China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statistics of ResearchInChina show that from January to May 2023, the installations of driving-parking integrated solutions in production vehicle models were 490,000 sets, soaring by 138% on a like-on-like basis, and the installation rate hit 6.7%, up 3.8 percentage points over the same period last year. It is predicted that the installations in 2025 will reach 6.19 million sets, and the installation rate will be 30%.

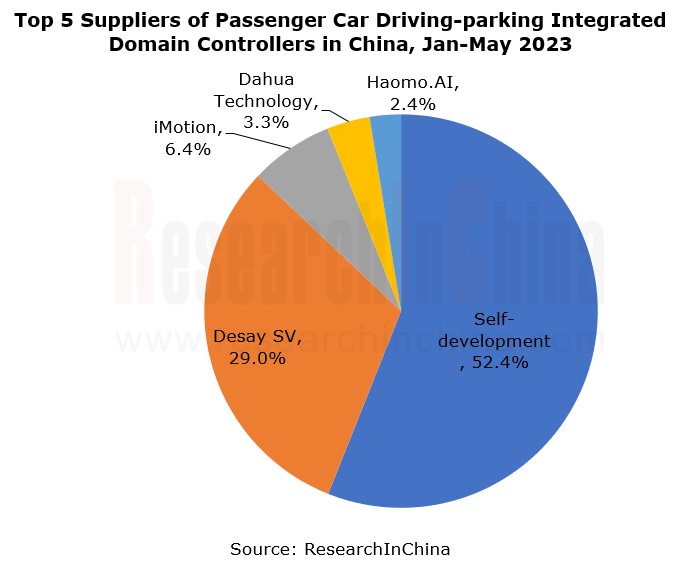

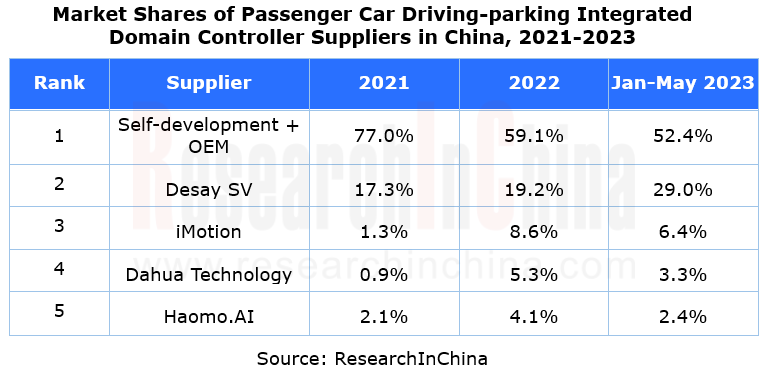

In terms of driving-parking integrated domain controller suppliers, from January to May 2023, automakers’ products built by way of “self-development + OEM” prevailed in the market, with a combined 52.4% share. The typical automakers that adopted the self-development model were emerging carmakers like Tesla and NIO.

From the shares of passenger car driving-parking integrated domain controller suppliers, it can be seen that the share of the “self-development + OEM” model declined from 77% in 2021 to 52.4% in the first five months of 2023. It shows that suppliers are becoming mainstream. In the driving-parking integration market, the solutions of suppliers tend to be diversified and abundant.

Local Tier 1 suppliers lead the driving-parking integrated solution market for the following reasons:

