Global and China Automotive Seating Industry Report, 2014-2015

-

Mar.2015

- Hard Copy

- USD

$2,300

-

- Pages:103

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

ZYW202

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

The report highlights the following:

1, Global automotive market and industry

2, Chinese automotive market and industry

3, Global automotive seating market and industry

4, Chinese automotive seating market and industry

5, Brief introduction to automotive seating

6, 15 automotive seating manufacturers

The seemingly simple automotive seating actually reflects a country's machining ability. In the world, at most 20 companies are capable of producing automotive seating whose frames are made of precision metals via stamping, while nearly a thousand companies have the capability to produce automotive engines.

In 2010, the global light vehicle output amounted to about 74.8 million; averagely, the automotive seating of a light vehicle was tagged with the selling price of approximately USD742, so the global light vehicle seating market valued USD53.8 billion. In 2014, the average selling price was USD786, a slight increase over USD771 in 2013; the global market was worth USD66.8 billion. In 2015, the average selling price is expected to reach USD800 and the overall market size will grow 30.3% from 2010 to USD70.1 billion.

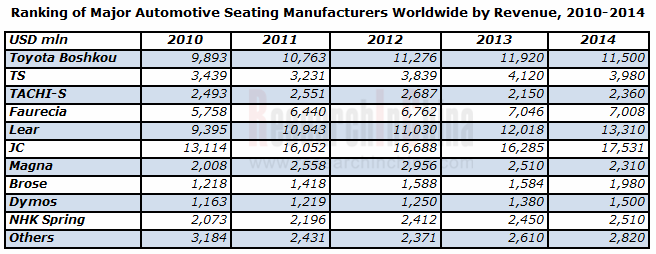

Global automotive seating manufacturers can be divided into three camps, namely North America, Japan and Europe that held about 50%, about 30% and 13% market share in 2014 respectively. Compared with 36% in 2010, the market share of Japanese manufacturers in 2014 was lower because of the depreciation of the yen instead of their weakened competitiveness.

Mergers and acquisitions occur frequently in the seating field. Large manufacturers are keen on taking over seating parts producers to improve the supply chain. Recently, Lear has acquired the world's largest manufacturer of automotive leather seating -- Eagle Ottawa for USD850 million. In 2012, Lear spent USD257 million on purchasing Guilford Mills which is an automotive seating fabric manufacturer. By virtue of mergers and acquisitions, Lear has become the most promising player in the seating market, and saw its revenue surge 10.8% in 2014. By contrast, Magna suffers consecutive decline, and supposes seating business as a burden; therefore, it has to either sell the business or acquire small factories to enhance competitiveness.

Johnson Controls Inc (hereinafter referred to as JCI), as the world's largest automotive seating manufacturer, firmly grasps the Chinese market, from which JCI reaped the revenue of USD6.1 billion in 2014 being the largest origin of its proceeds. JCI boasts 61 production bases in 30 cities throughout China with nearly 28,000 employees, serving all of car makers. 42 ones of these bases are joint ventures in which JCI enjoys the absolute right to speak, while JCI’s Chinese partners only play the role of financial investors. JCI seizes 53% market share in China.

European manufacturers are a great deal interested in the Chinese market as well. Faurecia plans to build seven new plants in China in the next three years, including six joint ventures and a sole proprietorship. Besides, Brose intends to raise the capacity of its Shanghai Plant; and Lear makes more investments in China. However, Japanese companies almost have no new investment plan due to the tension of Sino-Japanese ties.

