Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the software-driven stage 2.0 based on artificial rules, in the stage 3.0, the iteration of autonomous driving functions is driven by big data and foundation models; the perception mode is that multimodal sensors jointly output the results, while the information fusion mode evolves from post-fusion to in-fusion and pre-fusion.

As concerns data capability building, companies have shifted their focus to the efficiency and cost of the data closed loop, and can cope with more Corner Cases (extreme cases, e.g., traffic accidents, severe weathers or complex road conditions) on the premise of data compliance and data security, so as to expedite the development of user experience from "fatigue relief" to "scenario-based comfortable experience". Wherein, OEMs concentrate their efforts on improving application of autonomous driving in such scenario as city areas, urban overpasses and highways.

In highway scenarios, users can securely enable autonomous driving functions. The autonomous driving system provides a guide for accurate and comfortable on-ramp and off-ramp, keeps vehicles centering in lanes, allows vehicles to come around sharp corners at high speeds, balances follow and stop on congested road sections, intelligently selects the best lane, horizontally avoids and overtakes slow vehicles in lanes, and intelligently recognizes and avoids accidents and slow vehicles. For example, Pony.ai's NOA solution (see the figure below) makes a flexible response to highway and urban traffic scenarios, and performs well in such scenarios as automatic lane change, on/off-ramp, cruise control, lane centering, and obstacle avoidance.

In urban scenarios, city NOA functions like NIO NOP+, Huawei NCA, and Xpeng XNGP have come into service, with the improving scenario generalization capabilities for vehicle functions. For example, Huawei’s intelligent driving system ADS2.0 mounted on Avatr allows the car to successfully pass through between the two trucks on a narrow urban street (see the figure below), and rivals or even outperforms humans in making decisions.

In short, the autonomous driving system performs ever better in automatic lane change, obstacle avoidance and other scenarios, and lets drivers take control of vehicles less frequently. Behind the vehicle intelligence competition is the efficient flow of data in the vehicle-cloud closed loop. Examples include Baidu AI Cloud’s autonomous driving data closed loop solution that provides full-cycle autonomous driving data operation services and an autonomous driving tool chain platform to solve problems in the process of data collection, processing, and use.

1. The stage of data-driven Autonomous Driving 3.0 starts, and companies double down on building or improving all the links of their data closed loop system.

The essence of the Autonomous Driving 3.0 is to be driven by data for ever higher data mining efficiency and date utilization. In this stage, the scale of vehicle test data can cover more than 100 million kilometers, which poses challenges to the collection, annotation and other links in the data closed loop. In this regard, automakers raise the efficiency of data processing by way of improving the flexible collection logic of the shadow mode and simulating zero prototypes to gear up for algorithm iteration, model training and deployment.

Let’s look at automakers’ measures to improve efficiency from the following key links of data closed loop, i.e., data collection, data annotation, and simulation test.

Data collection

At present, data can be collected by road collection vehicles, production vehicles, cloud simulation, and vehicle owner contribution. Wherein, the shadow mode works relatively more efficiently when collecting dynamic/static data inside and outside the vehicle. The algorithm trigger logic set by automakers is more flexible and precise. For example, Xpeng sets more than 300 trigger signals on vehicles with the ability to collect data, and the system can judge which corner case is useful at present and then uploads it. SAIC Rising Auto sets up multiple Triggered Events in cars to collect and return multimodal data after triggering these conditions, having enabled backhaul of nearly 12 million clips of data just within three months. In addition, EXCEEDDATA’s data collection system uses the cloud low-level code tool vStudio and various operators, making it easy to build trigger algorithms. The complete vehicle-cloud cooperative solution allows for one-click distribution of trigger algorithms to vehicles, without needing a complicated OTA process, delivering high algorithm iteration efficiency. EXCEEDDATA’s shadow mode is evolving to the stage 2.0, helping to build a trigger scene library and enable human-computer comparison and AB model comparison, and the edge computing assists in mining unknown abnormal scenarios for far lower cost and much higher efficiency.

Data annotation

Data annotation is one of the most critical links in the autonomous driving data closed loop. At present, how to keep improving the efficient automatic annotation of collected multimodal high-value data is the focus of conventional annotation companies and data closed loop solution providers.

To better empower automakers, conventional annotation companies are developing their own automated data annotation platforms to improve the efficiency and quality of data annotation. Meanwhile, they have also begun to partner with various intelligent computing centers, and use foundation models for ever greater capabilities of annotation platforms and lower cost of annotation.

