China Heavy Truck Industry Report, 2015-2018

-

July 2015

- Hard Copy

- USD

$2,300

-

- Pages:86

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

YSJ088

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

In 2014, China’s heavy truck sales volume totaled 748,000 units, falling 3.32% year on year; the accumulative sales volume for Jan.-Apr. 2015 reached 193,300 units, a sharp reduction of 33.52% from the same period in 2014. That was mainly because growing economic downward pressure led to a slowdown in fixed assets investment so that the real estate market experienced volatile adjustment, thus resulting in a fall in demand for heavy trucks. Meanwhile, China began to implement national IV emission standards in January 2015, which brought cost pressure to carmakers and increased the users’ procurement costs. On the other hand, the national IV standard-related facilities were still not well-equipped, such as insufficient denitration, a lack of urea supply centers, and less technical reserves of enterprises, which made some users take a wait-and-see attitude for new products, thereby, to some extent, restraining the demand for heavy trucks.

As of June 2015, there were three major positive factors in China’s heavy truck market that would boost demand:

New projects – In 2015, China will expand the effective investment and set up the promotion mechanism of major infrastructure projects, including more than 420 projects from 7 major project packages with a proposed investment of over RMB10 trillion. And shantytown renovation, railway, road, and infrastructure projects will drive the demand for civil engineering heavy trucks

New projects – In 2015, China will expand the effective investment and set up the promotion mechanism of major infrastructure projects, including more than 420 projects from 7 major project packages with a proposed investment of over RMB10 trillion. And shantytown renovation, railway, road, and infrastructure projects will drive the demand for civil engineering heavy trucks

Energy conservation and emission reduction – In Sep. 2014, China introduced energy conservation and emissions reduction program, according to which around 600 yellow-label cars and old vehicles would be phased out, which would expand to a certain degree the new demand for heavy trucks.

Energy conservation and emission reduction – In Sep. 2014, China introduced energy conservation and emissions reduction program, according to which around 600 yellow-label cars and old vehicles would be phased out, which would expand to a certain degree the new demand for heavy trucks.

Logistics transportation – In 2014-2015, as China witnessed a rapid development in e-commerce, the express delivery demand grew at an astonishing pace, which brought huge demand for road transportation and logistics heavy trucks. Moreover, the development of free-trade zone will further promote the growth of port trailer towing vehicles, slag transport vehicles, and other market segments.

Logistics transportation – In 2014-2015, as China witnessed a rapid development in e-commerce, the express delivery demand grew at an astonishing pace, which brought huge demand for road transportation and logistics heavy trucks. Moreover, the development of free-trade zone will further promote the growth of port trailer towing vehicles, slag transport vehicles, and other market segments.

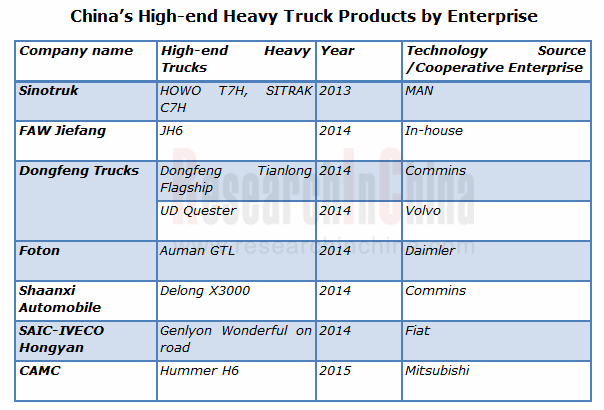

In the new normal, China is adjusting its economic growth pattern, and heavy trucks are undertaking the changes in profit model and product demand. In future, high-tech, high added-value heavy trucks will become the mainstream of development trend. Sinotruk, FAW Jiefang, Dongfeng Trucks, etc. have released high-end heavy truck products.

Source: ResearchInChina

As one of the major three heavy truck enterprises in China, Sinotruk developed and manufactured the country’s first heavy-duty truck, and has successfully brought in Steyr heavy-duty truck production project. Its independently developed HOWO product takes a crucial position in the Chinese heavy truck market. In 2014 and Jan.-Apr. 2015, the company ranked separately first and second with the sales volume of 120,000 units and 35,000 units. In January 2013, Sinotruk cooperated with MAN to launch SITRAK brand, and with the support from MAN, Sinotruk has entered the field of high-end heavy truck with HOWO T7H and SITRAK C7H.

A middle and heavy-duty truck maker under FAW Group, FAW Jiefang ranked first in heavy truck market with the sales volume of 37,000 units in Jan.-Apr. 2015, with a market share of 19.13%, 0.78 percentage points more than Sinotruk. In November 2014, JH6, a high-end heavy truck developed by FAW Jiefang, was released in FAW Jiefang Qingdao Automobile and delivered to the first batch of users. The model adopts the mainstream Aowei 11L 6DM2 National IV engine of FAW Jiefang Automotive Co., Ltd. Wuxi Diesel Engine Works, representing the company’s top level, and will promote the overall sales in the future.

