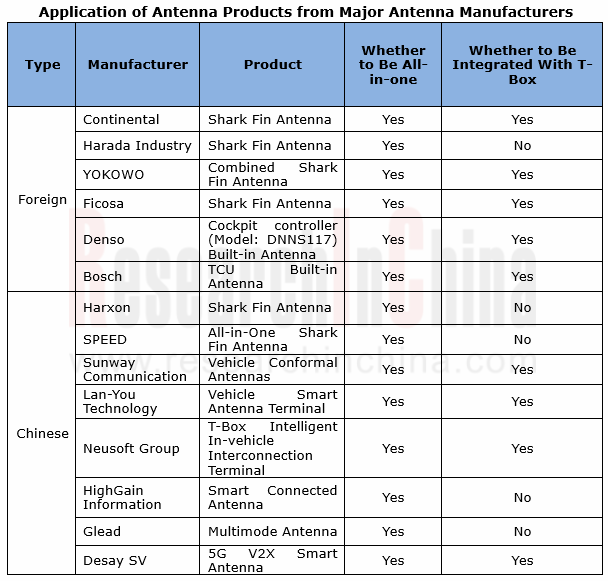

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversified and integrated.

Automotive antennas have entered an era of intelligence. OEMs place a higher premium on the application of antenna functions amid V2X and smartphone integration, thereby facilitating the intelligent, diversified, and integrated development of automotive antennas. As new technologies such as 5G and MIMO find application, antenna manufacturers also endeavor to research anti-jamming and all-in-one antenna technologies, that is, ensuring that multiple automotive antennas of different types work normally and independently in multi-antenna integration.

Main development trends of automotive antennas:

Intelligent: integrated with intelligent connected terminals, and applied to ADAS and V2X scenarios, e.g., Continental’s shark fin antenna;

Intelligent: integrated with intelligent connected terminals, and applied to ADAS and V2X scenarios, e.g., Continental’s shark fin antenna;

Integrated: more common in high-end vehicle models, adopt hidden antenna design, and highlight the reinforced anti-jamming performance of different types of antennas, e.g., SPEED's all-in-one antenna;

Integrated: more common in high-end vehicle models, adopt hidden antenna design, and highlight the reinforced anti-jamming performance of different types of antennas, e.g., SPEED's all-in-one antenna;

Diversified: bring antenna functions into full play in different scenarios, and use all-in-one antenna technology, e.g., Glead’s multi-mode antenna and YOKOWO’s combined shark fin antenna.

Diversified: bring antenna functions into full play in different scenarios, and use all-in-one antenna technology, e.g., Glead’s multi-mode antenna and YOKOWO’s combined shark fin antenna.

Foreign first-tier automotive antenna manufacturers are led by Continental, TE Connectivity, Harada Industry and Ficosa. They use all-in-one antenna technology to integrate AM/FM/cellular/GNSS antennas into the shark fin and combine them with intelligent connected terminals. For example, the shark fin antenna provided by Continental for OEMs like Volvo and BMW is integrated with T-Box and uses smart antenna modules to simplify the antenna layout of the car body; Bosch has also developed a smart antenna akin to the T-Box-integrated smart antenna.

Chinese automotive antenna manufacturers include Harxon, Desay SV, SPEED, Sunway Communication, Lan-You Technology and Neusoft Group. They also master all-in-one antenna development technology, and have the ability to develop smart antennas that can be integrated with intelligent connected terminals. One example is Neusoft Group’s C-V2X smart antenna having been mounted on Hongqi E-HS9.

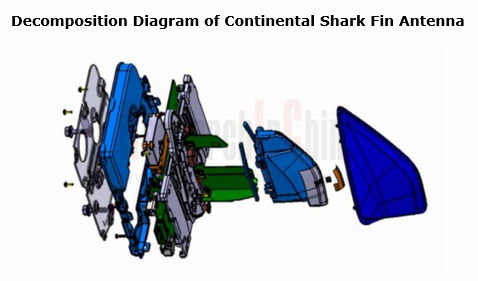

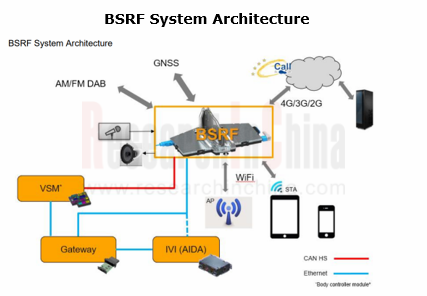

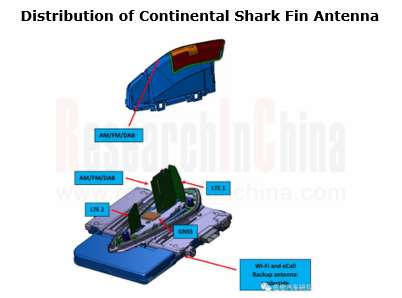

Continental Shark Fin Antenna

Continental's new-generation T-Box for Mercedes-Benz, Volvo and PSA is integrated with the shark fin antenna Continental calls BSRF. The figure below is the structure drawing of BSRF: from left to right is BroadR-Reach Ethernet connection, 20-pin master audio connection, and backup battery connection. There is also an FM connection on the other side.

