China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

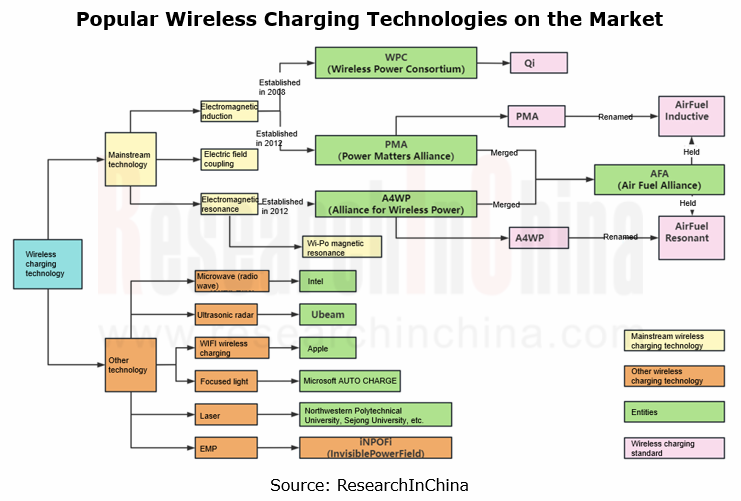

The automotive mobile phone wireless charging module is an integrated device that uses wireless charging technology to charge a mobile phone in the vehicle. The mainstream wireless charging technologies include electromagnetic induction, electromagnetic resonance and electric field coupling. At present, mainstream mobile phone wireless charging solutions use electromagnetic induction technology to charge a mobile phone as per the Qi Standard created by the Wireless Power Consortium (WPC). Since 2017, electromagnetic resonance-based mobile phone wireless charging solutions have appeared on the market, but their application scope is far narrower than electromagnetic induction-based ones.

The automotive mobile phone wireless charging modules has been a standard configuration for most mid-to-high-end models. It is often installed near the center console in line with the Qi Standard, with the general charging power range of 5W-15W. To improve the charging efficiency, some models cooperate with mobile phone vendors (Xiaomi, Huawei, OPPO, Apple, etc.) and adopt private protocols with the charging power ranging at 40W-50W. In the future, more models will be equipped with high-power wireless charging modules, and wireless charging solutions for continuous and stable charging during driving.

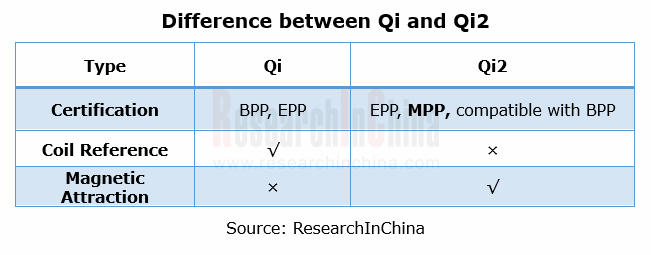

Following the launch of the logo of the Qi2 in January 2023, the WPC released the Qi2 Standard in April, with corresponding adjustments to the certification for mainstream automotive mobile phone wireless charging modules. The WPC developed Magnetic Power Profile (MPP), a magnetic attraction feature added to wireless charging modules.

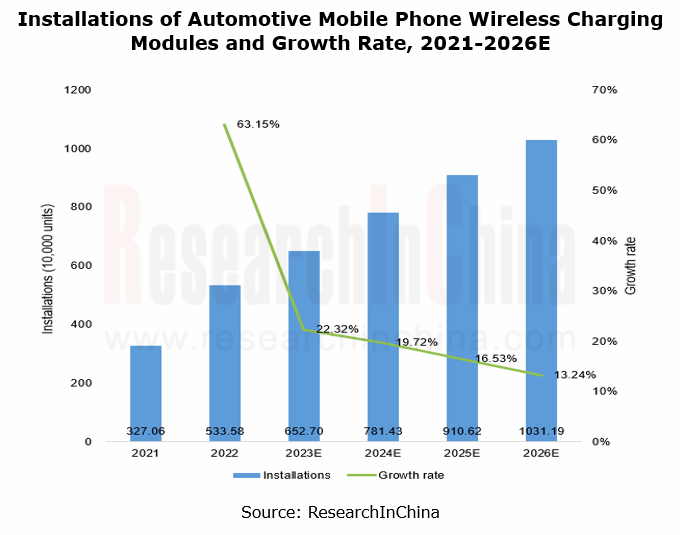

Market Size: the installations of automotive wireless charging modules are expected to hit more than 10 million units in 2026.

From 2021 to 2026, the installations of automotive mobile phone wireless charging modules will sustain steady growth, expected to exceed 10 million units in 2026.

Competitive landscape: there is still scope for localization.

