China Commercial Vehicle Exhaust Emission System Industry Report, 2015

-

Sep.2015

- Hard Copy

- USD

$2,500

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

LMX070

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

Since 2014, the output and sales volume of commercial vehicles in China have continued to decline, with the output and sales volume for Jan.-Jul. 2015 totaling 1.9837 million units and 1.9891 million units, respectively, down 14.62% and 13.89% year-on-year. That was mainly because economic downturn led to a fall in demand for commercial vehicles. On the other hand, the emission standards for diesel vehicles are so unprecedentedly strict that the industry is contracting to achieve industrial upgrading.

At present, China's mainstream line for National IV emission standard has been identified as follows: Heavy and medium-duty commercial vehicles adopt SCR system while light-duty commercial vehicles use EGR+DOC/POC system.

From the perspective of the development of SCR industry, China’s SCR industry is in the early stage of growth. Although there are much more newcomers, yet the number of excellent enterprises is still small. The autonomous enterprises include Weifu Lida, Kailong High Technology, and ZHEJIANG YINLUN MACHINERY, and the foreign-funded enterprises mainly involve Commins and TENNECO.

Among them, Weifu Lida boasts prominent SCR technical capacity. In the whole industry chain, all core parts are produced independently except carrier that is outsourced from outside. In H1 2015, the company recorded revenue of RMB1.326 billion and net income of RMB141 million, up 53.71% and 60.93%, respectively, on a year-on-year basis.

ZHEJIANG YINLUN MACHINERY specializes SCR system assembly and catalytic converters that are applicable to heavy and medium-duty diesel-powered vehicles. As one of the major SCR converter suppliers of Weichai, the company has advantages in the field of packaging. In H1 2015, the company reported revenue of RMB1.421 billion, up 18.31% year-on-year; net income of RMB104 million, up 27.79% year-on-year.

The autonomous EGR manufactures in China primarily include ZHEJIANG YINLUN MACHINERY, WUXI LONGSHENG TECHNOLOGY, and YIBIN TIANRUIDA AUTO PARTS while foreign-funded enterprises consist of Kunshan Pierburg, Ningbo BORGWARNER. Among them, WUXI LONGSHENG and YIBIN TIANRUIDA specialize in EGR valve and EGR system; ZHEJIANG YINLUN principally operates EGR cooler, which registers an around 9% market share in China. In the field of light-duty trucks, YINLUN occupies nearly a 50% share of total EGR cooler market, and thus its capacity for market penetration is increasing year by year.

The report mainly deals with the following:

Development background, industry standards and policies, as well as technology roadmap of commercial vehicle exhaust emission system industry;

Development background, industry standards and policies, as well as technology roadmap of commercial vehicle exhaust emission system industry;

Development of SCR system and EGR system industries, including their system structure, market pattern, market size, and main supported vehicle manufacturers;

Development of SCR system and EGR system industries, including their system structure, market pattern, market size, and main supported vehicle manufacturers;

Development of downstream market, including commercial vehicle production and sales, bus and truck production and sales, as well as the prediction of production and sales volume for 2015-2018;

Development of downstream market, including commercial vehicle production and sales, bus and truck production and sales, as well as the prediction of production and sales volume for 2015-2018;

10 major SCR system manufacturers, 5 EGR system manufacturers, and 5 POC/DOC catalyst manufacturers in China, including their operation, related product business, latest developments, development in China (mainly foreign enterprises), and relevant product supporting manufacturers, etc.

10 major SCR system manufacturers, 5 EGR system manufacturers, and 5 POC/DOC catalyst manufacturers in China, including their operation, related product business, latest developments, development in China (mainly foreign enterprises), and relevant product supporting manufacturers, etc.

