China Electric Bus Industry Report, 2015-2020

-

July 2015

- Hard Copy

- USD

$2,700

-

- Pages:118

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ys010

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

China Electric Bus Industry Report, 2015-2020 by ResearchInChina focuses on the followings:

Significance, status quo, development trends at home and abroad of electric bus promotion;

Significance, status quo, development trends at home and abroad of electric bus promotion;

Mainstream technology roadmaps for electric bus, and status quo & trend of bus battery, motor, electronic control industry chain in China;

Mainstream technology roadmaps for electric bus, and status quo & trend of bus battery, motor, electronic control industry chain in China;

Main subsidies for purchase (tax relief and fiscal subsidies) and usage in China electric bus industry, and promotion policies nationwide;

Main subsidies for purchase (tax relief and fiscal subsidies) and usage in China electric bus industry, and promotion policies nationwide;

Electric bus output & sales volume and future trends in China, competitive landscape among and market share, sales volume prediction, investment and capacity of major electric bus companies;

Electric bus output & sales volume and future trends in China, competitive landscape among and market share, sales volume prediction, investment and capacity of major electric bus companies;

Technological level, output & sales volume, capacity and development strategy of 12 major Chinese electric bus manufacturers.

Technological level, output & sales volume, capacity and development strategy of 12 major Chinese electric bus manufacturers.

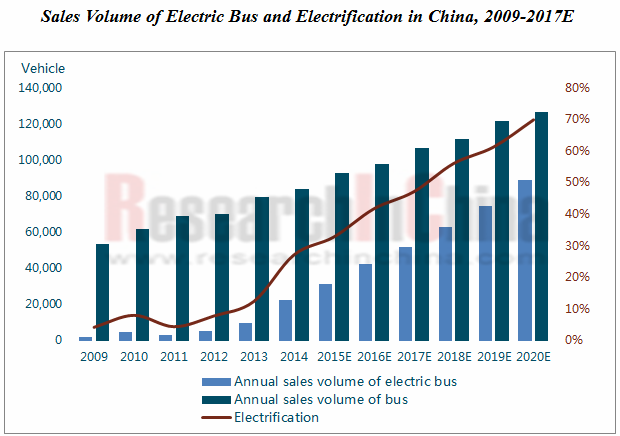

Sales volume of electric bus reached 27,000 vehicles throughout the year 2014, soaring by 160.3% from the previous year, and kept growing rapidly in the first half of 2015, approaching 20,000 vehicles. It is expected that China will sell 154,000 electric buses in 2020, with a CAGR of 33.6% during this period.

The variety that is vigorously promoted is electric public bus which accounts for 85% of total sales volume of electric bus. City bus ownership in China now has exceeded 500,000 vehicles, carrying 60% of city passenger transportation in urban public transport system. As of 2014, electric public bus ownership nationwide topped 80,000 vehicles.

Next, the Chinese government will gradually cut fuel subsidies for traditional bus and shifts financial support to electric model, the move that will give local governments a significant stimulus to replace new additional public buses with electric ones. It is expected that new electric public buses added in 2020 will make up 70% of new public buses added that year, and cumulative electric public bus ownership will exceed 300,000 vehicles by 2020. Technologically speaking, all-electric public bus, significantly propped up by policies, will be the main orientation of future development.

Besides public bus, light business-purpose bus and touring bus markets will be next market spotlights for electric bus. New energy commercial bus rating had been completed in the first quarter of 2015, and 3,000 vehicles are expected to be sold in 2015. With advances in battery technology, improvement in charging infrastructure along expressways, long-distance transportation will become possible, and the triggering point for this market segment is expected to occur around 2018.

Seen from battery, motor and electronic control industry chain, electric bus now adopts mainly LFP power battery and “LFP+ supercapacitor” dual-battery system. Based on the type of battery used by electric bus in the first half of 2015, configuration rate of LFP power battery including “LFP+ supercapacitor” dual-battery system was up to 82%. Rated power of drive motor for electric bus mostly falls into the range of 80 kW to 120kW. Asynchronous motor still holds a dominant position, as it can provide high-power traction; permanent-magnet synchronous motor starts to be massively used in medium-sized and small buses.

In point of competitive landscape among companies, top5 electric bus manufacturers in 2014 were Yutong Bus, Xiamen King Long Motor Group (including three wholly-owned subsidiaries: Higer Bus, Xiamen King Long United Automotive Industry, Xiamen Golden Dragon Bus), BYD, Nanjing Golden Dragon Bus and Zhongtong Bus, together producing 17,011 vehicles, 62.5% of the country’s total.

