China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

-

July 2023

- Hard Copy

- USD

$2,200

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

SDY019

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,000

-

- Hard Copy + Single User License

- USD

$2,400

-

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure

This report highlights the passenger car L2+ and above (including L2+, L2.5 and L2.9) ADAS domain controller market data, the ADAS domain controller master chip market data, the status quo and layout of major suppliers, the latest industry development trends, and the market size forecast for the next six quarters and the next five years.

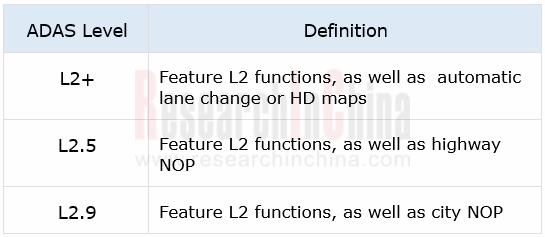

L2+, L2.5, and L2.9 are defined as follows:

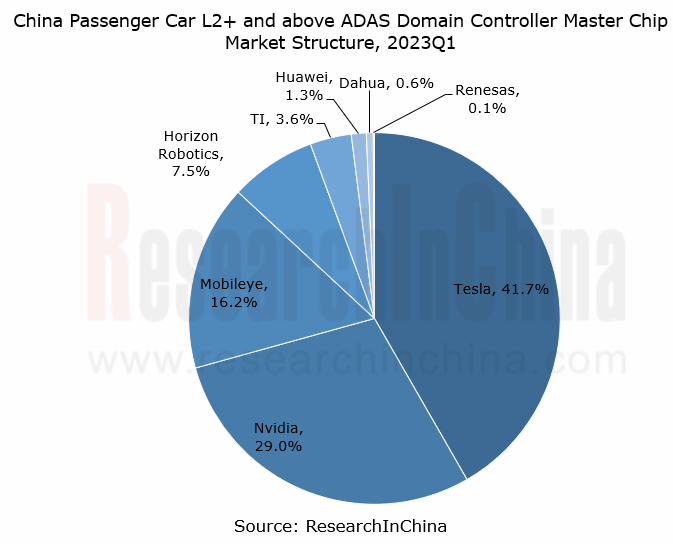

In 2023Q1, the sales of passenger cars (excluding imported ones) equipped with L2+ and above autonomous driving functions hit 360,000 units in China, a like-on-like upsurge of 68.2%. These 360,000 L2+ and above cars carried a total of 656,000 ADAS master chips, of which: Tesla's self-developed FSD chips swept 41.7%; Nvidia’s chips, most of which offer high computing power, were about 190,000 pieces, taking a 29.0% share.

According to expert interviews, this report also answers the following questions:

1. Currently what is the purchase price of a mainstream intelligent driving SoC and the domain controller based on this SoC?

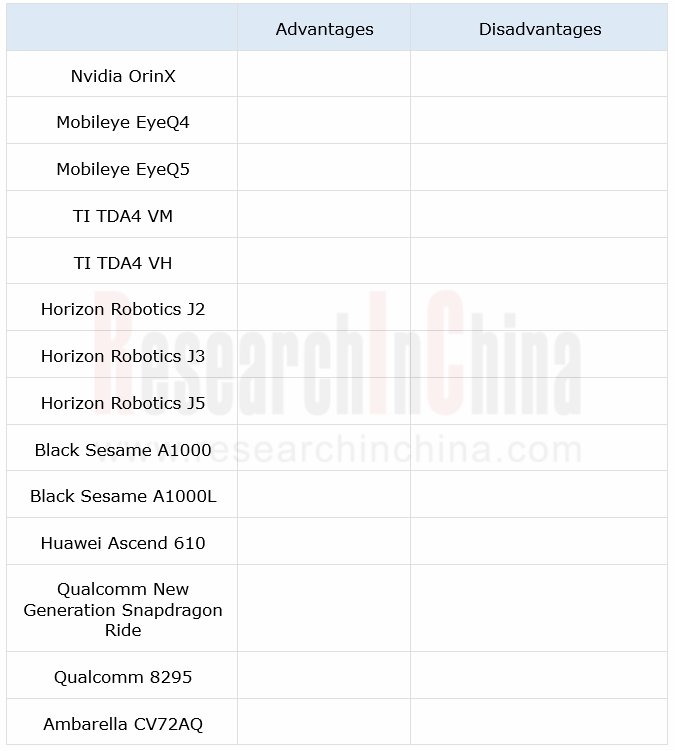

2. What are the advantages and disadvantages of the current mainstream ADAS SoCs?

3. The average intelligent driving domain controller packs a functional safety chip. Examples include TC397 and TC497, and what is their respective approximate purchase price? Is there any Chinese product to replace the TC Family, and what is the approximate purchase price of the domestic product?

