online vehicle services, remote real-time monitoring, and online navigation.

The system was first installed in the ARIYA model. Its IVI chip is Renesas R-CAR H3, and the display combination is 12.3-inch dual display + 10.8-inch HUD. Its entertainment ecosystem covers Amap, Kugou Music, Ximalaya, iQIYI, LazyAudio, Nissan Intelligent Mobility Radio (integrating Kaola FM and Tingban), in-car KTV, and in-car audio books. Despite offering big improvements in intelligent connectivity, the automaker still lags far behind emerging carmakers like NIO, XPeng Motors and Li Auto.

2.Electrification will become Nissan's primary lever.

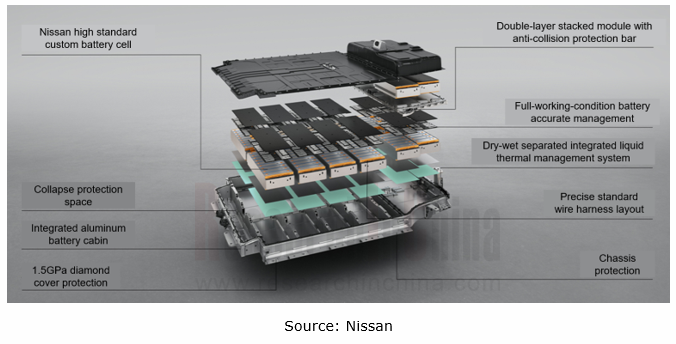

In September 2022, Nissan's first compact SUV BEV model ARIYA was launched on the Chinese market. ARIYA combines Nissan's 75-year all-electric techniques and more than 25-year experience in battery development and manufacture, enabling Nissan’s complete independent development chain of battery, motor and electric control unit (ECU). Adopting 9-layer protection architecture, the NISSAN ultra-safe battery on the car has undergone 111 items of industry high standard battery safety tests, and has enabled the car to travel a total of 21 billion kilometers without battery safety accidents. As concerns motor, Nissan creatively combines the merits of permanent magnet synchronous motor and AC asynchronous motor to complement their demerits, and develops an electrically excited synchronous motor with high performance and low energy consumption; the ECU uses 1/10000s ultra-high precision motors for torque control.

In terms of battery development, Nissan adheres to the parallel development route of lithium-ion batteries and all-solid-state batteries (ASSB). In February 2023, Nissan announced that it had successfully developed a new solid-state battery with halved cost. This ASSB has been successful in the laboratory and is expected to come into official production in 2025. A new ASSB-powered electric car will be manufactured in 2028. Meanwhile, Nissan also steps up its efforts to develop new lithium-ion battery technology, and plans to unveil a cobalt-free battery in 2028, favoring a slump in battery cost.

According to its plan, Nissan will introduce 9 battery electric models and Nissan e-POWER-enabled models (New Slyphy, New X-Trail, etc.) to the Chinese market by 2025; electric-driven models will account for more than 40% of the total model sales. In the future, electrification will become the primary weapon of Nissan to hold its ground in market.

3.Venucia is expected to open up a second front of new energy for Nissan.

From the sales of the three major brands under Dongfeng Nissan between 2020 and 2022, it can be seen that the Nissan brand still dominated but with a declining share in the sales, while the sales of Venucia ramped up, with its proportion rising from 6.3% (77,000 units) in 2020 to 7.0% (80,000 units) in 2021, and to 10.9% (98,000 units) in 2022. According to Nissan China’s latest sales data for February 2023, it sold 56,726 vehicles in the month, of which 6,003 units were Venucia (10.6% of the three brands), up 30.3% on a like-on-like basis, higher than the Nissan brand (23.5% MoM).

