AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more open and cooperative ecosystem.

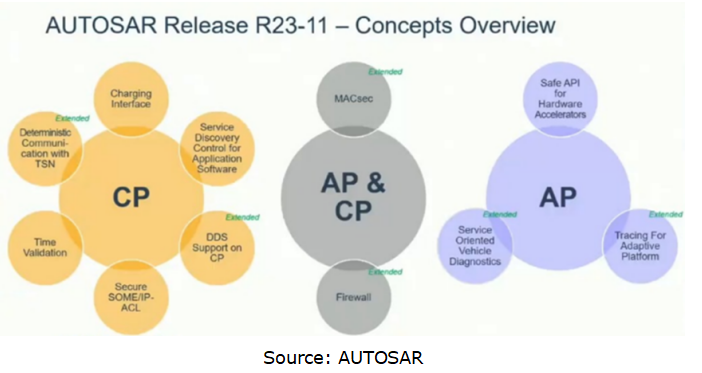

On December 7, 2023, AUTOSAR released the latest standard AUTOSAR Release R23-11. From a functional perspective, the update focuses on three aspects: information security, functional safety and communication protocol stack.

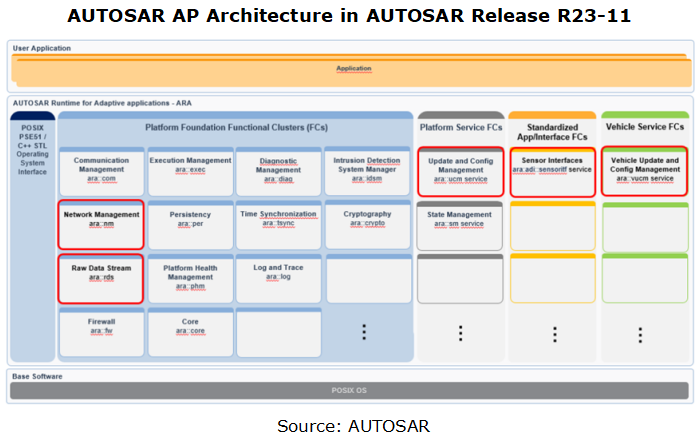

In the Release R23-11, the architecture of AUTOSAR Adaptive Platform (AP) is readjusted, and its functions are reorganized and described. The architecture is re-divided into Foundation, Platform Service, Standardized App/Interface and Vehicle Service.

Wherein, the function components (FC) of Vehicle Service are not required to be deployed on every Machine of the AP, but available within the vehicle. Platform Service is partially responsible for providing specific functions for a single AP Machine; Standardized App/Interface provides standard interfaces or applications; Foundation provides local functions and C++ library of an AP Machine.

In addition to continuous efforts to upgrade and improve functional standards, AUTOSAR will take a more open attitude and cooperate with other third-party organizations to build a new automotive ecosystem and favor the boom of the intelligent vehicle market, in the face of new trends such as software-defined vehicles.

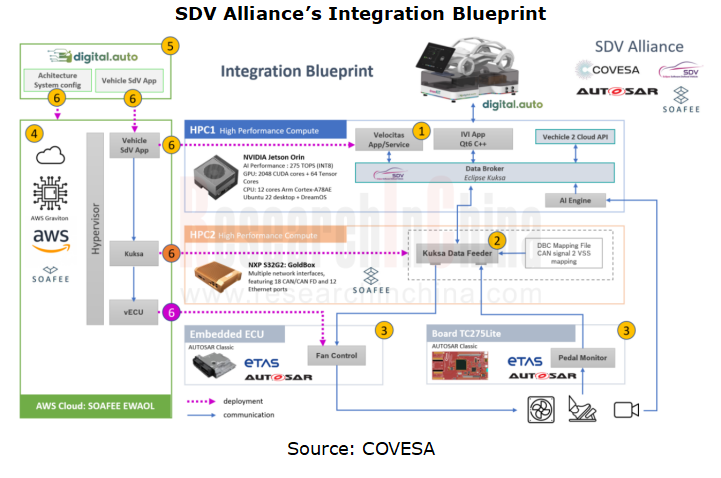

In March 2023, AUTOSAR, COVESA, Eclipse SDV and SOAFE jointly formed the SDV Alliance, a “collaboration of collaborations”. The main purpose of the collaboration is to align efforts in the SDV ecosystem. By embracing existing descriptions of SDV from each of these efforts, as well as other external organizations, the SDV Alliance will agree on a clear and unified definition of what constitutes an SDV.

The Alliance will then look at the different technologies, methodologies, and standards of each organization and show how they can work together for the development of the SDV. Recognizing that the SDV is conceptually too complex to be handled in a single industry consortium, and by looking at each of the organization’s core competencies and varied execution environments, the Alliance will pool these skills to create a joint SDV vision.

