Global and China Aluminum Alloy Automotive Sheet Industry Report, 2016-2020

-

Mar.2016

- Hard Copy

- USD

$2,600

-

- Pages:125

- Single User License

(PDF Unprintable)

- USD

$2,350

-

- Code:

BXM089

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,800

-

In recent years, driven by energy conservation, emission reduction and improvement of fuel efficiency, the automobile industry has been required to develop towards an increasingly lightweight trend. Automakers prefer to replace steel with aluminum.

Currently, aluminum sheet is mainly used in car doors, hoods, trunk lids and other parts. Meanwhile, a growing number of carmakers have been involved in the development and application of aluminum for car body over recent years, like the most typical Ford F-150.

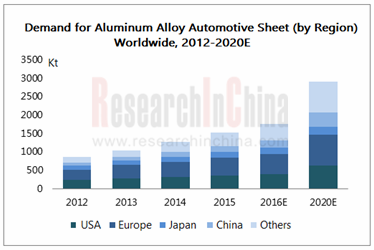

In the world's major automotive aluminum sheet production and consumption markets -- Europe, the United States and Japan, the demand for automotive aluminum sheet exceeded 1 million tons in 2015, and is expected to hit about 1.7 million tons by 2020.

Source: ResearchInChina

To seize the market, international aluminum giants Novelis, Kobe Steel, Constellium, Aleris, ALCOA, etc. have increased investment and newly built/expanded aluminum alloy automotive sheet projects in North America, Europe, China and other regions, wherein Novelis performs strikingly. By the end of 2015, Novelis had boasted worldwide capacity of automotive aluminum sheet up to 900,000 tons, including 400,000 tons in North America, 350,000 tons in Europe and 120,000 tons in China.

In addition, American Specialty Alloys also plans to invest USD12 billion in building the world's largest automotive aluminum sheet factory in the United States with the planned capacity of 600,000 tons/a. The first phase will be completed in late 2016, and the production goal will be fulfilled in 2017.

Subject to technical restrictions, China has been unable to conduct mass production of aluminum alloy automotive sheet, especially the one used for car body. In order to meet China's huge demand, local producers represented by Southwest Aluminum and Nanshan Aluminum have enhanced R & D and production of automotive aluminum sheet.

Southwest Aluminum succeeded in the trial production of aluminum alloy sheet -- 6016 aluminum alloy sheet suitable for automotive cover outer plate in August 2015. Mass production will be accomplished in 2016

Nanshan Aluminum completed R & D of 5182-O automotive inner plate and 6016-T4P automotive outer plate in July 2015. Its 200,000 tons/a super-size high-performance special aluminum alloy production line (including 80kt / a medium and heavy plate and 120kt / a thin plate and strip) went into operation in 2015.

The report highlights the followings:

Supply & demand and enterprise pattern of global aluminum alloy automotive sheet market as well as the development in Japan, the United States, and Europe.

Supply & demand and enterprise pattern of global aluminum alloy automotive sheet market as well as the development in Japan, the United States, and Europe.

Policies, supply & demand, enterprise pattern, key projects, etc. of aluminum alloy automotive sheet market in China;

Policies, supply & demand, enterprise pattern, key projects, etc. of aluminum alloy automotive sheet market in China;

Global and Chinese automotive markets and use of aluminum;

Global and Chinese automotive markets and use of aluminum;

Operation, aluminum alloy automotive sheet business, key projects, etc. of 8 global and 10 Chinese companies.

Operation, aluminum alloy automotive sheet business, key projects, etc. of 8 global and 10 Chinese companies.