As electric bus enjoys enormous space for future development and can greatly drive the development of relevant industrial chains, China has ushered in an electric bus investment boom since 2014, with planned investment in electric bus announced by key bus makers nationwide exceeding RMB21 billion according to preliminary statistics and a lot of capacity putting into production in 2016 and 2017. Cities like Shenzhen, Nanjing and Wuhan took a lead in this round of investment and attracted a number of technically leading bus manufacturers to settle in.

1 Overview of Electric Bus

1.1 Significance of Promotion

1.2 Environmental Friendliness & Economy

1.2.1 Environmental Friendliness

1.2.2 Economy

1.3 Status Quo and Trend of Promotion in China

1.3.1 Electric City Bus is the Key Promotion Category

1.3.2 Electric Highway Bus will See Explosive Growth in 2015

1.3.3 Battery Electric Bus will be the Main Direction in Future

1.4 Status Quo and Trend of Promotion Overseas

1.4.1 Status Quo of Electric Public Bus Promotion Overseas

1.4.2 Technology Trend of Electric Public Bus Overseas

2 Industry Chain

2.1 Technology Roadmap

2.2 Battery

2.3 Motor & Controller

3 Key Policies on the Industry

3.1 Policy of Purchase Tax Deduction and Exemption

3.2 Policy of Fiscal Subsidies

3.2.1 Subsidies for Electric Bus during 2014-2015

3.2.2 Subsidies for Electric Bus during 2016-2020

3.2.3 Subsidies for Fuel Cell Bus

3.3“Oil Reduction & Electricity Compensation” Policy

3.4 Electric Vehicle Promotion Policy

4 China Electric Bus Market

4.1 Electric Bus Market

4.1.1 Overall Market

4.1.2 Competition among Enterprises

4.1.3 Investment and Production Capacity

4.2 All Bus Market

4.2.1 Overall Market

4.2.2 Competition among Enterprises

5 Chinese Electric Bus Manufacturers

5.1 Zhengzhou Yutong Group

5.1.1 Profile

5.1.2 Operating Data

5.1.3 Electric Bus Business

5.1.4 All Bus Business

5.1.5 Bus Production Capacity

5.2 BYD

5.2.1 Profile

5.2.2 Operating Data

5.2.3 Electric Bus Business

5.2.4 Battery Business

5.2.5 All Bus Business

5.3 Xiamen King Long Motor Group

5.3.1 Profile

5.3.2 Operating Data

5.3.3 Electric Bus Business

5.3.4 All Bus Business

5.3.5 Bus Production Capacity

5.4 Nanjing Golden Dragon Bus Co., Ltd

5.4.1 Profile

5.4.2 Electric Bus Business

5.5 Zhongtong Bus Holding Co., Ltd

5.5.1 Profile

5.5.2 Operating Data

5.5.3 Electric Bus Business

5.5.4 All Bus Business

5.5.5 Bus Production Capacity

5.6 Foton Motor Group

5.6.1 Profile

5.6.2 Operating Data

5.6.3 Electric Bus Business

5.6.4 All Bus Business

5.6.5 Bus Production Capacity

5.7 Shanghai Sunwin Bus Corporation

5.7.1 Profile

5.7.2 Electric Bus Business

5.7.3 All Bus Business

5.7.4 Production Capacity

5.8 Hunan CSR Times Electric Vehicle Co., Ltd.

5.8.1 Profile

5.8.2 Operating Data

5.8.3 Electric Bus Business

5.8.4 Bus Production Capacity

5.9 Anhui Ankai Automobile Company Ltd.

5.9.1 Profile

5.9.2 Operating Data

5.9.3 Electric Bus Business

5.9.4 All Bus Business

5.9.5 Bus Production Capacity

5.10 China Youngman Automobile Group

5.10.1 Profile

5.10.2 Electric Bus Business

5.10.3 All Bus Business

5.10.4 Bus Production Capacity

5.11 Chongqing Hengtong Bus Co., Ltd

5.11.1 Profile

5.11.2 Operating Data

5.11.3 Electric Bus Business

5.11.4 All Bus Business

5.11.5 Bus Production Capacity

5.12 Shenzhen Wuzhulong Motors Co., Ltd.

5.12.1 Profile

5.12.2 Operating Data

5.12.3 Electric Bus Business

Ownership of Urban Public Buses in China, 2008-2014

Proportion of Urban Passenger Traffic in China

Pollutant Emission of Vehicle

CO2 Emissions Per km of Buses of Varied Types (g/km, vehicle)

