With a boom in sharing economy, car sharing companies represented by Zipcar, Uber, Getaround, and Car2go have flourished, pushing forward the development of car sharing around the world.

Fully-developed car sharing in foreign countries is primarily divided into three models: car-hailing apps, P2P car rental, and timeshare rental with the first represented by Uber, Lyft, and Ola Cabs, the middle Getaround, Turo, and Flightcar, and the latter Zipcar, Car2go, NriveNow, and Autolib.

Uber, the world’s largest car-hailing app player, has so far obtained a dozen rounds of financing and now is valued at USD60 billion. The company has penetrated into a total of 447 cities in countries consisting of the United States, China, India, Singapore, Malaysia, etc.

The Chinese car sharing market is still in the phase of rapid growth but has showed huge potential. A series of laws & regulations and policies, including the Guidance on Promoting Green Consumption and the Guidance on Promoting the Development of New Energy Vehicle Timeshare Sector in Shanghai, have been introduced by the central government and local authorities so as to regulate and encourage the development of car sharing industry.

Car-hailing apps: A competitive landscape with DidiChuxing, YidaoYongche, Uber, ShenzhouZhuanche, 51 Yongche, Dida Pinche, and TiantianYongche as major players have taken shape in the Chinese car-hailing apps market. Orders for car-hailing services totaled about 2 billion in China in 2015, including 1.43 billion or 71.5% of the total amount from DidiChuxing, followed by Uber with a percentage of 18.3%.

DidiChuxing, a result of the merger between DidiDache and KuaidiDache, combines their own advantages. Having raised more than USD5 billion, it is the largest domestic car-hailing app platform in China valued at USD20 billion. The number of drivers connected to the platform had exceeded 14 million and registered users amounted to 250 million by the end of 2015.

P2P car rental: With PP Zuche rolling out its services in China, PP car rental platforms like Atzuche, UU Cars, Baojia, and KuaikuaiZuche have sprung up around China.

P2P car rental firms now rely heavily on financing for capital to expand business scope and grab customers. PP Zuche, with the largest amount of financing, got RMB500 million in financing in Sept 2015, the largest one in P2P car rental market.

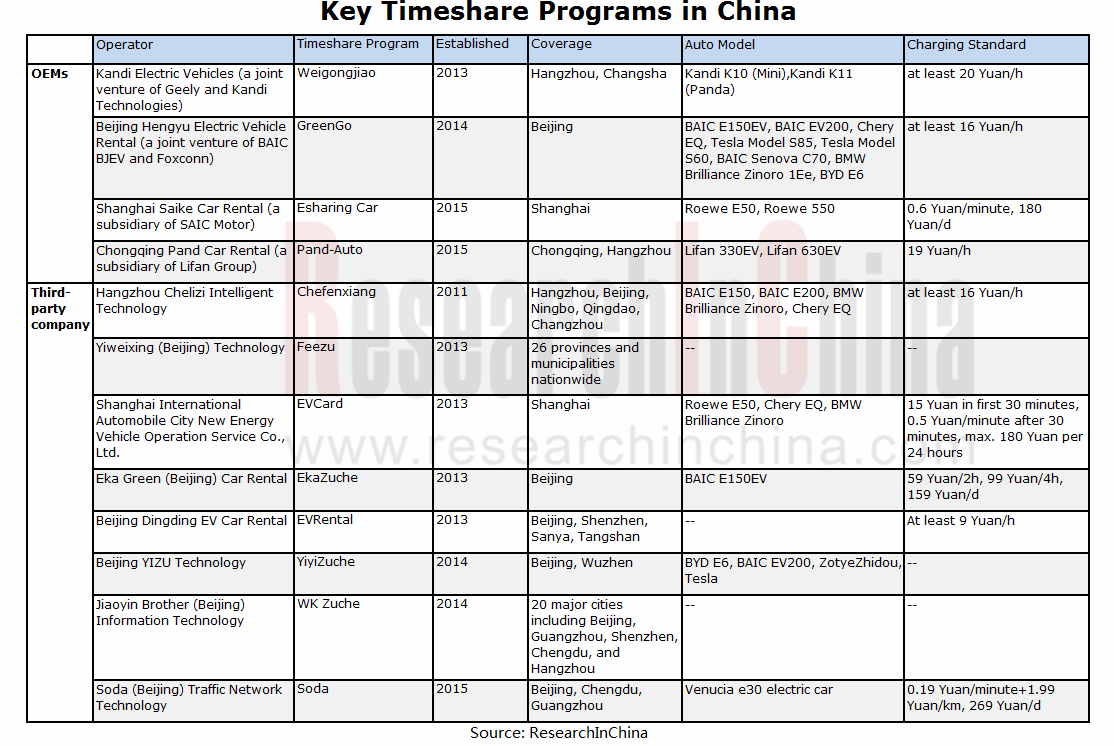

Timeshare: With growing heat-up of new-energy vehicle timeshare, localities have been active in developing new energy vehicle timeshare rental sector. And, new energy vehicle timeshare programs are being carried out in dozens of cities including Beijing, Shanghai, Hangzhou, and Shenzhen.

Propelled by favorable policies, carmakers, telematics enterprises, and Internet firms have flooded into the field. In addition, P2P car rental company- UU Cars announced in Oct 2015 that it would transform to timeshare model, plan to put 1,000 vehicles into operation by the end of 2015 and raise the figure to more than 6,000 units in the first half of 2016.

Major timeshare rental companies include Feezu, YiyiZuche, EVCard, WK Zuche, Soda, and EkaZuche. In addition, BAIC BJEV have launched GreenGo timeshare program, SAIC Motor E-sharing car, GeelyWeigongjiao, LifanPand-Auto, and Shou Qi Group Gofun.

The Chinese car sharing market will still be complementarily composed of car-hailing app firms, P2P car rental companies, and timeshare enterprises in the future.

Car-hailing apps market will be dominated by comprehensive mobile platforms represented by DidiChuxing and Uber; P2P car rental market will be further regulated with only two to three players surviving fierce competition; blossoming timeshare market will grow more mature under the joint efforts of market participants.

China Car Sharing Industry Report, 2016-2020 highlights the followings:

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...