Continental has launched a 5G V2X shark fin antenna as early as 2020. This antenna integrates 5G antenna, V2X antenna (C-V2X and DSRC), and GPS L1/L2 dual-band navigation antenna, enabling rapid transmission of a mass of data.

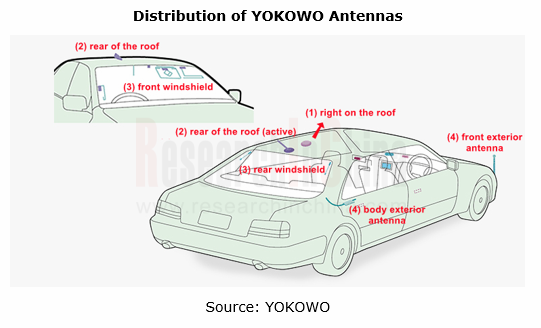

YOKOWO Antenna

YOKOWO's vehicle antenna products include:

- AM/FM antenna (frequency range: 0.5-110MHz);

- High-precision positioning antenna for L1/L2 and L1/L5;

- Shark fin antenna (customized according to vehicle models);

- GPS antenna

- V2X antenna

Where YOKOWO's vehicle antenna products are installed on a car: (1) right on the roof; (2) rear of the roof (active); (3) glass sunroof; (4) classic exterior positions, e.g., the front of the car.

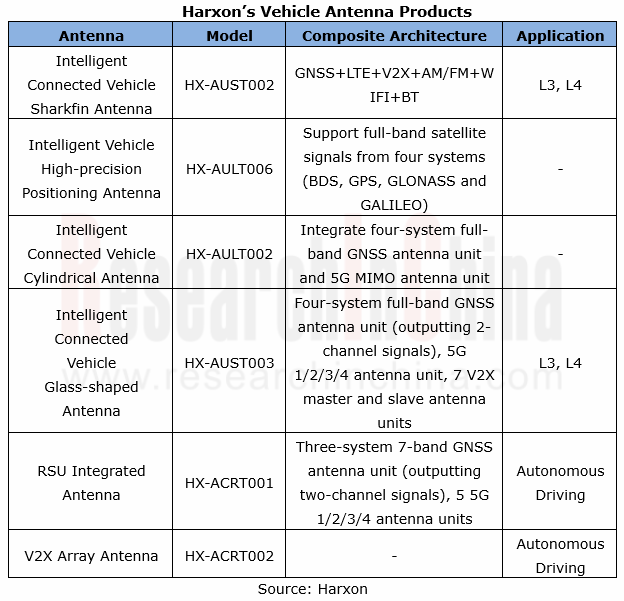

Harxon

Harxon, a subsidiary of BDStar Navigation, offers 6 types of vehicle antennas, among which shark fin antenna is applicable to L3 /L4 autonomous driving.

In June 2022, Harxon cooperated with Neta Auto on several new model projects, providing intelligent connected vehicle antenna products for Hozon New Energy Automobile. In September 2022, Harxon joined hands with Zhito Technology on application of high-precision positioning and intelligent connection and communication technologies in Zhito’s L3 intelligent heavy trucks, including high-precision positioning service, integrated navigation, 5G communication, and V2X communication.

Conventional automakers: shark fin becomes the main carrier for vehicle smart antennas.

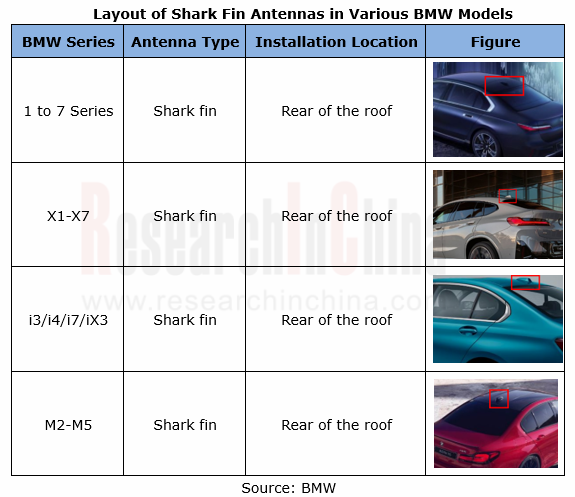

Shark fin antenna was developed by BMW in 2001 and initially applied to E65/E66 in the fourth-generation BMW 7 Series. BMW then developed the second-generation shark fin antenna that directly connected the connected driving telematics module and the shark fin base and added a dedicated communication antenna for connected driving. It was used in the new BMW 7 Series models.

At present, the mainstream models in the 1 to 7 Series all use shark fin antennas, and only one model in the I Series and M Series each does not use. BMW's shark fin antenna can integrate GSM antenna, GPS antenna, TCU emergency rescue antenna and DAB antenna (the integrated GSM antenna is used to amplify the phone signals in the car; the integrated GPS antenna is used for vehicle navigation and positioning; the integrated connected driving antenna is used for telecommunication). Its AM/FM antenna is installed at the rear windshield.

