China Low-speed Electric Vehicle Industry Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,500

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZJF077

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

Due to extremely low price and cost of usage and very high price/performance ratio, low-speed electric vehicle wins great popularity among people from all walks of life in third and fourth-tier cities and vast rural areas in China with a flourishing market. In 2014, China produced 427,000 low-speed electric vehicles, a 41.4% jump from a year ago. The figure reached nearly 300,000 in the first half of 2015.

From the perspective of competitive landscape, brand concentration in electric bicycle market segment is relatively low, with top4 manufacturers together seizing a merely 33.9% market share and top10 ones only 46.4%. There is little difference in functional configuration of products of electric tricycle manufacturers, the prices are very close to each other, and brands have not yet been built. Low-speed electric vehicle industry has developed rapidly, and high profit margins have attracted influx of electric bicycle and tricycle manufacturers into the field, intensifying the competition.

Introduction of Interim Provisions on Administration of Investment Projects and Production Access of Newly-built Battery Electric Passenger Vehicle Manufacturers by the National Development and Reform Commission didn’t give low-speed electric vehicle expected legal status. In the face of massive market demand, most of manufacturers take a wait-and-see attitude, while some stronger companies secure the qualifications for passenger vehicle production and enter the mini electric vehicle field through transformation & upgrading or cooperation.

We believe that, as mini electric vehicle and low-speed electric vehicle aim at similar market, and mini electric vehicle will gradually displace low-speed electric vehicle due to the former’s markedly lifted price/performance ratio caused by continuously declining costs, growth rate of low-speed electric vehicle will slow down over the next couple years.

China Low-speed Electric Vehicle Industry Report, 2015-2018 focuses on the followings:

Overview of low-speed electric vehicle industry in China, including development history, industry characteristics, and major policies;

Overview of low-speed electric vehicle industry in China, including development history, industry characteristics, and major policies;

Market size, regional development, competitive landscape, and development trends of main market segments including electric bicycle, electric tricycle, and low-speed electric vehicle;

Market size, regional development, competitive landscape, and development trends of main market segments including electric bicycle, electric tricycle, and low-speed electric vehicle;

Competitive landscape of key parts (including battery, motor and controller) for low-speed electric vehicle, main products, and advantages & disadvantages of manufacturers;

Competitive landscape of key parts (including battery, motor and controller) for low-speed electric vehicle, main products, and advantages & disadvantages of manufacturers;

Analysis of 16 major manufacturers including Yadea, AIMA, Xinri, Byvin, Jinpeng, Dojo, YOGOMO, Shifeng Group, Tokng, GreenWheel EV, KNDI, Lichi, and Baoya, covering profile, financial position, main products, R&D, production base, and technical features.

Analysis of 16 major manufacturers including Yadea, AIMA, Xinri, Byvin, Jinpeng, Dojo, YOGOMO, Shifeng Group, Tokng, GreenWheel EV, KNDI, Lichi, and Baoya, covering profile, financial position, main products, R&D, production base, and technical features.

