Global and China Automotive Wiring Harness Industry Report, 2015

-

Jan.2016

- Hard Copy

- USD

$2,300

-

- Pages:101

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZYW223

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Global and China Automotive Wiring Harness Industry Report, 2015 highlights the followings:

1. Global and China automobile market and industry

2. Downstream market of automotive wiring harness industry

4. Automotive wiring harness industry and market

5. 18 automotive wiring harness companies

In 2015, as the global economic deflation became more obvious, the prices for major commodities such as copper continued to drop, a situation that resulted in a fall in costs and prices of wiring harness. Meanwhile, the Japanese yen and the euro tumbled. In December 2015, the Federal Reserve raised interest rates, and Europe is still likely to expand its programme of quantitative easing, which would cause the yen and the euro to continue to depreciate, thus leading to a decline in automotive wiring harness market.

It is projected the global automotive wiring harness market would slide by 7% to USD39.721 billion in 2015, and to USD39.008 billion in 2016. By 2017, the market is expected to rebound to USD40.162 billion.

There are two hot topics in automotive wiring harness market: aluminum wire and high-voltage wiring harness in xEV. Sumitomo and Furukawa Electric are quite successful in automotive aluminum wire harness. Aluminum wire harness could reduce the mass of vehicles, but aluminum wire and copper alloy connector are two different kinds of metal and thus should be subject to special treatment and require special connectors.

In recent years, the xEV output has increased significantly. xEV needs to use a large quantity of high-voltage high-current wiring harness which has to be customized. While most of the companies have lower xEV output, and few ones are willing to customize wiring harness products, which provides opportunities to small companies. For example, Taiwan-based Bizlink exclusively supplies high-voltage wiring harness to Tesla. However, once the output increases, those companies are likely to transfer their orders to professional wiring harness companies.

