Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard

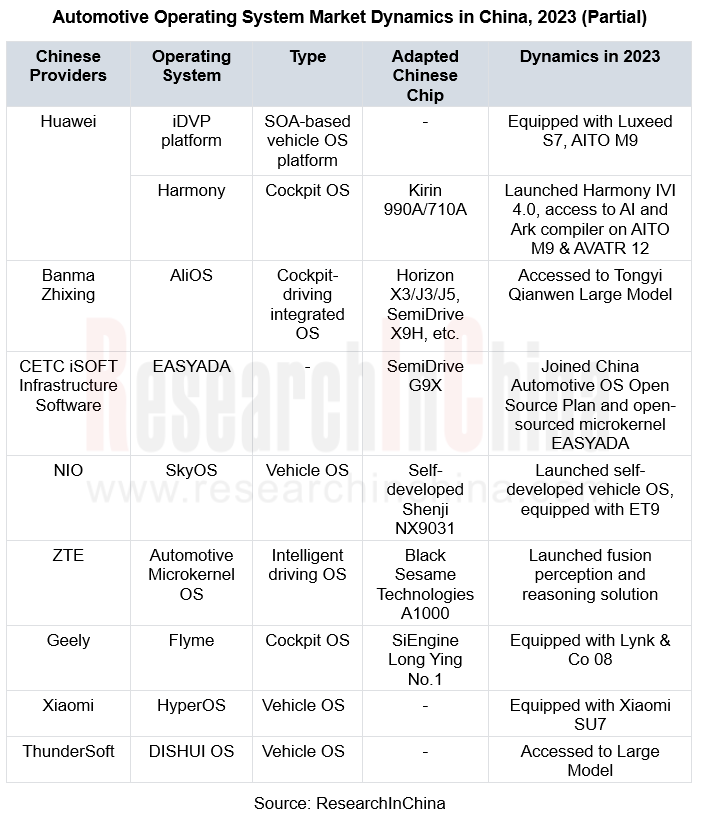

In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competitive advantages, adapting to Chinese chip solutions and obtaining designated projects from OEMs.

For example, Xiaomi, NIO, etc. have launched vehicle operating systems, and providers such as iSOFT and ZTE have strengthened real-time, security and other functions of operating system microkernel.

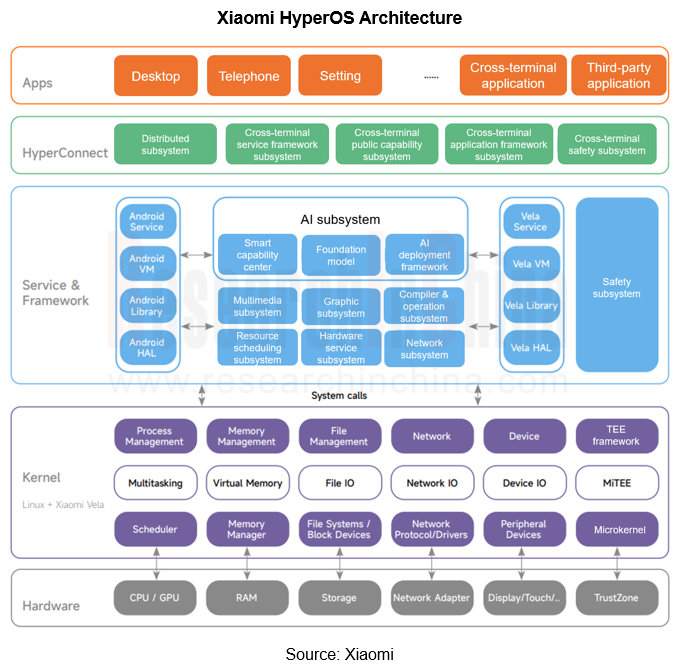

In October 2023, Xiaomi launched its self-developed HyperOS, with the underlying layer uses fusion of Linux and Vela kernels, middleware access to AI subsystem, setting priorities in multitasking process, and adopts level scheduling to improve operating system processing efficiency.

In terms of ecosystem, Xiaomi has created the CarIoT ecosystem, which connects Internet IoT and automobile field, realizing concept of "full ecosystem of people, vehicle and home".

