China Automotive Lightweight Material (Metal) Industry Report, 2014-2018

-

Aug.2015

- Hard Copy

- USD

$1,900

-

- Pages:80

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

ZYM066

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

Lightweight materials are one of key means to achieve lightweight vehicles. Currently, lightweight materials used in automobiles include high-strength steel, aluminum alloy, magnesium alloy, plastic and composites, carbon fiber and so forth. Among them, iron and steel (including high-strength steel) account for about 70%, aluminum alloy and plastic 8%-10% each, and magnesium alloy only 0.5%-1.0%.

By weight, body, powertrain and chassis system occupy about 60% of a vehicle, especially body shares more than 20%, so it is a target in terms of weight loss and an important part for the application of automotive lightweight materials.

Automotive Steel Sheet: Automotive steel sheet is a main raw material in automobile production. In 2014, China's automobile production consumed at least 15 million tons of steel. However, China has limited varieties of automotive steel sheet, and ultra-high strength steel sheet only makes up 2%-5%, while some lightweight automotive sheets with higher strength need to be imported due to the impossible commercialized mass production.

?

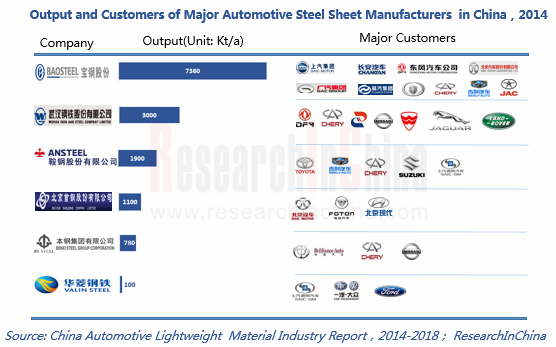

As a high-end product in the steel industry, automotive steel sheet is only supplied domestically by players such as Baosteel, Wuhan Iron and Steel, Anshan Iron and Steel, Shougang, Benxi Steel, and Valin Steel owing to high technical requirements, marking a high market concentration rate.

Baosteel is a giant in China's automotive steel sheet industry, holding 50% market share. Baosteel is the only Chinese enterprise that achieves large-scale production of ultra-high strength steel sheet. In 2014, its output reached 175,000 tons, accounting for 43.5% market share.

Following Baosteel, Wuhan Iron and Steel produced 3 million tons of automotive sheet in 2014, seizing about 20% market share. Meanwhile, Anshan Iron and Steel manufactured 1.9 million tons with 13% market share.

Although with the large capacity of automotive steel sheet up to 1.5 million tons/a, Valin Steel did not release the capacity fully in 2014. However, Valin Steel’s high-strength automotive sheet is in line with the automotive lightweight trend. In 2015, it is expected to show market competitiveness and seize about 10% market share.

?

Automotive Aluminum Alloy Materials: Aluminum and aluminum alloy are the current priority materials for the global automotive lightweight. Currently, they find wide application in auto parts like wheels, engines, heat exchangers, turbochargers and gearboxes.

However, there are rather high technical thresholds in the field of aluminum alloy automotive sheet. Chinese aluminum alloy processing enterprises are weak at technologies, and they mainly target popular economical cars and has limited demand for aluminum alloy cars. Therefore, in the past few years, China's automobile industry has developed rapidly, while China’s aluminum alloy automotive sheet industry has evolved slowly with the capacity growing sluggishly.

In 2014, China’s consumption of automotive aluminum alloy hit 300,000 tons. However, the supply and demand of aluminum alloy automotive sheet in the country still stayed at a low level. The high-end mainstream market was dominated by Novelis, KOBELCO, Aleris and other foreign brands.

In October 2014, Novelis (Changzhou) put its 120,000 t / a automotive aluminum sheet/strip project into operation, making China’s automotive aluminum alloy sheet capacity reach 185,000 tons. In addition, KOBELCO, Aleris, Zhongwang Group and other companies will put automotive aluminum sheet projects involving over 400,000 tons into operation in China in 2015-2016, then China’s automotive aluminum sheet capacity will attain up to 550,000 tons / a. In the next few years, China’s automotive aluminum alloy market size is expected to grow at a rate of about 20% in the wake of the enhanced trend of automotive lightweight.

