China Driving Recorder Industry Report, 2015-2019

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:100

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

YSJ092

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Chinese driving recorder market continues to heat up amid growing concerns over traffic accident disputes, such as Pengci, a word referring to fake accidents for extorting money. Driving recorder sales volume is estimated at around 13 million sets in China in 2015, representing a year-on-year surge of 85.71%. Notwithstanding, compared with huge car ownership, the installation rate of driving recorder in China is less than 5%, far below that in Japan, Taiwan, and Russia, indicating enormous potential for market growth.

In 2015, driving recorders are no longer confined to the function of preventing Pengci, but experience significant changes in function and shape. As to the function, besides driving recording, more and more products integrate Wi-Fi, rearview reverse parking camera, voice recognition, and navigation. Regarding the shape, smart rearview mirror leads the trend. Most companies have already developed or are developing such products, and add operating system, 3G module, ADAS, navigation, voice action, and gesture recognition, with the products developing towards intelligent driver assistant system. The integration of navigation has some impact on on-board navigation market.

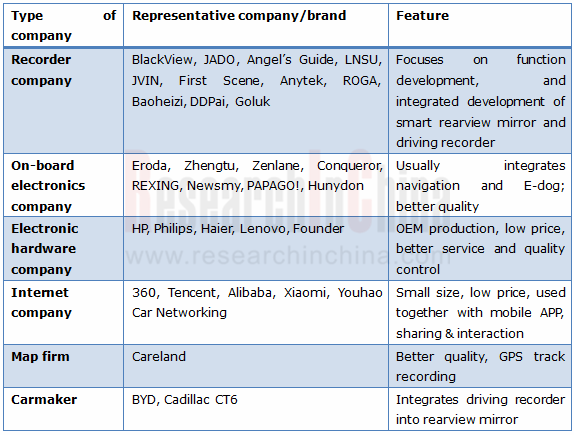

Companies are rushing into driving recorder field and use it as a medium to make layout in telematics. In addition to makers of on-board terminals including driving recorder and navigator, Internet firms, map companies, and automakers also want to get a piece of the pie. Internet and map companies aim to capture user resources, and carmakers wish to make their way into the driving recorder OEM market.

Internet companies that make aggressive actions include Qihoo 360 Technology, Tencent, Alibaba, and Xiaomi.

In May 2015, Qihoo 360 Technology launched 360 driving recorder, which has built-in Ambarella A7 image processor and 2-inch 1296P 160° wide-angle TFT display, and is sold at RMB299. 200,000 sets of the product were sold on Nov 11, 2015.

In Oct 2015, Tencent and DDPai jointly launched “QQ IoT driving recorder”. After DDPai and “QQ IoT” are connected, DDPai driving recorder can be added to “My Device” on QQ, and access and operations to the driving recorder can be gained.

In Oct 2015, JADO launched smart rearview mirror “Vision” carrying Alibaba’s YunOS operating system.

On Nov 24, 2015, Xiaoyi Technology under Xiaomi launched a driving recorder. The product has a 2.7-inch 165° wide-angle 16:9HD LED display, uses Ambarella A7LA70 chip (supposedly), supports a max. resolution of 1296P (2304×1296), and can record 60fps 1080P videos. In addition, it also carries ADAS, analyzing the data on lane, vehicle speed, and vehicle distance, and giving the alarm. The crowd-funding price is RMB289.

Representative Driving Recorder Companies in China

Source: China Driving Recorder Industry Report, 2015-2019 by ResearchInChina

China Driving Recorder Industry Report, 2015-2019 by ResearchInChina highlights the followings:

Development of global driving recorder;

Development of global driving recorder;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Development of driving recorder market segments in China;

Development of driving recorder market segments in China;

Chinese driving recorder chip market pattern;

Chinese driving recorder chip market pattern;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