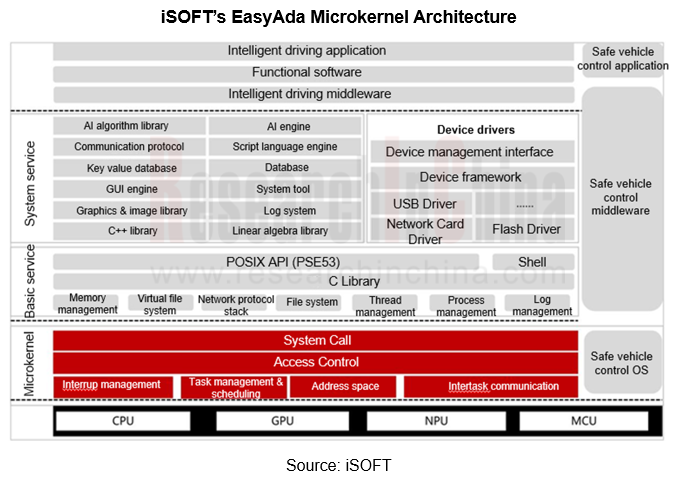

In middleware, AUTOSAR is still one of choices of most OEMs for vehicle control and autonomous driving. But it is not fully adapted to domestic chips, and feedback time of on-site communication processing is longer, which can't fully meet requirements of auto companies, resulting in partial providers and OEMs researching their own microkernel and middleware. In May 2023, China Association of Automobile Manufacturers (CAAM) formally released the first microkernel open-source project of China Automotive Operating System Open Source Plan, which plans to realize independent automotive OS based on open source microkernel and gradually replace QNX in 2025. Among them, iSOFT provided open source microkernel using the Mulan Public License (version 2); SemiDrive Technology provided G9X chip.

EasyAda microkernel provided by iSOFT can provide secure kernels for various chip platforms and application scenarios. For automotive field, iSOFT has implemented corresponding real-time improvement mechanisms for microkernel. For example, priority-based preemption mechanism for large-scale calculations of autonomous driving, preemption scheduling strategy of microkernel, as well as integrated algorithm, interrupt, delay mechanism and other technical means can improve microkernel to break through real-time and performance requirements.

OEMs: three methods to realize vehicle operating systems

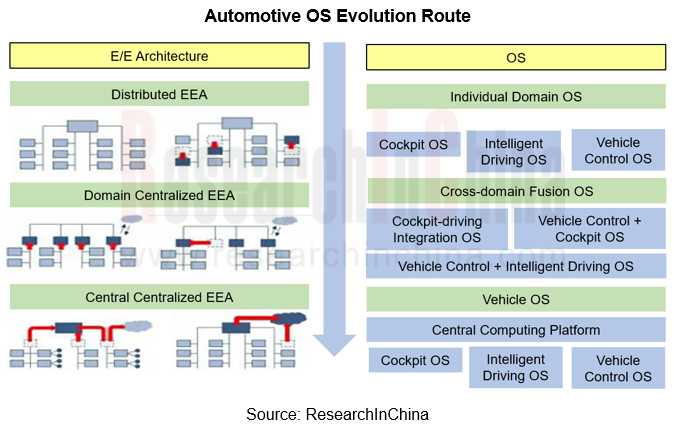

As EE architecture evolves towards a centralized computing architecture, software systems begin to move towards an SOA architecture, where operating systems begin to progress from domain-type to vehicle-level.

SOA-based vehicle operating system integrates functions of cockpit OS, intelligent driving OS, and safety vehicle control OS via central computing platform to provide vehicle-level platform with a set of programming interfaces. Characterized by layered decoupling and unified architecture, it improves development efficiency of auto companies via providing unified interfaces. Vehicle operating system realizes functions scheduling and integration in various domains of the vehicle by centrally scheduling hardware resources and computing power.

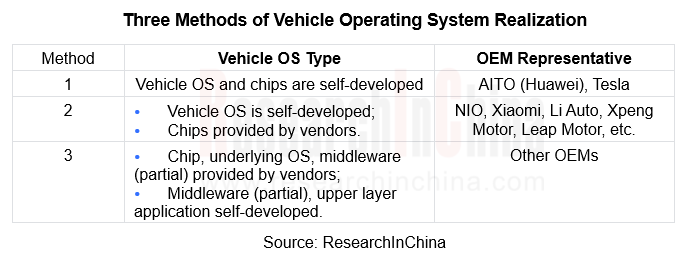

According to ResearchInChina, there are three methods to implement vehicle operating system:

