Global and China Automotive Wheel Industry Report, 2013-2014

-

May 2014

- Hard Copy

- USD

$2,500

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZYW173

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,700

-

The report analyzes the following aspects:

Global automotive market

Global automotive market

Chinese automotive market

Chinese automotive market

Global automotive wheel industry and market

Global automotive wheel industry and market

Chinese automotive wheel industry and market

Chinese automotive wheel industry and market

37 automotive wheel makers

37 automotive wheel makers

In 2013, aluminum wheel makers were satisfied to see the continuous falling upstream raw material prices and recovered downstream markets. Due to the excess capacity, the primary aluminum price declined more than 15% in China in 2013. The global primary aluminum price fell about 13%. As for downstream markets, Japan and the U.S. rebounded, the European market just went out of the bottom, while Russia witnessed decline.

In 2014, China’s primary aluminum price is still facing great pressure, but the decline rate is lower than that in 2013. On the international market, the primary aluminum price stops falling to show a stable trend.

China aluminum wheel industry performs stably. Although there are many aluminum wheel investment projects, most of them do not go into operation actually after loans are offered; therefore, the expected aluminum wheel overcapacity does not occur. In China aluminum wheel industry, large enterprises target the OEM market while SMEs focus on the AM market.

As the global leading position is strengthened, CITIC Dicastal continues to expand its market share in the conservative Japanese supply chain system with strong competitive advantages. Impact by CITIC Dicastal, the revenue of GAC CHUO SEIKI Component, a major supplier of GAC Toyota, dropped from RMB1.252 billion in 2012 to RMB603 million in 2013. CITIC Dicastal added Ningbo base to seize more market share. Lizhong Wheel also performed well in 2013, it surpassed Wanfeng Auto Wheel to become China's second largest maker of automotive aluminum wheels, and it has opened up the Thailand OEM market with huge development potentials.

SMEs still keep an eye on the AM export market, and about 110 ones of them rely on export. Top 30 SMEs realize the average export value of USD30-50 million, and mainly export products to the United States, Russia, Europe and the Middle East.

Except CITIC Dicastal, Chinese aluminum wheel enterprises still highlight the field of low-end products, for example, Lizhong Wheel offers the average unit price of about USD36 and CITIC Dicastal USD55, lower than USD66 offered by the U.S. Surperior Industries International and ALCOA’s over USD100.

In the field of steel wheels, the upstream raw material prices remain stable while the aluminum price keeps descending, which weakens the advantages of low-cost steel wheels; therefore, steel wheel makers have to sacrifice gross margin to stabilize customers. Under this context, China’s largest steel wheel maker ------ Zhengxing Wheel saw its gross margin dip from 25.2% in 2012 to 20.8 % in 2013. Meanwhile, the sluggish Chinese commercial vehicle market restricts the development of steel wheels, so small companies gradually suspend or reduce production, which leads to a higher market concentration degree.

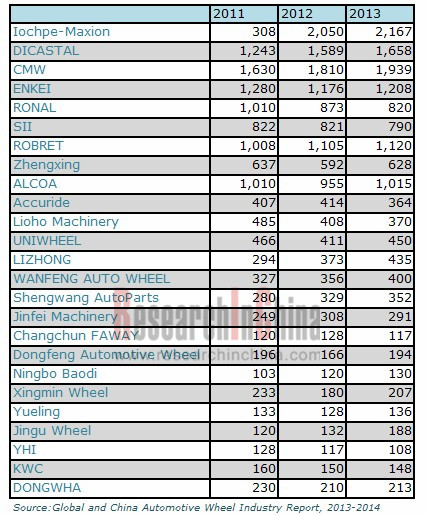

Ranking of Global Top 25 Wheel Companies by Revenue, 2011-2013 (USD mln)