1 Definition and Classification of Driving Recorder

1.1 Definition

1.2 Development

1.3 Classification

1.4 Structure

2 Development of Driving Recorder

2.1 Global Driving Recorder Market Size

2.1.1 Global

2.1.2 Japan

2.1.3 Taiwan

2.1.4 Russia

2.2 Chinese Driving Recorder Market Size

2.2.1 Sales Volume

2.2.2 Market Size

2.2.3 Competitive Landscape

2.2.4 Sales Channel

2.2.5 Development Characteristics

2.2.6 Internet Firms’ Layout

2.2.7 M&As

2.3 Development of Industry Chain

2.3.1 Overview

2.3.2 Master Chip

3 Development of Market Segments

3.1 Display CDR

3.2 Non-display WIFI Recorder

3.3 Smart Rearview Mirror

3.3.1 Definition

3.3.2 Application

3.3.3 Major Companies

3.3.4 Functions of Product

3.3.5 Development Trends

4 Major Chip Companies

4.1 Ambarella

4.1.1 Profile

4.1.2 Operation

4.1.3 Driving Recorder Business

4.2 Novatek

4.2.1 Profile

4.2.2 Operation

4.2.3 Main Products

4.2.4 Driving Recorder Business

4.3 Allwinner Technology

4.3.1 Profile

4.3.2 Operation

4.3.3 Main Products

4.4 Sunplus Technology

4.4.1 Profile

4.4.2 Operation

4.4.3 Driving Recorder Business

4.5 Syntek

4.5.1 Profile

4.5.2 Operation

4.5.3 Driving Recorder Business

4.6 SQ Technology

4.6.1 Profile

4.6.2 Operation

4.6.3 Driving Recorder Business

5 Major Players

5.1 PAPAGO,Inc.

5.1.1 Profile

5.1.2 Operation

5.1.3 Driving Recorder

5.1.4 Supply Chain

5.1.5 Strategic Planning

5.2 Youhao Car Networking

5.2.1 Profile

5.2.2 Operation

5.2.3 Main Products

5.2.4 Suppliers

5.2.5 Strategic Planning

5.3 Shenzhen Soling Industrial

5.3.1 Profile

5.3.2 Operation

5.3.3 Primary Business

5.3.4 Strategic Planning

5.4 CARCAM Electronic.Black View

5.4.1 Profile

5.4.2 Primary Business

5.4.3 Strategic Planning

5.5 JADO.JADO

5.5.1 Profile

5.5.2 Primary Business

5.5.3 Strategic Planning

5.6 Qihoo 360

5.6.1 Profile

5.6.2 Primary Business

5.6.3 Strategic Planning

5.7 vYou.DDPai

5.7.1 Profile

5.7.2 Primary Business

5.7.3 Strategic Planning

5.8 Jeavox.Angel’s Guide

5.8.1 Profile

5.8.2 Primary Business

5.8.3 Strategic Planning

5.9 LNSU Electronic & Technology.LNSU

5.9.1 Profile

5.9.2 Primary Business

5.9.3 Strategic Planning

5.10 Shenzhen JFK Electronic.JVIN

5.10.1 Profile

5.10.2 Primary Business

5.10.3 Strategic Planning

5.11 Aladdin.First Scene

5.11.1 Profile

5.11.2 Primary Business

5.12 Jiafeng Zhuoyue.REXING

5.12.1 Profile

5.12.2 Primary Business

5.13 Anytek

5.13.1 Profile

5.13.2 Primary Business

5.13.3 Strategic Planning

5.14 Hunydon

5.14.1 Profile

5.14.2 Primary Business

5.15 Zenlane

5.15.1 Profile

5.15.2 Primary Business

5.15.3 Strategic Planning

5.16 Wei Jia Yi Technology.ROGA

5.16.1 Profile

5.16.2 Primary Business

5.17 Baoheizi

5.17.1 Profile

5.17.2 Primary Business

5.18 Careland

5.18.1 Profile

5.18.2 Primary Business

5.18.3 Strategic Planning

5.19 Coagent

5.19.1 Profile

5.19.2 Operation

5.19.3 Primary Business

5.19.4 Strategic Planning

6 Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Development Trend

Representative Driving Recorders and Prices

Global Driving Recorder Market Size, 2014-2019E

Driving Recorder Sales Volume in China, 2013-2019E

Baidu Search Index of Driving Recorder, 2012-2015

Chinese Driving Recorder Market Size, 2013-2019E

Ranking of Driving Recorders by Sales Volume on Tmall on Nov 11, 2015

Top10 Driving Recorder Brands on JD, 2015

Market Share of Driving Recorders in China, 2015Q1

Major Driving Recorder Companies in China

Sales Channels for Driving Recorders in China

Representative Driving Recorder Companies in China

M&As in Driving Recorder (Including Smart Rearview Mirror) Field

Chinese Driving Recorder Master Chip Market Size, 2014-2019E

Global Driving Recorder Master Chip Market Size, 2014-2019E

Driving Recorder Industry Structure in China

Main Products of Chip Makers and Corresponding Video Pixel

Representative Chips and Identification Codes of Driving Recorder Main Control Solutions

Advantages of Mainstream Driving Recorder Companies

Parameters of Main Display Driving Recorders in China

Parameters of Main Non-display Driving Recorders in China

Smart Rearview Mirrors of Major Companies in China

Telematics Functions of Main Smart Rearview Mirrors in China

Revenue and Net Income of Ambarella, FY2011-FY2015

Revenue and Profit of Novatek, 2012-2015

Novatek’s Sales in Major Regions, 2013-2014

Main Products of Novatek

Applications of Novatek’s Main Products

Output and Output Value of Novatek’s Main Products, 2013-2014

Sales Volume and Value of Novatek’s Main Products, 2013-2014

Revenue and Profit of Allwinner Technology, 2012-2015

Gross Margin of Allwinner Technology, 2012-2015

Allwinner Technology’s Main Products and Their Applications

Operating Revenue Structure of Allwinner Technology by Product, 2012-2014

Smart Terminal Process Chip Business Revenue Structure of Allwinner Technology by Application, 2012-2014

Revenue and Profit of Sunplus Technology, 2013-2015

Operational Outlets of Sunplus Technology in Mainland China

Revenue and Profit of Syntek, 2012-2015

Revenue and Profit of SQ Technology, 2012-2015

Revenue and Profit of PAPAGO, 2013-2015

PAPAGO’s Sales in Major Regions, 2013-2014

Main Suppliers of PAPAGO

Top3 Suppliers of PAPAGO, 2013-2015

Top3 Trade Debtors of PAPAGO, 2013-2015

Revenue and Profit of Youhao Car Networking

Main Products of Youhao Car Networking

Revenue from Main Products of Youhao Car Networking, 2013-2015

Major Suppliers of Youhao Car Networking

Top5 Suppliers of Youhao Car Networking, 2013-2015

Revenue and Profit of Shenzhen Soling Industrial, 2012-2015

Gross Margin of Shenzhen Soling Industrial’s Smart CID System, 2013-2014

Major Partners of BlackView

Main Products of Jeavox

Revenue and Profit of Coagent, 2013-2015

Operating Revenue Structure of Coagent by Segment, 2013-2015

Operating Revenue Structure of Coagent by Product, 2013-2015

Global and Chinese Driving Recorder Market Size and Growth Rate, 2013-2019E

Chinese Driving Recorder Market Structure, 2015&2019E

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...