OBD (on-board diagnostic system) is an electronics self diagnostic system, typically used in automotive applications. It can monitor whether the automobile exhaust exceeds the standard or the system is normal at any time from the running state of the engine, and according to the fault code, maintenance personnel can quickly and accurately determine the nature and location of a fault. The information is stored in the ECU in the form of fault code, and ECU ensures the fault information access and processing through standard data interface.

OBD telematics is mainly composed of three parts: OBD terminal (hardware and plug-in OBD interface), software (mobile phone APP) and cloud platform.

Along with the development of intelligent automobile hardware and mobile internet, the car becomes the next fast-growing mobile terminal and telematics market also ushers in rapid development. At present, the enterprises are aggressively engaged in telematics market layout and seizing the entrance to telematics, then OBD-based telematic solutions become an important entrance.

Part of the fleet management and vehicle tracking solution providers (such as Geotab, Xirgo, Scope Technologies and ATrack), automotive electronic enterprises (Danlaw, TECHTOM, etc.) and insurance companies (Progressive, State Farm, Allstate, Insurethebox) launched their OBD telematics products during 2006-2012. In 2013-2014, the OBD intelligentt hardware market attracted the attention of capital market; and automotive electronic enterprises, start-up companies, insurance companies, mobile operators, etc. were getting involved in it successively. Among them, the startup Automatic Labs recorded more than one million units in OBD terminal shipments each year.

Prior to 2012, some Chinese enterprises developed OBD terminal, but failed in marketization due to technology and other reasons. Some companies formed the “OBD terminal + APP + Cloud Platform” business model at the outset of 2012. From the end of 2013 to early 2014, influenced by the foreign OBD intelligent hardware investment boom, this OBD telematics mode gained market attention, and all enterprises started OBD telematics market layout.

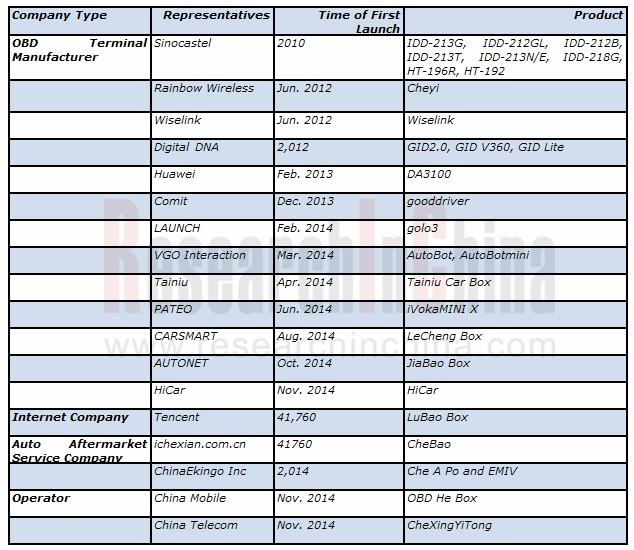

Currently, enterprises involved in OBD telematics (including independent brand OBD terminal) fall into four types: traditional OBD terminal manufacturers (part of the vehicle manufacturers, telematics companies, start-ups, etc.), internet companies, operators, and auto aftermarket service companies.

China’s OBD Telematics Market Participants and Their Products, 2010-2014

Source: ResearchInChina

In addition to a large number of enterprises’ inburst, the global and Chinese OBD telematics market characterized the followings in 2014:

(1) The service function of OBD telematics was further promoted besides application in UBI, fleet management, etc. In January 2015, Automatic worked with the smart thermostats company -- Nest to make its OBD products turn into the smart home controller. In the same month, Zubie also reached data exchange cooperation with PEQ, a provider of all software and services for SmartHome Ventures.

(2) The cloud platform of OBD telematics will be further opened, with API available for software developers which can use the data collected by the platform as well as OBD terminal equipment access interface for other competitors to increase the use of big data through data sharing, e.g. Carvoyant opened platform interface to Velio (an OBD device manufacturer) in January 2015.

(3) The voice recognition technology will be applied to OBD telematics. So far, some OBD telematics companies have added the function of voice broadcast in APP, such as Comit’s gooddriver, Baidu map version golo, etc., but the application of speech recognition is almost blank in OBD telematics.

(4) Currently, OBD is focused on the analysis of data; in the future, OBD terminal is expected to further integrate other function modules (air purification module, voice recognition module) and become multi-functional and intelligent.

Global and China OBD Telematics Industry Report, 2014-2015 mainly covers contents below:

Overview of OBD (including definition, composition, development history, interface and related products);

Overview of OBD (including definition, composition, development history, interface and related products);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...