At CES 2024, the SDV Alliance announced its first integration blueprint, contributing to promoting software-defined vehicles.

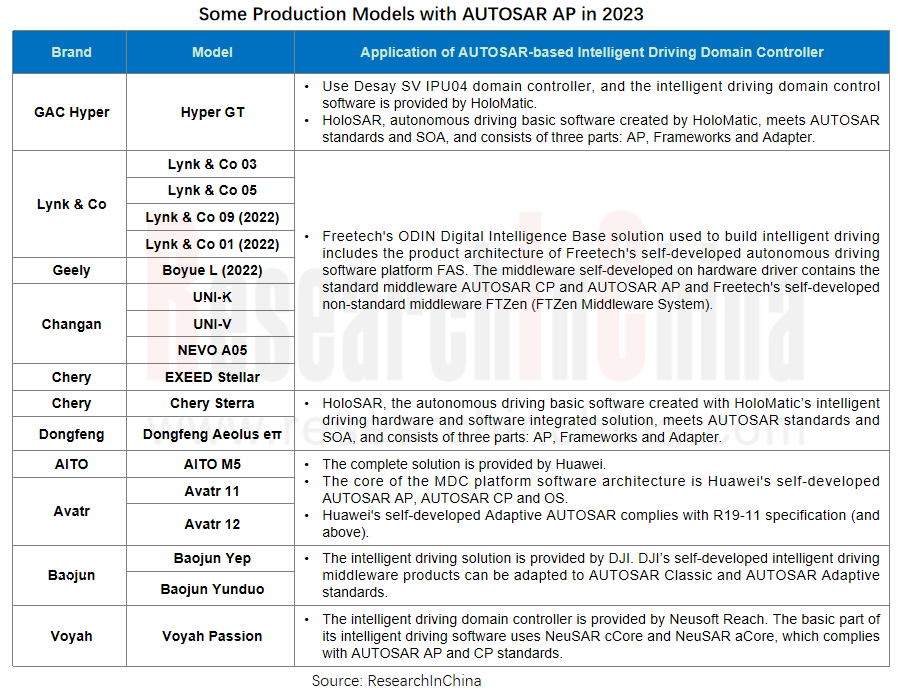

Mass production of intelligent driving solutions based on AUTOSAR AP is increasing.

As autonomous driving domain controllers are spawned and installed in vehicles, supported by solutions of major suppliers, intelligent driving software based on AUTOSAR AP has also achieved mass production and application, and keeps increasing. As well as intelligent driving domain controllers for Volkswagen ID series that use AUTOSAR AP basic software, intelligent driving solutions for multiple vehicle models of Chinese independent brands, like Geely Boyue L and Changan NEVO A05, have also adopted AUTOSAR AP solutions since 2022.

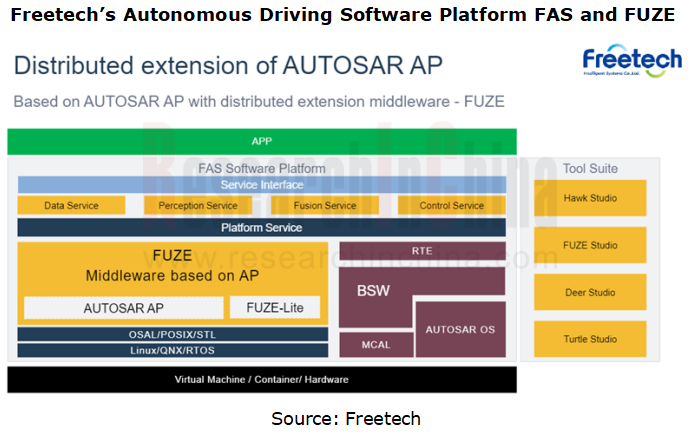

Freetech launched ODIN Digital Intelligence Base, a domain control solution that includes FAS, its self-developed autonomous driving software platform. FAS, middleware self-developed on hardware driver, contain standard middleware AUTOSAR CP and AUTOSAR AP and non-standard middleware FTZen (FTZen Middleware System), and enables EM management, status machine management, EOL, communication management and data services, node services and so on. Accordingly, the FAS toolchain also provides configurations for AP, CP, and non-standard middleware.

Based on ODIN Digital Intelligence Base, Freetech has launched multiple domain controller products such as ADC 15, ADC 20, ADC 25 and ADC30, and has mass-produced them.

AUTOSAR attracts increasing attention in the Chinese market, and localization is accelerating.