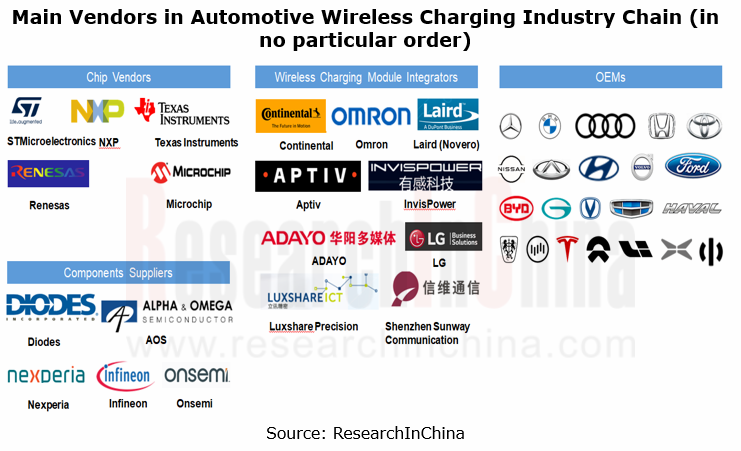

The main vendors in the automotive wireless charging industry chain are as follows:

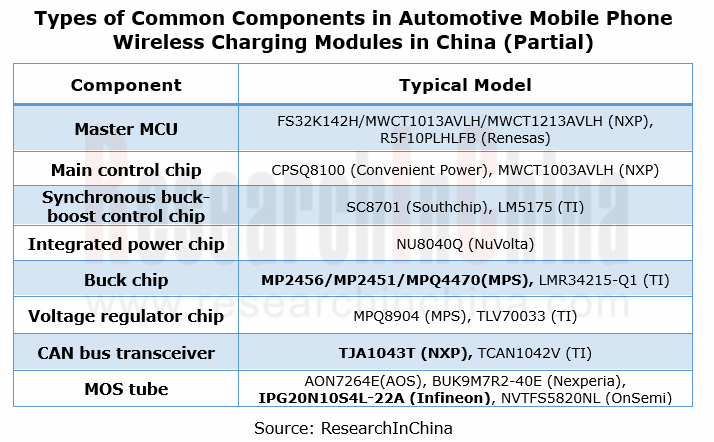

Foreign vendors like NXP and Renesas Electronics can design automotive mobile phone wireless charging solutions and provide chip products. Chinese vendors such as InvisPower, ADAYO and Sunway Communication can manufacture modules and provide automotive wireless charging solutions leveraging the key components from foreign vendors, such as NXP’s main control chip, TI’s voltage regulator chip, and AOS’ MOS tube. The widely used wireless charging chip solutions in China are those from ConvenientPower and Southchip.

NXP

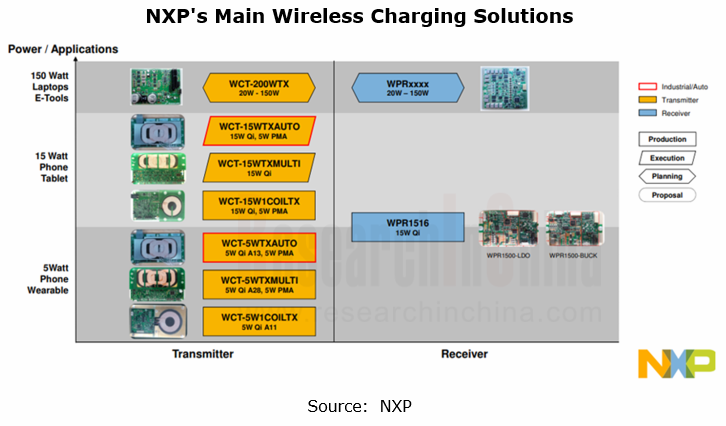

Among NXP's main wireless charging solutions, WCT-15WTXAUTO and WCT-5WTXAUTO are the most widely used, with respective power of 15W and 5W. The platforms are specially designed for AUTOSAR-compliant automotive wireless charging application. They use automotive-grade components, and AUTOSAR software and drivers, and conform to the latest Qi Standard.