Preface

1. Overview of Commercial Vehicle Exhaust Emission System Industry

1.1 Development Background

1.2 Standard and Policy

1.3 Technical Routes

1.3.1 Introduction

1.3.2 Technical Routes Contrast

1.3.3 Technical Routes in Major Countries

2. Development of SCR System and EGR System Industries

2.1 SCR System

2.1.1 System Composition

2.1.2 Market Pattern

2.1.3Market Size

2.1.4 Supporting Enterprises

2.2 EGR System

2.2.1 System Composition

2.2.2 Market Pattern

2.2.3 Market Size

2.2.4 Supporting Enterprises

3. Downstream Market

3.1 Overall Development

3.1.1 Definition and Classification

3.1.2 Output and Sales Volume

3.2 Truck and Incomplete Truck

3.3 Passenger Car and Incomplete Car

3.4 Forecast

4. POC and DOC Enterprises

4.1 BASF

4.1.1 Profile

4.1.2 Catalyst Products

4.1.3 Catalyst Business Revenue

4.1.4 Catalyst Business in China

4.2 UMICORE

4.2.1 Profile

4.2.2 Operation

4.2.3 Catalyst Business

4.2.4 Catalyst Business in China

4.2.5 Supporting Enterprises

4.3 ECOCAT

4.3.1 Profile

4.3.2 Supporting Enterprises

4.4 SINO-PLATINUM METALS

4.4.1 Profile

4.4.2 Operation

4.4.3 Business Structure

4.4.4 Catalyst Business

4.4.5 Supporting Enterprises

4.4.6 Performance Forecast

4.5 ACT BLUE

4.5.1 Profile

4.5.2 Supporting Enterprises

5. EGR SYSTEM ENTERPRISES

5.1 WUXI LONGSHENG TECHNOLOGY

5.1.1 Profile

5.1.2 Supporting Enterprises

5.2 YIBINTIANRUIDA AUTO PARTS

5.2.1 Profile

5.2.2 Supporting Enterprises

5.3 ZHEJIANG JOOLOONG

5.4 PIERBURG

5.4.1 Profile

5.4.2 EGR Products

5.4.3 Operation

5.4.4 Development in China

5.4.5 Supporting Enterprises

5.5 BORGWARNER

5.5.1 Profile

5.5.2 EGR Products

5.5.3 Operation

5.5.4 Development in China

5.5.5 BorgWarner expands production in China for advanced emissions technologies

5.5.6 Supporting Enterprises

6. SCR System Enterprises

6.1 WEIFU HIGH-TECHNOLOGY

6.1.1 Profile

6.1.2 Development Course

6.1.3 Exhaust Emission System

6.1.4 Operation

6.1.5 Revenue Structure

6.1.6 Gross Margin

6.1.7 R & D and Investment

6.1.8 Supporting Enterprises

6.1.9 Performance Forecast

6.2 ZHEJIANG YINLUN MACHINERY

6.2.1 Profile

6.2.2 Development Course

6.2.3 Introduction of SCR Products and EGR Products

6.2.4 Operation

6.2.5 Revenue Structure

6.2.6 Gross Margin

6.2.7 Main Clients

6.2.8 R & D and Investment

6.2.9 Supporting Enterprises

6.2.10 SAIC Capital Takes Shares

6.2.11 Performance Forecast

6.3 KAILONG HIGH TECHNOLOGY

6.3.1 Profile

6.3.2 Main Clients

6.4 POWER GREEEN

6.4.1 Profile

6.4.2 Main Products

6.4.3 Supporting Enterprises

6.5 LIUZHOU LIHE EXHAUST SYSTEMS CONTROL

6.6 TIANJIN CATARC AUTO

6.7 BEIJING GREENTEC ENVIRONMENTAL PROTECTION EQUIPMENT

6.7.1 Profile

6.7.2 Operation

6.7.3 Analysis of Strength and Weakness

6.7.4 Development Plan

6.8 GUANGXI SUNLIGHT TECHNOLOGY

6.8.1 Profile

6.8.2 Supporting Enterprises

6.9 TENNECO

6.9.1 Profile

6.9.2 Operation

6.9.3 Development in China

6.9.4 Supporting Enterprises

6.10 CUMMINS

6.10.1 Profile of Cummins

6.10.2 Cummins Emission Solutions

6.10.3 Supporting Enterprises

Main Air Pollution Accidents in the Global History

Share Ratio of Pollution Emission of Automobile in China (by Fuel), 2013

Exhaust Emission Standard and Execution Plan of Heavy Vehicle in the World

Emission Regulation Upgrading Process of Heavy Vehicle in China

Related Policies on Commercial Vehicle Exhaust Emission System Industry in China

Main Environmental Measures during “12th Five-Year Plan”

Sketch Map of EGR and SCR Routes

Contrast Between SCR and EGR Routes

Development Course of Exhaust Emission Routes in Western Countries

Exhaust Emission Routes of Commercial Vehicle Manufacturers in Europe after European IV Standard Implementing