1 Global Automotive Industry and Market

1.1 Industry

1.2 Market

2 Chinese Automotive Market

2.1 Overview

2.2 Industrial Analysis

2.3 Status Quo

2.4 Competition

3 Global and Chinese Wheel Market and Industry

3.1 Global Aluminum Wheel Market

3.2 Geographical Pattern of Aluminum Wheels

3.3 Relationship between Aluminum Wheel Makers and Vehicle Makers

3.4 China’s Wheel Export

3.5 China Aluminum Wheel Industry

3.6 China Steel Wheel Industry

3.7 Ranking of Global Wheel Enterprises

4 Aluminum Wheel Companies

4.1 CITIC Dicastal

4.1.1 Dicastal Xinglong

4.1.2 Binzhou Mengwei Dicastal Wheel

4.1.3 Chongqing Dicastal Jieli

4.2 Lizhong Wheel

4.3 Zhejiang Jinfei Machinery Group

4.4 SMX Dicastal Wheel Manufacturing

4.5 Liuhe Group

4.5.1 Liufeng Machinery Industry Co., Ltd.

4.5.2 Liuhe Light Alloy (Kunshan) Co., Ltd.

4.5.3 Hunan Changfeng Liuhe Aluminum/Magnesium Products

4.6 Sheng Wang Auto Parts

4.7 Wanfeng Auto Wheels

4.8 Darewheel

4.9 Fuhai Group

4.10 Shanghai Jinheli

4.11 Dongling(Holding) Co.,Ltd

4.12 Alcoa

4.13 Hayes Lemmerz (Iochpe-Maxion)

4.14 ENKEI

4.15 Chuo Seiki

4.16 Asahi Tec

4.17 ACCURIDE

4.18 SURPERIOR INDUSTRIES INTERNATIONAL

4.19 BORBET

4.20 UNIWHEEL

4.21 RONAL

4.22 YHI

4.23 TOPY

4.24 KWC

4.25 Donghe Casting

4.26 Taishan Int'l Traffic Equipment Fittings

4.27 Shanghai Mingqi Aluminum Industry

4.28 Lianyungang Qichuang Aluminum Products

4.29 Yueling

4.30 Guangsheng Aluminum Industry

4.31 SuperAlloy Industrial Co., Ltd.

4.32 Ningbo Baodi Autoparts

5 Steel Wheel Companies

5.1 Dongfeng Automotive Wheel

5.2 Zhengxing Wheel

5.3 Changchun FAWAY

5.4 Xingmin Wheel

5.5 Jingu Wheel

China’s Vehicle Output, 2001-2013

Global Light-duty Vehicle Output and Aluminum Wheel Popularity Rate, 2010-2016E

Global Aluminum Wheel Market Scale by Output, 2010-2016E

Global Aluminum Wheel Market Scale, 2010-2016E

Global Aluminum Wheel Industry Output Value by Region, 2008-2013

Global Aluminum Wheel Output by Region, 2008-2011

Aluminum Wheel Supplier Structure of Toyota, 2013

Aluminum Wheel Supplier Structure of Honda, 2013

Aluminum Wheel Supplier Structure of Nissan, 2013

Aluminum Wheel Supplier Structure of GM, 2013

Aluminum Wheel Supplier Structure of Ford, 2013

Aluminum Wheel Supplier Structure of VW, 2013

Aluminum Wheel Supplier Structure of Hyundai, 2013

China Wheel Export Value, 2004-2013

Market Occupancy of Major Steel Wheel Companies in China by Value, 2010

Market Occupancy of Major Steel Wheel Companies in China by Shipment, 2010

Sales Volume of Major Global Automotive Brands, 2010-2013

Production of Light Vehicles, 2011-2014

Production of Heavy Vehicles, 2011-2014

Annual Output YoY Growth Rate of Vehicles in China by Type, 2008-2013

Sales Volume of Major Chinese Vehicle Makers, 2013

Sales Volume of Independent Brand Vehicle Makers, 2013

Monthly Automotive Sales Volume in China, Jan 2005-Apr 2014

Monthly Sales Volume of Passenger Cars in China, Jan 2006-Apr 2014

Monthly Sales Volume of Commercial Vehicles in China, Jan 2006-Apr 2014

Market Share of Major Chinese Passenger Car Brands, 2012-2014

Export Value of Aluminum/Steel Wheel in China, 2007-2013

Export Value of Top 12 Wheel Exporters in China, 2010-2013

Import Value and Import Sources of Aluminum Wheel in China, 2012-2013

Market Share of Major Chinese Steel Wheel Makers, 2013

Market Share of Major Chinese Steel Wheel Makers (by Shipment), 2013

Revenue and Shipment of Major Chinese Steel Wheel Makers, 2013

Ranking of Global Top 25 Wheel Manufacturers by Revenue, 2011-2013

Ranking of Global Aluminum Wheel Companies by Revenue, 2013

Revenue and Net Profit Margin of CITIC Dicastal, 2004-2013

Revenue and Operating Margin of Lizhong Wheel, 2003-2014

Revenue of Lizhong Wheel by Region, 2006-2013

Capacity Utilization of Lizhong Wheel, 2004-2013

Revenue and Gross Margin of Lizhong Wheel, 2008-2014

Financial Data of Lizhong Wheel, 2009-2013

Revenue of Lizhong Wheel by Chanel, 2011-2012