Method 1, Huawei:

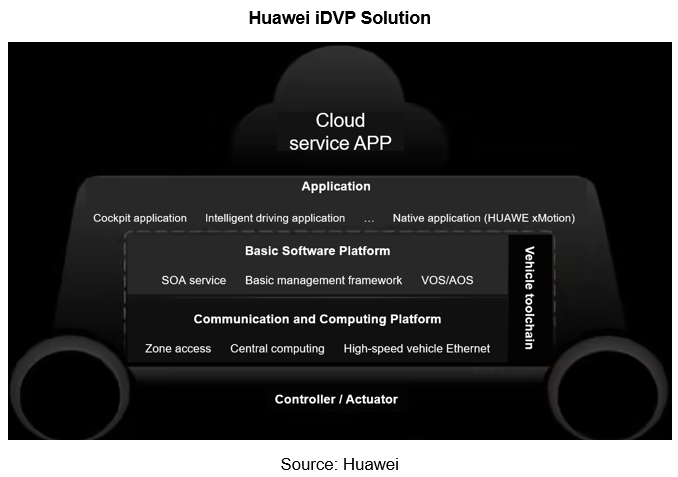

In April 2023, Huawei launched iDVP Intelligent Digital Vehicle Platform (i.e., vehicle operating system), which is a digital base designed based on SOA architecture, integrating functions of Huawei's various domain operating systems (AOS, HOS, and VOS), and realizing decoupling of software and hardware through atomic service layer, thus realizing rapid adaptation for cross-model development.

In 2023, representative model were AITO M9 and Luxeed S7, whose Toulin chassis is developed based on iDVP and realizes centralized and collaborative control of vehicle driving, braking, steering, and suspension through native applications such as HUAWEI xMotion configured with iDVP. In 2024, iDVP platform is scheduled to launch seven vehicles.

Method 2, NIO:

In September 2023, NIO released vehicle operating system "SkyOS", using self-developed microkernel and Hypervisor to replace QNX kernel service. SkyOS is divided into four modules, of which SkyOS-M module is based on a self-developed microkernel and has strong real-time performance and security. Its microkernel architecture is equipped with Hypervisor system for cockpit-driving integration, which is installed on NIO NT 3.0 platform; SkyOS-L module uses a self-developed middleware platform to replace AUTOSAR solution.

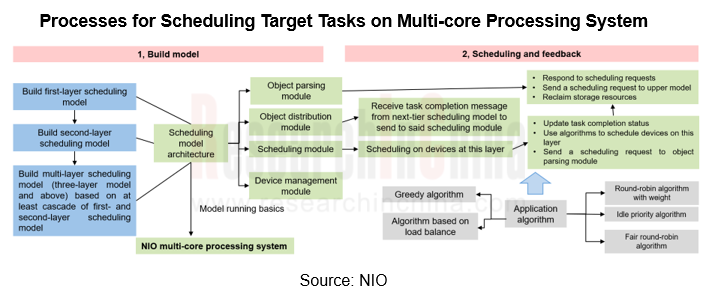

During OS development, NIO has released a number of technologies, including those for realizing task scheduling on multi-core processing system and improving task scheduling efficiency. Among them, multi-layer scheduling model is adopted for scheduling target tasks on multi-core processing system. equipped with fair round robin algorithm/most idle priority algorithm, etc., the vehicle operating system is able to coordinate hardware resources (computing power, sensors) under different working conditions by means of perception function groups.

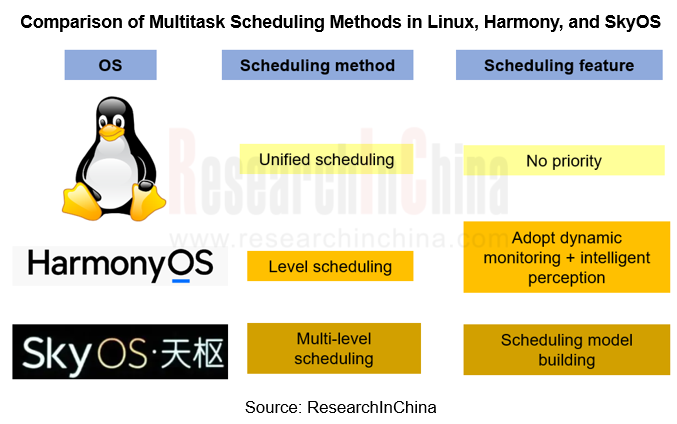

Linux, Harmony, SkyOS and other operating systems use different scheduling methods for multitasking, and evolved from initial unified scheduling to multi-layer scheduling, which improves processing efficiency, as well as security performance.

