Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

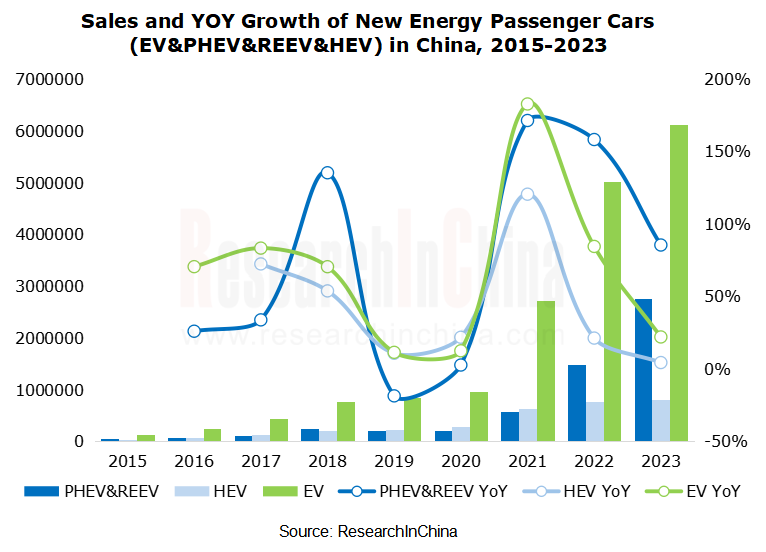

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric passenger cars, a year-on-year spurt of 85.5%, a growth rate higher than battery electric passenger car models for five consecutive quarters, and the overall growth of the new energy vehicle market.

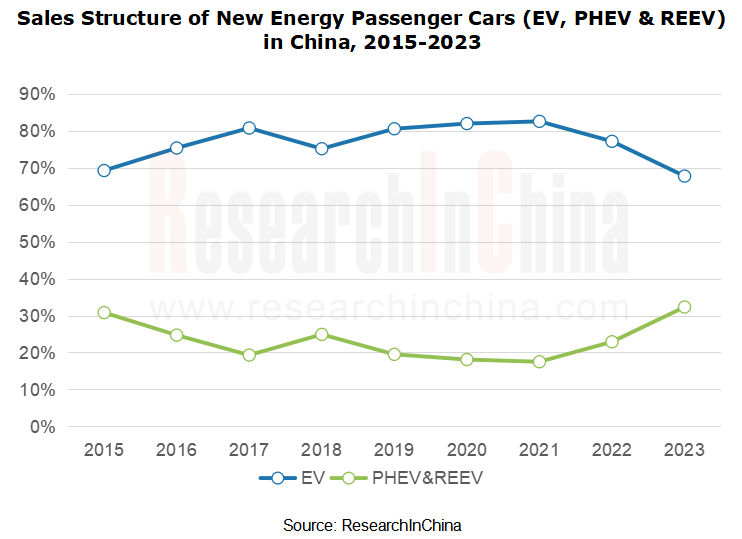

In China, plug-in/extended-range hybrid electric passenger cars already make up 30.6% of new energy passenger cars. In 2023, automakers in China launched more than 30 new plug-in/extended-range hybrid electric vehicle models. As new models continue to emerge, the sales of plug-in/extended-range hybrid electric passenger cars will be on the rise. It is expected that by 2025, plug-in/extended-range hybrid electric passenger cars will take up 40% of the new energy passenger car sales in China.

2. “Electrification plans” are set back globally, and hybrid technology ushers in a boom period.

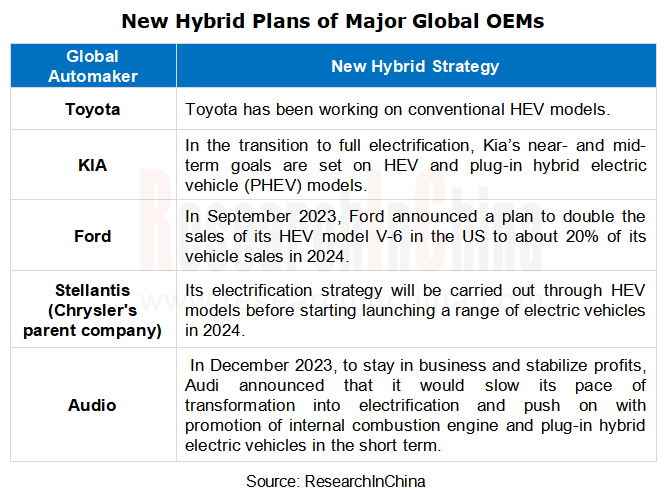

As battery electric vehicles (BEV) see a lower-than-expected growth in sales, major global automakers concentrate more on hybrid electric vehicle (HEV) models to meet customers’ demand and the need for a gradual transition to electrification. By combining conventional internal combustion engine (ICE) system with electric systems, HEV models can help to reduce fuel consumption and emissions in the short term. Also they are very superior in adapting to consumers’ driving habits and alleviating range anxiety.

From the transformation into electrification by global OEMs, it can be seen that GM, Ford and Audi have all postponed their electrification plans. Volkswagen has scaled down its BEV production in Europe. The reasons for the delays and adjustments are reduced orders and lower-than-expected sales. HEV models, especially PHEV & REEV, have become a compromise of automakers in transformation into electrification. It is expected that the launch of new BEVs will slow down in 2024, and PHEV & REEV models will be rolled out in quantities.

