China Passenger Car Telematics Industry Report, 2015-2018

-

Nov.2015

- Hard Copy

- USD

$2,400

-

- Pages:109

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

HEJ007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

As Chinese passenger vehicle manufacturers accelerate to popularize telematics system in 2015, smartphone integration and 4G LTE technologies have found wider application, and IVI (In-Vehicle Infotainment) and networking functions have got enriched and optimized to get better user experience.

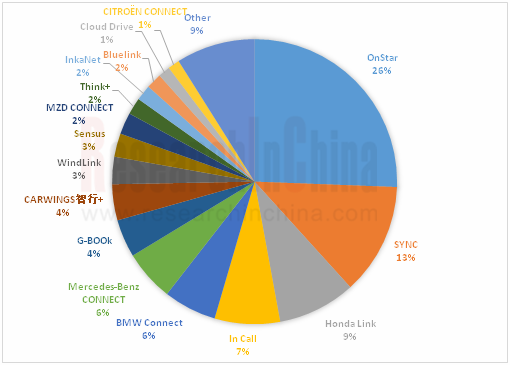

In January-September 2015, China’s new passenger vehicles equipped with telematics products approximated 1.8 million units, up 32.1% from a year earlier. Among them, OnStar held 26% and ranked first, followed by SYNC and Honda Link. It is noted that in 2015 Changan Automobile launched several models equipped with In Call system, occupying 7%, thus making it the only self-owned brand that ranked among the top 5.

Pre-installation of Major Branded Telematics in China’s Passenger Vehicle Market, Jan.-Sept. 2015

Source: ResearchInChina

Traditional Chinese third-party telematics enterprises are still in difficulties. For example, the companies like PATEO and China TSP are pursuing transformation based on its OEM business, and LAUNCH Tech and Carsmart continued to seek for consumers’ concern in the aftermarket. Meanwhile, mapping service providers such as NavInfo, AutoNavi, and Careland began to speed up layout in telematics with map as the breakthrough point.

It is projected that prior to 2016 the penetration of OEM telematics will be on the rise. On the one hand, the model of OEM-led platform and third-party telematics enterprises providing services will continue to be adopted. They will work together to deliver more of more mature products and services to car owners. On the other hand, passenger vehicle market is unlikely to recover and grow like the previous high-speed expansion, which would entail prompting OEMs to rapidly lift OEM telematics pre-installations to compete for the market. At the same time, we also note that aftermarket like intelligent rearview mirror also provides networking and recreational functions, which, to some extent, helps diversify the options of car owners.

China Passenger Vehicle Telematics Industry Report, 2015-2018 by ResearchInChina focuses on the following:

Development of China passenger vehicle telematics market, including market overview, industrial chain, market size, service comparison, supported products, etc.;

Development of China passenger vehicle telematics market, including market overview, industrial chain, market size, service comparison, supported products, etc.;

Analysis of passenger vehicle telematics brands in China, including business analysis, expenses, new users, supported models, development strategy, and technology trends, etc.;

Analysis of passenger vehicle telematics brands in China, including business analysis, expenses, new users, supported models, development strategy, and technology trends, etc.;

TSP enterprises of China passenger vehicle telematics, including product analysis, business analysis, application cases, customer structure, and development model, etc.

TSP enterprises of China passenger vehicle telematics, including product analysis, business analysis, application cases, customer structure, and development model, etc.