4. Currently what is the proportion of the intelligent driving domain controller to the entire intelligent driving system (including sensor and decision systems and excluding the execution system)? What is the average proportion of the intelligent driving system to the cost of a vehicle?

5. Tesla (as well as NIO, Huawei, etc.) insists on charging for the intelligent driving system, while the NOA system of Li Auto is free. Which one do you think represents the future trend?

6. We see that there are still increasing high-compute chip companies trying to enter the intelligent driving chip market, such as Cambricon Singgo, Chipletgo (chiplet technology), Rhino, and Houmo.AI (the first computing in memory chip). Do you think they still have a market opportunity? If so, who do you prefer, and why?

7. We have seen that leading high-compute chip companies like Qualcomm, Horizon Robotics and Nvidia have large software teams working on basic software and algorithms such as middleware, visual perception algorithm, driving and parking algorithms, and NOA algorithm, and they obviously squeeze the living space of conventional Tier 1 suppliers. ADAS Tier 1 suppliers also try to multiplex algorithms provided by mainstream chip companies in a bid to launch driving-parking integrated or NOA solutions as fast as they can. Will this blunt the competitive edges of ADAS Tier 1 suppliers?

8. NIO, Xpeng and Li Auto independently develop intelligent driving domain controllers. Competitive OEMs like SAIC, Geely, Great Wall Motor, BYD and Chery all build their own autonomous driving team to self-develop intelligent driving domain controllers. Will this narrow the living space of Tier 1 suppliers engaged in intelligent driving domain controllers? How should intelligent driving Tier 1 suppliers respond?

9. Which type of intelligent driving domain controller companies perform well at present, and what’s the reason? Please give an example.

10. Which type of intelligent driving domain controller companies are unsuccessful in the business development, and what’s the reason? Please give an example.

11. Some listed cockpit companies like ThunderSoft, Desay SV and Foryou have set up an autonomous driving department or branch, and also deploy cockpit-driving integration. What do you think of the intelligent driving domain controllers developed by them? Do you think they will gain an upper hand in the implementation of cockpit-driving integration?

12. In the development of driving-parking integrated domain controllers (or cockpit-driving integrated domain controllers), OEMs split the task into two or more to suppliers, or some outsource it to one supplier. Which model do you prefer, and why?

13. Single-chip driving-parking integrated domain controllers that can bring a lower cost are becoming an important direction. Do you think they can become mainstream, and why?

14. Many driving-parking integrated domain controllers use the TDA4 and J3 combination. What is the purpose of this and what do they complement each other?

15. Now cutting-edge autonomous driving companies have switched to BEV algorithms. What impact will it have on the design of autonomous driving domain controllers?

16. It is said that quite a few start-ups have engineering difficulties in their driving-parking integrated domain controller projects. Although their products have been designated, they fail to achieve engineering implementation and mass production. What’s the main reason? Does this mean that ADAS companies without a Tier 1 background will face big challenges in OEM mass production even if they are proficient in algorithms? How to solve this problem?

