ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

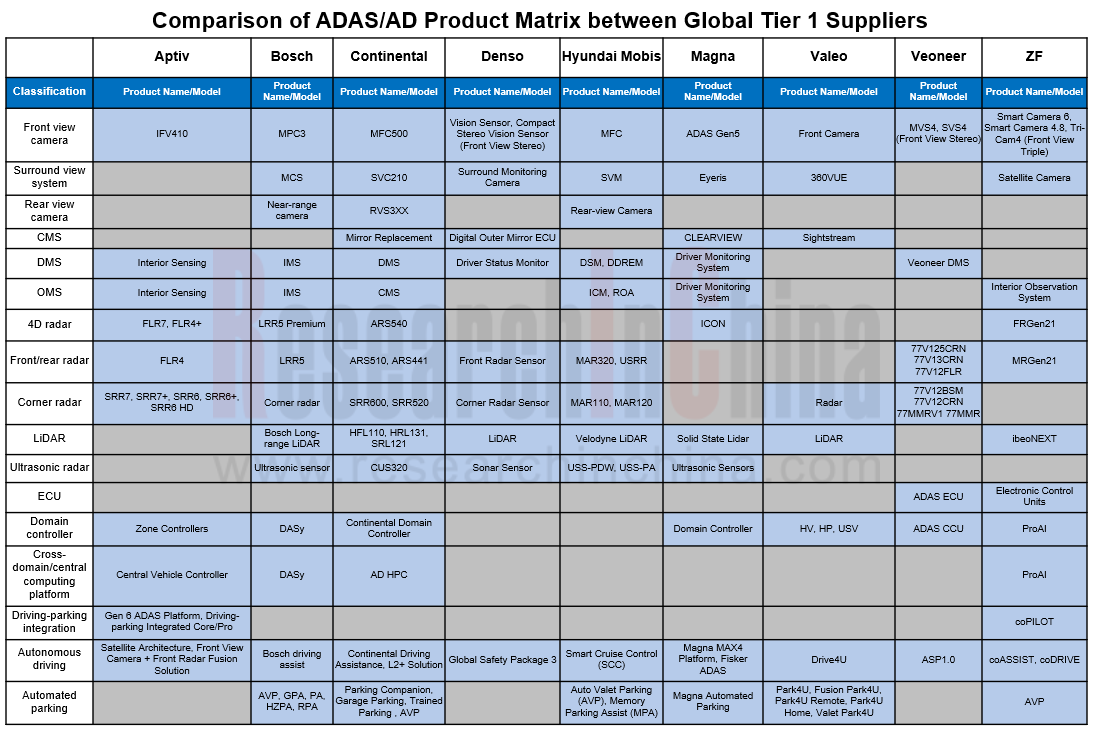

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous efforts to grab the Chinese market.

From the ADAS/AD product matrix, it can be seen that some Tier 1 leaders have almost complete product matrix.

For example, Continental’s latest products include: cockpit monitoring system (CMS, OMS), configured with an OMS camera and a cockpit radar and expected to be released in 2024; HRL131, a 1550nm long-range LiDAR with a detection range of more than 300m, 128° HFOV, 28° VFOV, expected to be mass-produced in 2024; and CUS320, a ultrasonic radar with a detection range of 0.1m-6m, expected to be spawned in 2024.

Bosch has a full range of ADAS/AD products except CMS. Its latest products include: a 1550nm long-range LiDAR, physically displayed at the CES 2023, with a detection range of over 200m and power consumption of less than 20W; an in-cabin monitoring system (IMS, OMS), configured with an OMS camera installed above the center console screen or integrated with the interior rearview mirror, and expected to come into mass production in 2024.

Yet in terms of solutions, currently few global Tier 1 suppliers deploy driving-parking integrated solutions that are hot in China, mainly because it takes them a period of about 2 or 3 years to launch the solutions after they put forward. One example is Continental’s Ambarella CV3-based L2+ solution which was announced in January 2021 but will not be production-ready until 2026.