Exhaust Emission Routes in China after National IV Standard Phase

SCR System Composition

Cost Structure and Main Enterprises of Parts of SCR System

Major SCR System Enterprises and Capacities in China

SCR System Market Shares in China, 2013

Market Size of SCR System in China, 2014-2018E

SCR Catalytic Converter Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

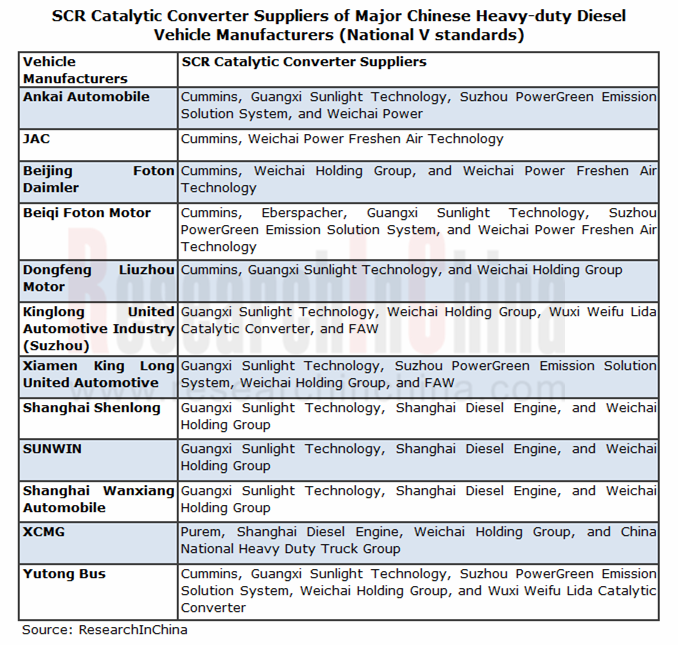

SCR Catalytic Converter Suppliers of Major Chinese Automobile Manufacturers (National V Standard)

EGR System Composition

Contrast among DOC, POC and DPF Routes

Major EGR Enterprises and Output in China

Major POC and DOC Enterprises in China

POC and DOC Market Shares in China, 2013

Market Size of EGR System in China, 2014-2018E

EGR Products Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

DOC Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

DOC Suppliers of Major Chinese Automobile Manufacturers (National V Standard)

Classification of Commercial Vehicle in China

Output and YoY Change of Commercial Vehicle in China, 2005-2015

Sales Volume and YoY Change of Commercial Vehicle in China, 2005-2015

Output of Commercial Vehicle in China (by Types), 2005-2015

Sales Volume of Commercial Vehicle in China (by Types), 2005-2015

Output and YoY Change of Truck in China, 2005-2015

Sales Volume and YoY Change of Truck in China, 2005-2015

Output of Truck in China (by Types), 2005-2015

Output of Incomplete Truck in China (by Types), 2005-2015

Output and YoY Change of Passenger Car in China, 2005-2015

Sales Volume and YoY Change of Passenger Car in China, 2005-2015

Output of Passenger Car in China (by Types), 2005-2015

Output of Incomplete Passenger Car in China (by Types), 2005-2015

Output and YoY Change of Commercial Vehicle in China, 2015E-2018E

Output and YoY Change of Passenger Car in China, 2015E-2018E

Output of Passenger Car in China (by Types), 2015E-2018E

Output of Incomplete Passenger Car in China (by Types), 2015E-2018E

Output and YoY Change of Truck in China, 2015E-2018E

Output of Truck in China (by Types), 2015E-2018E

Output of Incomplete Truck in China (by Types), 2015E-2018E

Main Financials of BASF, 2014-2015

Financial Data of Functional Materials & Solutions Segment of BASF

Catalysts Revenue of BASF, 2011-2015

Revenue Structure of BASF (by Regions), 2014

Catalyst Capacity Expansion of BASF, 2011-2014

Organization Structure of Umicore

Global Business Distribution of Umicore

Main Financials of Umicore, 2010-2015

Revenue Structure of Umicore (by Business Units), H1 2015

Global Automobile Catalyst Business Distribution of Umicore

Main Financials of Catalysis Business of Umicore, 2010-2015

Development of Umicore in China

Basic Information of UmicoreAutocat (China) Co., Ltd

Some Supporting Enterprises of DOC of UmicoreAutocat (China) Co., Ltd

Basic Information of Nanjing ECOCAT Auto Catalyst Co., Ltd

Some Supporting Enterprises of DOC of Nanjing ECOCAT Auto Catalyst Co., Ltd

Revenue and YoY Change of Sino-Platinum Metals, 2010-2015

Net Income and YoY Change of Sino-Platinum Metals, 2010-2015

Main Products and Application of Sino-Platinum Metals

Revenue and Gross Margin of Sino-Platinum Metals (by Business Units), 2010-2015

Basic Information of SPMC

Some Supporting Enterprises of DOC of SPMC

Revenue and Net Income of Sino-Platinum Metals, 2015E-2017E

Some Supporting Enterprises of POC and DOC of Act Blue

Some Supporting Enterprises of EGR Products of Wuxi Longsheng Technology

Some Supporting Enterprises of EGR Products of YibinTianruida Auto Parts

Development Course of Zhejiang Jooloong

Sales Network of Zhejiang Jooloong

EGR Valve of Pierburg

Basic Information of Pierburg Shanghai Nonferrous Components Co., Ltd

Some Supporting Enterprises of EGR Products of Pierburg Automotive Components (Kunshan) Co., Ltd

