China Car Electric Window Regulator Industry Report, 2014-2017

-

July 2014

- Hard Copy

- USD

$2,500

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ075

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

With the maturity and development of technologies as well as users’ higher requirements on comfort, the installation rate of Chinese car electric window regulators has been gradually rising. In 2013, the installation rate exceeded 88% and the demand outnumbered 75 million pieces, up 19% year on year. In the next few years, Chinese car electric window regulator market will present a CAGR of over 10%; in 2017, the market size is expected to exceed 110 million pieces, with the installation rate up to 95%.

Globally, car electric window regulators include three types: cable, flexible axle and cross-arm. Cable and cross-arm ones dominate the Chinese market, with the combined market share of over 95% in 2013. In China, cable ones are mainly used in sedans, while cross-arm ones are suitable for sedans and commercial vehicles. Flexible axle ones can be applied to various models of vehicle, but they only find application in a tiny minority of cars since China's flexible axle and flexible axle motor technologies still desire to be much improved; nevertheless, the flexible axle window regulator is expected to be the future development direction.

As China's largest local car electric window regulator manufacturer, Shanghai SIIC Transportation Electric Co., Ltd. seized 10% market share in 2013, slightly lower than 2012. Founded by HUAYU Automotive Systems Co., Ltd. (70% stake) and SIIC (30% stake) jointly, the company mainly produces cable and cross-arm car electric window regulators and serves Shanghai Volkswagen, Shanghai GM, etc..

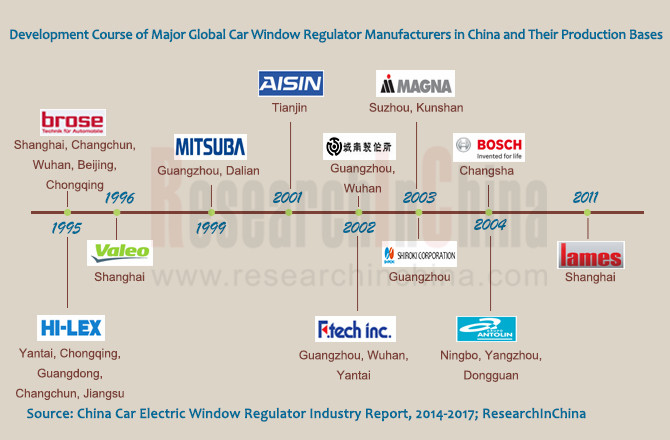

Foreign manufacturers Brose, Hi-Lex, Mitsuba, F. Tech and Magna Closures have established production bases in China, in which Brose is the first one that entered the Chinese market in 1995 to produce cable and cross-arm car electric window regulators, power window motors and anti-pinch electronic modules. As of June 2014, Brose had established a headquarters, three R & D / sales centers, five wholly owned factories and four joint-stock plants, with a total headcount of 3,300 in China.

The report mainly includes:

Installation rate and development trend of car electric window regulators in China;

Installation rate and development trend of car electric window regulators in China;

Demand and development trend of car electric window regulators in China;?

Demand and development trend of car electric window regulators in China;?

Import and export of car electric window regulators in China;

Import and export of car electric window regulators in China;

Supporting and Market Size of cable, flexible axle and cross-arm? car electric window regulators in China;

Supporting and Market Size of cable, flexible axle and cross-arm? car electric window regulators in China;

Sales channels and gross margin by channel of car electric window regulators in China;?

Sales channels and gross margin by channel of car electric window regulators in China;?

Operation, window regulator output and sales volume, market share and supply of domestic and foreign car electric window regulator manufacturers in China.

Operation, window regulator output and sales volume, market share and supply of domestic and foreign car electric window regulator manufacturers in China.