To cope with the current passive position, global Tier 1 suppliers are also trying to seek changes. For example, Wave3, Bosch’s driving-parking integrated solution, is being developed simultaneously by the XC Division in China and the headquarters in Germany, of which the Chinese solution adopts dual Orin SoCs and is scheduled to be mass-produced in 2023 at the earliest; in June 2023, ZF announced the merger of the divisions for passenger car chassis technology and active safety technology to reduce the internal friction between divisions when making decisions and shorten the time-to-market of products and solutions. In the future, ZF may build a corporate architecture where the active safety integrates all the vehicle businesses such as cockpit and chassis.

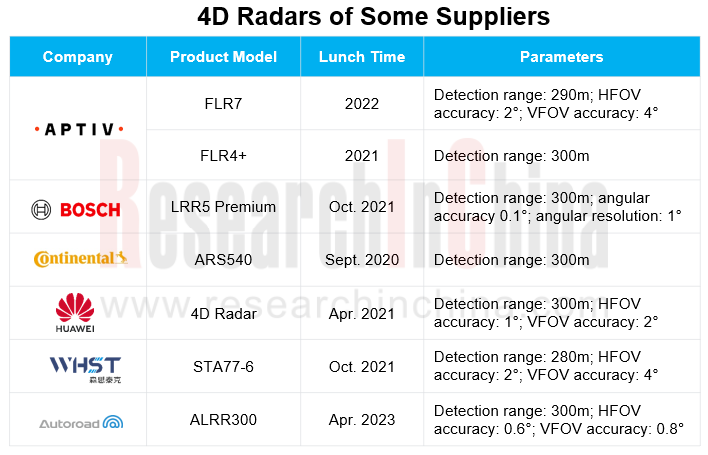

2. 4D radars begin to find mass adoption, and global Tier 1 suppliers grab first-mover advantages.

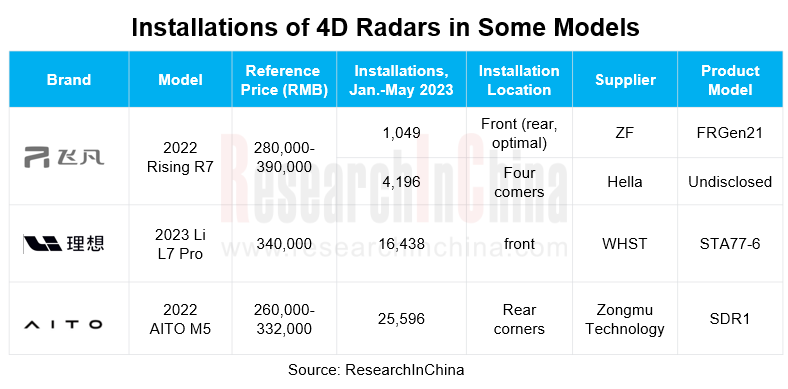

According to our data, from January to May 2023, the overall installations of 4D radars in new passenger cars in China were 65,500 units, of which 35,700 units were front view and rear view radars, and 29,800 units were corner radars. Models confirmed to pack 4D radars include Rising Auto R7, Li Auto L7 Pro and AITO M5.

4D radars have passed through three development phases: infancy, growth and SOP.

Infancy: before 2022, foreign Tier 1 suppliers were the first to start upgrading from conventional 3D radar to 4D radar, for example, Continental went about developing ARS540 early in 2016.

Growth: during 2022-2024, Chinese suppliers set about deploying 4D radar products. For example, in 2022 Nova Electronics introduced 4D-S front radar and corner radar products, as well as a new 6-cascade product; Freetech released FVR40 in 2022.

SOP: beyond 2024, it is expected that 4D radars will begin to be spawned and mounted on vehicles.

Currently, 4D radars are still in the verification phase, and whether the installations will rise depends on the following:

(1) Verify the cost performance of 4D radars (replacing ordinary radars) used in low-level driving assistance solutions (L2-L2+). Examples include Aptiv’s satellite architecture-based sensing and computing system that supports L2 and L2+ with 5R5V12U.