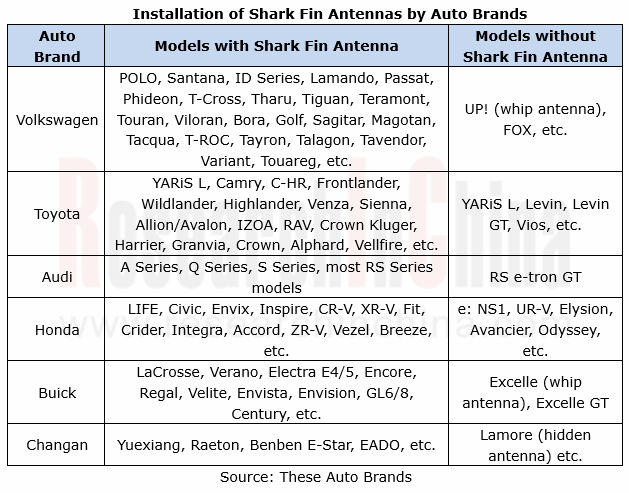

Auto brands with high market shares, including Volkswagen, Toyota, Audi, Honda, Buick and Changan, also favor shark fin antennas when choosing antenna solutions, and install them at the rear of the roof.

Emerging carmakers: underline differentiation of smart antenna solutions.

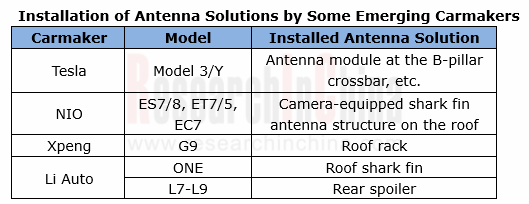

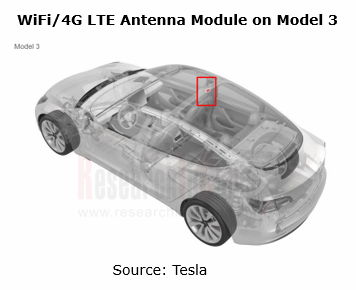

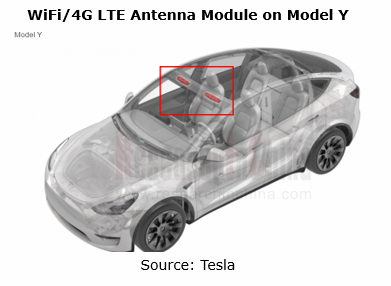

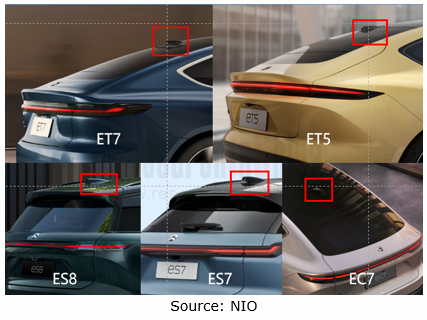

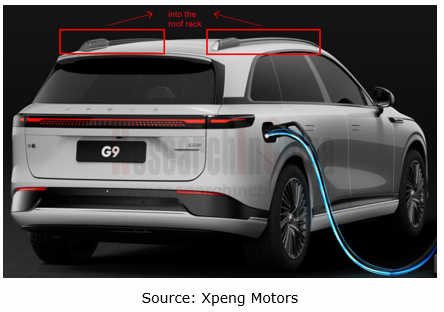

Unlike conventional automakers using shark fin antennas, emerging carmakers prefer differentiation when selecting smart antennas. Among them, NIO chooses a camera-equipped shark-fin antenna structure as the smart antenna solution for its new models; Xpeng Motors and Li Auto integrate smart antennas into the roof rack and spoiler, respectively, for the latest models to make them look more sleek-framed; Tesla chooses to integrate the antenna module into the crossbar of the car body to further simplify the antenna layout.

New Tesla Model 3/Y has placed WiFi and 4G LTE antennas in crossbar in the middle of the sunroof above the B-pillar; the GPS antenna module of Model 3 is located above the interior rearview mirror in the same space as the camera module.

NIO ES7/8, ET7/5, and EC7 are all equipped with a shark fin antenna structure (with a camera) at the rear of the roof and above the trunk. For example, the shark fin antenna of ES7/8 integrates a rearview driving assistance camera and 5G communication module; the shark fin antenna structure of ET7/5 highlights camera design in appearance.

Xpeng G9 uses a hidden 5G antenna and integrates it into the roof rack. This antenna can support high-speed data transmission for the car.

Li Auto ONE packs a shark fin antenna, while the automaker switches to a spoiler-integrated antenna for models from L7 to L9. The antenna accessories for the L7 to L9 models are all provided by SPEED, including 5G antenna, high-precision positioning antenna and radio amplifier. Li Auto L9's Bluetooth antenna can sense both horizontal/vertical coordinates and height of the user's smartphone.

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...