China ETC (Electronic Toll Collection) Industry Report, 2015-2019

-

Jan.2016

- Hard Copy

- USD

$2,300

-

- Pages:96

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

ZLC028

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Electronic toll collection (ETC) is a commonly-used means of road tolling in the world. By the end of 2014, the mileage of toll highways in China amounted to 162,600 km, including 106,700 km of toll expressways, accounting for 65.7%; there were 1,665 mainline toll stations on toll highways nationwide, 696.5 of which were the ones on expressways, making up 41.8%.

By the end of Oct 2015, China had had 25.15 million ETC users; except for Hainan and Tibet, 29 provinces across the country had realized the networking of expressway ETC and cumulatively built 12,772 ETC lanes with 98.8% of mainline toll stations equipped with ETC lanes and 89.2% of ramp toll stations with ETC lanes.

The Chinese ETC equipment (OBU, RSU) market size has expanded rapidly in recent years, growing at a CAGR of 33.5% during 2012-2014. With advances in networked ETC nationwide, the Chinese ETC equipment market size is estimated to be up to RMB1.35 billion in 2015, presenting a year-on-year jump of 40.5%.

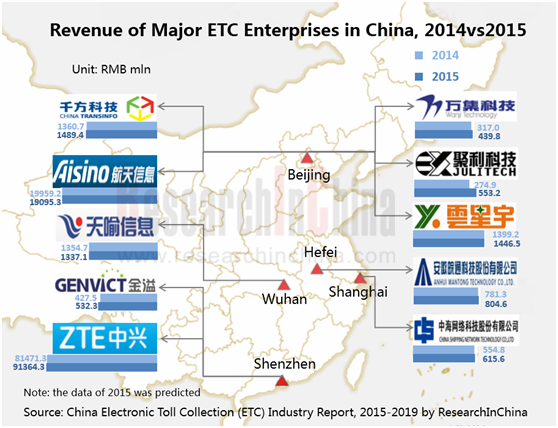

Companies in ETC industry in China can be categorized into equipment providers and system integrators with the former represented by GENVICT, Juli Science & Technology, Wanji Technology, and ZTE, of which the former three have made their presence in ETC OEM market, and the latter represented by Beijing Yunxingyu Traffic Technology, Anhui Wantong Technology, China TransInfo Technology, ZTE, and China Shipping Network Technology.

GENVICT is a leader among equipment suppliers in ETC industry in China. It had sold more than 5.5 million sets of OBU by the end of 2014, around 40% of OBU stock market. The company has introduced multiple intelligent front-mounted ETC electronic tags, of which ETC rearview mirror integrated electronic tag is being jointly tested by many companies.

Beijing Yunxingyu Traffic Technology Ltd. is a corporate champion among system integrators in ETC industry in China. Relying on powerful strength and resources of Beijing Capital Highway Development Group, the company holds a higher share in expressway intelligent transportation market in Beijing and is expected to record revenue of RMB1.447 billion throughout the year 2015. Sutong Technology, a subsidiary of Beijing Yunxingyu Traffic Technology, is the operator of ETC systems in Beijing and the service agency for networked sorting of ETC systems in Beijing, Tianjin, Hebei, Shandong, and Shanxi. The subsidiary made revenue of RMB179 million in 2014, and the figure is predicted to be up to RMB200 million in 2015.

China ETC (Electronic Toll Collection) Industry Report, 2015-2019 by ResearchInChina focuses on the followings:

Environment for ETC industry in China, including policy environment, development of expressway industry, automobile industry, intelligent transportation industry, and foreign experience in development of ETC industry;

Environment for ETC industry in China, including policy environment, development of expressway industry, automobile industry, intelligent transportation industry, and foreign experience in development of ETC industry;

Development of ETC industry in China, covering status quo, market size, competitive pattern, development forecast;

Development of ETC industry in China, covering status quo, market size, competitive pattern, development forecast;

Operation, ETC business, etc. of 10 companies in ETC industry in China.

Operation, ETC business, etc. of 10 companies in ETC industry in China.