(2) Verify the feasibility of 4D radars replacing LiDAR in high-level intelligent driving solutions (L2.5-L2.9, that is, supporting ADAS in highway NOA and city NOA).

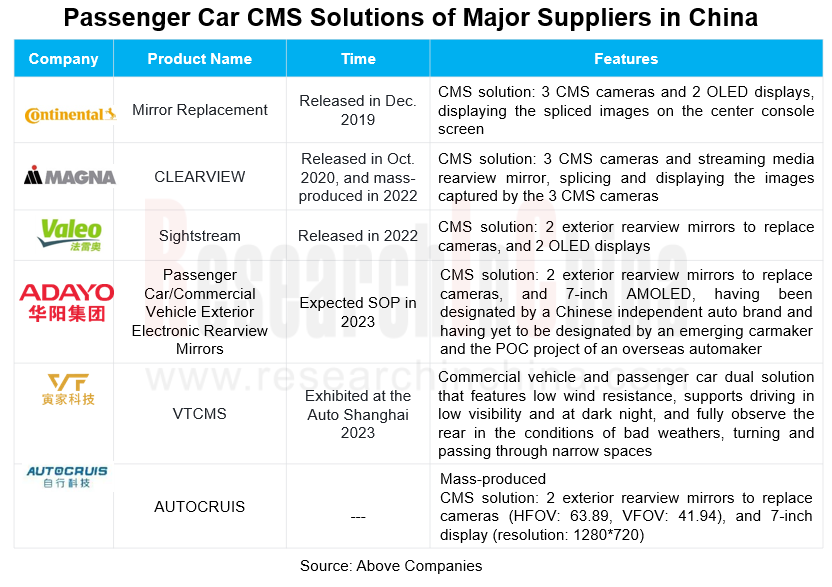

3. China’s adjusted regulation allows CMS to be installed in vehicles, and the competition in the new market is fierce.

On July 1, 2023, the GB 15084-2022 Motor Vehicles - Devices for Indirect Vision - Requirements of Performance and Installation came into effect, specifying that Class M/N motor vehicles are allowed to carry electronic rearview mirrors to replace conventional optical exterior rearview mirrors.

At present, a number of global Tier 1 suppliers, Chinese suppliers and automakers have already made layout of CMS products. Wherein, the global Tier 1 suppliers that have unveiled/mass-produced CMS products include Continental, Magna and Valeo; Chinese suppliers include Autocruis, Voyager Technology, Foryou Group and etc.

On the whole, global Tier 1 suppliers start CMS layout a little earlier than Chinese companies, due to early introduction of regulations.

From a technical point of view, the mainstream CMS solution currently adopted by global Tier 1 suppliers is 2 CMS cameras + 2 OLED displays, that is, replace the left and right rearview mirrors with 2 rearview CMS cameras (generally wide-angle cameras). Another solution of 3 CMS cameras + 2 OLED displays + streaming rearview camera/center console screen is adopted by relatively few companies, as it involves additional technologies such as image stitching/correction. A typical case is Magna CLEARVIEW that adopts the solution of 3 CMS cameras + streaming media rearview mirror tiled display. Noticeably, Magna also proposed a solution of 2 CMS cameras + 2 OLED displays in 2017, but the product Magna actually produces in quantities is still the current 3CMS solution.