1. Overview of Telematics

1.1 Related Definitions

1.1.1 ITS

1.1.2 IOV

1.1.3 Telematics

1.2 Industry Chain

2. China Telematics Market

2.1 Overview

2.2 Business of Main Telematics Brands

2.3 Market Size

3. Telematics Business of Joint Ventures in China

3.1 Shanghai GM OnStar

3.1.1 Overview and Support

3.1.2 Business Analysis

3.1.3 Number of New Telematics Users

3.1.4 Development Strategy

3.2 Toyota G-BOOK

3.2.1 Overview and Support

3.2.2 Business Analysis

3.2.3 Number of New Telematics Users

3.2.4 Development Strategy

3.3 Honda HondaLink

3.3.1 Overview and Support

3.3.2 Business Analysis

3.3.3 Number of New Telematics Users

3.3.4 Development Strategy

3.4 Volvo SENSUS

3.4.1 Overview and Support

3.4.2 Business Analysis

3.4.3 Number of New Telematics Users

3.4.4 Development Strategy

3.5 Changan Ford SYNC

3.5.1 Overview and Support

3.5.2 Business Analysis

3.5.3 Number of New Telematics Users

3.6 Dongfeng Nissan CARWINGS

3.6.1 Overview and Support

3.6.2 Business Analysis

3.6.3 Number of New Telematics Users

3.6.4 Development Strategy

3.7 Dongfeng Yueda Kia UVO

3.7.1 Overview and Support

3.7.2 Business Analysis

3.7.3 Number of New Telematics Users

3.8 Dongfeng Citroen Citro?n Connect

3.8.1 Overview and Support

3.8.2 Business Analysis

3.8.3 Number of New Telematics Users

3.9 Dongfeng Peugeot Blue-i

3.9.1 Overview and Support

3.9.2 Business Analysis

3.9.3 Number of New Telematics Users

3.10 Mercedes-Benz CONNECT

3.10.1 Overview and Support

3.10.2 Business Analysis

3.10.3 Number of New Telematics Users

3.10.4 Development Strategy

3.11 Beijing Hyundai Blue Link

3.11.1 Overview and Support

3.11.2 Business Analysis

3.11.3 Number of New Telematics Users

3.12 BMW Brilliance ConnectedDrive

3.12.1 Overview and Support

3.12.2 Business Analysis

3.12.3 Number of New Telematics Users

3.12.4 Development Strategy

4. Telematics Business of Local Companies in China

4.1 SAIC inkaNet

4.1.1 Overview and Support

4.1.2 Business Analysis

4.1.3 Number of New Telematics Users

4.2 Changan in Call

4.2.1 Overview and Support

4.2.2 Business Analysis

4.2.3 Number of New Telematics Users

4.3 Geely G-NetLink

4.3.1 Overview and Support

4.3.2 Business Analysis

4.3.3 Number of New Telematics Users

4.4 Chery Cloudrive

4.4.1 Overview and Support

4.4.2 Business Analysis

4.3.3 Number of New Telematics Users

5. Chinese Telematics Companies

5.1 LAUNCH Tech Company Limited

5.1.1 Profile

5.1.2 Operating Performance

5.1.3 Revenue Structure

5.1.4 R&D Costs

5.1.5 Latest News

5.2 Beijing Carsmart Technology Co., Ltd

5.2.1 Profile

5.2.2 Revenue Structure

5.2.3 Lecheng Box and UBI Business

5.3 YESWAY

5.3.1 Profile

5.3.2 Operation

5.3.3 Business Model and Main Business

5.3.4 Revenue Structure

5.3.5 Gross Margin

5.3.6 OBD Telematics Service (YESWAY Box)

5.3.7 Top5 Customers

5.3.8 Development Prospects

5.4 NavInfo Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Telematics Business of NavInfo

5.4.4 Mapbar will Become Independent Telematics Business Group of NavInfo

5.4.5 Comparative Analysis between NavInfo WeDrive2.0 and Baidu CarLife

5.5 Careland

5.5.1 Profile

5.5.2 Operation

5.5.3 Development Goal

5.6 AutoNavi

5.6.1 Profile

5.6.2 Operation

5.6.3 R&D

5.6.4 Latest News

5.7 China TSP

5.7.1 Profile

5.7.2 Products

5.7.3 Telematics Business

5.7.4 Application Cases

5.8 TimaNetworks

5.8.1 Profile

5.8.2 Products

5.8.3 Application Cases

5.9 WirelessCar

5.9.1 Profile

5.9.2 Application Cases

5.10 PATEO

5.10.1 Profile

5.10.2 Products

5.10.3 Telematics Business

5.10.4 Application Cases

Telematics Industry Chain

Support of Main Telematics Brands in Chinese Automobile Market

Security Protection Function Comparison between Main Telematics Brands

Navigation Function Comparison between Main Telematics Brands

Internet Entertainment Function Comparison between Main Telematics Brands

Pricing Comparison between Main Telematics Brands

Preinstalled Volume of Main Telematics Brands in Chinese Passenger Car Market, Jan-Sep. 2015

Telematics Assembly Rate of Passenger Cars, 2015-2018

Supported Vehicle Models and Sales Volume of OnStar

OnStar’s Services

Pricing of OnStar Package

Number of New Users of OnStar in Chinese Passenger Car Market, Jan-Sep. 2015

OnStar’s Development Course

OnStar’s Communications Technology Roadmap

Main Functions and Parameters of MyLink 2.0

Supported Vehicle Models and Sales Volume of MyLink

Supported Vehicle Models and Sales Volume of IntelliLink

Vehicle Models Supporting G-BOOK and their Sales Volume

Comparison between G-BOOK's Connection with Mobile Phones and G-BOOK's Connection with DCM