In DataOcean AI’s case, its self-developed autonomous driving annotation platform DOTS-AD can support multi-dimensional, all-round autonomous driving annotation tasks, with up to 8 times higher data annotation efficiency. Another example is the MindFlow SEED data service platform which drives the mass annotation of autonomous driving data via AI+RPA, increases the comprehensive labor efficiency by an average of 30% and lowers the data production cost by an average of 40%.

In terms of driving scene recognition capabilities, the Haomo DriveGPT-based 4D Clips driving scene recognition solution built by Haomo.ai, a data closed loop solution provider, can cut down the annotation cost of a single picture to 0.5 yuan, a tenth of the current industry average cost. Haomo.ai is opening up the image frame and 4D Clips automatic driving scene recognition service to the industry. At present, quite a few annotation companies have joined hands with Haomo.ai, including Datatang, DataOcean AI, Appen, Testin and Stardust AI. The win-win cooperation between companies is bound to slash the data use cost for the industry and improve data quality.

Simulation test

Cloud simulation platform construction is one of the tool chain capabilities of companies. The purchase and maintenance of simulation equipment is a cost pressure. Yet in the autonomous driving R&D process, compared with the approach using component prototypes to verify functions, virtual simulation needs fewer or zero prototypes. The higher cost performance makes simulation investment almost a must.

There are several simulation forms: MiL (model-in-the-loop), SiL (software-in-the-loop), HiL (hardware-in-the-loop), DiL (driver-in-the-loop), and ViL (vehicle-in-the-loop). Companies require a different simulation form in different stages of their R&D cycle. Currently many automakers are using simulation tools to verify functions and shorten the R&D cycle and the time-to-market of new models. For example, VI-grade’s products are used by BMW, Mercedes-Benz, Audi, Ford, Honda, Toyota, SAIC, FAW, GAC and NIO among others.

2. When constructing a data closed loop ecosystem, companies quicken their pace of building "digital intelligence/data base" capabilities.

Data, algorithm, and computing power are the three cornerstones of autonomous driving technology. The volume and quality of data determine the upper limit of algorithm capabilities, and computing power is the carrier of data processing. The integration of software and hardware means the "smoothness" of adaptability between algorithms and domain controller/chip. Currently just a few companies like Tesla in the industry have built a complete intelligent ecosystem of "data + algorithm + computing power", and take 100% control of data. To have control over data, OEMs and software algorithm companies are running after them.

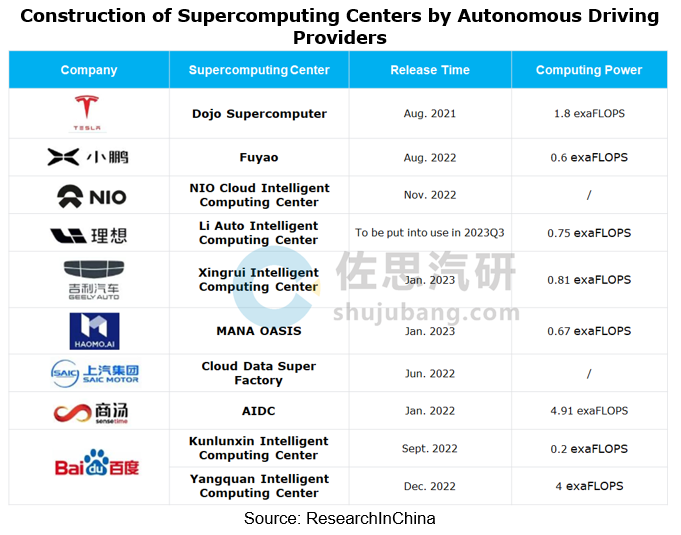

Build intelligent computing centers

As the initial investment in supercomputing centers is relatively high, OEMs and Tier 1 suppliers generally budget over RMB100 million for building AI computing centers. In the case of Dojo, Tesla’s supercomputer platform that was put into use in July 2023, Tesla will invest more than USD1 billion in Dojo in 2024 to facilitate training of the supercomputer and neural networks.