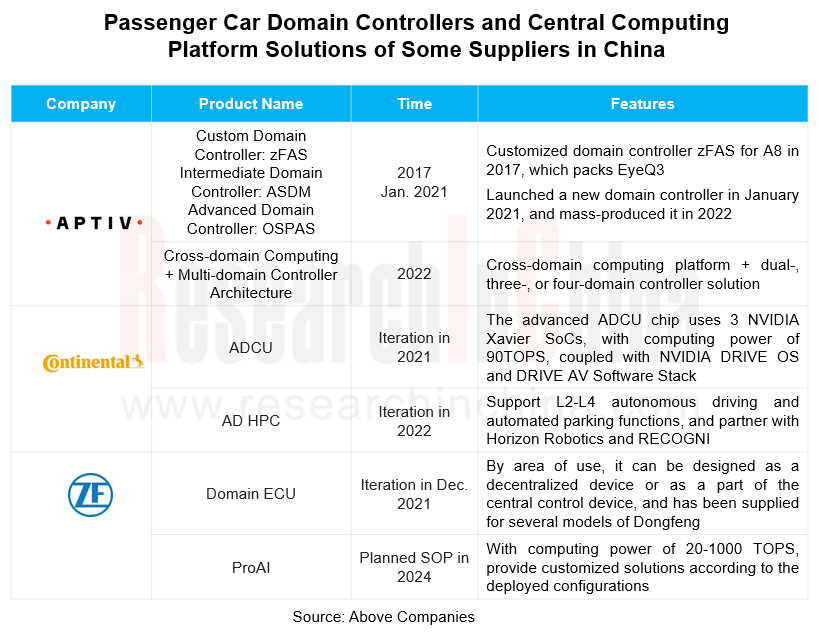

4. As decision products upgrade, a number of Tier 1 suppliers have launched cross-domain/central computing platforms.

As automotive architecture upgrades, the main control units of vehicle internal electronics have also evolved from hundreds of ECUs to several domain controllers. Next cross-domain computing platforms (e.g., cockpit-parking integrated domain controller and driving-parking integrated domain controller) will be used to meet the computing needs of vehicles. In the future, central computing platforms will be used to complete all the computing tasks and enable centralized E/E architecture.

In current stage, several global Tier 1 suppliers have released/iterated multi-domain/central computing platform solutions in 2022. In terms of time node, they are the next-generation alternative to domain controller products.

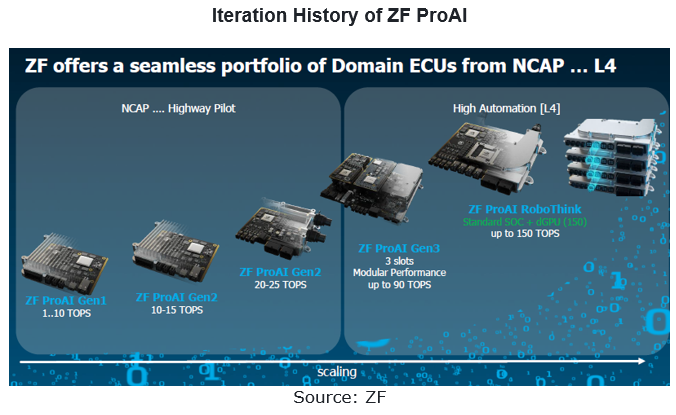

The early solutions include ZF ProAI, which has gone through several iterations, with the computing power increased from 1-10 TOPS to the current 20-1500 TOPS. The latest version of ProAI, scheduled to start volume production in 2024, enables cross-domain computing, packs ZF's domain control middleware, and is optimized for deep learning. Aptiv, on the other hand, puts forward three solutions based on a cross-domain computing platform: a cross-domain computing platform + dual domain controllers, a cross-domain computing platform + three domain controllers, and a cross-domain computing platform + four domain controllers.