1 Overview of Low-speed Electric Vehicle Industry

1.1 Definition and Classification of Low-speed Electric Vehicle

1.2 Industrial Policy

1.2.1 Overall

1.2.2 Shandong

1.2.3 Hebei

1.2.4 Jiangsu

1.2.5 Guangdong

1.3 Industry Characteristics

1.3.1 Intense Competition

1.3.2 Highly Regional Concentration

2 Development of Electric Bicycle Industry

2.1 Market Size

2.2 Competitive Landscape

2.3 Industry Forecast

3 Development of Electric Tricycle Industry

3.1 Market Size

3.2 Development in Key Regions

3.3 Competitive Landscape

3.4 Industry Forecast

4 Development of Low-speed Electric Vehicle Industry

4.1 Market Size

4.2 Development in Key Regions

4.2.1 Shandong

4.2.2 Hebei

4.3 Competitive Landscape

4.4 Mini Electric Vehicle

4.5 Industry Forecast

5 Development of ATV (All-Terrain Vehicle) Industry

5.1 Market Size

5.2 Regional Development

5.3 Competitive Landscape

5.4 Industry Forecast

6 Market for Main Parts

6.1 Battery

6.1.1 Major Manufacturers and Competitive Landscape

6.1.2 Products of Major Manufacturers

6.1.3 Advantages and Disadvantages of Major Manufacturers

6.2 Motor

6.2.1 Major Manufacturers and Competitive Landscape

6.2.2 Products of Major Manufacturers

6.2.3 Advantages and Disadvantages of Major Manufacturers

6.3 Motor Controller

6.3.1 Major Manufacturers and Competitive Landscape

6.3.2 Products of Major Manufacturers

6.3.3 Advantages and Disadvantages of Major Manufacturers

7 Chinese Low-speed Electric Vehicle Manufacturers

7.1 AIMA

7.1.1 Profile

7.1.2 Production

7.1.3 Main Products

7.1.4 Production Bases

7.2 Yadea

7.2.1 Profile

7.2.2 Production Base

7.3 Byvin

7.3.1 Profile

7.3.2 Main Products

7.3.3 Main Production Bases

7.3.4 LEVDEO

7.4 Xinri

7.4.1 Profile

7.4.2 Production Base

7.4.3 Strategic Planning

7.4.4 Development during 2014-2015

7.5 Jinpeng

7.5.1 Profile

7.5.2 Main Products

7.5.3 Main Production Bases and Output & Sales

7.6 YOGOMO

7.6.1 Profile

7.6.2 Output and Sales Volume

7.6.3 Three Brands Released by YOGOMO

7.6.4 Models Launched in 2015

7.7 Shifeng Group

7.7.1 Profile

7.7.2 Operation

7.7.3 Production

7.7.4 Strategic Planning

7.8 Tokng

7.8.1 Profile

7.8.2 Main Products

7.9 Fulu Vehicle

7.9.1 Profile

7.9.2 Main Products

7.9.3 Investment and Development

7.10 DOJO

7.10.1 Profile

7.10.2 Main Products

7.10.3 Production Bases and Capacity

7.10.4 New Models Launched in 2015

7.10.5 Operation

7.11 Baoya

7.11.1 Profile

7.11.2 Main Products

7.11.3 Production Bases

7.11.4 Strategic Planning

7.12 Green Wheel EV

7.12.1 Profile

7.12.2 Production Bases

7.12.3 Developments

7.13 Lichi

7.13.1 Profile

7.13.2 Main Products

7.13.3 Operation

7.13.4 Equity Transaction

7.14 KANDI

7.14.1 Profile

7.14.2 Revenue

7.14.3 Main Business

7.14.4 Main Products

7.14.5 Vehicle-share Scheme

7.15 Xinyuzhou (Yudea Group)

7.15.1 Profile

7.15.2 Main Products

7.15.3 Production Bases

7.15.4 Main Qualifications

7.15.5 New Vehicles Launched in 2015

7.16 Apache

7.16.1 Profile

7.16.2 Main Products

Main Classifications of Low-speed Electric Vehicles

Main Types of Electric Tricycles on the Market

Economic Benefits Comparison between Low-speed Electric Vehicle and Other Types of Vehicles

Main Applications of Low-speed Electric Vehicle

Policies on Low-speed Electric Vehicle in Major Regions

Elaboration on Local Policies and Laws & Regulations on Low-speed Electric Vehicle in Recent Years

Part of Regulations on Low-speed Electric Vehicle in Shandong (Trial)

Regulations on Low-speed Electric Vehicle in Some Cities in Shandong Province

Technical Indicator Provisions in Regulations on Low-speed Electric Vehicle in Xingtai (Trial)

Electric Bicycle Output in China, 2009-2015 (mln Vehicles)

Electric Bicycle Ownership in China, 2009-2015 (mln Vehicles)

Ranking of Electric Bicycle Companies, 2014 (mln Vehicles)

Electric Bicycle Output Forecasts, 2014-2018E (mln Vehicles)

Electric Tricycle Output in China, 2009-2015 (mln Vehicles)

Electric Tricycle Ownership in China, 2009-2015 (mln Vehicles)

Main Production Bases of and Sales Regions for Electric Tricycle

Competitive Landscape in Electric Tricycle Industry

Electric Tricycle Output Forecasts in China, 2014-2018E (mln Vehicles)

Low-speed Electric Vehicle Output in China, 2009-2015 (1,000 Vehicles)

Low-speed Electric Vehicle Ownership in China, 2009-2015 (1,000 Vehicles)

Low-speed Electric Vehicle Output in Shandong, 2009-2015 (1,000 Vehicles)

Share of Shandong’s Output of Low-speed Electric Vehicle in National Total, 2014 (1,000 Vehicles)

Main Operational Regions for Low-speed Electric Vehicles in China

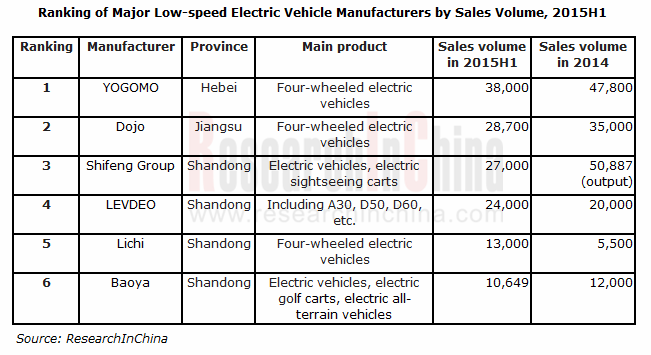

Ranking of Major Low-speed Electric Vehicle Makers in China by Sales Volume, 2014-2015