China Heavy Truck Industry Report, 2015-2018 by ResearchInChina mainly covers the following:

Overview of China heavy truck industry, including definition, classification, technology introduction, etc.;

Overview of China heavy truck industry, including definition, classification, technology introduction, etc.;

Study of China’s overall heavy truck market, including ownership, output, sales volume, competition pattern and the latest market characteristics;

Study of China’s overall heavy truck market, including ownership, output, sales volume, competition pattern and the latest market characteristics;

Analysis on China’s heavy truck market segments (complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles), consisting of output and sales volume, competition pattern, import and export;

Analysis on China’s heavy truck market segments (complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles), consisting of output and sales volume, competition pattern, import and export;

Study of China’s heavy truck industry chain, including key parts market, raw material market and downstream market;

Study of China’s heavy truck industry chain, including key parts market, raw material market and downstream market;

Study of major heavy truck companies in China, covering their operation, output, sales volume, customers, new products, etc.

Study of major heavy truck companies in China, covering their operation, output, sales volume, customers, new products, etc.

1. Overview of Heavy Truck Industry

1.1 Definition and Classification

1.2 Technology Introduction

1.3 Emission Standards

1.4 Product Trends

2. Overall Heavy Truck Market

2.1 Ownership

2.2 Output and Sales Volume

2.2.1 Output

2.2.2 Sales Volume

2.3 Market Structure

2.4 Competition Pattern

2.4.1 Market Share

2.4.2 Sales Targets

2.5 LNG Heavy Truck

2.5.1 Sales Volume

2.5.2 Competition

2.5.3 Market Potential

2.6 High-end Heavy Truck

3. Heavy Truck Market Segments

3.1 Complete Heavy Truck

3.1.1 Output and Sales Volume

3.1.2 Import and Export

3.1.3 Competition Pattern

3.2 Incomplete Heavy Truck

3.2.1 Output and Sales Volume

3.2.2 Import and Export

3.2.3 Competition Pattern

3.3 Semi-trailer Towing Vehicle

3.3.1 Output and Sales Volume

3.3.2 Import and Export

3.3.3 Competition Pattern

3.3.4 Market Segments

4. Heavy Truck Industry Chain

4.1 Overview

4.2 Key Components

4.2.1 Cost Structure

4.2.2 Supporting

4.3 Raw Materials Market

4.3.1 Steel Market

4.3.2 Rubber Market

4.4 Downstream Market

4.4.1 Infrastructure Construction

4.4.2 Real Estate Construction

4.4.3 Highway Freight

5. Key Companies

5.1 FAW Jiefang Automotive Company, Ltd.

5.1.1 Profile

5.1.2 Output and Sales Volume

5.1.3 Product Launch

5.1.4 Production Base

5.2 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK)

5.2.1 Profile

5.2.2 Operation

5.2.3 Heavy Truck Business

5.2.4 Overseas Expansion

5.3 Dongfeng Motor Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Heavy Truck Business

5.4 Beiqi Foton Motor Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Heavy Truck Business

5.4.4 Production Capacity

5.5 Shaanxi Automobile Group Co., Ltd.

5.5.1 Profile

5.5.2 Main Products

5.5.3 Heavy Truck Business

5.6 Anhui Jianghuai Automobile Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Heavy Truck Business

5.7 Anhui Hualing Automobile Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Heavy Truck Business

5.7.4 Business Objectives for 2015

5.8 Qingling Motors (Group) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Heavy Truck Business

5.9 Chengdu Dayun Automotive Group Company Limited

5.9.1 Profile

5.9.2 Heavy Truck Business

5.10 BEIBEN Trucks Group Co.,Ltd

5.10.1 Profile

5.10.2 Heavy Truck Business

5.11 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd

5.11.1 Profile

5.11.2 Heavy Truck Business

5.11.3 The First High-end Heavy Truck Model – New Stralis Hi-Way Launched

5.12 Hubei Tri-Ring Special Vehicle Co., Ltd.

5.12.1 Profile

5.12.2 Heavy Truck Business

5.13 Nanjing Xugong Automobile Manufacturing Co., Ltd.

5.13.1 Profile

5.13.2 Heavy Truck Business

5.14 GAC Hino Motors Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Heavy Truck Business

5.14.4 New 700-Series Products Complying with National Ⅳ Emission Standards Launched

5.15 Zhejiang Feidie Automobile Manufacturing Co., Ltd.

5.15.1 Profile

5.15.2 Heavy Truck Business

6. Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Competition Pattern

6.4 Trends

Classification of Heavy Truck Industry

Technology Introduction of Key Heavy Truck Manufacturers in China

China Vehicle Emission Standards

China's Heavy Truck Ownership, 2005-2018E

China's Heavy Truck Output, 2005-2018E

China's Heavy Truck Sales Volume, 2005-2018E

China's Heavy Truck Output and Growth Rate by Model, 2014-2015

China's Heavy Truck Sales Volume and Growth Rate by Model, 2014-2015

Sales Volume and Market Share of Top 10 Heavy Truck Enterprises in China, 2014-2015