1. Brief Introduction to Automotive Seating

1.1 Structure

1.2 Frame

1.3 Motor

1.4 Fabric

2. Global and Chinese Automotive Market

2.1 Global Automotive Market

2.2 Global Automotive Industry

2.2.1 Volkswagen

2.2.2 Mercedes-Benz and BMW

2.2.3 Volvo, PSA and Fiat

2.2.4 GM and Hyundai

2.2.5 Toyota

2.2.6 Renault-Nissan

2.3 Overview of Chinese Automotive Market

2.4 Recent Developments of Chinese Automotive Market

2.5 Analysis on Chinese Automotive Market

2.6 Sales Volume of Typical Chinese Automakers

3 Global and China Automotive Seating Industry

3.1 Global Market Size

3.2 Ranking of Global Automotive Seating Industry

3.3 Supply Relationship between Automotive Seating Manufacturers and Automakers Worldwide

3.4 Share of Automotive Seating Suppliers for Automakers Worldwide

3.5 China Automotive Seating Industry

3.6 Supply Relationship between Automotive Seating Manufacturers and Automakers in China

4. Automotive Seating Manufacturers

4.1 Toyota Boshoku

4.1.1 Changchun Faway Toyota Boshoku Auto Parts Co., Ltd.

4.1.2Tianjin Intex Auto Parts Co., Ltd

4.1.3 Tianjin Kahou Automotive Decoration Co., Ltd

4.1.4 Tianjin Feng'ai Automotive Seat Parts Co., Ltd.

4.1.5 Tianjin Toyota Boshoku Automotive Parts Co., Ltd

4.1.6 Chengdu Toyota Boshoku Automotive Parts Co., Ltd

4.1.7 Shanghai Toyota Boshoku Automotive Parts Co., Ltd

4.1.8 Kunshan Toyota Boshoku Automotive Parts Co., Ltd.

4.1.9 Ningbo ARACO Co., Ltd

4.1.10 Toyota Boshoku Ningbo Co., Ltd

4.1.11Guangzhou Intex Auto Parts Co., Ltd

4.1.12 Feng'ai (Guangzhou) Auto Seat Parts Co., Ltd.

4.1.13 Toyota Boshoku Foshan Co., Ltd.

4.2 TS

4.2.1 Guangzhou TS Automotive Interior Systems Co., Ltd.

4.2.2 Wuhan TS-GSK Auto Parts Co., Ltd.

4.3 TACHI-S

4.3.1 TACLE Guangzhou Automotive Seat Co., Ltd.

4.4 Faurecia

4.5 Lear

4.5.1 Lear Dongfeng Automotive Seating Co., Ltd

4.5.2 Jiangxi Jiangling Lear Interior Systems Co., Ltd.

4.5.3 Shenyang Lear Automotive Seating and Interior Systems Co., Ltd

4.5.4 Chongqing Lear Chang'an Automotive Interior Decoration Co. Ltd

4.5.5 Lear (Wuhu)

4.5.6 Lear Automotive Fabric Co., Ltd

4.5.7 Nanjing Lear Xindi Automotive Interiors System Co., Ltd

4.5.8 TACLE Guangzhou Automotive Seat Co., Ltd.

4.5.9 Lear Corporation Changchun Automotive Interior System Co., Ltd

4.5.10 Beijing Lear Dymos Automotive Systems Co., Ltd

4.5.11 Shanghai Lear STEC Automotive Parts Co., Ltd

4.6 Johnson Controls

4.6.1 KEIPER

4.6.2 Shanghai YFJC

4.6.3 Nanjing YFJC

4.6.4 Wuhu Johnson Controls Yunhe Automotive Seating Co., Ltd

4.6.5 Chongqing YFJC

4.6.6 Guangzhou Dongfeng Johnson Controls Automotive Seating

4.6.7 Changchun Faway-Johnson Controls Automotive Systems Co., Ltd.

4.6.8 Changchun FAW Faway Johnson Controls Metal Components Co., Ltd.

4.7 Magna

4.8 Brose

4.9 DYMOS

4.10 Sitech

4.11 Changchun Xuyang

4.12 WuHan New Yunhe Automotive Seating Co., Ltd

4.13 Hubei Aviation Precision Machinery Technology Co., Ltd

4.14 GSK Industrial

4.15 NHK Spring

Global Automobile Sales Volume, 2010-2015

Global Light Vehicle Output by Region, 2003-2015

Automobile Sales Volume in China, 2005-2015

Annual Sales Volume and YoY Growth Rate of Automobiles in China by Type, 2008-2015

Monthly Sales Volume of Passenger Cars in China, 2011-2014

Monthly Sales Volume of Commercial Vehicles in China, 2011-2014

Sales Volume of Passenger Cars in China, 2016-2014

Sales Volume of Commercial Vehicles in China, 2016-2014

Monthly Sales Volume of BYD, 2011-2014

Monthly Sales Volume of Great Wall Motor, 2011-2014

Monthly Sales Volume of Geely, 2011-2014

Monthly Sales Volume of Passenger Cars of GAC, 2011-2014

Monthly Sales Volume of Passenger Cars of DFG, 2011-2014

Monthly Sales Volume of CNHTC, 2012-2014

Monthly Sales Volume of BMW Brilliance, 2011-2014

Scale of Global Passenger Car Seating Industry, 2006-2016E

Output Value of Global Passenger Car Seating Industry by Region, 2010 vs 2014

Ranking of Major Automotive Seating Manufacturers Worldwide by Revenue, 2010-2014