Driven by the boom of intelligent vehicles in China, AUTOSAR catches the increasing attention of the Chinese market, specifically:

First, AUTOSAR works hard on layout in the Chinese market. In 2022, the organization established China Center in the country. By organizing AUTOSAR-related public training, cooperating with universities, and holding AUTOSAR open conferences, it makes greater efforts to promote and improve its services in the Chinese market.

Moreover, the number of AUTOSAR’s Chinese members is increasing, and they have a bigger say. The number of AUTOSAR’s members in China increased from 21 in 2019 to over 60 in 2023, and Neusoft Reach, iSoft, Jingwei HiRain are all its premium partners. In 2023, Huawei became AUTOSAR’s Premium Partner Plus (there are only three worldwide, and the other two are Vector and Denso). Premium Partner Plus need to send a Project Leader to participate in management of formulation of AUTOSAR standards, and co-decision on standardization, In the future, ever more Chinese voices will be heard in formulation of AUTOSAR specifications.

Second, in China there are increasing software vendors using AUTOSAR. Neusoft Reach, iSoft, Jingwei HiRain, Huawei, Baidu, EnjoyMove Tech, HoloMatic Technology, Freetech, Novauto, Hinge Tech, Zhicong Technology, and CICV among others make product layout in line with AUTOSAR standards.

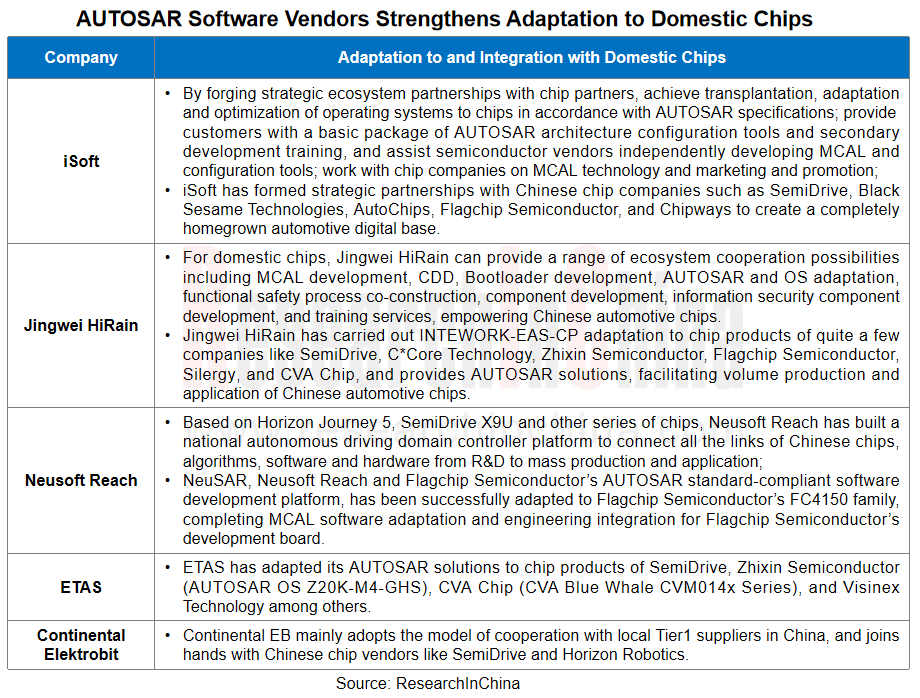

Third, in the trend towards localization of automotive chips and OS in China, AUTOSAR software vendors vigorously adapt to domestic MCUs and other chip products, accelerating mass production and application of Chinese full-stack solutions. Under the wave of localization of basic software and chips, there is an increasing demand for independent R&D of automotive software platforms. In China, AUTOSAR-based software development has also transitioned from the "introduction phase" to the "application phase", and will enter the "innovation phase" in the future, absorbing the quintessence of AUTOSAR and empowering independent automotive software development. In recent years, quite a few basic software vendors have worked on adaptation to domestic MCU and OS products to accelerate the mass production of domestic solutions and application in vehicles.

Finally, factors including intelligent vehicle development and policies will bring the opportunities of domestic replacement of AUTOSAR, especially in the field of intelligent driving.

With the rapid iteration of EEA, a unified standard for intelligent driving basic software middleware has yet to form. Currently AUTOSAR AP is one of the options, and many OEMs or suppliers with software strength, such as Technomous, Zuxia Technology and IMotion Automotive Technology, will choose to self-develop middleware products.

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...

China Passenger Car Digital Chassis Research Report, 2025

Digital chassis research: Local OEMs accelerate chassis digitization and AI

1. What is the “digital chassis”?

Previously, we mostly talked about concepts such as traditional chassis, ch...

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...