E/E architecture research: 14 key technologies, and innovative layout of 24 OEMs

Key technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E architectures involves: high computing power HPC for vehicle-cloud architecture integration; high-bandwidth, high-speed backbone network for inter-domain cooperative computing; service-oriented architecture (SOA) that enables software and hardware decoupling, generalized software/hardware architecture and standardized interfaces; complete development tool chain that uses the V-model development process; support for L4 advanced driving assistance; intelligent low-voltage power supply architecture.

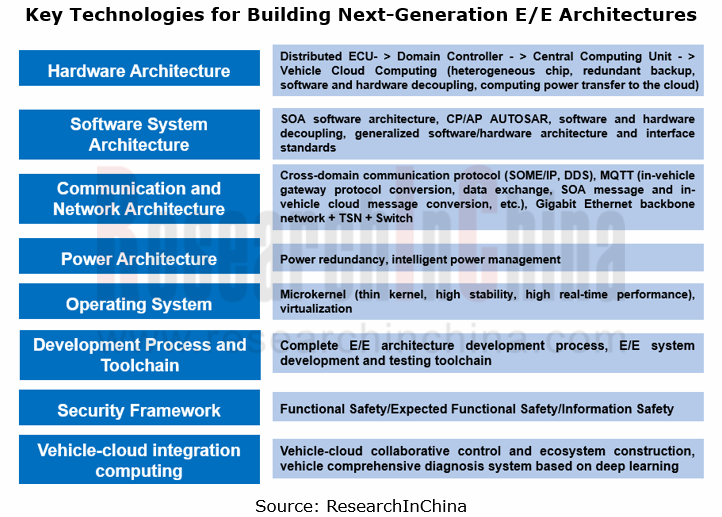

For the development of next-generation E/E architectures, we have summarized 14 key technologies. The following lists and analyzes the progress in some key technologies:

Key technologies of EEA: complete development tool chain, advanced architecture standards, and V-model-based EEA development process.

Currently there is no global automotive EEA standard. ISO 26262 Road Vehicles-Functional Safety, ISO/SAE 21434 Road Vehicles-Cybersecurity Engineering, and GB/T 34590 Road Vehicles-Functional Safety among others provide a reference for design and optimization of automotive EEAs.

In China, in April 2021 Automotive Electronic and Electrical Architecture Working Group was reviewed and established at the second council of the third session of China Industry Technology Innovation Strategic Alliance for Electric Vehicle. At present, experts from over 35 companies including OEMs, architecture solution providers, software firms, communication companies, and testing tools and services providers have participated.

In China, the formulation of automotive EEA standards forges ahead very rapidly. There have been several group or organization standards filed or released, including:

?Data Distribution Service (DDS) Test Methods for Intelligent Connected Vehicles

?Technical Requirements for Security of Automotive Ethernet Switch Equipment

?Technical Requirements for Vehicle Time Sensitive Network Middleware

?Software-Defined Vehicle Service API Reference Specification 2.0

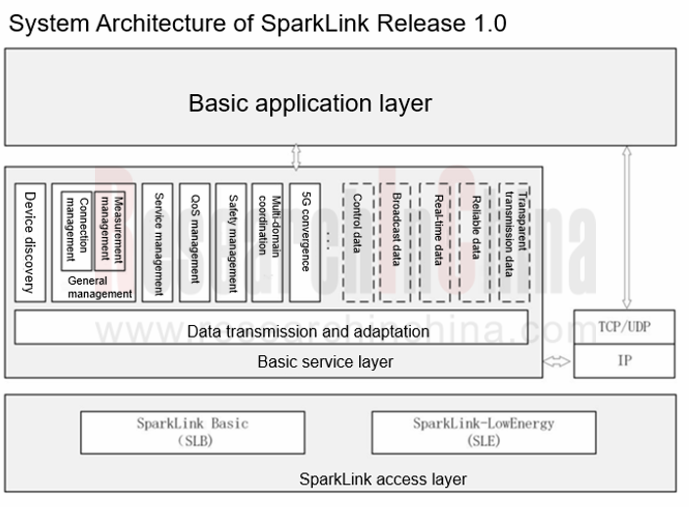

?11 Group Standards in SparkLink Release 1.0

?Technical Requirements and Test Methods for Vehicle Dedicated Short-distance Wireless Transmission System

Key technologies of EEA: computing power tends to be centralized and cluster in cloud, enabling vehicle-cloud architecture integration.