Operating Indicators of BorgWarner

EGR Products of BorgWarner

Development Course of BorgWarner Emissions Systems

Main Financials of BorgWarner, 2014-2015

Revenue Breakdown of BorgWarner (by Business Units), 2012-2015

Ningbo Plant of BorgWarner

Basic Information of BorgWarner Auto Parts and Components (Ningbo) Co., Ltd

Some Supporting Enterprises of EGR Products of BorgWarner Automotive Components (Ningbo) Co., Ltd

Development Course of Weifu High-technology

Exhaust Emission Business of Weifu High-technology

Main Operating Indicators of WeifuLida Catalytic Converter, 2011-2015

Output, Sales Volume and Inventory of Exhaust Emission System of Weifu High-technology, 2011-2014

Revenue and YoY Change of Weifu High-technology, 2010-2015

Net Income and YoY Change of Weifu High-technology, 2010-2015

Revenue Breakdown of Weifu High-technology (by Business Unit), 2009-2015

Revenue Structure of Weifu High-technology (by Regions), 2009-2015

Gross Margin of Weifu High-technology, 2011-2015

R&D Costs and % of Total Revenue of Weifu High-technology, 2012-2014

Some Supporting Enterprises of SCR Catalytic Converter of WeifuLida Catalytic Converter Co., Ltd (National IV Standard)

Some Supporting Enterprises of SCR Catalytic Converter of WeifuLida Catalytic Converter Co., Ltd (National V Standard)

Some Supporting Enterprises of DOC of WeifuLida Catalytic Converter Co., Ltd

Some Supporting Enterprises of DOC of Wuxi Weifu Environmental Catalysts Co., Ltd

Revenue and Net Income of Weifu High-technology, 2015E-2017E

Development Course of Zhejiang Yinlun Machinery

Market Strategy of EGR Business of Zhejiang Yinlun Machinery

EGR Products of Zhejiang Yinlun Machinery

Revenue and YoY Change of Zhejiang Yinlun Machinery, 2010-2015

Net Income and YoY Change of Zhejiang Yinlun Machinery, 2010-2015

Output and Sales Volume of Zhejiang Yinlun Machinery, 2013

Revenue Structure of Zhejiang Yinlun Machinery (by Products), 2010-2015

Revenue Structure of Zhejiang Yinlun Machinery (by Regions), 2010-2015

Gross Margin of Zhejiang Yinlun Machinery (by Products), 2010-2015

Main Clients of Zhejiang Yinlun Machinery

R&D Costs and % of Total Revenue of Zhejiang Yinlun Machinery, 2010-2015

Fund-raising Projects of Zhejiang Yinlun Machinery

Some Supporting Enterprises of SCR Catalytic Converter of Zhejiang Yinlun Machinery

Revenue and Net Income of Zhejiang Yinlun Machinery, 2015E-2017E

Main Clients of Kailong High Technology

Development Course of Power Greeen

Main Products of Power Greeen

Main Clients of Power Greeen

Some Supporting Enterprises of SCR Catalytic Converter of Power Greeen

Main Clients of SCR System of Beijing Greentec Environmental Protection Equipment

Operating Indicators of Beijing Greentec Environmental Protection Equipment, 2011-2015

Revenue Structure of Beijing Greentec Environmental Protection Equipment (by Business Units), 2011-2015

Revenue from Top Five Clients of Beijing Greentec Environmental Protection Equipment and % of Total Revenue, H1 2015

Some Supporting Enterprises of SCR Catalytic Converter of Guangxi Sunlight Technology (National IV Standard)

Some Supporting Enterprises of SCR Catalytic Converter of Guangxi Sunlight Technology (National V Standard)

Some Supporting Enterprises of EGR Products of Guangxi Sunlight Technology (National V Standard)

Introduction of Tenneco

Global Business Distribution of Tenneco

Main Financials of Tenneco, 2014-2015

Revenue Structure of Tenneco, 2014

Main Financials of Tenneco, 2009-2014

Revenue Structure of Tenneco, 2013-2014

Basic Information of Tenneco (China) Co., Ltd

Basic Information of Shanghai Tenneco Exhaust System Co., Ltd

Basic Information of Tenneco (Dalian) Exhaust System Co., Ltd

Basic Information of Tenneco Auto Industry (Suzhou) Co., Ltd

Some Supporting Enterprises of SCR Catalytic Converter of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DOC of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DPF of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DOC of Tenneco (China) (National V Standard)

Four Business Divisions of Cummins

Emission Standard of Cummins Emission Solutions

Some Supporting Enterprises of SCR Catalytic Converter of Cummins Emission Solutions (China)

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...