Pollutant Emissions inside City of Buses of Varied Types (Kg/year, Vehicle)

Pollutant Emissions outside City of Buses of Varied Types (Kg/year, Vehicle)

Overall Pollutant Emission of Different Types of Bus (Kg/year, vehicle)

Total Costs (before Subsidies) in Full Lifespan of Different Types of Bus

Total Costs (Subsidies Received after Purchase) in Full Lifespan of Different Types of Bus

Total Costs (After Purchase and Fuel Subsidies) in Full Lifespan of Different Types of Bus

Results of Comprehensive Comparison of Different Technology Roadmaps

Global Electric Public Bus Promotion (as of 2014)

Wireless Charging Public Bus Technology Sketch Map

Online Fast-charging Electric Bus Network Planning in London, 2020

Common Sharing of Vehicle Charging Facilities for Bus and Private Car

Technical Parameters of Electric Bus with Different Technical Routes

Battery, Motor and Electric Control Industry Chains of Electric Vehicle

Requirements of Electric Vehicle on Performance of Battery and Battery System

Rate of Power Battery (by Technical Route) Installation in Electric Bus, 2015H1

Motor and Controller Supply Relation of Key Electric Bus Enterprises

Statistics on Vehicle Models in the Purchase Tax Exemption Catalog in the First Three Batches Issued by MIIT

Standards of Subsidies (Central Finance) for Electric Bus in China, 2014-2015

Standards of Subsidies (Central Finance) for Electric Bus in China, 2016

Standards of Subsidies for Fuel Cell Vehicle in China, 2016

Electric Vehicle Promotion Program and Progress in Cities (Cluster) in China, 2013-2015

Electric Vehicle Promotion Program (Public Traffic and Personal Consumption) in China, 2014-2015

Electric Vehicle Promotion Quantity in Cities (Cluster) in China, 2014

Electric Bus Output of China, 2012-2020E

Proportion of Electric Bus (by Power Type) Output in China, 2014

Electric Bus (by Power Type) Output in China, 2015H1

Proportion of Electric Bus (by Power Type) Output in China, 2015H1

Electric Bus (by Application) Output in China, 2012-2020E

Electric City Bus Sales Volume and Electric Rate in China, 2009-2017E

Output and Market Share of Top 15 Electric Bus Enterprises, 2014

Output and Market Share of Top 15 Electric Bus Enterprises, 2015H1

Output and Market Share of Top 10 Battery Electric Bus Enterprises, 2014

Output and Market Share of Top 14 Battery Electric Bus Enterprises, 2015H1

Output and Market Share of Top 10 Hybrid Bus Enterprises, 2014

Output and Market Share of Top 10 Hybrid Bus Enterprises, 2015H1

Sales Volume of Leading Electric Bus Enterprises, 2012-2017E

Electric Bus Investments in China, 2009-2014

China’s Bus (Excluding Incomplete Vehicle) Sales Volume, 2009-2017E

Bus (by Length) Sales Volume in China, 2009-2017E

Ranking of Top 10 Large Bus Enterprises by Sales Volume, 2014

Ranking of Top 10 Medium Bus Enterprises by Sales Volume, 2014

Ranking of Top 10 Light Bus Enterprises by Sales Volume, 2014

Equity Structure of Zhengzhou Yutong Group, 2014

Business Performance of Zhengzhou Yutong Group, 2010-2015Q1

Revenue of Zhengzhou Yutong Group by Regions, 2010-2014

Electric Bus Sales Volume of Zhengzhou Yutong Group, 2011-2015

Electric Bus Sales Volume as Percent of Total of Zhengzhou Yutong Group, 2011-2015