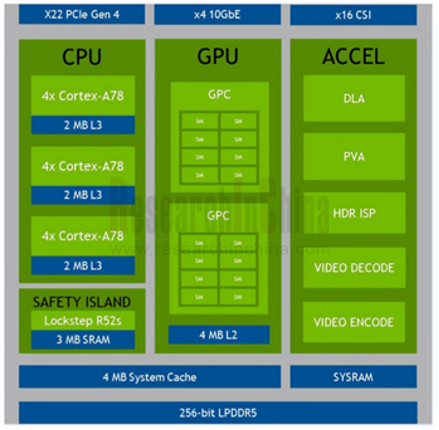

Vehicles are heading in the direction of brain-inspired intelligence + central nerves + terminal nerves. At present, semiconductor vendors inside and outside China are developing and designing vehicle computing center chips with strong computing power for intelligent vehicles. These chips use multi-core parallel CPUs, GPUs for graphics and image processing, and AI computing accelerators. A typical example is NVIDIA ORIN which boasts multi-task parallel computing capabilities for powering cockpits, autonomous driving, AI and more.

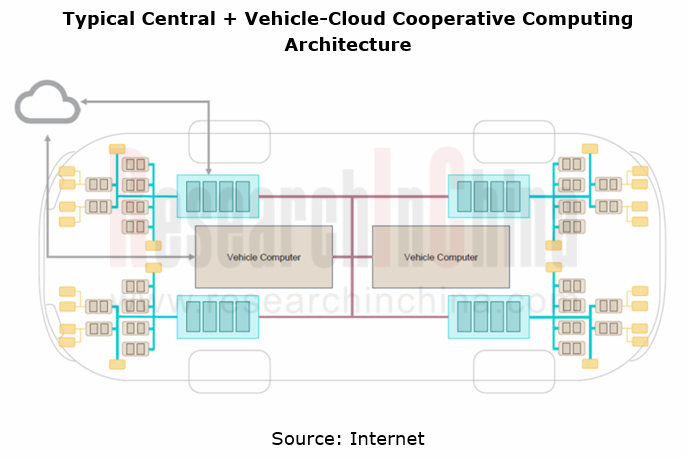

In the future, as vehicle high-speed network and 5G technologies mature, vehicles will eventually tend to be based on central computers and centralized EEA, and evolve towards cooperative vehicle-cloud control; and computing power will be centralized and cluster in cloud to avoid the unlimited expansion of computing power of vehicle terminals.

Key technologies of EEA: CP+AP AUTOSAR, SOA software, generalized software/hardware architecture and interface standards.

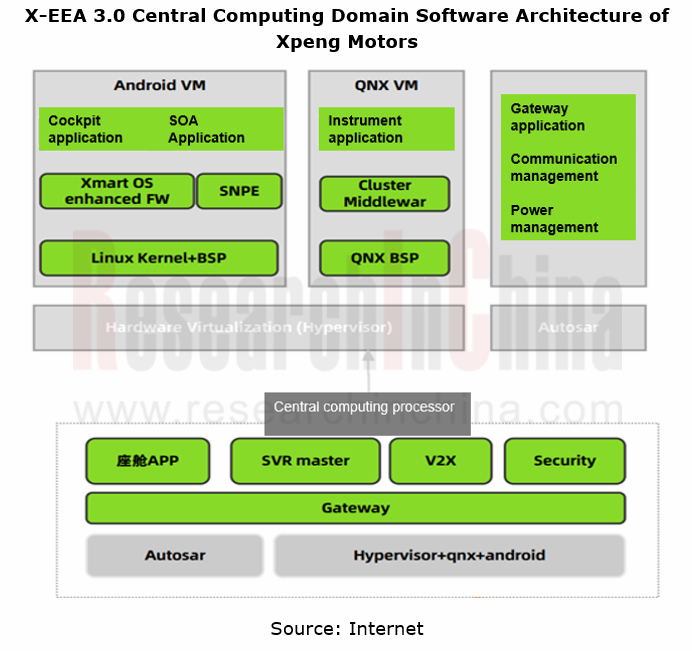

Vehicle software architectures evolve towards CP+AP AUTOSAR hybrid software architecture. CP AUTOSAR is oriented to the vehicle control domain that requires high reliability and high real-time performance. AP AUTOSAR targets intelligent driving and entertainment domains that need parallel processing of massive data. It also allows standardized design according to functional characteristics of interfaces, and integrates interface designs to build a general interface platform.