The report includes the following aspects:

Status quo, market supply and demand, competition pattern and development forecast of China's automotive steel industry;

Status quo, market supply and demand, competition pattern and development forecast of China's automotive steel industry;

Market supply and demand, competition pattern and development forecast of China’s automotive aluminum alloy industry;

Market supply and demand, competition pattern and development forecast of China’s automotive aluminum alloy industry;

Market supply and demand, competition pattern and development forecast of China’s automotive magnesium alloy industry;

Market supply and demand, competition pattern and development forecast of China’s automotive magnesium alloy industry;

Operation, automotive materials-related business and development forecast of four global and 11 Chinese automotive steel/aluminum alloy/magnesium alloy companies.

Operation, automotive materials-related business and development forecast of four global and 11 Chinese automotive steel/aluminum alloy/magnesium alloy companies.

1 Concept of Automotive Lightweight

1.1 Definition

1.2 Materials

2 Overview of Chinese Automotive High Strength Steel Market

2.1 Status Quo

2.2 Supply and Demand

2.3 Competition Pattern

3 Overview of Chinese Automotive Aluminum Alloy Market

3.1 Status Quo

3.2 Global Market

3.3 Chinese Market

3.3.1 Supply and Demand

3.3.2 Competition Pattern

4 Overview of Chinese Automotive Magnesium Alloy Market

4.1 Concept

4.2 Supply and Demand

5 Major Automotive Lightweight (Metal) Materials Enterprises in China

5.1 Baosteel

5.1.1 Profile

5.1.2Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Automotive Materials-related Business

5.1.6 Development Forecast

5.2 Wuhan Iron and Steel

5.2.1Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Automotive Materials-related Business

5.2.6 Development Forecast

5.3 Valin Steel

5.3.1Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Automotive Materials-related Business

5.3.5 Development Forecast

5.4 Anshan Iron and Steel

5.4.1Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Automotive Materials-related Business

5.4.5 Development Forecast

5.5 APALT

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Automotive Materials-related Business

5.5.6 Development Forecast

5.6 Weifang Sanyuan Aluminum

5.6.1 Profile

5.6.2 Automotive Materials-related Business

5.7 Northeast Light Alloy

5.7.1 Profile

5.7.2 Operation

5.7.3 Automotive Materials-related Business

5.8 Southwest Aluminum

5.8.1 Profile

5.8.2 Operation

5.8.3 Automotive Materials-related Business

5.9 China Zhongwang Holdings Limited

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Output and Sales Volume

5.9.5 Automotive Materials Business

5.9.6 Development Forecast

5.10 Jiangsu Caifa Aluminum Group

5.10.1 Profile

5.10.2 Operation

5.10.3 Automotive Materials-related Business

5.11 Other Foreign Automotive Aluminum Alloy Companies

5.11.1 Novelis

5.11.2 Aleris

5.11.3 Norsk Hydro

5.11.4 Constellium

5.12 Nanjing Yunhai Special Metals Co., Ltd.

5.12.1 Profile

5.12.2 Operation

5.12.3 Revenue Structure

5.12.4 Gross Margin

5.12.5 Automotive Materials-related Business

5.12.6 Development Forecast

Way to Automotive Lightweight

Significance of Automotive Lightweight

Proportion of Several Typical Automotive Materials Worldwide

Comparison between Automotive Lightweight Metal Materials

Distribution of Vehicle Weight

Forming Performance Comparison between Automotive Body-use Aluminum Alloy Sheet and Steel Sheet

Major Automotive Steel Sheet Companies and Output in China, 2014

Proposed / Ongoing Automotive Steel Sheet Projects in China, 2015-2016E

History of Aluminum Alloy Application in Automobiles

Weight Comparison between Aluminum, Cast Iron and Steel Auto Parts

Proportion of Aluminum Alloy Applied in Automobiles

Aluminum Penetration Rate of Global Major Automotive Components, 2012-2025E

Global Aluminum Alloy Automotive Sheet Capacity, 2010-2018E

Global Aluminum Alloy Automotive Sheet Demand, 2006-2018E

Some Aluminum Alloy Body Parts Developed by Global Automobile Companies since 2000

Capacity and Customers of Global Major Aluminum Alloy Automotive Sheet Manufacturers, 2014