1 Overview

1.1 Definition

1.2 Structure and Operating Principle

1.3 Classification

1.4 Advantage

2 Environment for ETC Industry in China

2.1 Policies

2.2 Development of Expressway Industry

2.2.1 Mileage of Toll Highways

2.2.2 Mainline Toll Station

2.2.3 Investment in Toll Highway

2.2.4 Vehicle Toll

2.3 Development of Automobile Industry

2.4 Development of Intelligent Transportation Industry

2.5 Foreign Experience in ETC

3 Development of ETC Industry in China

3.1 Status Quo

3.2 Market Size

3.3 Competitive Pattern

3.4 Forecast

3.4.1 A Surge in the Number of ETC Users

3.4.2 Sustained Growth in Demand for OBU

3.4.3 Replacement of MTC by ETC

3.4.4 Scaled-up Investment

3.4.5 AM towards OEM

3.4.6 Popularization of ETC in Parking Lots

4 Major Players

4.1 GENVICT

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Gross Margin

4.1.5 Capacity, Output and Sales

4.1.6 Supply and Marketing

4.1.7 R&D and Investment

4.1.8 Forecast and Outlook

4.2 Wanji Technology

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Gross Margin

4.2.5 Capacity, Output and Sales

4.2.6 R&D and Investment

4.2.7 Forecast and Outlook

4.3 Juli Science & Technology

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Gross Margin

4.3.5 R&D and Investment

4.3.6 Forecast and Outlook

4.4 Beijing Yunxingyu Traffic Technology Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Gross Margin

4.4.5 Supply and Marketing

4.4.6 R&D and Investment

4.4.7 Forecast and Outlook

4.5 Anhui Wantong Technology Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Gross Margin

4.5.5 R&D and Investment

4.5.6 Forecast and Outlook

4.6 China TransInfo Technology Co., Ltd.

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 Gross Margin

4.6.5 R&D and Investment

4.6.6 ETC-related Business

4.6.7 Forecast and Outlook

4.7 ZTE

4.7.1 Profile

4.7.2 Operation

4.7.3 Revenue Structure

4.7.4 Gross Margin

4.7.5 ETC-related Business

4.8 China Shipping Network Technology Co., Ltd.

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.4 Gross Margin

4.8.5 ETC-related Business

4.9 Wuhan Tianyu Information Industry Co., Ltd.

4.9.1 Profile

4.9.2 Operation

4.9.3 Revenue Structure

4.9.4 Gross Margin

4.9.5 ETC-related Business

4.10 Aisino

4.10.1 Profile

4.10.2 Operation

4.10.3 Revenue Structure

4.10.4 ETC-related Business

Structure of ETC Equipment

Applications of ETC

Comparison between ETC and MTC

Policies on ETC Industry in China, 2010-2015

Mileage of Expressways in China, 2010-2015

Mileage of Toll Highways in China by Grade, 2014

Proportion of Mainline Toll Stations in China by Grade, 2014

Proportion of Investment in Toll Highways in China by Grade, 2014

Proportion of Vehicle Toll Revenue from Toll Highways in China by Grade, 2014

Vehicle Toll Revenue from Toll Highways in China by Region, 2014

Automobile Production and YoY Growth Rate in China, 2009-2015

Auto Sales Volume and YoY Growth Rate in China, 2009-2015

Development History of Intelligent Transportation System (ITS) in China

Key Highway ITSs under Construction in China

Classification and Objective Functions of Urban ITSs in China

China’s Investment in ITS, 2007-2015

Typical ETC Projects in Foreign Countries

Development History of ETC National Networking in China

Chinese ETC Equipment Market Size, 2012-2015

Major Companies in ETC Industry in China, 2015

Operating Data of Major Companies in ETC Industry in China, 2014-2015

Chinese ETC Equipment Market Share by Company, 2015

Characteristics of Quick Electronic Payment Tools and Plate Video Recognition

Development History of GENVICT

Main Products and Their Applications of GENVICT

Revenue and Net Income of GENVICT, 2012-2014

Revenue Breakdown of GENVICT by Product, 2012-2014

Unit Price of GENVICT’s Products, 2012-2014

Revenue Breakdown of GENVICT by Region, 2012-2014

Revenue Breakdown of GENVICT by Sales Model, 2012-2014

Gross Margin of GENVICT, 2012-2014

Gross Margin of GENVICT by Product, 2012-2014

Capacity, Output and Sales Volume of GENVICT, 2014

GENVICT’s Procurement from Top5 Suppliers, 2012-2014

GENVICT’s Revenue from Top5 Customers, 2012-2014

GENVICT’s Revenue from Top5 Customers via Direct Selling, 2012-2014

GENVICT’s Revenue from Top5 Customers via Invitation of Bids, 2012-2014

Key Projects of GENVICT

R&D Costs and % of Total Revenue of GENVICT, 2012-2014

GENVICT’s Projects with Raised Funds

Revenue and Net Income of GENVICT, 2014-2019E

Main Products of Wanji Technology

Revenue and Net Income of Wanji Technology, 2011-2015