3. The boom of hybrid electric passenger cars gives a big boost to the downstream components market.

3.1 Multi-motor/electronically controlled hybrid power systems become mainstream, favoring the rapid development of the industry chain.

In hybrid power systems, dual-motor hybrid power systems have great advantages in fuel consumption, especially paired with long-range batteries. BYD, Li Auto, Geely and Great Wall among others therefore have launched their own hybrid power systems and quickly seized the market with plug-in hybrid or extended-range energy types.

The ratio between hybrid vehicle and motors is generally 1:2/1:3. When HEVs replace ICE vehicles and rapidly increase in volume, they will be a great driving force in the development of the motor industry chain. In the case of the P1+P3 hybrid configuration, P1 is the input shaft with a motor (generator), and P3 is the output shaft with a motor (drive motor). The P1+P3 configuration actually means installation of two motors. To achieve the four-wheel drive performance, HEV models add a motor to the position of P4. This is the P1+P3+P4 configuration, namely, three motors.

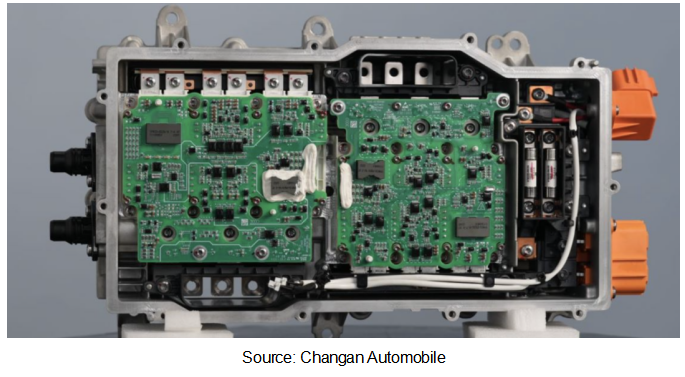

Dual-electronic control systems include two sets of modules that simultaneously control the generator and drive motor to implement the strategies for the entire hybrid power system. As Chinese independent automakers launch more projects, ever more electronic control suppliers participate in the competition in the dual-electronic control system market. Sungrow E-Power, BorgWarner and other suppliers have forged long-term partnerships with automakers like Geely and Great Wall on dedicated hybrid transmission (DHT) vehicles. The dual-electronic control system market thus keeps growing accordingly.

In Changan's P1+P3 hybrid architecture, the drive system uses TC387, a quad-core chip with computing power of 300 megabits per core, for high-precision dynamic torque response control and real-time active noise reduction. It adopts dual 4-core high-compute electronic control chips, and the core is the optimal A-ECMS intelligent energy consumption algorithm for high-precision control and real-time monitoring.

At the 2023 Munich Motor Show (IAA MOBILITY) in Germany, Sungrow E-Power introduced a hybrid dual-motor controller along with Lynk & Co EM-P, a super extended-range electric solution that uses Sungrow’s HEM hybrid dual-motor controller and applies the new-generation power device parallel technology.

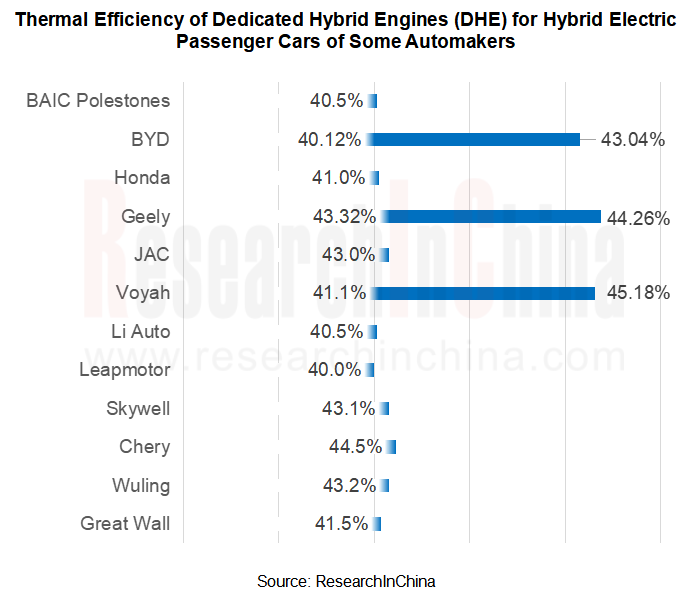

3.2 Dedicated hybrid engines (DHE) with thermal efficiency of 45% have been mass-produced, and industrial upgrade is imminent.

The thermal efficiency of engines is closely related to the fuel consumption and cruising range of HEVs. The higher the engine thermal efficiency, the lower the carbon emissions and user fuel consumption in the same power output. DHEs use deep electromechanical coupling to change the operating conditions from the surface to the domain or line, favoring ultra-high fuel efficiency.

As OEMs like Geely, Dongfeng, BYD, GAC, Great Wall, and Chery lavish on research and development, hybrid electric passenger car models with thermal efficiency higher than 43% have been mass-produced by the end of 2023, especially the 2024 Voyah Dreamer carrying the new Lanhai Power hybrid engine (a 1.5T engine with front and rear dual motors) with thermal efficiency up to 45.18%. It is expected that in 2025, DHEs with thermal efficiency of 45% will find massive industrial application.

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...