1 Global and Chinese Automotive Market

1.1 Global Automotive Market

1.2 China Automotive Industry Overview

1.3 Recent Development of China Automotive Market

2 Automotive Wiring Harness Industry

2.1 Overview

2.2 Characteristics

3. Automotive Wiring Harness Market and Industry

3.1 Global Automotive Wiring Harness Market

3.2 Chinese Automotive Wiring Harness Market

3.3 Global Automotive Wiring Harness Industry

3.4 China Automotive Wiring Harness Industry

4. Automotive Wiring Harness Corporation

4.1 Sumitomo Electric Industries

4.1.1 Changchun SE Bordnetze

4.1.2 Tianjin Jin-Zhu Wiring Systems

4.1.3 Wuhan Sumiden Wiring Systems

4.1.4 Chongqing Jin-Zhu Wiring Systems

4.1.5 Fuzhou Zhu Wiring Systems

4.1.6 Fujian JK Wiring Systems

4.1.7 Huizhou Sumitomo Wiring Systems

4.1.8 Huizhou Zhurun Wiring Systems

4.1.9 Sumidenso Mediatech Suzhou

4.1.10 Huizhou Zhucheng Wiring Systems

4.1.11 Suzhou Bordnetze Electrical Systems

4.2 Delphi

4.2.1 Delphi Packard Electric System Changchun

4.2.2 Delphi Packard Electric System Baicheng

4.2.3 Delphi Packard Electric System Guangzhou

4.2.4 Delphi Packard Electric System Yantai

4.2.5 Delphi Packard Electric System Wuhan

4.2.6 Delphi Packard Electric System

4.3 Yazaki

4.3.1 Tianjin Yazaki Automotive Parts

4.3.2 Hangzhou Yazaki

4.3.3 Shantou Yazaki

4.3.4 Yantai Yazaki

4.3.5 Foshan Shunde Yazaki Auto Parts

4.3.6 Zhangzhou Yazaki

4.4 Leoni

4.4.1 Leoni Electrical Systems Shanghai

4.4.2 Leoni Wiring Systems Changchun

4.4.3 Leoni Wiring Systems Liuzhou

4.5 Furukawa Electric

4.5.1 Changchun Furukawa Automotive Wiring Harness

4.5.2 Furukawa Auto Parts (Huizhou)

4.5.3 Furukawa Electric Shenzhen

4.5.4 Furukawa Electric Hongkong

4.5.5 Furukawa Automotive Parts (Dongguan)

4.6 Gold Peak Industries

4.6.1 Shanghai Jinting Automobile Harness

4.7 Lear

4.7.1 Wuhan Lear-DFM Auto Electric

4.8 Nantong Unistar Electro-Mechanical Industries

4.8.1 Nantong Unistar Wiring Harness

4.9 Kyungshin Industrial

4.9.1 Qingdao Kyungshin Electronic

4.9.2 Jiangsu Kyungshin Electronic

4.10 Coroplast

4.10.1 Coroplast Harness Technology (Taicang)

4.11 Kunshan Hu Guang Auto Harness

4.12 THB

4.13 Kromberg & Schubert

4.14 Fujikura

4.14.1 Fujikura Zhuhai

4.14.2 Fujikura Changchun

4.15 Qingdao Yujin Electro-Circuit Systems

4.16 YURA

4.16.1 Beijing Yura

4.16.2 Beijing Shiyuan ECS

4.16.3 Weihai Yura

4.16.4 Rongcheng Shiyuan electric equipment

4.17 Hefei Jianghuai Xinfa Automobile

4.18 PKC

Global Automobile Sales Volume, 2001-2016

Global Light Vehicles Output by Region, 2003-2015

China’s Automobile Sales Volume, 2005-2015

Output Growth of Automobile in China by Type, 2005-2014

Global Automotive Wiring Harness Market Size, 2007-2017E

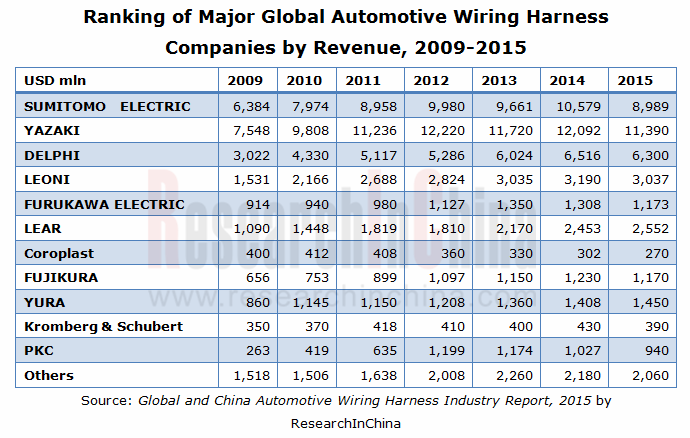

Ranking of Major Global Automotive Wiring Harness Companies by Revenue, 2009-2015

Market Share of Major Global Manufacturers of Automotive Wiring Harness, 2012

Global Output Value of Automotive Wiring Harness by Region, 2014

Market Share of Major Manufacturers of Automotive Wiring Harness in China (by Shipment), 2013

Market Share of Major Manufacturers of Automotive Wiring Harness in China (by Value), 2013