Main Applications of Aluminum Alloy Automotive Sheet

China's Aluminum Alloy Automotive Sheet Capacity, 2010-2014

Aluminum Alloy Consumption per Car of China Automobile Industry, 2010-2018E

China's Aluminum Alloy Automotive Sheet Demand, 2010-2018E

Capacity of Major Aluminum Alloy Automotive Sheet Manufacturers in China, 2014

Key Proposed / Ongoing Aluminum Alloy Automotive Sheet Projects in China, 2014-2016E

Applications of Magnesium Alloy in Automobiles

Performance of Typical Automotive Magnesium Alloy Castings

Auto Parts Made of Magnesium Alloy by European and American Automakers

China's Magnesium Alloy Output, 2010-2018E

Theoretical Magnesium Alloy Demand of China Automobile Industry, 2010-2018E

Sales Volume of Baosteel's Main Products, 2014

Baosteel's Revenue and Profit, 2010-2015

Baosteel's Revenue (by Product), 2010-2014

Baosteel's Revenue (by Region), 2010-2014

Baosteel's Gross Margin (by Product), 2012-2014

Net Income of Baosteel Nippon Steel, 2012-2014

Revenue and Profit of Wuhan Iron and Steel, 2010-2015

Revenue of Wuhan Iron and Steel (by Product), 2010-2014

Gross Margin of Wuhan Iron and Steel (by Product), 2010-2014

Revenue and Net Income of Wuhan Iron and Steel, 2014-2018E

Output and Sales Volume and Inventory of Valin Steel, 2011-2014

Revenue and Profit of Valin Steel, 2010-2015

Operating Revenue Structure of Valin Steel (by Product), 2014

Revenue of Valin Steel (by Region), 2010-2014

Revenue and Profit of Anshan Iron and Steel, 2010-2015

Revenue of Anshan Iron and Steel (by Product), 2010-2014

Revenue of Anshan Iron and Steel (by Region), 2010-2014

Revenue and Net Income of Anshan Iron and Steel, 2014-2018E

APALT's Output and Sales Volume, 2011-2014

APALT's Revenue and Profit, 2010-2015

APALT's Operating Profit and Net Income, 2014-2018E

Major Aluminum Alloy Automotive Sheet Projects of Sanyuan Aluminum

Subsidiaries and Their Business of Northeast Light Alloy, 2014

Main Product Applications and Customers of Northeast Light Alloy

Revenue and Net Income of Northeast Light Alloy, 2010-2015

Production Lines of Northeast Light Alloy, by the end of 2014

Aluminum Alloy Automotive Sheet Performance Comparison between Northeast Light Alloy and Foreign Counterparts

Aluminum Alloy Sheet / Strip Projects of Northeast Light Alloy

Revenue and Net Income of Southwest Aluminum, 2012-2015

Zhongwang's Revenue and Net Income, 2008-2015

Zhongwang's Aluminum Profile Revenue and % (by Product), 2011-2015

Zhongwang's Revenue and % (by Region), 2011-2014

Zhongwang's Aluminum Profile Capacity and Output, 2010-2014

Zhongwang's Aluminum Profile Sales Volume and Average Selling Price (by Product), 2011-2015

Zhongwang's Aluminum / Sheet / Strip / Foil Capacity, 2015-2018E

Revenue and Total Profit of Caifa Aluminum, 2010-2014

Aluminum Alloy Automotive Sheet Production Bases and Major Customers of Novelis

Global Automotive Aluminum Sheet Capacity of Novelis, 2017E

Aluminum Rolling and Extrusion Production Bases of Aleris

Aluminum Alloy Automotive Sheet Customers and Competitors of Aleris

Production Bases of Aleris in China, 2014

Aluminum Alloy Automotive Sheet Production Bases and Capacity of Norsk Hydro

Applications of Hydro's Aluminum Alloy Automotive Sheet by Type

Plants of Norsk Hydro in China, 2014

Constellium's Aluminum Alloy Automotive Sheet

Constellium's Production Bases in China

Yunhai's Revenue and Profit, 2010-2015

Yunhai's Operating Revenue (by Product), 2010-2014

Yunhai's Operating Revenue (by Region), 2010-2014

Yunhai's Gross Margin (by Product), 2010-2014

Yunhai's Revenue and Net Income, 2014-2017E

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...