The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market is a high-growth semiconductor segment.

Automotive memory chips accounted for about 8-9% of the value of automotive semiconductors in 2023, and the proportion is expected to rise to 10-11% in 2028, mainly because the faster innovation in automotive memory chips promotes the rapid adoption of advanced memory chips into cars. Main driving forces are:

?DRAM: DRAM is the memory chip with the largest market size. In the field of consumer electronics (mobile phones, PCs, tablet PCs, etc.), DDR5 (LPDDR5) has become mainstream and will gradually replace the conventional DDR4 (LPDDR4) in the next 2-3 years. In the automotive field, the conventional DDR is evolving to DDR4, LPDDR3 and LPDDR4, and then to advanced storage products such as LPDDR5 and GDDR6.

?HBM: as the enhanced version of DRAM, HBM provides higher bandwidth and capacity by stacking multiple DRAM chips. Because of high price, it is unlikely to appear in vehicles for a long time, but the cloud server used for training the Transformer AI foundation model must be equipped with multiple HBMs which account for about 9% of the AI server cost, with the ASP (average selling price) per unit as high as USD18,000.

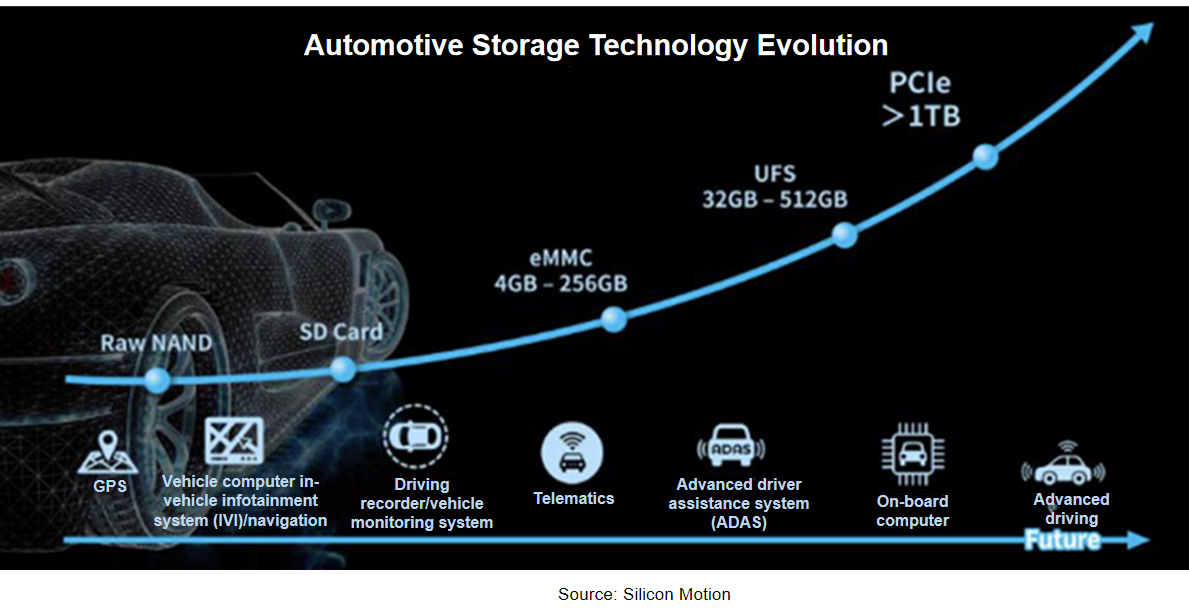

?NAND Flash: In the automotive computing system, important data and trained weight models are stored in the hard disk (i.e., eMMC or UFS). NAND generally stores continuous data in ADAS, IVI systems, center consoles, etc. In the trend towards five-domain fusion, a single vehicle will need 2TB+ NAND in the next 3-5 years, and automotive PCIe SSD for central computing will become an important growth engine.

?SRAM: SRAM is much faster than NAND and DRAM but more expensive. Independent SRAM has almost disappeared, and it is mainly integrated directly into CPU, GPU and various SoCs in the form of an IP kernel. High-performance automotive SoCs generally integrate high-capacity on-chip SRAM.