1. Definition and Classification

1.1 Definition

1.2 Classification

2. Car Electric Window Regulator Market in China

2.1 Evolution

2.2 Market Size

2.2.1 Installation Ratio

2.2.2 Market Demand

2.2.3 OEM & AM Markets

2.2.4 Market Structure

2.2.5 Window with Anti-trap Function

2.3 Competition Pattern

2.3.1 Market Shares

2.3.2 Supply Relation

2.4 Distribution Channel

2.5 Profit Level

2.6 Development Trend

3. Import and Export

3.1 Import

3.2 Export

4. Industry Chain

4.1 Overview of Industry Chain

4.2 Raw Materials Market

4.2.1 Motor

4.2.2 Reducer

4.2.3 Wiring Harness

4.2.4 Plastic

4.3 Downstream Development

4.3.1 Global Demand

4.3.2 China’s Demand

5. Key Foreign Companies

5.1 Brose

5.1.1 Profile

5.1.2 Operation

5.1.3 Car Window Regulator

5.1.4 Status in China

5.2 Magna Closures

5.2.1 Profile

5.2.2 Car Window Regulator

5.2.3 Status in China

5.3 Bosch

5.3.1 Profile

5.3.2 Operation

5.3.3 Car Window Regulator

5.3.4 Status in China

5.4 Aisin

5.4.1 Profile

5.4.2 Operation

5.4.3 Car Window Regulator

5.4.4 Status in China

5.5 Valeo

5.5.1 Profile

5.5.2 Operation

5.5.3 Status in China

5.6 Mitsuba

5.6.1 Profile

5.6.2 Operation

5.6.3 Car Window Regulator

5.6.4 Status in China

5.7 Shiroki

5.7.1 Profile

5.7.2 Operation

5.7.3 Car Window Regulator

5.7.4 Status in China

5.8 Hi-Lex

5.8.1 Profile

5.8.2 Operation

5.8.3 Car Window Regulator

5.8.4 Status in China

5.9 Grupo Antolin

5.9.1 Profile

5.9.2 Operation

5.9.3 Car Window Regulator

5.9.4 Status in China

5.10 Johnan Manufacturing

5.10.1 Profile

5.10.2 Car Window Regulator

5.10.3 Status in China

5.11 F. Tech

5.11.1 Profile

5.11.2 Operation

5.11.3 Status in China

5.12 Lames

5.12.1 Profile

5.12.2 Car Window Regulator

5.12.3 Status in China

6. Key Local Manufacturers

6.1 Shanghai Hongbao Auto Parts Co., Ltd.

6.1.1 Profile

6.1.2 Output & Sales Volume & Supporting Coustomer

6.1.3 Subsidiary

6.2 Shanghai SIIC Transportation Electric Co.,Ltd.

6.2.1 Profile

6.2.2 Output & Sales Volume & Supporting Coustomer

6.3 Shenyang Jinbei Kwan Jin Auto Parts Co., Ltd.

6.3.1 Profile

6.3.2 Output & Sales Volume & Supporting Coustomer

6.4 Guizhou Guihang Automotive Components Co.,Ltd

6.4.1 Profile

6.4.2 Revenue and Gross Margin

6.4.3 Output & Sales Volume & Supporting Coustomer

6.4.4 Subsidiary

6.5 Tri-Ring Group

6.5.1 Profile

6.5.2 Output & Sales Volume & Supporting Coustomer

6.6 Shanghai Inteva Automotive Door Systems Co., Ltd.

6.6.1 Profile

6.6.2 Output & Sales Volume & Supporting Coustomer

6.7 Guangzhou Mitsuba Electric Co.,Ltd.

6.7.1 Profile

6.7.2 Output & Sales Volume & Supporting Coustomer

6.8 Aisin Tianjin Body Parts Co.,Ltd.

6.8.1 Profile

6.8.2 Output & Sales Volume & Supporting Coustomer

6.9 Shanghai Brose Automotive Components Co., Ltd.

6.9.1 Profile

6.9.2 Output & Sales Volume & Supporting Coustomer

7. Summary and Prediction

7.1 Market Summary and Prediction

7.1.1 Equipment Ratio

7.1.2 Market Demand

7.2 Manufacturers Summary and Prediction

7.2.1 Market Share

7.2.2 Supporting Relationship

Main Types of Electric Window Regulators

Feature Comparison between Cable, Flexible Axle and Cross-arm Window Regulators

Performance Comparison between Cable, Flexible Axle and Cross-arm Window Regulators

Development History of Electric Window Regulators in China

Installation Rate of Car Electric Window Regulators in China, 2011-2017E

Installation Rate of Passenger Car Electric Windows in China, 2012-2017E

China’s Demand for Car Electric Window Regulators, 2011-2017E

Failure Rate of Car Door and Window in China

Methods of Fixing Window Regulators

Demand for Car Electric Window Regulators in Chinese OEM Market, 2011-2017E

Demand for Car Electric Window Regulators in Chinese AM, 2011-2017E

Installation Rate of Cable, Flexible Axle and Cross-arm Electric Window Regulators in China, 2013

Installation Rate of Passenger Car Window Anti-pinch Function in China, 2012-2017E

Market Share of Major Car Electric Window Regulator Enterprises in China, 2012-2014

Supply of Window Regulators in the World

Supply of Window Regulators in China

Sales Channels of Car Window Regulators in China

Gross Margin of Car Window Regulators in China by Sales Channel

Import Volume and Value of Car Window Regulators in China, 2009-2014

Average Import Price of Car Window Regulators in China, 2009-2014

Top 10 Import Sources of Car Window Regulators in China, 2013

Top 10 Import Sources of Car Window Regulators in China, Jan-Apr 2014

Export Volume and Value of Car Window Regulators in China, 2009-2014

Average Export Price of Car Window Regulators in China, 2009-2014

Top 10 Export Destinations of Car Window Regulators in China, 2013

Top 10 Export Destinations of Car Window Regulators in China, Jan-Apr 2014

Car Electric Window Regulator Industry Chain

Output and Sales Volume of Major Automotive Micromotor Enterprises in China, 2012