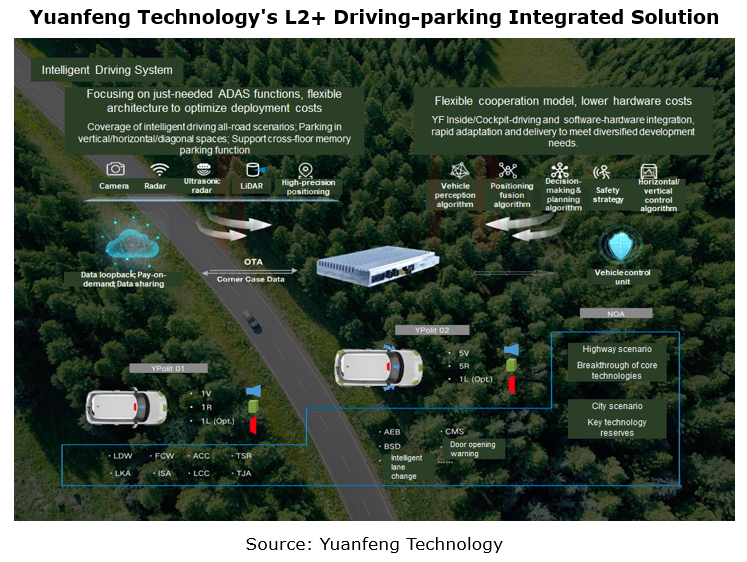

Local suppliers have deployed driving-parking integration early and made continuous efforts to improve their hardware and software full-stack development capabilities. For example, Desay SV has started to make layout in the driving-parking integration market since 2020, and has become a supplier that integrates the "hardware + underlying software + middleware + system integration" capabilities. As concerns Yuanfeng Technology’s L2+ driving-parking integrated solutions, the company not only independently develops autonomous driving domain controllers, but also deep learning algorithms which enable fused positioning covering GNSS, IMU, lane lines, semantic SLAM, wheel speed & mileage, etc. Its solutions can remodel the environment according to multi-sensor perception (camera, radar, etc.) and positioning data, for the purpose of global path, trajectory and behavior prediction planning, as well as transverse and longitudinal control and actuator management. At present, the mass-produced Super Park 1.0 solution delivers a parking space recognition accuracy of 97% and a parking success rate of 95%, covers over 180 types of mainstream parking spots, and supports head-in parking; for unconventional parking spaces, the custom AR parking allows users to deal with in stride.

Local suppliers have deployed driving-parking integration early and made continuous efforts to improve their hardware and software full-stack development capabilities. For example, Desay SV has started to make layout in the driving-parking integration market since 2020, and has become a supplier that integrates the "hardware + underlying software + middleware + system integration" capabilities. As concerns Yuanfeng Technology’s L2+ driving-parking integrated solutions, the company not only independently develops autonomous driving domain controllers, but also deep learning algorithms which enable fused positioning covering GNSS, IMU, lane lines, semantic SLAM, wheel speed & mileage, etc. Its solutions can remodel the environment according to multi-sensor perception (camera, radar, etc.) and positioning data, for the purpose of global path, trajectory and behavior prediction planning, as well as transverse and longitudinal control and actuator management. At present, the mass-produced Super Park 1.0 solution delivers a parking space recognition accuracy of 97% and a parking success rate of 95%, covers over 180 types of mainstream parking spots, and supports head-in parking; for unconventional parking spaces, the custom AR parking allows users to deal with in stride.

Local suppliers provide flexible and open cooperation models to meet the differentiated and customized needs of OEMs. For instance, the Baidu Apollo Self Driving Openness White Paper Baidu released in April 2023 indicates four key capabilities: open product experience definition for automakers, open independent experience evolution, open full-cycle OTA services, and open co-creation with car manufacturing partners. Freetech takes the ODIN intelligent driving digital base as the pillar and deploys products and solutions in each module, providing modular services.

Local suppliers provide flexible and open cooperation models to meet the differentiated and customized needs of OEMs. For instance, the Baidu Apollo Self Driving Openness White Paper Baidu released in April 2023 indicates four key capabilities: open product experience definition for automakers, open independent experience evolution, open full-cycle OTA services, and open co-creation with car manufacturing partners. Freetech takes the ODIN intelligent driving digital base as the pillar and deploys products and solutions in each module, providing modular services.

