Global and China Automotive Lighting Industry Report, 2016 focuses on the followings:

1, Status quo and trend of headlight design

2, Technical analysis on laser/OLED/AFS/ADB/night vision system

3, Global and Chinese automotive lighting market size and forecast

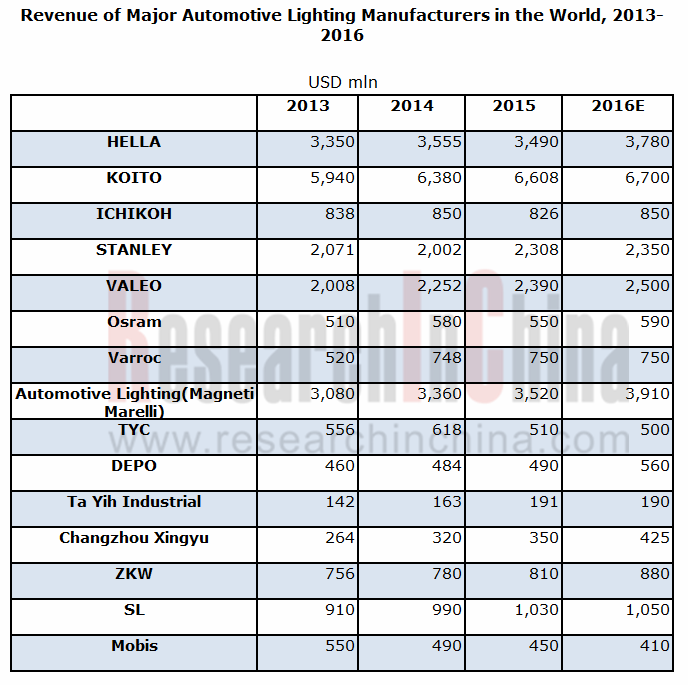

4, Competitive landscape of global and China automotive lighting industry

5, Competitive landscape of global and China automotive LED industry

6, Global brake system and EPS manufacturers

Global automotive lighting market size was USD27 billion in 2015, up 3.8% from a year earlier, and is expected to grow by 1.9% year on year to USD27.5 billion in 2016. The reasons for the slowdown are as follows:

Slowdown in both Chinese and American markets

Slowdown in both Chinese and American markets

Drastic devaluation of the euro and the yen

Drastic devaluation of the euro and the yen

Continued decline in prices of LED dies and LED lamps

Continued decline in prices of LED dies and LED lamps

Falling prices of oil and plexiglass (a raw material of headlights)

Falling prices of oil and plexiglass (a raw material of headlights)

In 2015, the global OEM automotive lighting market valued about USD24 billion, while the maintenance and modification markets fetched about USD1.5 billion each. The maintenance market remained stable, but the modification market witnessed gradual decline with the growth of pre-installed xenon lamps.

Adaptive Driving Beam (ADB) must be with LED headlights. Low power consumption, simple design (compared with HID) and dropping prices of LED propel the application of LED headlights quickly as the share may increase from 9% in 2015 to 27% in 2020. At the same time, xenon lamps still occupy a place in the medium and high-end market because of the high brightness, and the share herein will stabilize at around 14%. Especially in China, people are enthusiastic about xenon lamps because they meet their pursuit for fashion and dazzling, so such lamps will still be more popular than LED in Chinese medium and high-end market. Due to high costs, laser headlights are expected to seize the share of only 1% in 2019. The ADB penetration rate will jump from 5% in 2015 to 25% in 2020, the AFS penetration rate will escalate from 10% in 2015 to 23% in 2020, and China will see 30%.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...