Revenue Breakdown of Wanji Technology by Product, 2012-2015

Revenue Breakdown of Wanji Technology by Region, 2012-2015

Average Unit Price of Wanji Technology’s Main Products, 2012-2015

Revenue Breakdown of Wanji Technology by Customer, 2012-2015

Revenue from Top10 Customers Buying Wanji Technology’s ETC Products, 2013-2015

Gross Margin of Wanji Technology, 2012-2015

Gross Margin of Wanji Technology by Product, 2012-2015

Road Side Unit Capacity and Output & Sales Volume of Wanji Technology, 2012-2015

On Board Unit Capacity and Output & Sales Volume of Wanji Technology, 2012-2015

R&D Costs and % of Total Revenue of Wanji Technology, 2012-2015

Main R&D Projects and R&D Expenditure of Wanji Technology, 2012-2015

Wanji Technology’s Investment in Projects with Raised Funds

New Capacity of Projects with Raised Funds of Wanji Technology

Revenue and Net Income of Wanji Technology, 2014-2019E

Revenue and Net Income of Juli Science & Technology, 2012-2015

Revenue Breakdown of Juli Science & Technology by Product, 2010-2013

Sales Volume and Unit Price of Main Products of Juli Science & Technology, 2010-2012

Juli Science & Technology’s Revenue from Top5 Customers, 2010-2012

Gross Margin of Juli Science & Technology, 2010-2015

R&D Costs and % of Total Revenue of Juli Science & Technology, 2012-2015

Revenue and Net Income of Juli Science & Technology, 2014-2019E

Main Businesses of Beijing Yunxingyu Traffic Technology

Revenue and Net Income of Beijing Yunxingyu Traffic Technology, 2012-2014

Revenue Breakdown of Beijing Yunxingyu Traffic Technology by Product, 2012-2014

Revenue Breakdown of Beijing Yunxingyu Traffic Technology by Region, 2012-2014

Gross Margin of Beijing Yunxingyu Traffic Technology, 2012-2014

Gross Margin of Beijing Yunxingyu Traffic Technology by Product, 2012-2014

Beijing Yunxingyu Traffic Technology’s Revenue from Top5 Customers, 2012-2014

Beijing Yunxingyu Traffic Technology’s Procurement from Top5 Suppliers, 2012-2014

R&D Costs and % of Total Revenue of Beijing Yunxingyu Traffic Technology, 2012-2014

Ongoing R&D Projects of Beijing Yunxingyu Traffic Technology by the End of 2014

Projects with Raised Funds of Beijing Yunxingyu Traffic Technology

Revenue and Net Income of Beijing Yunxingyu Traffic Technology, 2014-2019E

Revenue and Net Income of Wantong Technology, 2011-2015

Revenue Breakdown of Wantong Technology by Business, 2012-2015

Revenue Breakdown of Wantong Technology by Region, 2012-2015

Gross Margin of Wantong Technology by Business, 2012-2015

Gross Margin of Wantong Technology by Region, 2012-2015

R&D Costs and % of Total Revenue of Wantong Technology, 2012-2015

Revenue and Net Income of Wantong Technology, 2014-2019E

Revenue and Net Income of China TransInfo, 2011-2015

Revenue Breakdown of China TransInfo by Business, 2014-2015

Revenue Structure of China TransInfo by Business, 2014-2015

Revenue Breakdown of China TransInfo by Region, 2014-2015

Revenue Structure of China TransInfo by Region, 2014-2015

Gross Margin of China TransInfo by Business, 2014-2015

Gross Margin of China TransInfo by Region, 2014-2015

R&D Costs and % of Total Revenue of China TransInfo, 2011-2015

Revenue and Net Income of China TransInfo, 2014-2019E

Revenue and Net Income of ZTE

Revenue Breakdown of ZTE by Product, 2012-2015

Revenue Breakdown of ZTE by Region, 2012-2015

Gross Margin of ZTE, 2012-2015

Gross Margin of ZTE by Business, 2012-2015

Gross Margin of ZTE by Region, 2012-2015

Intelligent Transportation ETC Solutions of ZTE

Revenue and Net Income of China Shipping Network Technology, 2011-2015

Revenue Breakdown of China Shipping Network Technology by Business, 2012-2015

Revenue Breakdown of China Shipping Network Technology by Region, 2012-2015

Gross Margin of China Shipping Network Technology, 2012-2015

Gross Margin of China Shipping Network Technology by Business, 2012-2015

Expressway Networked Toll Collection System Solutions of China Shipping Network Technology

Revenue and Net Income of Wuhan Tianyu Information Industry, 2011-2015

Revenue Breakdown of Wuhan Tianyu Information Industry by Product, 2012-2015

Revenue Breakdown of Wuhan Tianyu Information Industry by Region, 2012-2014

Gross Margin of Wuhan Tianyu Information Industry, 2012-2015

Gross Margin of Wuhan Tianyu Information Industry by Product, 2012-2015

Revenue and Net Income of Aisino, 2011-2015

Revenue Breakdown of Aisino by Product, 2014-2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...