1 Overall Data Trends

1.1 Sales of L2+ and Above

1.1.1 Sales and Penetration of L2+ and Above Passenger Cars in China, 2021Q1-2023Q1

1.1.2 Share of L2+ in China Passenger Car Market, 2021Q1-2023Q1

1.1.3 Installation Structure of L2+ and Above in Passenger Cars (by Price Range) in China, 2021Q1-2023Q1

1.1.4 Penetration of L2+ and Above in Passenger Cars (by Price Range) in China, 2021Q1-2023Q1

1.1.5 Installations and Penetration of L2+ and Above in Passenger Cars (by OEM Type) in China, 2021Q1-2023Q1

1.1.6 Sales of L2+ and Above Passenger Car Models (By Energy Type) in China, 2021Q1-2023Q1

1.1.7 Sales Structure of L2+ and Above Passenger Car Models (By Energy Type) in China, 2021Q1-2023Q1

1.1.8 Penetration of L2+ and Above Passenger Car Models (by Energy Type) in China, 2021Q1-2023Q1

1.1.9 Installation Structure of L2+ and Above in Passenger Cars (By Auto Brand) in China, 2022Q1-2023Q1

1.2 Sales of L2+ Vehicle Models

1.2.1 Installations of L2+ in Passenger Cars (by Model Price Range) in China, 2022Q1-2023Q1

1.2.2 Installations of L2+ in Passenger Cars (by OEM Type) in China, 2022Q1-2023Q1

1.2.3 Installation Structure of L2+ in Passenger Cars (by Fuel Type) in China, 2022Q1-2023Q1

1.3 Sales of L2.5 Vehicle Models

1.3.1 Installations of L2.5 in Passenger Cars (by Model Price Range) in China, 2022Q1-2023Q1

1.3.2 Installations of L2.5 in Passenger Cars (by OEM Type) in China, 2022Q1-2023Q1

1.3.3 Installation Structure of L2.5 in Passenger Cars (by Fuel Type) in China, 2022Q1-2023Q1

1.4 Sales of L2.9 Vehicle Models

1.4.1 Installations of L2.9 in Passenger Cars (by Model Price Range) in China, 2022Q1-2023Q1

1.4.2 Installations of L2.9 in Passenger Cars (by OEM Type) in China, 2022Q1-2023Q1

1.4.3 Installation Structure of L2.9 in Passenger Cars (by Fuel Type) in China, 2022Q1-2023Q1

1.5 Market Share of ADAS Domain Controller/Algorithm Suppliers (L2+ and Above)

1.5.1 Market Share of Passenger Car L2+ and Above (Domain Controller) Suppliers in China, 2021Q1-2023Q1

1.5.2 Market Share of Passenger Car L2+ and Above (Algorithm) Suppliers in China, 2021Q1-2023Q1

1.5.3 Market Share of Passenger Car L2+ and Above (Domain Controller) Suppliers (Joint Venture Models) in China, 2021Q1-2023Q1

1.5.4 Market Share of Passenger Car L2+ and Above (Domain Controller) Suppliers (Chinese Independent Models) in China, 2021Q1-2023Q1

1.5.5 Market Share of Passenger Car L2+ and Above (Algorithm) Suppliers (Joint Venture Models) in China, 2021Q1-2023Q1

1.5.6 Market Share of Passenger Car L2+ and Above (Algorithm) Suppliers (Chinese Independent Models) in China, 2021Q1-2023Q1