Share of Automotive Seating Suppliers for Toyota, 2014

Share of Automotive Seating Suppliers for Honda, 2014

Share of Automotive Seating Suppliers for Renault-Nissan, 2014

Share of Automotive Seating Suppliers for VW, 2014

Share of Automotive Seating Suppliers for GM, 2014

Share of Automotive Seating Suppliers for Ford, 2014

Share of Automotive Seating Suppliers for Hyundai, 2014

Share of Automotive Seating Suppliers for PSA, 2014

Market Share of Major Manufacturers in Chinese Automotive Seating Market, 2014

Ranking of Major Automotive Seating Manufacturers in China by Revenue, 2010-2014

Revenue and Operating Margin of Toyota Boshkou, FY 2006-FY2015

Shipment of Toyota Boshkou, FY2011-FY2015

Shipment of Toyota Boshkou by Region, FY 2011-FY2015

Revenue of Toyota Boshkou by Region, FY 2006-FY2014

Operating Income of Toyota Boshkou by Region, FY2010-FY2015

Presence of Toyota Boshkou in China

Financial Performance of Tianjin Intex Auto Parts, 2013

Revenue and Operating Margin of TS, FY2006-FY2015

Operating Income of TS, FY2014

Main Vehicle Models Supported by TS’ Products, FY2011

Main Vehicle Models Supported by TS’ Products, FY2014

Main Vehicle Models Supported by TS’ Products, FY2015

Revenue Structure of TS by Product, FY2010-FY2011

Revenue Structure of TS by Product, FY2013-FY2014

Revenue Structure of TS by Region, FY2010-FY2015

Operating Income Structure of TS by Region, FY2010-FY2015

Operating Income of TS, FY2015

TS TECH Capital Investment Depreciation by Region, FY2014-2015

Revenue and Operating Margin of TACHI-S, FY2006-FY2015

Customer Distribution of TACHI-S, FY2007-FY2015

Revenue of TACHI-S by Region, FY2013-FY2015

Operating Income of TACHI-S by Region, FY2013-FY2015

Subsidiaries of TACHI-S in China

Faurecia's Revenue and Operating Margin, 2005-2014

Faurecia's Revenue by Customer, 2014

Faurecia's Revenue by Product, 2009-2014

Faurecia's Revenue by Region, 2012-2014

Faurecia's Revenue in China by Business, 2014

Faurecia's Seating Revenue in China, 2010-2014

Faurecia's Seating Market Share and Capacity in China

Faurecia's Seating Business Expansion Plan in China

Faurecia's Seating Business Roadmap

FAS China Product Plan on Mechanisms

Lear’s Revenue and Operating Margin, 2007-2014

Lear's Revenue by Business, 2010-2014

Lear's Revenue by Region, 2013-2014

Lear's Revenue by Customer, 2014

Revenue of Eagle Ottawa by Region/Customer

Lear’s Global Branches

Revenue of Automotive Seating Division of Johnson Controls by Region, 2014

Revenue and Operating Margin of Automotive Division of Johnson Controls, FY2006-FY2012

Global Braches of Johnson Controls

Revenue and Workforce of KEIPER, 2007-2010

Seating Revenue of Shanghai YFJC, 2005-2014

Revenue and Net Income of Changchun Faway-Johnson Controls Automotive Systems, 2010-2015

Assets and Liabilities of Changchun Faway-Johnson Controls Automotive Systems, 2010-2013

Revenue and Net Income of Changchun FAW Faway Johnson Controls Metal Components, 2010-2015

Assets and Liabilities of Changchun FAW Faway Johnson Controls Metal Components, 2010-2015

Revenue and Net Profit Margin of DYMOS, 2008-2014

Plant Distribution of DYMOS

Revenue and Operating Income of Hubei Aviation Precision Machinery Technology, 2006-2014

Major Customers of Hubei Aviation Precision Machinery Technology

Revenue and Operating Margin of NHK Spring, FY2007-FY2015

Revenue of NHK Spring by Business, FY2008-FY2015

Operating Income of NHK Spring by Business, FY2008-FY2015

Revenue of NHK Spring by Region, FY2008-FY2015

Automotive Seating Revenue of NHK Spring by Region, FY2012-FY2014

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...