?MRAM: Wafer giants such as Samsung and TSMC are developing MRAM for the next-generation automotive applications. NXP plans to introduce MRAM to its next-generation S32 zonal ECUs and MCUs. The industry believes that MRAM is expected to replace SRAM as cache memory.

?EEPROM: a smart car requires up to 30-40 EEPROM chips, while an ordinary fuel-powered vehicle only needs about 15 EEPROM chips. EEPROM is extending to BMS, intelligent cockpits, gateways, "electric drive, battery, electric control" systems and other applications.

?FRAM: FRAM outperforms conventional Flash and EEPROM in reading and writing durability, writing speed and power consumption, and has been applied to airbag data storage, event data recorder (EDR), new energy vehicle CAN-BOX, new energy vehicle communication terminal (T-BOX) and other fields.

Evolution of automotive NAND Flash memory: UFS 4.0, PCIe SSD for central computing, CXL memory expansion technology

As with a computer system, a current automotive computing system also has a hard disk where important data and trained weight models are stored.

eMMC5.1 and UFS3.1 have become the mainstream standards for automotive NAND Flash memory. In February 2024, KIOXIA announced sampling of the industry’s first Universal Flash Storage (UFS) Ver. 4.0 embedded flash memory devices designed for automotive applications in line with AEC-Q100 Grade2 requirements. UFS 4.0 supports theoretical interface speeds of up to 23.2Gbps per lane or 46.4Gbps per device. It is conceivable that by 2025, UFS 4.0 will become one of automotive storage standards, and will be applicable to different automotive EEAs.

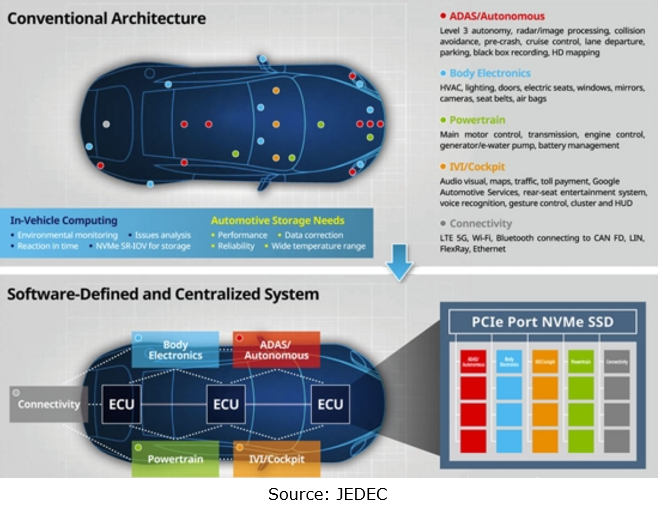

In the future, the automotive NVMe SSD based on PCIe interfaces will offer data throughput of more than 10GB/s, and the massive storage capacity will provide strong support for the next-generation intelligent automotive systems. Automotive SSD refers to the solid-state drive with PCIe as the physical layer and NVMe as the communication protocol.

NVMe supports ultra-long queues so as to greatly ease the storage bottleneck problem during parallel computing. In the era of central computing, storage should be integrated into the central computer, and PCIe is the best choice. SSD is connected to the central computing unit SoC via a PCIe switch.

JEDEC, a standard setter in the storage industry, approved the JESD312 standard in November 2022, and officially released it on December 14. JESD312 defines the specifications of interface parameters, signaling protocols, environmental requirements, packaging, and other features for a solid state drive (SSD) targeted primarily at automotive applications. Automotive SSD is directly mounted on PCB in the form of BGA, with the size not larger than 28x28 mm. It uses four PCIe 4.0 interfaces to provide a peak transmission rate of up to 8 Gb/s.

JESD312 takes into a full account the changes of automotive electronic architectures, targets software-defined vehicles and central computing architecture, and allows the storage array to be partitioned.