1 Overview of Aluminum Alloy Automotive Sheet

1.1 Product Introduction

1.2 Classification and Application

1.3 Industry Chain

2 Global Aluminum Alloy Automotive Sheet

2.1 Overview

2.2 Production

2.3 Demand

2.3.1 Demand Volume

2.3.2 Demand Structure

2.3.3 Major Customers

2.4 Major Countries/Regions

2.4.1 North America

2.4.2 Europe

2.4.3 Japan

2.5 Enterprise Pattern

3 Development Environment of Aluminum Alloy Automotive Sheet in China

3.1 Key Policies

3.2 Automotive Lightweight

3.2.1 Material Lightweight

3.2.2 Application of Aluminum Alloy in Automotive Lightweight

3.3 Status Quo of Aluminum Processing Industry

4 Chinese Aluminum Alloy Automotive Sheet Market

4.1 Production

4.1.1 Capacity

4.1.2 Production Structure

4.1.3 Key Projects

4.2 Demand

4.2.1 Application

4.2.2 Quantity Demanded

4.3 Competition

4.3.1 Enterprise Competition

4.3.2 Market Competition

5 Status Quo of Automobile Industry

5.1 Production and Sale

5.1.1 Global

5.1.2 China

5.2 Major Automobile Manufacturers

5.2.1 Global

5.2.2 China

5.3 Automotive Aluminum

6 Major Global Aluminum Alloy Automotive Sheet Manufacturers

6.1 ALCOA

6.1.1 Profile

6.1.2 Operation

6.1.3 Aluminum Alloy Automotive Sheet Business

6.1.4 Development in China

6.1.5 Dynamics

6.2 Constellium

6.2.1 Profile

6.2.2 Operation

6.2.3 Aluminum Alloy Automotive Sheet Business

6.2.4 Development in China

6.3 Norsk Hydro

6.3.1 Profile

6.3.2 Operation

6.3.3 Aluminum Alloy Automotive Sheet Business

6.3.4 Development in China

6.4 Aleris

6.4.1 Profile

6.4.2 Operation

6.4.3 Aluminum Alloy Automotive Sheet Business

6.4.4 Development in China

6.5 Novelis

6.5.1 Profile

6.5.2 Operation

6.5.3 Aluminum Alloy Automotive Sheet Business

6.6 Kobe Steel

6.6.1 Profile

6.6.2 Operation

6.6.3 Aluminum Alloy Automotive Sheet Business

6.6.4 Development in China

6.7 UACJ

6.7.1 Profile

6.7.2 Operation

6.7.3 Aluminum Alloy Automotive Sheet Business

6.7.4 Development in China

6.8 AMAG

6.8.1 Profile

6.8.2 Operation

6.8.3 Aluminum Alloy Automotive Sheet Business

7 Key Chinese Aluminum Alloy Automotive Sheet Manufacturers

7.1 Weifang Sanyuan Aluminum Co., Ltd.

7.1.1 Profile

7.1.2 Aluminum Alloy Automotive Sheet Projects

7.2 Northeast Light Alloy Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Aluminum Alloy Automotive Sheet Business

7.3 Southwest Aluminum (Group) Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Aluminum Alloy Automotive Sheet Business

7.3.4 Competitive Edge

7.4 Jiangsu CAIFA Aluminum Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Aluminum Alloy Automotive Sheet Business

7.5 Jiangsu AlchaAluminium Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Aluminum Alloy Automotive Sheet Business

7.6 China Zhongwang Holdings Limited

7.6.1 Profile

7.6.2 Operation

7.6.3 Aluminum Alloy Automotive Sheet Business

7.7 Mingtai Aluminum Industry Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Aluminum Alloy Automotive Sheet Business

7.8 Shandong Nanshan Aluminum Co., Ltd

7.8.1 Profile

7.8.2 Operation

7.8.3 Aluminum Alloy Automotive Sheet Business

7.9 AlnanAluminium Inc.

7.9.1 Profile

7.9.2 Operation

7.9.3 Aluminum Alloy Automotive Sheet Business

7.10 Henan Zhongfu Industrial Co., Ltd

7.10.1 Profile

7.10.2 Aluminum Alloy Automotive Sheet Business

8 Summary and Forecast

8.1 Market

8.2 Enterprise

Aluminum Alloy Automotive Sheets (Auto Parts)

Components of Main Aluminum Alloy Automotive Sheets Globally

Basic Components and Characteristics of 6000 Series and 5000 Series Aluminum Alloys

Application of Aluminum Alloy in Automotive Covering Parts

Aluminum Alloy Automotive Sheet Industry Chain

History of Aluminum Alloy’s Application in Automobile

Weight of Aluminum/Cast Iron/Steel Auto Parts

Main Applications of Aluminum Alloy Automotive Sheet

Forming Property of Aluminum Alloy Sheet and Steel Sheet for Sedan Body

Major Aluminum Alloy Automotive Sheet Projects Worldwide, 2015-2016

Global Aluminum Alloy Automotive Sheet Capacity, 2010-2020E

Global Automobile Output, 2008-2020E

Automobile Energy Conservation and Emission Reduction Targets of Nations across the World

Aluminum Alloy Use of Per Automobile Worldwide, 2010-2030E

Global Demand for Aluminum Alloy Automotive Sheet, 2010-2030E

Global Demand for Aluminum Alloy Automotive Sheet by Region, 2012-2020E

Global Demand for Aluminum Alloy Sheet for Auto Body, 2011-2020E

Aluminum Alloy Auto Body Parts Developed by Auto Makers Worldwide

Aluminum Use of Per Light Vehicle in North America, 1975-2025E

Aluminum Use of Major Parts of Automobile in North America, 2015

Aluminum Use of Per Light Vehicle in North America by Type of Aluminum Product, 2012-2025E