Major Medium and Small–sized Automotive Wiring Harness Companies in China

Output Value of Automotive Wiring Harness in China by Region, 2009-2012

Automotive Wiring Harness Export in China by Region, 2003-2008

Revenue and Operating Margin of Sumitomo Electric, FY2008-FY2016

Revenue of Sumitomo Electric by Product, FY2009-FY2016

Operating Profit of Sumitomo Electric by Division, FY2009-FY2016

Revenue of Sumitomo Electric by Region, FY2013-FY2016

Automotive Wiring Harness Revenue of Sumitomo Electric, FY2009-FY2015

Automobile Revenue of Sumitomo Electric by Region, FY2012

Revenue of Sumitomo Wiring System, FY2006-FY2015

Revenue and Operating Margin of Tianjin Jin-Zhu Wiring Systems, 2006-2011

Revenue of Chongqing Jin-Zhu Wiring Systems, 2007-2011

Financial Status of Fujian JK Wiring Systems, 2012-H1 2014

Revenue and Employees of Huizhou Sumitomo Wiring Systems, 2007-2014

Revenue and Employees of Huizhou Zhurun Wiring Systems, 2007-2014

Delphi’s Revenue and Operating Margin, 2007-2015

Delphi’s Revenue by Product, 2009-Q3 2015

Delphi’s Operating Profit by Product, 2012-Q3 2015

Delphi’s Client Distribution, 2010-2017E

Delphi’s Revenue by Region, 2010-2014

Delphi’s Net Property by Region, 2011-2014

Revenue of Delphi’s Electrical / Electronic Architecture, 2014

Yazaki’s Number of Employees by Region, FY2011-FY2015

Yazaki’s Revenue, FY2006-FY2015

Yazaki’s Revenue by Region, FY2011-FY2015

Revenue of Leoni Wiring Systems, 1996-2016

Revenue and EBIT of Leoni Wiring Systems, 2005-2015

Consolidated Statement of LEONI Group, 2015Q3

Revenue of Wiring Business of LEONI by Region, 2015

Revenue and EBIT of Wiring Business of LEONI Group, 2005-2015

Revenue of Leoni Wiring Systems by Client, 2015

Number of Employees of Leoni Wiring Systems, 2005-2014

Number of Employees of Leoni Wiring Systems by Region, end of Sep 2011

Number of Employees of Leoni Wiring Systems by Region, end of June 205

Global Distribution of Leoni Wiring Systems

Clients of Leoni Wiring Systems

Revenue and Operating Profit of Furukawa Electric, FY2011-FY2016

Revenue and Operating Profit of Electronics and Automotive of Furukawa Elecrtic, FY2011-FY2016

Revenue and Output of Furukawa Automotive Parts (Huizhou), 1995-2011

Organizational Structure of Gold Peak Industries

Revenue and Operating Margin of LEAR, 2010-2015

LEAR’s Revenue by Business, 2010-2015

LEAR's Revenue by Region, 2010-2014

LEAR's Revenue by Client, 2013

LEAR's Revenue by Client, 2014

Main Products of LEAR's EPMS Division

Revenue and Operating Margin of Kyungshin Industrial, 2004-2014

Financial Data of THB, 2007-2012Q3

THB’s Revenue by Product, 2008-2011

Balance Sheet of THB, 2011

Client Structure of Kromberg & Schubert

Main Vehicle Models Supported by Kromberg & Schubert

Fujikura’s Revenue and Operating Margin, FY2006-FY2015

Fujikura’s Revenue by Division, FY2008-FY2013

Fujikura’s Revenue by Product, FY2013-FY2015

Fujikura’s Operating Income by Division, FY2007-FY2013

Global Distribution of Fujikura’s Automotive Product Business

YURA’s Employee Distribution

YURA's Corporate Structure

YURA's R&D Structure

YURA's Revenue and Net Income, 2007-2014

YURA's Global Distribution

YURA's Global Capacity Distribution

PKC’s Market Share Worldwide, 2013

PKC’s Market Share Worldwide, 2014

PKC’s Market Share in North America, 2015

PKC’s Market Share in Europe, 2015

PKC’s Market Share in Brazil, 2015

PKC’s Market Share in China, 2015

PKC’s Global Distribution

PKC’s Revenue and Operating Margin, 2005-2015

Quarterly Revenue of PKC, Q12014-Q3 2015

Quarterly Number of Employees of PKC, Q12014-Q3 2015

Quarterly Revenue and EBITDA of PKC’s Wiring Business, Q1 2014-Q3 2015

Quarterly Net Working Capital of PKC, Q12014-Q3 2015

Sales of PKC and AEES by Product, 2010

Sales of PKC and AEES by Region, 2010

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...