Sales Target of Major Heavy Truck Enterprises in China, 2015

Sales Volume of LNG Heavy Trucks in China, 2012-2018E

Major LNG Heavy Truck Manufacturers in China

International Crude Oil and Liquefied Natural Gas Price, 2011-2015

High-end Heavy Truck Products in China by Enterprise

China's Complete Heavy Truck Output and Sales Volume, 2005-2018E

China's Complete Heavy Truck Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Complete Heavy Truck Enterprises in China, 2014-2015

China's Incomplete Heavy Truck Output and Sales Volume, 2005-2018E

China's Incomplete Heavy Truck Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Incomplete Heavy Truck Enterprises in China, 2014-2015

China's Semi-trailer Towing Vehicle Output and Sales Volume, 2005-2018E

China's Semi-trailer Towing Vehicle Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Semi-trailer Towing Vehicle Enterprises in China, 2014-2015

Market Structure of Semi-trailer Towing Vehicles in China, 2005-2018E

Output and Sales Volume of Semi-trailer Towing Vehicles (≤25 Tonnage)in China, 2005-2018E

Sales Volume and Market Share of Top 10 Semi-trailer Towing Vehicle (≤25 Tonnage) Enterprises in China, 2014-2015

Output and Sales Volume of Semi-trailer Towing Vehicles (25-40 Tonnage) in China, 2005-2018E

Sales Volume and Market Share of Top 5 Semi-trailer Towing Vehicle (25-40 Tonnage) Enterprises in China, 2014-2015

Output and Sales Volume of Semi-trailer Towing Vehicles (>40 Tonnage) in China, 2005-2018E

Sales Volume and Market Share of Semi-trailer Towing Vehicles (>40 Tonnage) in China by Enterprise, 2014-2015

Automotive Industry Chain

Transmission, Axle and Engine Supply of Major Heavy Truck Manufacturers in China

China's Galvanized Sheet (Strip) Output and Sales Volume, 2005-2015

China's Galvanized Coil Price, 2013-2015

China's Cold-rolled Thin Sheet Output and Sales Volume, 2005-2015

China's Cold-rolled Coil Price, 2013-2015

China's Natural Rubber Spot Price, 2013-2015

China's Investment in Fixed Assets, 2005-2015

China's Investment in Real Estate Development, 2005-2015

China's New Housing Construction Area and Sales Area, 2004-2014

Proportion of Logistics Heavy Truck to Engineering Heavy Trucks in China by sales volume,, 2005-2018E

China's Highway Freight Volume and Turnover, 2005-2015

FAW Jiefang’s Heavy Truck Output and Sales Volume, 2009-2015

Sinotruk’s Revenue and Net Income, 2010-2015

Sinotruk’sGross Margin, 2010-2015

Sinotruk’s Revenue Structure by Business, 2014

Sinotruk's Heavy Truck Output and Sales Volume, 2009-2015

Dongfeng Motor's Revenue and Net Income, 2010-2015

Dongfeng Motor's Gross Margin, 2010-2015

Dongfeng Motor's Revenue from Major Regions, 2013-2014

Dongfeng Motor's Heavy Truck Output and Sales Volume, 2009-2015

Foton's Revenue and Net Income, 2010-2015

Foton's Gross Margin, 2010-2015

Foton's Revenue and Gross Margin by Business, 2013-2014

Foton's Heavy Truck Output and Sales Volume, 2009-2015

Capacity of Beijing Foton Daimler, 2015

Main Heavy Truck Products of Shaanxi Automobile Group

Shanxi Automobile Group’s Heavy Truck Output and Sales Volume, 2009-2015

JAC’s Revenue and Net Income, 2010-2015

JAC’s Gross Margin, 2010-2015

JAC's Overseas Revenue and % of Total, 2009-2014

JAC’s Heavy Truck Output and Sales Volume, 2009-2015

Hualing Automobile’s Assets and Net Income, 2012-2014

CAMC’s Products Series

Hualing Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

Hualing Automobile’s Production and Operation Target, 2015

Qingling Motors’ Revenue and Net Income, 2010-2014

Qingling Motors’ Gross Margin, 2010-2014

Qingling Motors’ Heavy Truck Output and Sales Volume, 2009-2015

Dayun Automotive’s Heavy Truck Output and Sales Volume, 2009-2015

BEIBEN Trucks’ Heavy Truck Output and Sales Volume, 2009-2015

SAIC-IVECO Hongyan’s Heavy Truck Output and Sales Volume, 2009-2015

Main Heavy Truck Products of Tri-Ring Special Vehicle

Tri-Ring Special Vehicle’s Heavy Truck Output and Sales Volume, 2009-2015

Xugong Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

GAC Hino Motors’s Assets, Liabilities, and Revenue, 2012-2014

GAC Hino Motors’s Heavy Truck Output and Sales Volume, 2009-2015

Feidie Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

Growth Rate of China's Heavy Trucks in Sales Volume, 2006-2015

China's Heavy Truck Market Structure, 2005-2018E

China's Heavy Truck Market Concentration, 2009-2015

Market Share of Major Heavy Truck Enterprises in China, 2009-2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...