Output and Sales Volume of Major Automotive Reducer Enterprises in China, 2012

Enterprises Whose Automotive Wiring Harness Sales Volume Exceeded 1 Million Sets in China, 2012

Plastic Price Indices in China, 2011-2014

Global Automobile Output, 2009-2017E

China's Automobile Output, 2009-2017E

Brose’s Sales, Number of Employees and Investment, 2004-2014

Main Vehicle Models Supported by Brose’s Car Window Regulators

Brose’s Plants in China

Main Vehicle Models Supported by Car Window Regulators of Magna Closures

Bosch’s Key Financial Indicators, 2009-2013

Bosch’s Sales Structure, 2013

Main Vehicle Models Supported by Bosch’s Car Window Regulators

Bosch’s Sales in Major Countries, 2012-2013

Aisin’s Revenue, Net Income and Gross Margin, FY2009-FY2014

Aisin’s Revenue Breakdown (by Division), FY2010-FY2014

Aisin’s Revenue Breakdown (by Region), FY2009-FY2014

Name List and Revenue Contribution of Aisin’s Top 5 Clients, FY2010-FY2014

Main Vehicle Models Supported by Aisin’s Car Window Regulators

Aisin’s Subsidiaries in China

Valeo’s Revenue Structure, 2011-2013

Valeo’s Gross Margin and Operating Margin, 2011-2013

Mitsuba’s Key Financial Indicators, FY2010-FY2014

Mitsuba’s Sales and Profit Structure, FY2010-FY2014

Main Vehicle Models Supported by Mitsuba’s Car Window Regulators

Shiroki’s Shareholder Structure, FY2013

Shiroki’s Organizational Structure

Shiroki’s Sales, FY2010-FY2014

Shiroki’s Sales Structure (by Product), FY2010-FY2014

Main Vehicle Models Supported by Shiroki’s Car Window Regulators

Hi-Lex’s Key Financial Indicators, FY2011-FY2013

Main Vehicle Models Supported by Hi-Lex’s Car Window Regulators

Hi-Lex’s Subsidiaries in China

Key Financial Indicators of Grupo Antolin, 2011-2013

Client Structure of Grupo Antolin, 2012-2013

Sales Structure of Grupo Antolin (by Product), 2012-2013

Sales Structure of Grupo Antolin (by Region), 2012-2013

Main Vehicle Models Supported by Car Window Regulators of Grupo Antolin

Subsidiaries of Grupo Antolin in China

Worldwide Distribution of Jonan Manufacturing

Main Vehicle Models Supported by Car Window Regulators of Johnan Manufacturing

F.tech’s Sales and Profit, FY2012-FY2014

F.tech’s Sales Structure (by Region), FY2013-FY2014

F.tech’s Distribution in China

Main Vehicle Models Supported by Car Window Regulators of F.tech (Zhongshan)

Main Vehicle Models Supported by Car Window Regulators of Lames

Window Regulator Output, Sales Volume and Clients of Shanghai Hongbao, 2010-2014

STEC’s Assets and Revenue, 2011-2013

STEC’s Window Regulator Output, Sales Volume and Clients, 2010-2014

Revenue and Net Income of Shenyang Jinbei Kwan Jin, 2013

Window Regulator Output, Sales Volume and Clients of Shenyang Jinbei Kwan Jin, 2010-2014

Guihang’s Key Financial Indicators, 2009-2014

Guihang’s Window Regulator Revenue and Gross Margin, 2009-2013

Guihang’s Window Regulator Output, Sales Volume and Clients, 2010-2014

Assets and Profit of Guiyang Wanjiang Aviation Electricalmechanical Co., Ltd., 2012-2013

Assets and Profit of Guizhou Huachang Auto Electric Co., Ltd., 2012-2013

Window Regulator Output, Sales Volume and Clients of Tri-Ring Group, 2010-2014

Window Regulator Output, Sales Volume and Clients of Shanghai Inteva, 2011-2014

Window Regulator Output, Sales Volume and Clients of Guangzhou Mitsuba, 2010-2014

Development Course of Aisin Tianjin Body Parts Co., Ltd.

Window Regulator Output and Sales Volume of Aisin Tianjin Body Parts Co., Ltd., 2011-2014

Window Regulator Output and Sales Volume of Shanghai Brose, 2011-2014

Proportion of Car Electric Window Regulators in China, 2011-2017E

Installation Rate of Passenger Car Electric Window Regulators in China, 2012-2017E

China’s Demand for Car Electric Window Regulators, 2011-2017E

Installation Rate of Cable, Flexible Axle and Cross-arm Electric Window Regulators in China, 2013

Market Share of Major Car Electric Window Regulator Enterprises in China, 2012-2014

Supply of Window Regulators in the World

Supply of Window Regulators in China

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...