Subsidy Policies on Battery Electric Passenger Vehicle Adopted by Central and Some Local Governments, 2015

Main Technical Indicators of Some Best-selling Minicars

Main Ways for Low-speed Electric Vehicle Manufacturers to Secure Qualification for Electric Vehicle Production

Low-speed Electric Vehicle Output Forecasts in China, 2014-2018E (1,000 Vehicles)

ATV (All-Terrain Vehicle) Output in China, 2009-2015 (1,000 Vehicles)

ATV Sales Volume in China, 2009-2015 (1,000 Vehicles)

ATV Sales Volume in China’s Main Regions, 2009-2014 (1,000 Vehicles)

Top5 Sightseeing Cart Manufacturers in China by Sales Volume, 2014

Forklift Output Breakdown in China by Market Segment, 2013-2015

Top10 Forklift Manufacturers in China by Sales Volume, 2014

ATV Output and Sales Volume Forecasts in China, 2014-2018E (1,000 Vehicles)

Share of Major Battery Suppliers in Electric Bicycle and Tricycle Markets

Share of Major Battery Suppliers in Low-speed Electric Vehicle Market

Chilwee’s Main Batteries for Low-speed Electric Vehicle

Tianneng Power’s Main Batteries for Low-speed Electric Vehicle

Sacred Sun’s Sealed Lead-acid Batteries for Electric On-road Vehicle

Capacity of Major Motor Manufacturers in Electric Bicycle and Tricycle Industries in China

Shandong Xindayang’s Main Motor Series for Electric Bicycle and Tricycle

Ananda’s Main Motors

Boyu’s Main Motors of Low-speed Electric Vehicle

Yucheng Futong Motor’s Main Motors

Capacity of Major Manufacturers of Motor Controller for Electric Bicycle in China

Capacity of Major Manufacturers of Motor Controller for Electric Vehicle in China

Deyang Electronic Technology’s Main Motor Controllers

Ananda’s Main Controllers

Wuxi Jinghui Electronics’ Main EV Controllers

Tianneng Power’s Main Motor Controllers

Shanghai Edrive’s Motor Control Systems for Low-speed Electric Vehicle

Tianjin Santroll Electric Automobile Technology’s Main Motor Controllers for Low-speed Electric Vehicle

V&T’s Main EV Controllers

AIMA’s Electric Vehicle Output, 2010-2014 (mln Vehicles)

AIMA’s Main Electric Vehicles and Performance

Main Production Bases of AIMA

Byvin’s Main Electric Vehicles

Configuration Parameters of Byvin’s Main Electric Bicycles

Main Production Bases of Byvin

Jinpeng’s Main Electric Vehicles

Low-speed Electric Vehicle Sales Volume of YOGOMO, 2011-2015

Three Brands and Market Segmentation of YOGOMO Electric Vehicle

Main Configuration Parameters of YOGOMO 330

Operating Revenue and Profits & Taxes of Shifeng Group, 2010-2015 (RMB bn)

Vehicle and Electric Vehicle Output of Shifeng Group, 2010-2015 (1,000 Vehicles)

Main Performance Parameters of Tokng’s Sunny Angel

Main Performance Parameters of Tokng’s Prince

Main Performance Parameters of Tokng’s Minivan

Main Performance Parameters of Fulu Vehicle’s Xiangle (Electric Version)

Main Performance Parameters of Fulu Vehicle’s Xinle (Electric Version)

Main Performance Parameters of Fulu Vehicle’s Xirui (GD04G)

Main Performance Parameters of New Xiangrui (FLE360-F)

Main Technical Parameters of Dojo’s Pioneer

Main Technical Parameters of Dojo’s Parkour

Main Technical Parameters of Dojo’s Dream Achiever

Main Configuration Parameters of Baoya’s Yabei Low-Speed Electric Vehicle

Main Configuration Parameters of Baoya’s Tongnian Low-Speed Electric Vehicle

Main Production Bases of Baoya Group

Auto Models of Lichi

Operating Revenue and Net Profit Margin of KANDI, 2009-2015 (USD mln)

Revenue Breakdown of KANDI by Product, 2012-2015 (USD mln)

Revenue Breakdown of KANDI by Region, 2012-2015 (USD mln)

Main Low-speed Electric Vehicles of KANDI

Main Technical Parameters of Xinyuzhou Yudea’s Electric Golf Carts

Main Technical Parameters of Xinyuzhou Yudea’s Electric Sightseeing Carts

Main Production Bases of Yudea Group

Configuration Parameters of Apache’s Main Electric Vehicles

Configuration Parameters of Apache’s Main Electric Vintage Vehicles

Configuration Parameters of Apache’s Main Electric Police Cars

Configuration Parameters of Apache’s Main Electric Sightseeing Carts

Configuration Parameters of Apache’s Main Electric Golf Carts

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...