Aluminum Consumption Structure of Light Vehicle in North America by Product, 2012-2025E

Aluminum Sheet Demand for Auto Body and Closure Parts in North America, 2012-2025E

Aluminum Alloy Use of Per Automobile in the United States, 2010-2020E

Structure of Automotive Aluminum Alloy Products in the United States, 2015

Automobile Output and Aluminum Alloy Automotive Sheet Demand in the United States, 2012-2015

Aluminum Alloy Use of Per Automobile in Europe, 2012-2020E

Structure of Automotive Aluminum Alloy Products in Europe, 2015

Automobile Output and Aluminum Alloy Automotive Sheet Demand in Europe, 2012-2015

Aluminum Alloy Use of Per Automobile in Japan, 2010-2020E

Structure of Automotive Aluminum Alloy Products in Japan, 2015

Automobile Output and Aluminum Alloy Automotive Sheet Demand in Japan, 2012-2020E

Capacity and Customers of Major Aluminum Alloy Automotive Sheet Manufacturers Worldwide, 2015

China’s Policies on Aluminum Alloy Automotive Sheet Industry, 2010-2016

Limits on Average Fuel Consumption of Passenger Vehicle in China, 2015-2020E

Diagram for Relationship between Mass and Fuel Consumption of Passenger Vehicle Worldwide

Approaches to Lightweight Vehicle

Performance and Application of Several Lightweight Materials

Weight Reduction Effects of Common Lightweight Materials Compared with Low-carbon Steel

Typical Applications of Aluminum Alloy in Lightweight Vehicle

China’s Output of Aluminum Processed Materials, 2008-2020

China’s Output of Aluminum Processed Materials by Product, 2008-2015

China’s Aluminum Alloy Automotive Sheet Capacity, 2009-2020E

Major Aluminum Alloy Automotive Sheet Projects in China by the end of 2015

Aluminum Alloy Consumption of Per Vehicle in China, 2006-2020E

China’s Demand for Aluminum Alloy Automotive Sheet, 2010-2020E

Capacity of Major Aluminum Alloy Automotive Sheet Manufacturers in China, 2015-2018E

Progress in Local Automotive Aluminum Sheet R&D in China

Global Automobile Output by Region, 2010-2015

Global Passenger Vehicle Output by Region, 2010-2015

Global Commercial Vehicle Output by Region, 2010-2015

China’s Automobile Output by Model, 2008-2020E

China’s New Energy Vehicle Output, 2013-2015

Ranking of Major Automakers Worldwide by Output, 2014

Top10 Companies in China by Sales of Auto Model, 2015

Top10 Passenger Vehicle Brands by Sales, 2015

Aluminization of New Vehicles of Main Auto Brands, 2012

Average Aluminum Consumption of Cars in North America

Aluminum Consumption of 2015 F-150 by Part

Revenue and Net Income of ALCOA, 2010-2016

Sales Breakdown of ALCOA by Country, 2013-2015 (USD mln)

Sales and After-tax Profit of ALCOA, 2011-2015

Aluminum Rolling Factories and Products of ALCOA, 2015

Major Customers and Products of ALCOA’s Aluminum Alloy Automotive Sheet Business

ALCOA’s Revenue from Aluminum Alloy Automotive Sheet, 2013-2020E

ALCOA’s Factories and Business in China, 2015

ALCOA’s Sales in China, 2009-2016

Development History of Constellium

Main Production Bases of Constellium

Sales of Constellium, 2010-2016

Shipments and Sales Breakdown of Constellium by Business, 2014-2015

Automotive Solutions of Constellium

Aluminum Alloy Automotive Sheets of Constellium

Aluminum Alloy Automotive Sheet R&D and Production Bases of Constellium

Constellium’s Production Bases in China

Sales and Net Income of Norsk Hydro, 2009-2015

Businesses of Norsk Hydro

Revenue Breakdown of Norsk Hydro by Business, 2014-2015

Revenue Structure of Norsk Hydro by Region, 2015

Output of Norsk Hydro’s Main Products, 2011-2015

Aluminum Rolling Business Structure of Norsk Hydro by Field, 2015

Main Production Bases and Capacity of Norsk Hydro’s Aluminum Rolling Business, 2015