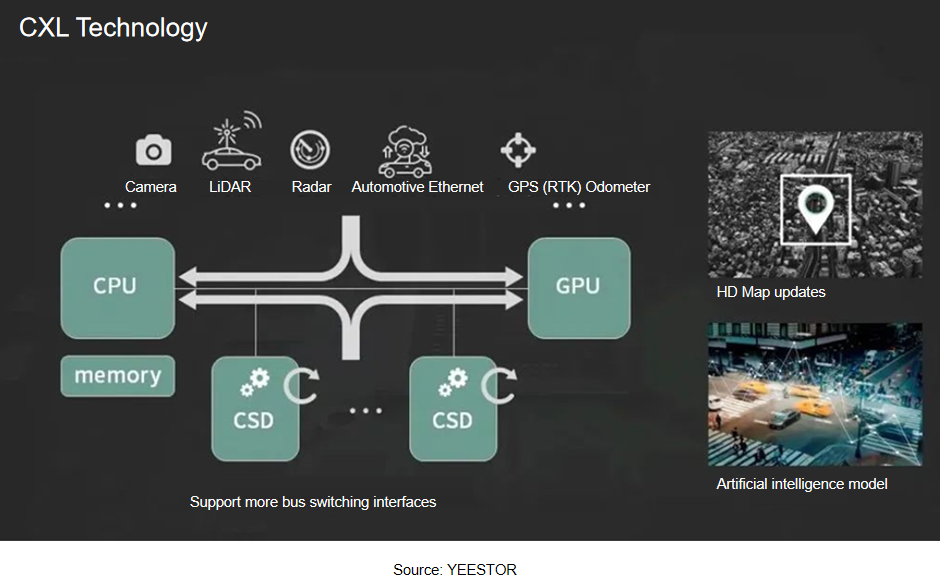

CXL (Compute Express Link), a storage technology based on PCIe, will be one of the important development directions of automotive storage in the future. CXL is a new open interconnect standard, and its essence is to change the original hard disk access model into the existing memory access model and exchange data in the form of memory access. CXL enables high-speed and efficient interconnect between CPU and GPU, FPGA or other accelerators, thus meeting the requirements of high-performance heterogeneous computing.

Evolution of automotive DRAM: In the era of Transformer model, GDDR6 and HBM develop rapidly, and storage cost shoots up.

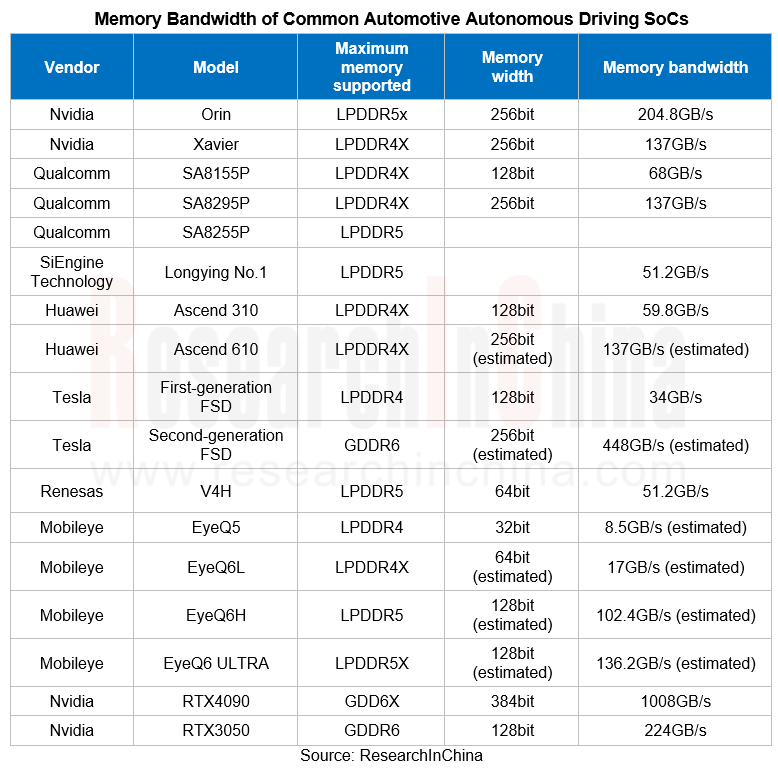

The key to AI operation lies in storage instead of AI processor. 90% of the power consumption and delay of AI operation come from storage or data transfer. In 90% working conditions, the AI processor is waiting for the storage system to transfer data, and the time required by the computing system is almost negligible, so the performance of the storage system actually determines the real computing power. Wherein, the storage bandwidth can basically be equated to the performance of the storage system and the real computing power.