Even so, automakers or technology providers with a long-term plan for autonomous driving are building their own supercomputing centers to hold stable computing resources and shorten the development cycle and the time-to-market of autonomous driving products. One example is "Fuyao", Xpeng’s autonomous driving AI intelligent computing center co-funded with Alibaba in August 2022. The center can speed up the model training of autonomous driving algorithms by 170 times, and has the scope to increase computing power by 10 to 100 times in the future.

"Digital intelligence/data base" capability building

The full life cycle of intelligent vehicles needs to be driven by data, and it is the data-based vehicle-cloud full-link capability base that some autonomous driving solution providers work hard to build. For example, ExceedData’s vehicle-cloud integrated computing architecture combines with its vehicle high-performance time-series database to build a data base for intelligent vehicles, and redefines the cost and efficiency of vehicle data intelligence, enabling an 85% reduction in the total cost. The data base solution has been well accepted by first-tier automakers including FAW, SAIC, SAIC Z-ONE, Human Horizons, Dongfeng Voyah, BAIC and Geely, and has been mass-produced and designated for more than 10 vehicle models.

Freetech has the ability to develop, mass-produce and deliver software and hardware integrated platforms, and has built a data closed loop link of "large-scale data collection - data processing system - automated iteration". Freetech’s ODIN intelligent driving digital intelligence base supports large-scale mass production data closed loop system, and is composed of Freetech’s large-scale mass production data base and the computing power platform deployed at the National Super Computing Center. Freetech has built a complete data closed loop system that supports algorithm evolution, and can complete the iterative evolution of perception algorithms, and the closed-loop verification of planning and control algorithms. The ODIN digital intelligence base is composed of self-developed domain controller, sensor, autonomous driving algorithm, and data closed loop system as the four pillar systems, having cooperated with more than 40 auto brands on over 100 model projects.

3. BEV+Transformer enables end-to-end perception and decision integration.

The enhancement of autonomous driving capabilities is the result of the joint optimization of “more data + better algorithms + higher computing power”, and it is also the inevitable result of advancement of perception, decision, planning and control technologies.

A variety of complex scenarios, especially corner cases, require higher perception and decision capabilities of autonomous driving. BEV technology enhances the perception of autonomous driving systems by providing a holistic perspective. Transformer models can be used to extract features from multimodal data, such as LiDAR point clouds, images and radar data. The end-to-end training on these data allows Transformer to automatically learn the internal structure and interrelation of these data, so as to effectively recognize and locate obstacles in environments.

BEV+Transformer can build an end-to-end autonomous driving system to achieve high-precision perception, prediction and decision. In SenseTime’s case, based on a multimodal foundation model, it can enable data closed loops of prediction and decision. UniAD, SenseTime's perception-decision integrated end-to-end autonomous driving solution, increases the lane line prediction accuracy by 30%, and reduces the errors of motion displacement prediction by nearly 40% and the planning errors by nearly 30%. With regard to AI decision, SenseTime and Shanghai Artificial Intelligence Laboratory launched OpenDILab, a decision AI platform which can also be used in autonomous driving for planning and control.

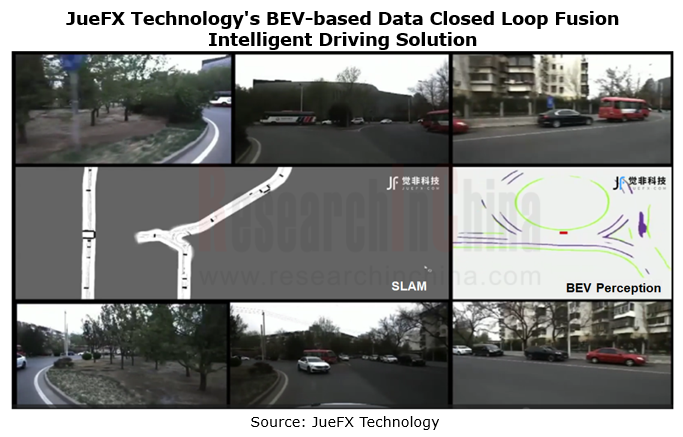

In addition, JueFX Technology also has the "perception-decision-data" closed-loop capability, and its competitive edge lies in the integration and flywheel effect between algorithms and data. In terms of software, JueFX’s core technology path is the fusion of computing power, that is, fuse the spatial data related to the position and attitude of the vehicle, the static data of heavy or light maps, and the sensor perception data, compute them in real time, and apply them to the perception system, positioning system, path planning system or memory mapping system of autonomous driving.

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...