Output of Norsk Hydro’s Aluminum Alloy Automotive Sheet Production Bases, 2013-2015

Aluminum Alloy Automotive Sheets and Their Applications of Norsk Hydro

Norsk Hydro’s Factories in China, 2016

Global Production Bases of Aleris

Revenue and Net Income of Aleris, 2010-2015

Revenue Breakdown of Aleris by Region, 2013-2015

Revenue Structure of Aleris by Application Market, 2015

Major Competitors of Aleris by Region

Lewisport ABS Expansion Project of Aleris

Major Customers and Competitors of Aleris’ Aluminum Alloy Automotive Sheets

Main Production Bases and Distribution of Novelis

Revenue and Net Income of Novelis, FY2010-FY2016

Novelis’ Shipments of Aluminum Rolled Products by Region, FY2015-FY2016

Aluminum Rolled Products Shipments Structure of Novelis by Business, FY2013-FY2016

Novelis’ Aluminum Alloy Automotive Sheets and Their Applications

Novelis’ Aluminum Alloy Automotive Sheet Production Bases and Major Customers, 2015

Novelis’ Automotive Aluminum Sheet Capacity Worldwide, 2015

Sales and Net Income of Kobe Steel, FY2009-FY2015

Sales Breakdown of Kobe Steel by Business, FY2013-FY2015

Main Products and Their Applications of Kobe Steel’s Alumimum& Copper Business

Sales of Kobe Steel’s Alumimum& Copper Business by Product, FY2014-FY2015

Kobe Steel’s Production Bases in China for Alumimum& Copper Business, 2015

Development History of UACJ

Business and Products of UACJ

Capacity of UACJ Rayong Works, FY2014-FY2020E

Key Economic Indicators of UACJ, FY2013-FY2015

Sales Breakdown of UACJ by Business, FY2013-FY2015

Medium-term Goals of UACJ (2015-2017)

Performance Indicators of Furukawa-sky’s Aluminum Alloy Automotive Sheet

Performance Indicators of Sumitomo Light Metal’s Aluminum Alloy Automotive Sheet

Hardness of Sumitomo Light Metal’s SG112-T4A Automotive Aluminum Sheet and Common Aluminum Sheet

UACJ’s Factories in China, 2015

UACJ’s Global Supply Network for Automotive Heat Exchanger Materials

Global Network of AMAG

Business Structure of AMAG

Key Economic Indicators of AMAG, 2012-2015

Shipments and Revenue Breakdown of AMAG by Revenue, 2015

Revenue Breakdown of AMAG by Place of Origin, 2015

Application of AMAG’s Aluminum Products in Automobile

AMAG 2020

Major Aluminum Alloy Automotive Sheet Projects of Sanyuan Aluminum

Capacity of Northeast Light Alloy’s Main Products, 2015

Applications and Customers of Main Products of Northeast Light Alloy

Affiliated Enterprises and Business of Northeast Light Alloy

Revenue and Total Profits of Northeast Light Alloy, 2009-2016

Aluminum Alloy Automotive Sheet Series of Northeast Light Alloy

Performance Comparison between Northeast Light Alloy’s Aluminum Alloy Automotive Sheet and Foreign Products

Aluminum Alloy Plate and Strip Projects of Northeast Light Alloy

Output of Southwest Aluminum, 2011-2015

Output Structure of Southwest Aluminum by Product, 2015

Revenue and Net Income of CAIFA Aluminum, 2011-2015

Revenue and Net Income of AlchaAluminium, 2009-2015

AlchaAluminium’s Projects under Construction, 2016

Sales Volume and Revenue of Zhongwang Holdings by Business, 2012-2015

Aluminum Sheet/Strip/Foil Capacity of Zhongwang Holdings, 2016-2019E

Revenue and Net Income of Mingtai Aluminum, 2010-2015

Operating Revenue Breakdown of Mingtai Aluminum, 2012-2015

Mingtai Aluminum’s 200,000 t/a High-precision Traffic-dedicated Aluminum Sheet/Strip Project

Progress in Main Businesses of Nanshan Aluminium, 2015

Revenue and Net Income of Nanshan Aluminium, 2009-2015

Operating Revenue Breakdown of Nanshan Aluminium by Product, 2014-2015

Revenue and Net Income of Zhongfu Industrial, 2010-2015

Automotive Aluminum Sheets of Zhongfu Industrial

Aluminum Alloy Automotive Sheet Capacity and Demand in China, 2012-2020E

Revenue and YoY Growth of Major Aluminum Alloy Automotive Sheet Manufacturers Worldwide, 2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...