With SOA software, automakers enable open ecosystems for development of application services (interfaces are open to the outside), differentiation of scene function development (combination and splicing of any sub-service), and rapid iteration of single scene-based functions (only requiring the reconfiguration of sub-services). In the X-EEA 3.0 architecture of Xpeng Motors, SOA software is primarily applied to cockpit platforms.

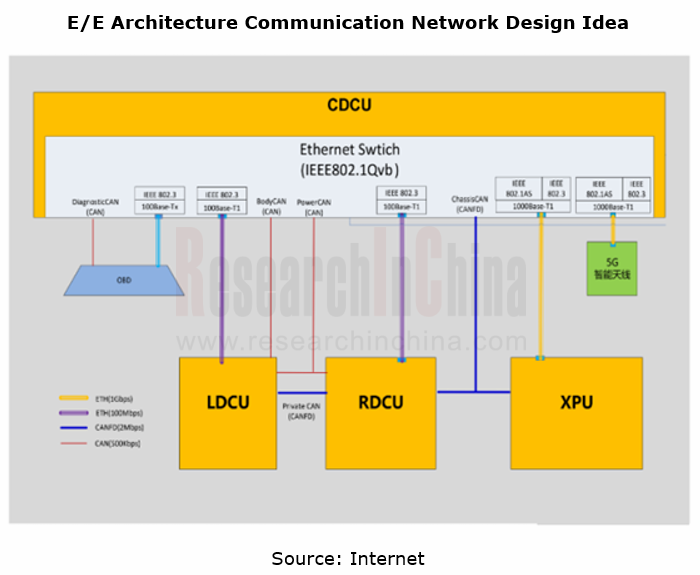

Key technologies of EEA: cross-domain communication protocols (SOME/IP and DDS), Gigabit Ethernet backbone network + TSN + Switch, and high-bandwidth/high-speed communication network, combine to achieve inter-domain high-speed communication and cooperative computing.

Body networks need to meet the performance requirements for the sheer volume of data, high-speed transmission, low latency and high real-time performance. Backbone networks have been Ethernet + CAN-FD high-speed networks, providing the foundation for the cross-domain communication protocol SOME/IP + DDS. The mainstream communication middleware SOME/IP and DDS have their own advantages.

As well as communication middleware, vehicle cloud platforms currently prefer to use MQTT, a communication protocol that allows devices to easily and flexibly connect to IoT cloud services, such as real-time online vehicle data analysis and monitoring, OTA, HD map applications, vehicle big data, and Al analysis.

Key technologies of EEA: vehicle dedicated short-range wireless communication.

In China, SparkLink Alliance was founded in September 2020. Following the launch of SparkLink Release 1.0 in late 2021, the Alliance introduced test instruments and also started the filing of SparkLink Release 2.0 2022H1. Several chip members in the organization have created specific chip-based road signs and plan to launch commercial chips in 2022H2. Based on commercial chips, bellwethers in major industries have formulated development plans for commercial terminals which are projected to come out in 2023.

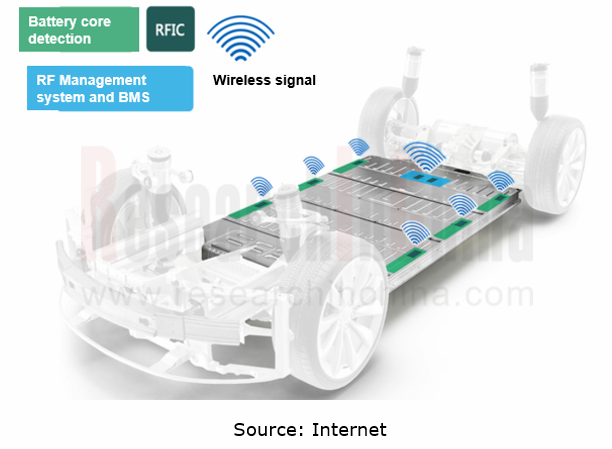

“SparkLink” short-range wireless communication technology is often used in: immersive vehicle sound zone and noise reduction, wireless interactive mirroring, in-vehicle wireless ambient lighting, 360-degree panoramic surround view, and wireless BMS (battery management system).

Cadillac LYRIQ is the world’s first one to introduce the wireless battery management system (wBMS), a disruptive technology which reduces 90% battery pack wiring harnesses, and corresponding connectors and plug-ins, fundamentally avoiding the problem of wiring harness aging. Meanwhile, the internal space saved by fewer battery pack wiring harnesses enables more flexible layout and configuration and accommodates more chips to increase the cruising range.