Number of New Users of G-BOOK in China, Jan-Sep. 2015

Vehicle Models Supporting HondaLink and Their Sales Volume

Main Functions and Services of HondaLink

Number of New Users of HondaLink, Jan-Sep. 2015

Vehicle Models Supporting Sensus and Their Sales Volume

Functions and Services of Sensus Connect

Functions and Services of Volvo On Call

Number of New Users of Sensus in China, Jan-Sep. 2015

Vehicle Models Supporting SYNC and Their Sales Volume

Functions and Services of SYNC

Number of New Users of SYNC, Jan-Sep. 2015

Vehicle Models Supporting CARWINGS and Their Sales Volume

Functions and Services of CARWINGS

Number of New Users of CARWINGS in China, Jan-Sep. 2015

Functions and Parameters of Nismo Watch

Vehicle Models Supporting UVO and Their Sales Volume

Services of UVO

UVO’s Pricing

Number of New Users of UVO in China, Jan-Sep. 2015

Vehicle Models Supporting Citro?n Connect

Functions and Services of Citro?n Connect

Number of New Users of Citro?n Connect in China, Jan-Sep. 2015

Vehicle Models Supporting Blue-i and Their Sales Volume

Functions and Services of Blue-i

Number of New Users of Blue-i in China, Jan-Sep. 2015

Vehicle Models Supporting Mercedes-Benz CONNECT and their Sales Volume

Functions and Services of Mercedes-Benz CONNECT

Number of New Users of Mercedes-Benz CONNECT in China, Jan-Sep. 2015

Vehicle Models Supporting Blue Link and their Sales Volume

Pricing of BlueLink

Services of Blue Link

Number of New Users of Blue Link in China, Jan-Sep. 2015

Vehicle Models Supporting ConnectedDrive and their Sales Volume

Functions and Services of ConnectedDrive

Number of New Users of ConnectedDrive in China, Jan-Sep. 2015

Vehicle Models Supporting inkaNet and their Sales Volume

Functions and Services of inkaNet

Pricing of SAIC's inkaNet Package

Number of New Users of inkaNet in China, Jan-Sep. 2015

Vehicle Models Supporting In Call and their Sales Volume

Supported Vehicle Models and Pricing of In Call

Number of New Users of In Cal in China, Jan-Sep. 2015

Supported Vehicle Models and Sales Volume of G-NetLink

Functions and Services of G-NetLink

Number of New Users of G-NetLink in China, Jan-Sep. 2015

Vehicle Models Supporting Cloudrive and their Sales Volume

Functions and Services of Cloudrive

Number of New Users of Cloudrive in China, Jan-Sep. 2015

Revenue and YoY Growth of LAUNCH, 2009-2015

Net Income and YoY Growth of LAUNCH, 2009-2015

Revenue Structure of LAUNCH by Product, 2009-2014

Revenue Structure of LAUNCH by Region, 2009-2014

Sales Volume of LAUNCH’s Telematics Products, 2015H1

R&D Costs and % of Total Revenue of LAUNCH, 2009-2014

Revenue and Net Income of Carsmart, 2010-2014

Revenue Structure of CARSMART (by Business), 2011-2014

Revenue and YoY Growth of YESWAY, 2011-2015

Net Income and YoY Growth of YESWAY, 2011-2015

OEM Telematics Services of YESWAY

AM Telematics Services of YESWAY

Smart Driving Services of YESWAY

Revenue Breakdown of YESWAY by Business, 2011-2014

Gross Profit and Gross Margin of YESWAY by Business, 2011-2014H1

Gross Margin and R&D Costs of YESWAY, 2011-2015

YESWAY’s Sales from Top5 Customers, 2013-2014

YESWAY’s Sales from Top5 Customers, 2015H1

Financial Data of NavInfo, 2008-2015H1

Performance of NavInfo by Product, 2015H1

Revenue, Net Income and R&D Costs of Careland, 2012-2015

Revenue and Operating Cost of Careland by Business, 2015H1

Financial Data of AutoNavi, FY2007-FY2014

Revenue of AutoNavi by Product, FY2008-FY2014

R&D Cost of AutoNavi, FY2007-FY2014

Chinatsp's Product Mix

Chinatsp's Product Applications

FAW's D_Partner System

Main Function Modules of Products

Product Comparison in the Same Industry

TimaNetworks’ Product Application Structure

PATEO's Product Platform System

HMI Features of PATEO's Products

Development Overview of PATEO’s Telematics Business

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...