1 Global Regulations on Application of Autonomous Driving on Roads and Development Plans

1.1 Global Regulations on Application of Autonomous Driving on Roads

1.1.1 UN Automated Lane Keeping Systems (ALKS) - Main Test Items

1.1.1 UN Automated Lane Keeping Systems (ALKS) - System Safety and Failsafe Response

1.1.1 UN Automated Lane Keeping Systems (ALKS) - Human Machine Interface (HMI) / Operator information

1.1.1 UN Automated Lane Keeping Systems (ALKS) - Object Event Detection and Data Storage

1.1.2 Summary on Autonomous Driving Development Plans of Some Countries/Regions

1.2 European Union & Europe’s Regulations on Application of Autonomous Driving on Roads

1.2.1 Germany’s Law on Autonomous Driving

1.2.2 EU & Europe’s Autonomous Driving Development Plan

1.2.3 EU Autonomous Driving Roadmap and 2040 Outlook

1.3 United Sates’ Regulations on Application of Autonomous Driving on Roads

1.3.1 US Autonomous Driving Development Plan

1.4 Japan’s Regulations on Application of Autonomous Driving on Roads

1.4.1 Japan's Action Plan for Realizing and Popularizing Autonomous Driving 4.0

1.4.2 Japan’s Autonomous Driving Development Plan

1.4.3 Japan’s "RoAD to the L4 Project" - 4 Major Themes

1.5 South Korea’s Regulations on Application of Autonomous Driving on Roads

1.5.1 South Korea’s Autonomous Driving Development Plan

2 Development Trends of Products and Solutions of Global Tier 1 Suppliers

2.1 SOP of New Products: the Volume Production of 4D Radars Starts

2.2 Regulation Adjustment: China Allows for Use of CMS in Vehicles

2.3 Product Upgrade: from Domain Controller to Central Computing Platform

2.4 Solution Upgrade: from Automated Driving/Parking to Driving-parking Integration

2.5 R&D Direction: Product Matrix Improvement + Product Iteration

3 Key Foreign Autonomous Driving Tier 1 Suppliers

3.1 Aptiv

3.1.1 Profile

3.1.2 Revenue

3.1.3 Competitors/Main Customers

3.1.4 Product Classification

3.1.5 Perception Products - Front View Camera

3.1.6 Perception Products - 4D Front Radar

3.1.7 Perception Products - Corner Radar

3.1.8 Decision Products - Domain Controller/Central Computing Platform

3.1.9 Solutions - Driving-parking Integration

3.1.10 Solutions - Autonomous Driving

3.1.11 Autonomous Driving Layout

3.1.12 Product/Market Planning

3.1.13 Summary

3.2 Bosch

3.2.1 Profile

3.2.2 Revenue

3.2.3 Product Classification

3.2.4 Perception Products - Front View Camera

3.2.5 Perception Products - Surround View System

3.2.6 Perception Products - 4D Front Radar

3.2.7 Perception Products - Front Radar

3.2.8 Perception Products – Corner Radar

3.2.9 Perception Products - LiDAR

3.2.10 Perception Products - DMS/OMS

3.2.11 Perception Products - Ultrasonic Radar

3.2.12 Decision Products - Domain Controller

3.2.13 Middleware

3.2.14 Solutions - Autonomous Driving

3.2.15 Solutions - Automated Parking

3.2.16 Recent Development Layout/Planning

3.2.17 Autonomous Driving Partners

3.2.18 Summary

3.3 Continental

3.3.1 Profile

3.3.2 Revenue

3.3.3 Product Classification

3.3.4 Perception Products - Front View Camera

3.3.5 Perception Products - Rear View Camera

3.3.6 Perception Products - Surround View System

3.3.7 Perception Products – CMS

3.3.8 Perception Products - DMS

3.3.9 Perception Products– OMS

3.3.10 Perception Products - Front Radar

3.3.11 Perception Products - Corner Radar

3.3.12 Perception Products - LiDAR

3.3.13 Perception Products - Ultrasonic Radar

3.3.14 Decision Products - Domain Controller

3.3.15 Decision Products - Central Computing Platform

3.3.16 Solutions - Autonomous Driving

3.3.17 Solutions - Automated Parking

3.3.18 Solutions - Road Data Solution

3.3.19 Engineering Solutions

3.3.20 Robotaxi

3.3.21 Autonomous Driving Roadmap