Cadillac uses the wireless battery management system (wBMS) solutions from Analog Devices, Inc. (ADI).

OEMs are stepping up their pace of evolving EEA

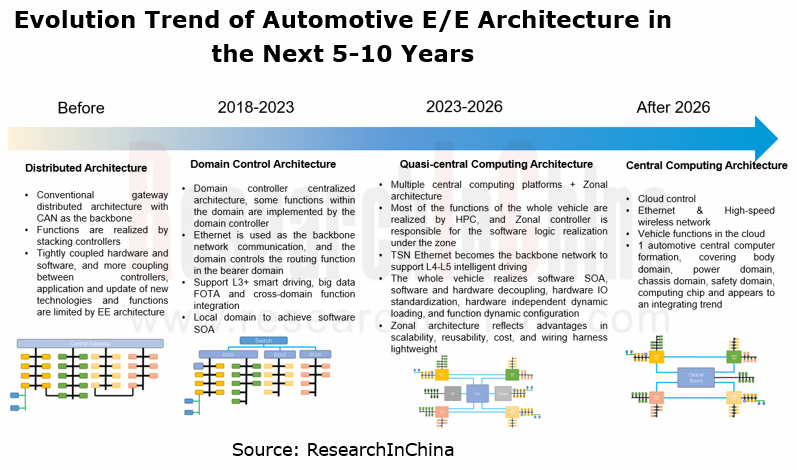

- Stage 1: domain centralized architecture

Such architectures as Volkswagen E3, Great Wall Motor’s GEEP3.0 Architecture, BYD's E Platform 3.0, Geely's Sustainable Experience Architecture (SEA) and Xpeng's EE 2.0 are all typical domain centralized architectures.

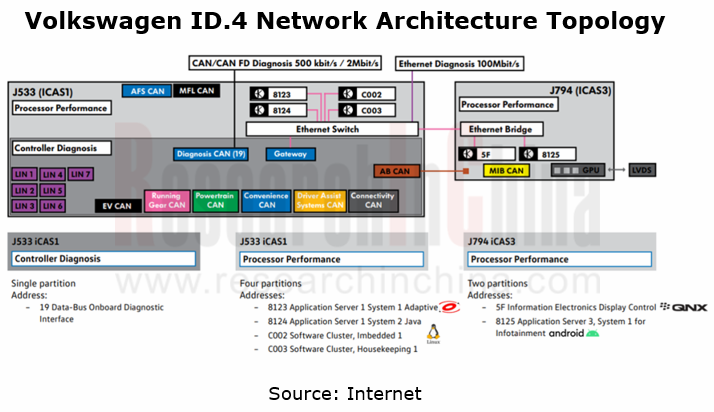

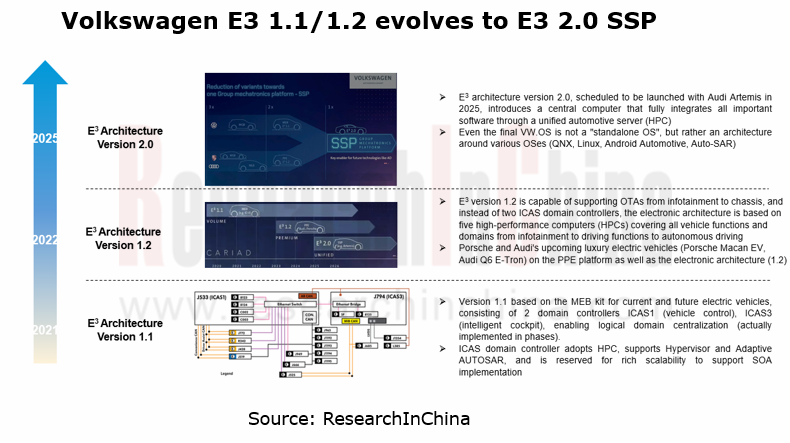

In Volkswagen E3’s case, this architecture is composed of three domain controllers: vehicle control (ICAS1), intelligent driving (ICAS2), and intelligent cockpit (ICAS3). ICAS1 and ICAS3 have been developed and mounted on models like ID.3 and ID.4, while ICAS2 has not been developed yet. The driving assistance functions are currently called via distributed ECUs and ICAS1.