Output of Zhengzhou Yutong Group by Vehicle Model, 2009-2015H1

Sales Volume of Zhengzhou Yutong Group by Vehicle Model, 2009-2015H1

Sales Volume of Zhengzhou Yutong Group by Application, 2011-2015

Proportion of Yutong Bus’ Sales Volume by Application, 2011-2015

Capacity Layout of Zhengzhou Yutong Group (Including Electric Bus), 2014

Business Performance of BYD, 2010-2015Q1

Revenue Structure of BYD by Business, 2012-2014

Gross Margin of BYD by Business, 2009-2014

Electric Bus Sales Volume of BYD, 2012-2017E

Cost Breakdown of BYD K9 Battery Electric Bus

Power & Energy Storage Battery Business Scale of BYD, 2011-2017E

Technical Parameters of LFMP Battery

Capacity, Weight and Cost of BYD’s Power Battery Pack

Electric Vehicle Sales Volume of BYD, 2011-2017E

Equity Structure of King Long Motor Group, 2014

Selected Financial Indicators of King Long, 2010-2015Q1

Revenue of King Long by Regions, 2009-2014

Electric Bus Sales Volume of King Long, 2011-2015

Proportion of King Long’s Electric Bus Sales Volume, 2011-2015

Parallel-serial Hybrid Power System of Golden Dragon

Output (by Model) of King Long, 2009-2015H1

Sales Volume (by Model) of King Long, 2009-2015H1

Capacity Layout (Including Electric Bus) of King Long, 2014

Electric Bus Investment Plan of King Long

Electric Bus Sales Volume of Nanjing Golden Dragon Bus, 2013-2017E

Equity Structure of Zhong Tong Bus, 2014

Business Performance of Zhong Tong Bus, 2009-2015Q1

Revenue and Gross Margin of Zhong Tong Bus by Regions, 2009-2014

Electric Bus Sales Volume of Zhong Tong Bus, 2011-2015

Proportion of Zhong Tong Bus’ Electric Bus Sales Volume, 2011-2015

Core Suppliers for Electric Bus of Zhong Tong Bus

Medium and Large Bus Output of Zhong Tong Bus, 2009-2015H1

Medium and Large Bus Sales Volume of Zhong Tong Bus, 2009-2015H1

Electric Bus Projects under Construction of Zhong Tong Bus

Equity Structure of Foton

Selected Financial Indicators of Foton, 2009-2015Q1

Revenue of Foton by Products, 2009-2014

Revenue of Foton by Regions, 2009-2014

Electric Bus Sales Volume of Foton, 2013-2017E

Core Supplies for Electric Bus of Foton

Light Bus Revenue, Sales Volume and Price of Foton, 2011-2016E

Medium and Large Bus Revenue, Sales Volume and Price of Foton, 2011-2016E

Bus (Including Electric Bus) Capacity Layout of Foton

Equity Structure of Shanghai Sunwin Bus, 2014

Electric Bus Sales Volume of Shanghai Sunwin Bus, 2013-2017E

Output (by Model) of Shanghai Sunwin Bus, 2009-2015H1

Sale Volume (by Model) of Shanghai Sunwin Bus, 2009-2015H1

Bus (Including Electric Bus) Production Capacity Layout of Shanghai Sunwin Bus, 2014

Investment Plan of Shanghai Sunwin Bus

Business Performance of CSR Times, 2011-2014

Electric Bus Sales Volume of CSR Times, 2012-2017E

Core Suppliers for Electric Bus of CSR Times

Electric Bus Capacity Layout of CSR Times, 2014

Equity Structure of Ankai, 2014

Selected Financial Indicators of Ankai, 2009-2015Q1

Revenue of Ankai by Products, 2009-2014

Revenue of Ankai by Regions, 2009-2014

Electric Bus Sales Volume of Ankai, 2012-2017E

Core Suppliers for Electric Bus of Ankai

Output (by Model) of Ankai, 2009-2015H1

Sales Volume (by Model) of Ankai, 2009-2015H1

Capacity Layout (Including Electric Bus) of Ankai

Core Suppliers for Electric Bus of Youngman

Output (by Model) of Youngman, 2009-2015H1

Sales Volume (by Model) of Youngman, 2009-2015H1

Capacity Layout of Youngman, 2014

Equity Structure of Chongqing Hengtong Bus

Business Performance of Chongqing Hengtong Bus, 2012-2014

Electric Bus Sales Volume of Chongqing Hengtong Bus, 2012-2014

Electric Bus Business Performance of Chongqing Hengtong Bus, 2012-2014

Output (by Model) of Chongqing Hengtong Bus, 2011-2015H1

Sales Volume (by Model) of Chongqing Hengtong Bus, 2011-2015H1

Business Performance of Shenzhen Wuzhoulong Motors, 2012-2014

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...