The product iteration is fast and responds to the local market needs more quickly. Examples include Haomo.AI's HPilot, a passenger car driving assistance solution that has undergone six OTA updates since its release in 2020 and has been iterated to HPilot 3.0, with its advanced intelligent driving capabilities covering three major scenarios: highway, parking, and city open roads.

The product iteration is fast and responds to the local market needs more quickly. Examples include Haomo.AI's HPilot, a passenger car driving assistance solution that has undergone six OTA updates since its release in 2020 and has been iterated to HPilot 3.0, with its advanced intelligent driving capabilities covering three major scenarios: highway, parking, and city open roads.

With regard to the adaptability of chip platforms, some suppliers can cover a number of mainstream chip platforms of NVIDIA, TI, Horizon Robotics and the like. In HoloMatic’s case, the platforms it has adapted or is adapting to include TI TDA4, Huawei MDC610, Horizon Journey 2/Journey 3/Journey 5, and NVIDIA Orin.

With regard to the adaptability of chip platforms, some suppliers can cover a number of mainstream chip platforms of NVIDIA, TI, Horizon Robotics and the like. In HoloMatic’s case, the platforms it has adapted or is adapting to include TI TDA4, Huawei MDC610, Horizon Journey 2/Journey 3/Journey 5, and NVIDIA Orin.

The mass adoption of driving-parking integration starts in 2023.

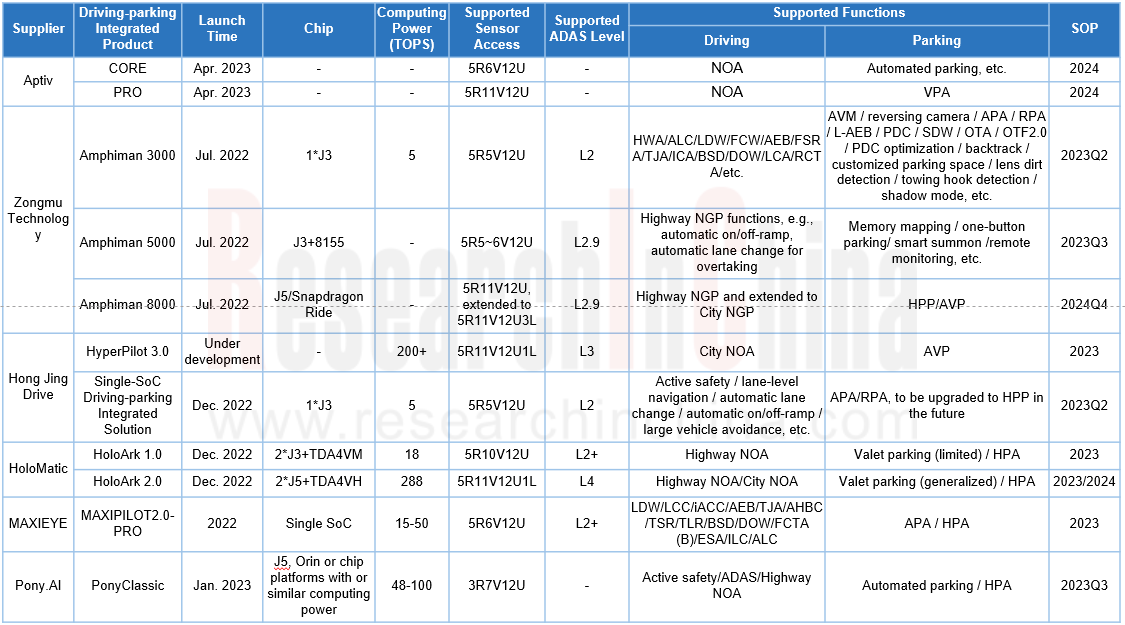

Starting from 2023, driving-parking integrated solutions enter the stage of mass adoption. According to the planning of suppliers, there are up to 20 mass production projects from 2023 to 2024.