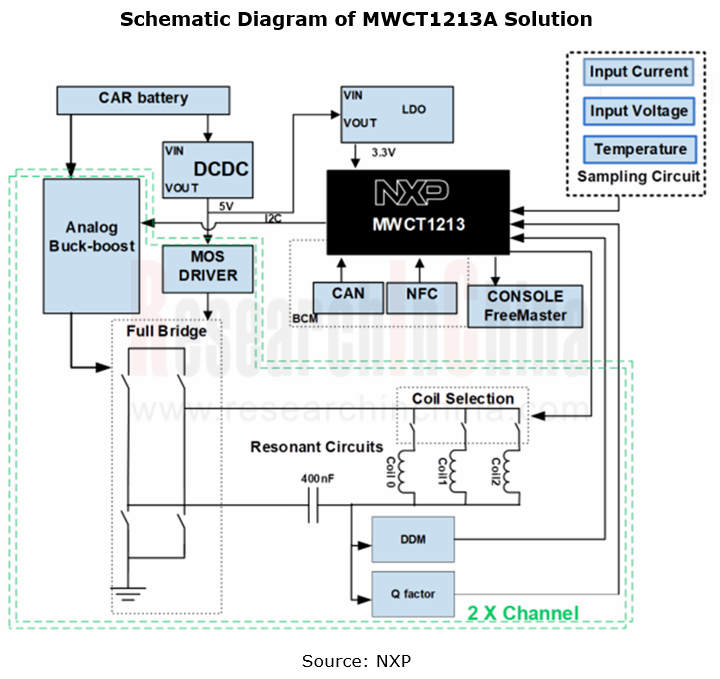

Among multiple MCUs, the MWCT1x1xA family is the most popular, for example, in the MWCT1213A solution, the system supports dual-channel transmitter control and manages overall system state, with the power of 15W.

Strategy of automakers: pursue high-power solutions and independently develop heat dissipation technology

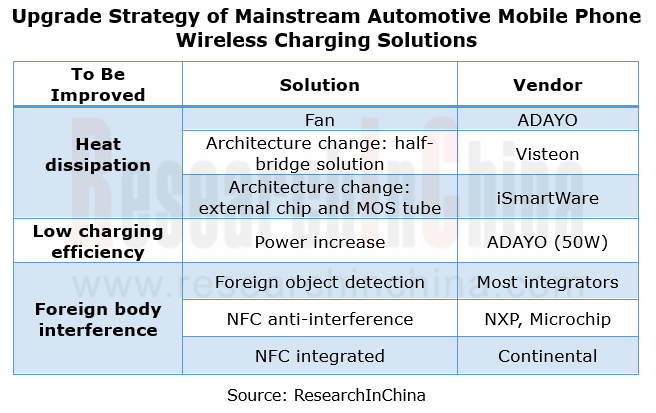

At present, the Qi Standard-certified electromagnetic induction charging solutions are the mainstream automotive mobile phone wireless charging solutions. In terms of structure, SOC solutions with built-in full-bridge MCUs and built-in power tubes have a serious problem of heating.

The mainstream automotive mobile phone wireless charging solutions have the following three shortcomings: 1. Severe heating problem; 2. Slow charging and low module transmitting power; 3. Vulnerable to interference, e.g., metal and NFC key.

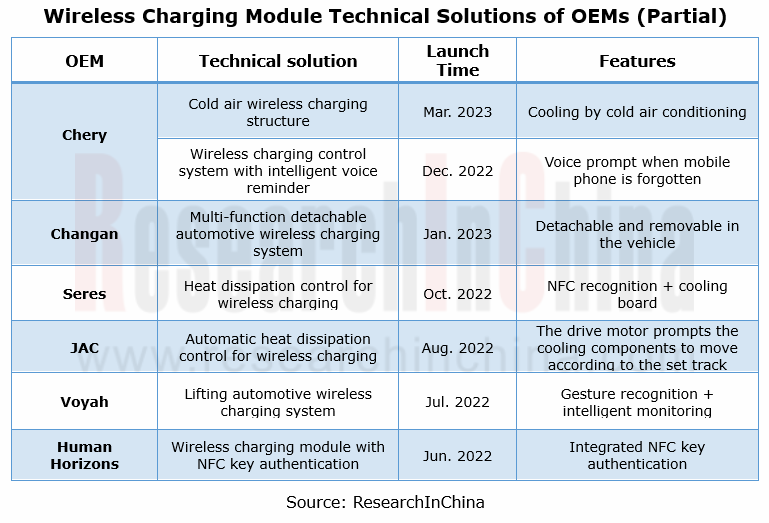

To solve the above problems, OEMs have begun to independently develop corresponding technical solutions. They have developed such technologies as air cooling, intelligent voice prompt, NFC integration, and detachable wireless charging modules.

The wireless charging board of Li L series models (L7-L9) lies in the center console, and is supplied by Luxshare Precision. It features slow charging, adopts the Qi Standard and supports both Android and Apple phones. The charging power of Android phones is 50W. In 2022, Li L series introduced the MFM-certified MagSafe wireless charging board, raising the charging power of Apple phones to 15W.

In the IM L7, the intelligent lifting wireless charging panel uses the gravity sensing function to detect the mobile phone completely placed on the module, then automatically tilts and sinks before the system starts charging; when a non-metallic device is placed on it, the panel will remain still.

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...