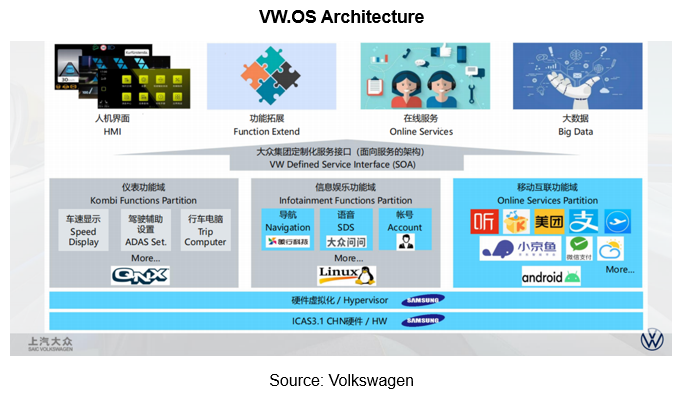

Method 3, Volkswagen:

Volkswagen VW.OS consists of SDK (Software Development Kit), reference applications, software components and configuration tools for embedded software and cloud connectivity. By working in conjunction with VW.AC and BigLoop, it forms a vehicle software development platform that realizes conversion of distributed to centralized processing methods and achieves a core architecture reduction to three in-vehicle central processors.

As of February 2023, some Porsche and Audi models already carry partial components of VW.OS 1.2 (including software updates, cloud-based data transfer, diagnosis, and data accumulation), and Volkswagen plans to roll out the full software platform as version 2.0 in 2025, with partners including BlackBerry and Microsoft.

Providers: building an OS ecosystem

OS large-scale application requires the support of a strong ecosystem. In 2023, while actively implementing vehicle operating systems, automotive OS providers will also increase expansion of OS ecosystem, including adapting to more domestic chips and establishing more upstream and downstream partners.

Upstream/downstream cooperation:

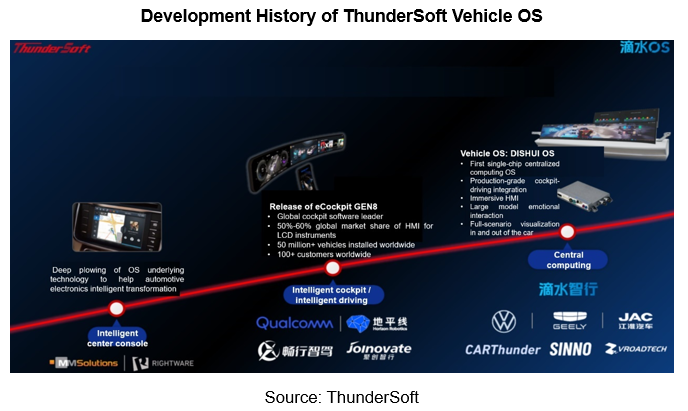

ThunderSoft: worked closely with its subsidiary DISHUI Zhixing and Lingang section of Shanghai Pilot Free Trade Zone to set up a vehicle R&D base; in addition, ThunderSoft and Cariad, a subsidiary of Volkswagen, established Carthunder as a joint venture to cooperate in the fields of intelligent connectivity, intelligent cockpit, and operating system.

ArcherMind Technology: established a strategic partnership with EB in AUTOSAR.

Chip:

ThunderSoft: ThunderSoft is deeply bound to Qualcomm chips. For example, it has achieved stable operation of the LLaMA-2 13 billion parameter model on edge devices equipped with Qualcomm 8 series chip platforms, and improved competitiveness of vehicle platform products through AI large models.

ArcherMind Technology: In 2023, ArcherMind Technology built a Hesper OS software platform solution for J5 and J6 based on Horizon TogetherROS.Auto platform. This solution adds SOA functions based on FusionDrive functions. In addition, ArcherMind Technology signed a cooperation agreement with NVIDIA to become its ecosystem software partner, providing intelligent driving vision solutions based on Orin and Xavier chips to intelligent driving-related companies.

Build a developer ecosystem: Huawei, for example, launched HarmonyOS NEXT and provides middleware and tool chains for developers.

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...