3.3.22 Continental China's Autonomous Driving Planning

3.3.23 Autonomous Driving Technologies

3.3.24 Summary

3.4 Denso

3.4.1 Profile

3.4.2 Revenue

3.4.3 Product Classification

3.4.4 Perception Products - Front View Camera

3.4.5 Perception Products - Surround View System

3.4.6 Perception Products - Front Radar

3.4.7 Perception Products - LiDAR

3.4.8 Perception Products - Ultrasonic Radar

3.4.9 Solutions - ADAS

3.4.10 Solutions - Autonomous Driving

3.4.11 Autonomous Driving Development Roadmap

3.4.12 Autonomous Driving Capabilities and R&D Layout

3.4.13 Summary

3.5 Hyundai Mobis

3.5.1 Profile

3.5.2 Revenue

3.5.3 Perception Products - Front View Camera

3.5.4 Perception Products - Surround View System

3.5.5 Perception Products - DMS

3.5.6 Perception Products - Radar

3.5.7 Perception Products - LiDAR & Ultrasonic Radar

3.5.8 Solutions - Automated Parking

3.5.9 Solutions - Autonomous Driving

3.5.10 Autonomous Concept Car

3.5.11 Autonomous Driving Development Planning

3.5.12 Summary

3.6 Magna

3.6.1 Profile

3.6.2 Revenue

3.6.3 Product Classification

3.6.4 Perception Products - Front View Camera

3.6.5 Perception Products - Surround View System

3.6.6 Perception Products - CMS

3.6.7 Perception Products - DMS/OMS

3.6.8 Perception Products - 4D Front/Corner Radar

3.6.9 Perception Products - LiDAR & Ultrasonic Radar

3.6.10 Decision Products - Domain Controller

3.6.11 Solutions - Autonomous Driving

3.6.12 Solutions - Automated Parking

3.6.13 Autonomous Driving & Intelligent Connectivity Planning

3.6.14 Summary

3.7 Valeo

3.7.1 Profile

3.7.2 Revenue

3.7.3 Autonomous Driving Product Layout

3.7.4 Automotive Product Layout

3.7.5 Distribution of R&D Bases in China

3.7.6 Autonomous Driving Products - Front View Camera

3.7.7 Autonomous Driving Products - Surround View System

3.7.8 Autonomous Driving Products - CMS

3.7.9 Autonomous Driving Products - Radar

3.7.10 Autonomous Driving Products - LiDAR

3.7.11 Autonomous Driving Products - Domain Controller

3.7.12 Autonomous Driving Products - Ultrasonic Radar

3.7.13 Solutions - Automated Parking

3.7.14 Solutions - Autonomous Driving

3.7.15 Autonomous Delivery Vehicles

3.7.16 Intent Prediction Technology

3.7.17 360-degree Autonomous Emergency Braking System

3.7.18 Autonomous Driving Product Partners

3.7.19 Summary

3.8 Veoneer

3.8.1 Profile

3.8.2 Revenue

3.8.3 Corporate Development Roadmap

3.8.4 Autonomous Driving Product Layout

3.8.5 Summary on Autonomous Driving Products

3.8.6 Perception Products - Camera

3.8.7 Perception Products - DMS

3.8.8 Perception Products - Radar

3.8.9 Perception Products - LiDAR

3.8.10 Decision Products - Domain Controller

3.8.11 Autonomous Driving Products - Positioning System

3.8.12 Autonomous Driving Products - V2X

3.8.13 Solutions - Autonomous Driving

3.8.14 Development History and Planning of Autonomous Driving Solutions

3.8.15 Main Partners

3.8.16 ADAS Technology Releases, 2021

3.8.17 Application of ADAS Products in Vehicles, 2021

3.8.18 Distribution of ADAS Product Customers, 2021

3.8.19 Summary

3.9 ZF

3.9.1 Profile

3.9.2 Recent Changes in Business Division Structure

3.9.3 Revenue

3.9.4 Product Classification

3.9.5 Perception Products - Front View Camera

3.9.6 Perception Products - Surround View System

3.9.7 Perception Products - OMS

3.9.8 Perception Products - 4D Front Radar

3.9.9 Perception Products - Front Radar

3.9.10 Perception Products - LiDAR & Sound Sensor

3.9.11 Decision Products - Vehicle Computing Platform

3.9.12 Decision Products - Domain Controller & Middleware

3.9.13 Solutions - Autonomous Driving & Driving-parking Integration

3.9.14 Solutions - Automated Parking

3.9.15 Development Trends & Layout

3.9.16 Summary

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...