For example, Aptiv’s driving-parking integrated solution launched in April 2023 can be divided into Core and Pro versions by configuration. Wherein, the sensing system of the Pro version packs Aptiv’s next-generation 4D imaging radar, and thus enables NOA and VPA functions. Its driving-parking integrated domain controller solution will be mass-produced and become available in 2024.

Amphiman 3000, Zongmu Technology's driving-parking integrated solution unveiled in July 2022, is based on one J3 chip, and supports the basic configuration of 1R5V12U, which can be extended to 3R5V12U or 5R5V12U. This solution enables HWA/ALC driving function, APA/RPA parking function, AVM (around view monitor)/reversing camera, power-duration curve (PDC) optimization, backtrack, and customized parking spaces. The solution is scheduled to be mass-produced in 2023.

Hong Jing Drive's driving-parking integrated solution introduced in December 2022 is based on one J3 chip and supports 5R5V12U. This solution enables NOP-H driving and APA/remote parking functions. In the future, it can be upgraded to support home-zone parking assist. It is also expected to be spawned in 2023.

Driving-parking Integrated Solutions Planned for Mass Production, 2023-2024 (Part)

According to OEMs’ planning, a number of models equipped with driving-parking integrated solutions will be available on market in 2023 and beyond.

For example, in 2023, Chery EXEED VX (Lanyue) with iDC Mid Domain Controller is already on sale; the GAC Hyper GT with HoloMatic’s driving-parking integrated intelligent driving system has been launched on market; BYD will sell a model in cooperation with Horizon Robotics (Journey 5); Great Wall Motor will launch the new Mocha DHT-PHEV and the WEY Blue Mountain both equipped with HPilot 3.0; the new Voyah FREE with the Apollo Highway Driving Pro solution will be available on market in H2 2023. In 2024, FAW Hongqi E001 and E202 are expected to be mass-produced and will pack a driving-parking integrated domain controller based on the Huashan-2 A1000L series chips. In addition, Dongfeng Passenger Vehicle's first all-electric sedan and first all-electric SUV, as well as several SOL-branded production models, will also bear the Huashan II A1000 chips.

Driving-parking integrated solutions that emphasize perception over maps are becoming mainstream.

At present, Haomo.AI, IM Motor, Li Auto, Baidu, Pony AI, QCraft.AI, AutoBrain, DeepRoute.AI and DJI among others have revealed driving-parking integrated solutions with “more weight on perception, less weight on maps.

For example, HPilot 3.0, a city NOA product Haomo.AI unveiled in April 2022, supports 5R12V12U2L, and relies on the LiDAR + radar + camera perception capability, riding itself of HD maps. This solution enables such functions as automatic lane change for overtaking, traffic signal recognition and vehicle control, complex intersection passing, and unprotected left/right turn in urban environments. Haomo.AI’s timing-based Transformer model allows for virtual real-time BEV mapping, bringing more stable and accurate perception outputs. Additionally, Haomo.AI also puts forward introduction of Transformer into its MANA data intelligence system, and gradual use of it in real road perception tasks, including obstacle detection, lane line detection, drivable area segmentation, and traffic sign recognition.

Furthermore, Haomo.AI forged a partnership with Navinfo in April 2023. Navinfo will help Haomo.AI to implement the plan of launching City NOH in 100 cities in an orderly manner in 2024.

In March 2023, DeepRoute.AI announced the D-AIR, a driving-parking integrated product based on Driver 3.0 (DeepRoute-Driver 3.0) technology framework. This solution supports 3R7V, and is free from HD maps through the emphasizing perception + navigation map approach. It enables highway NOA and basic urban assistance functions such as ACC, LCC, ILC, AEB and APA. Wherein, Driver 3.0 can perceive the fine road information covered by HD maps, including lane lines, traffic signals, road signs and warning signs. Moreover, Driver 3.0 can locate the vehicle in real time, and accurately judge the lane where the vehicle is and the distance from the adjacent lane line.

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...