In the Transformer era, there are at least more than 1 billion model parameters, a model is at least 1GB, and the storage bandwidth determines whether Transformer can be run. In addition, storage dominates power consumption. According to Intel's research, when the semiconductor process reaches 7nm, an AI chip (accelerator) takes as high as 35pJ/bit to transfer data, making up 63.7% of the total power consumption.

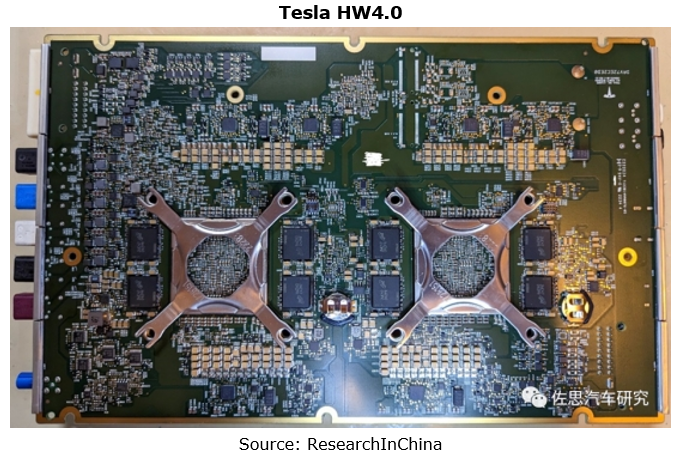

Intelligent vehicles pose ever higher requirements for image floating-point operation. To run Transformer smoothly, the weight model should be read up to 200 times per second, so the storage bandwidth should be at least 400GB/s, 600 GB/s better. On this basis, Samsung and Micron plan to launch their own automotive GDDR6 solutions.

In Tesla HW3.0, the storage bandwidth of the first-generation FSD is only 34GB/s, which is difficult to support the next-generation foundation models. Tesla’s latest self-driving brain HW4.0 therefore uses GDDR6 at all costs, 16 pieces (2GB per piece) used, with 8 each on the front and back side, plus the 4 GDDR6 chips (also 2GB) in the cockpit controller, totaling 20 pieces (40GB), and the cost is more than USD160. HW3.0 uses 8 LPDDR4 chips, and a total of 8 LPDDR4 RAMs, each with capacity of 1GB, totaling 8GB, and the cost is about USD28.

In Tesla HW4.0, GDDR6 is non-automotive-grade D9PZR provided by Micron, and the GDDR6 physical layer of is from Cadence. Rambus also provides the GDDR6 physical layer and earns approximately USD140 million in annual revenue from its storage physical layer IPs. In September 2023, Cadence acquired the SerDes and memory interface PHY IP business from Rambus Inc.

Currently, among Tesla's automotive memory chips, the 2nd-generation FSD has the highest bandwidth ranging from 448Gb/s to 1008GB/s. SK Hynix’s HBM2E (H5WG6HMN6QX038R) supports minimum bandwidth of 460GB/s, with the density of 16GB. The dual-channel design allows for 920GB/s, even up to 1840GB/s, but it is still far less cost-effective than GDDR6.

GDDR6 is expected to prevail, and HBM may follow. Tesla HW 5.0 or the third-generation FSD chip may use HBM, but this is a distant future.

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...

China Passenger Car Digital Chassis Research Report, 2025

Digital chassis research: Local OEMs accelerate chassis digitization and AI

1. What is the “digital chassis”?

Previously, we mostly talked about concepts such as traditional chassis, ch...

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...