1.6 ADAS Domain Controller Chip Market Structure (L2+ and Above)

1.6.1 Share of Domain Controller Master Chip Solutions for L2+ and Above Passenger Car Models in China, 2021Q1-2023Q1

1.6.2 Installations of Domain Controller Master Chips in L2+ and Above Passenger Car Models in China, 2021Q1-2023Q1

1.6.3 Market Share of Domain Controller Master Chips for L2+ Passenger Car Models in China, 2021Q1-2023Q1

1.6.4 Installations of Domain Controller Master Chips in L2+ Passenger Car Models in China, 2021Q1-2023Q1

1.6.5 Market Share of Domain Controller Master Chips for L2.5 Passenger Car Models in China, 2021Q1-2023Q1

1.6.6 Installations of Domain Controller Master Chips in L2.5 Passenger Car Models in China, 2021Q1-2023Q1

1.6.7 Market Share of Domain Controller Master Chips for L2.9 Passenger Car Models in China, 2021Q1-2023Q1

1.6.8 Installations of Domain Controller Master Chips in L2.9 Passenger Car Models in China, 2021Q1-2023Q1

1.7 Market Data of Parking Systems for L2+ and Above Vehicle Models

1.7.1 Penetration of Automated Parking in L2+ and Above Passenger Car Models, 2021Q1-2023Q1

1.7.2 Market Share of Parking System Suppliers for L2+ and Above Passenger Car Models, 2021Q1-2023Q1

1.7.3 Penetration of Home-zone Parking Pilot in L2+ and Above Passenger Car Models, 2021Q1-2023Q1

1.7.4 Penetration of Remote Parking in L2+ and Above Passenger Car Models, 2021Q1-2023Q1

1.7.5 Penetration of Vision-based Parking in L2+ and Above Passenger Car Models, 2021Q1-2023Q1

2 Data and Dynamics of ADAS Domain Controller Companies

2.1 Desay SV

2.1.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.1.2 Latest Dynamics

2.2 Freetech

2.2.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.2.2 Latest Dynamics

2.3 Aptiv

2.3.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.3.2 Latest Dynamics

2.4 Hong Jing Drive

2.4.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.4.2 Latest Dynamics

2.5 Veoneer

2.5.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.5.2 Latest Dynamics

2.6 iMotion

2.6.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.6.2 Latest Dynamics

2.7 Bosch

2.7.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.7.2 Latest Dynamics

2.8 ZF

2.8.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.8.2 Latest Dynamics

2.9 Jingwei Hirain

2.9.1 (L2+ and Above) ADAS Domain Controller Sales, 2021Q1-2023Q1

2.9.2 Latest Dynamics

2.10 Dynamics of Other ADAS Domain Control Suppliers

3 Data and Dynamics of ADAS Domain Controller Master Chip Vendors

3.1 Nvidia

3.1.1 (L2+ and Above) ADAS Domain Controller Chip Sales, 2021Q1-2023Q1

3.1.2 Latest Dynamics

3.2 Mobileye

3.2.1 (L2+ and Above) ADAS Domain Controller Chip Sales, 2021Q1-2023Q1

3.2.2 Latest Dynamics

3.3 Horizon Robotics

3.3.1 (L2+ and Above) ADAS Domain Controller Chip Sales, 2021Q1-2023Q1

3.3.2 Latest Dynamics

3.4 TI

3.4.1 (L2+ and Above) ADAS Domain Controller Chip Sales, 2021Q1-2023Q1

3.4.2 Latest Dynamics

3.5 Dynamics of Other ADAS SoC Vendors

3.5.1 Latest Dynamics of Black Sesame Technologies

3.5.2 Latest Dynamics of Houmo.AI

3.5.3 Latest Dynamics of SiEngine

3.5.4 Latest Dynamics of Chipletgo

.......................

4 Data Forecast and Trends

4.1 Data Forecast

4.1.1 Sales of Above L2+ ADAS Domain Controllers, 2022Q1-2024Q4E

4.1.2 Installations of Masters Chips in Above L2+ Vehicle Models, 2022Q1-2024Q4E

4.1.3 Penetration of L2+/L2.5/L2.9, 2022Q1-2024Q4E

4.1.4 Sales of Above L2+ ADAS Domain Controllers, 2021-2028E

4.1.5 Installations of Masters Chips in Above L2+ Vehicle Models, 2021-2028E

4.1.6 Penetration of L2+/L2.5/L2.9, 2022-2028E

4.1.7 Above L2+ ADAS Domain Controller Market Size, 2021-2028E

4.1.8 Market Size of ADAS Master Chips for Above L2+ Vehicle Models, 2021-2028E

4.2 Trends and Dynamics

4.2.1 Current Purchase Prices of the Mainstream Intelligent Driving SoC and the Domain Controller Based on the SoC

4.2.2 Advantages and Disadvantages of Current Mainstream ADAS SoCs

4.2.3 Purchase Price of Functional Safety Chips and Replacement of Foreign Products in China

4.2.4 Market Opportunities for New High-compute ADAS Chip Entrants

4.2.5 Will the Living Space of Conventional ADAS Tier 1 Suppliers Be Squeezed by ADAS Chip Companies and OEMs?

4.2.6 Which Type of ADAS Domain Controller Companies Perform Well

4.2.7 Which Type of ADAS Domain Controller Companies Fail to Develop the Business

4.2.8 Where Are the Opportunities for Listed Cockpit Companies to Deploy ADAS Domain Controllers

4.2.9 The Development Outsourcing Model for Driving-parking Integrated Domain Controllers (or Cockpit-driving Integrated Domain Controllers)

4.2.10 What Impact BEV Algorithms Have on the Design of Autonomous Driving Domain Controllers

4.2.11 Engineering Challenges Faced by Start-ups in Driving-parking Integrated Domain Controller Projects

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...