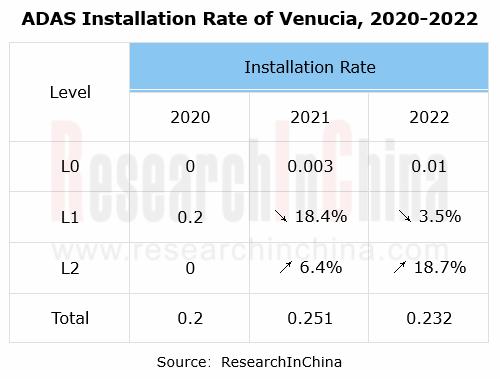

ADAS installation of Venucia in 2022:

?L1: the installations plunged by 76.4% on the previous year, and the installation rate slumped from 18.4% in 2021 to 3.5% in 2022.

?L2: the installations soared by 258.6% year on year in 2022, and the installation rate also showed a rapid upward trend, up to 18.7% in 2022.

From Venucia’s installation rates of L1 and L2, it can be seen that the surging installation of L2 ADAS undoubtedly reflects the rising level of intelligence.

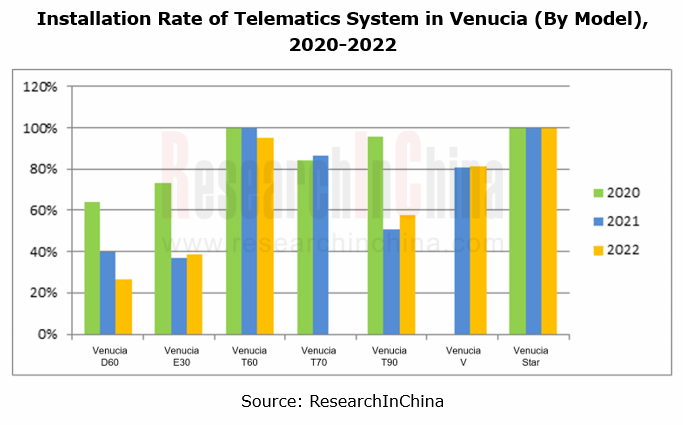

In terms of connectivity, in 2022, Venucia installed telematics systems in 52,758 of its vehicles, with installation rate up to 53.7%. By model, in 2022, the installation rate of telematics system in Venucia Star hit 100%, and both Venucia V and Venucia T60 boasted an installation rate of over 80%.

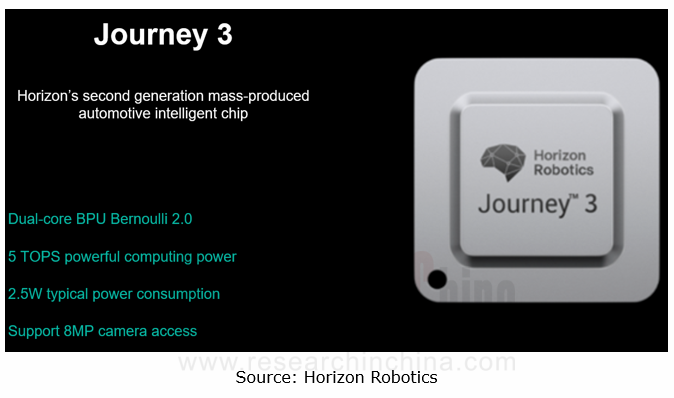

On December 30, 2022, Horizon Robotics and Venucia built cooperation on a new intelligent driving project. Venucia's new intelligent driving platform will bear Horizon Journey 3 chip and Horizon Matrix ? Mono 3 (8MP) visual perception solution to enable advanced driving assistance functions.

The intelligent driving platform will be first applied to several new energy models under Venucia, and the first model will be available in 2023. According to its plan, Venucia will launch at least two new energy models every year in the future. Moreover, Venucia also has the systematic ability to sell 300,000 units annually, and will gradually challenge the sales goal of 500,000 units per year. As for technology, Venucia sticks to developing multiple technology routes simultaneously, having built the Venucia V-π native all-electric platform and Venucia DD-i super hybrid technology. In Dongfeng Nissan's long-term plan and layout, Venucia will make continuous efforts on intelligence and electrification, and will become Dongfeng Nissan's second front of new energy.

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...