Revenue of Lizhong Wheel by Business, 2012-2013

Revenue and Operating Margin of SMX Dicastal Wheel Manufacturing, 2004-2012

Shipment and Average Price of SMX Dicastal Wheel Manufacturing, 2006-2010

Revenue and Operating Margin of Wanfeng Auto Wheel, 2006-2014

Proportion of Wheel Revenue in China of Wanfeng Auto Wheel, 2006-2013

Proportion of AM and OEM of Wanfeng Auto Wheel, 2005-2012

Revenue of Wanfeng Auto Wheel by Product, 2007-2013

Gross Margin of Wanfeng Auto Wheel by Product, 2007-2013

Cost Structure of Wanfeng Auto Wheel, 2007-2013

Selected Financial Data of Liufeng Machinery, 2004-2010

Selected Financial Data of Liuhe Light Alloy (Kunshan) Co., Ltd., 2004-2010

Assets, Liabilities, Revenue and Net Income of Darewheel, 2009-2013

Revenue and Gross Margin of Iochpe-Maxion, 2006-2012

Revenue and Net Profit Margin of Iochpe-Maxion, 2006-2012

Revenue of Iochpe-Maxion by Business, 2006-2011

Revenue of Iochpe-Maxion by Business, 2011-2012

Wheel Revenue of Iochpe-Maxion by Region, 2006-2011

Revenue from Light Vehicle Steel Wheels of Iochpe-Maxion by Region, 2011-2012

Revenue from Light Vehicles Aluminum Wheels of Iochpe-Maxion by Region, 2012

Revenue from Commercial Vehicle Steel Wheels of Iochpe-Maxion by Region, 2011-2012

Clients of Iochpe-Maxion, 2012-2013

Iochpe-Maxion Region in Value, 2011

Organization of Hayes Lemmerz

Revenue of Hayes Lemmerz by Client, 2010

Shipment of Hayes Lemmerz by Product, 2007-2011

Regional Distribution of Aluminum Wheel Production Bases of Hayes Lemmerz

Revenue and Net Profit Margin of Hayes Lemmerz, FY2005-FY2012

Revenue of Hayes Lemmerz by Country

CMW’s Revenue, 2007-2012

CMW’s Revenue by Product, 2012

Revenue, Assets and Liabilities of GAC CHUO SEIKI Component, 2012-2013

Output of ENKEI by Region, 2010

Revenue and Operating Margin of Accuride, 2006-2012

Revenue of Accuride by Product, 2011-2013

Operating Profit of Accuride by Product, 2011-2013

Shipment of SII by Client, 2011-2012

Shipment of SII by Client, 2012-2013

Gross Margin Chart of SII, 2011-2012

Revenue and Operating Margin of SII, 2004-2014

Shipment and Average Price of SII, 2007-2012

Quarterly Shipment of SII, 2008Q1-2014Q1

Major Clients and Proportion of SII, 2010

Proportion of the Top 3 Clients of SII, 2006-2011

Clients Distribution of SII, 2012-2013

Global Presence of BORBET

Revenue and EBITDA of UNIWHEEL, 2008-2014

Shipment of UNIWHEEL, 2008-2014

Organization of UNIWHEEL

Organization of YHI

Revenue and Operating Margin of YHI, 2004-2013

Revenue of YHI by Business, 2004-2013

Revenue of YHI by Region, 2009-2013

Supporting Automotive Models of Products Made by Surperior Industries International

Revenue and Operating Profit of TOPY, FY2004-FY2011

Revenue and Operating Profit of TOPY from Automotive and Construction Machinery Fields, FY2004-FY2010

Distribution of Worldwide Wheel Production Bases under TOPY

Financial Data of KWC China, 2013

Yueling’s Revenue and Operating Profit, 2010-2013

Yueling’s Output, 2010-2013

Yueling’s Revenue by Region, 2010-2013

Revenue and Gross Margin of SuperAlloy Industrial, 2009-2014

Monthly Revenue and Growth Rate of SuperAlloy Industrial, Apr 2012- Apr 2014

Revenue of Zhengxing Wheel by Region, 2011-2013

Cost Structure of Zhengxing Wheel, 2008-2013

Revenue and Operating Margin of Changchun FAWAY, 2005-2013

Cost Structure of Xingmin Wheel, 2012-2013

Revenue and Operating Margin of Zhengxing Wheel, 2004-2014

Revenue and Gross Margin of Zhengxing Wheel, 2009-2013

Organization of Zhengxing Wheel

Revenue of Zhengxing Wheel by Business, 2008-2013

Revenue of Zhengxing Wheel by Product, 2008-2013

Regional Distribution of Zhengxing Wheel

Revenue and Operating Margin of Xingmin Wheel, 2006-2012

Shipment of Xingmin Wheel by Product, 2006-2010

Revenue of Xingmin Wheel by Product, 2006-2012

Revenue and Operating Profit of Jingu Wheel, 2007-2013

Top Five Domestic Clients of Jingu Wheel, 2010H1

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...