The MEB architecture passes through two stages: E3 1.1 and E3 1.2. The platform offers continuously evolving and optimized functions. Starting from 2025, all the three automakers Volkswagen, Audi and Porsche will use the E3 2.0 SSP (Scalable Systems Platform), a central computing platform which may be first available to the Audi Artemis project.

- Stage 2: quasi-central computing architecture, to enable multi-domain integration (e.g., cockpit and driving integration).

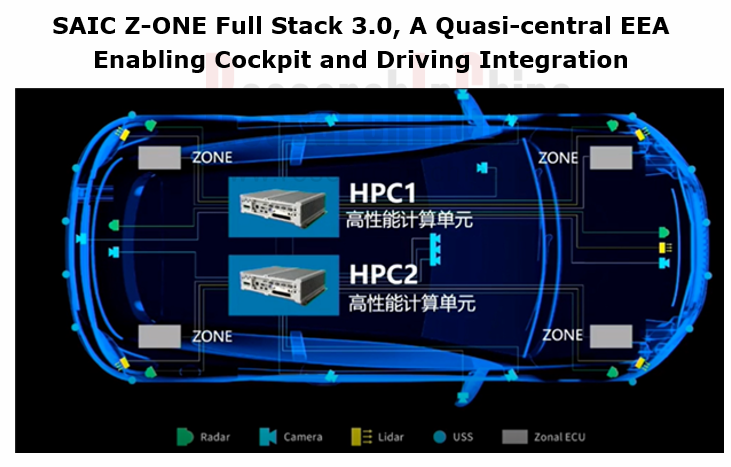

Z-ONE’s E/E architecture Galaxy Full Stack 3.0 uses two master-slave high-performance computing units, namely, HPC1 and HPC2, to enable the capabilities of intelligent driving, intelligent cockpit, intelligent computing, and intelligent driving backup, and plus 4 zone controllers, realizes related functions in each zone to fully support L4+ intelligent driving technologies. The architecture will integrate different network communication technologies like CAN FD, Gigabit Ethernet, and 5G, ensuring that a vehicle has powerful enough brain pathways.

- Stage 3: central computing architecture, with computing power centralized in a supercomputing platform, and the pace of mass production possibly faster than expected.

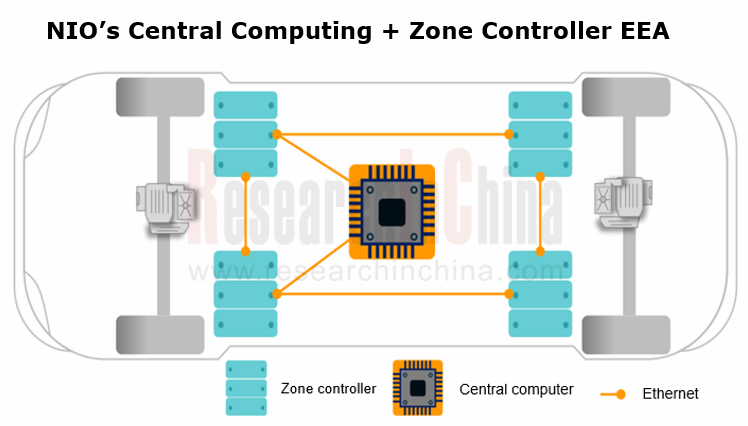

The framework of the central computing architecture consists of a central computing unit, zone controllers and high-speed Ethernet. The cooperation of the three builds an adaptive and self-learning system to realize intelligent connectivity and high-level autonomous driving.

NIO's central computing unit boasts computing power of more than 1000TOPS, and over 1GHz master frequency. It may use NVIDIA Adam supercomputing platform;

NIO's zone controllers highlight the following functions: distributed edge computing, vehicle control arbitration center, information communication network for SOA service communication, zonal centralized data center, vehicle power distribution hub, and sensor and actuator data exchange. Considering the limited computing resources in zone controllers, NIO uses AMP multi-core architecture in zone controllers for integration and isolation of cross-domain functions, and the RTOS in the AMP mode runs one operating system case on each CPU.

Through the lens of development trends, automotive EEA will eventually evolve to central computing architectures with functional logics centralized in one central controller. OEMs become ever more radical in EEA planning. For emerging carmakers and conventional OEMs, the year of 2023 will be a key time node to mass-produce the next-generation “central computing + zone controller” architectures.

Moreover, as computing platforms with ultra-high computing power are production-ready and software technology iterates rapidly, central computing architectures may even be spawned in the five years to come at the earliest.

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...