China Vehicle Inspection Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,500

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZJF088

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

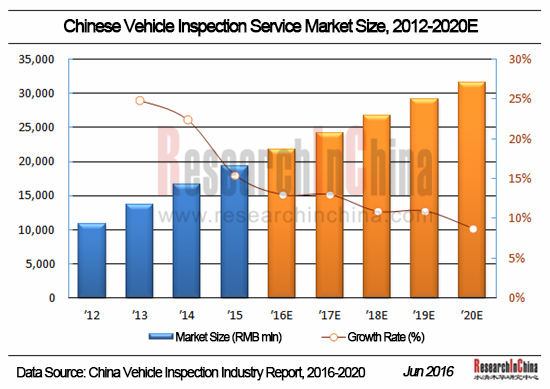

As the Chinese automobile market expands rapidly, car ownership has continued to rise, amounting to 172 million units by the end of 2015. To ensure traffic safety and protect environment, regulatory authorities including the Ministry of Public Security and the Ministry of Environmental Protection have intensified their efforts for vehicle inspection, fueling a boom in the Chinese vehicle inspection market. Vehicle inspection market, based on difference of business, can be divided into vehicle inspection service market and vehicle inspection system market, with the former having a market scale of RMB19.269 billion and the latter RMB2.816 billion in 2015, up 15.5% and 10.3% from a year ago, respectively.

?

?

Vehicle inspection service enterprises can be divided into state-owned ones and private ones according to their nature. State-own enterprises include mainly National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Guangdong Automotive Test Center Co., Ltd., Wuhan Vehicle Test Equipment Institute Co., Ltd., National Passenger Car Quality Supervision and Inspection Center (Tianjin Automotive Test Center), etc. Private firms cover Anhui Xiayang Motor Vehicle Inspection Co. Ltd., Jiangsu Jiecheng Motor Vehicle Inspection Co., Ltd., TangshanJingdong Grand Health Co., Ltd. etc. Large state-owned enterprises provide full inspection services covering safety of vehicle/parts, environmental friendliness, and overall performance with powerful comprehensive strength, whereas private players, because of their weak inspection capability, offer only a few inspection services and gain an edge over state-owned counterparts in some regional markets.

Vehicle inspection system market features obviousregionality. In China, the majority of systems are supplied by local businesses in regions where customers are highly concentrated, place few annual orders, and generate small sales size. There are a small number of large companies in the sector with great R&D strength and broad coverage of business, represented chiefly by Shenzhen Anche Technologies Co., Ltd. (with fairly complete product lines consisting of safety inspection, environmental inspection, comprehensive inspection, and automobile off-assembly-line inspection), LAUNCH TECH Co., Ltd. (a company listed on HKEx, providing automotive diagnosis, inspection, and maintenance products, and now focusing on golo car cloud platform dominated by diagnostic system based on which other system businesses are developed), Shijiazhuang Huayan Traffic Technology Co., Ltd. (Huayan Technology), Nanhua Instruments Co., Ltd. (an A-share listed company with existing products including motor vehicle emissions inspection instruments, vehicle environmental inspection system, vehicle safety inspection instruments, and vehicle safety inspection system), and Chengdu Chengbao Development Co., Ltd.

China Vehicle Inspection Industry Report, 2016-2020 focuses on the followings:

Vehicle inspection in China (definition & classification, development trend, laws & regulations, development of relevant sectors, etc.);

Vehicle inspection in China (definition & classification, development trend, laws & regulations, development of relevant sectors, etc.);

China’s vehicle inspection service industry (market size, competitive landscape, development trend, etc.);

China’s vehicle inspection service industry (market size, competitive landscape, development trend, etc.);

China’s vehicle inspection system industry (market size, competitive landscape, development trends, etc.);

China’s vehicle inspection system industry (market size, competitive landscape, development trends, etc.);

Ten vehicle inspection system companies (LAUNCH TECH, Shenzhen Anche Technologies, Shijiazhuang Huayan Traffic Technology, Nanhua Instruments, Chengdu Chengbao Development, Bosch Diagnostics, Zhejiang Jiangxi Auto Inspection Equipment, Cosber, Qingdao Hongsheng Automobile Testing Equipment, and Chengdu Iyasaka Technology Development) (profile, business performance, revenue structure, R&D costs, inspection system business, development strategy, etc.);

Ten vehicle inspection system companies (LAUNCH TECH, Shenzhen Anche Technologies, Shijiazhuang Huayan Traffic Technology, Nanhua Instruments, Chengdu Chengbao Development, Bosch Diagnostics, Zhejiang Jiangxi Auto Inspection Equipment, Cosber, Qingdao Hongsheng Automobile Testing Equipment, and Chengdu Iyasaka Technology Development) (profile, business performance, revenue structure, R&D costs, inspection system business, development strategy, etc.);

Eight vehicle inspection service agencies (Guangdong Automotive Test Center, Shanghai Motor Vehicle Inspection Center, XiangyangDa’an Automobile Test Center, National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Anhui Xiayang Motor Vehicle Inspection, Jiangsu Jiecheng Motor Vehicle Inspection, Tangshan Jingdong Grand Health, and Hangzhou Automobile General Performance Testing Center) (profile, business performance, revenue structure, inspection business, development strategy, etc.)

Eight vehicle inspection service agencies (Guangdong Automotive Test Center, Shanghai Motor Vehicle Inspection Center, XiangyangDa’an Automobile Test Center, National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Anhui Xiayang Motor Vehicle Inspection, Jiangsu Jiecheng Motor Vehicle Inspection, Tangshan Jingdong Grand Health, and Hangzhou Automobile General Performance Testing Center) (profile, business performance, revenue structure, inspection business, development strategy, etc.)

1 Vehicle Inspection Industry

1.1 Definition and Classification

1.2 Development

1.3 Laws and Policies

1.3.1 Motor Vehicle Inspection Equipment & System Regulators

1.3.2 Motor Vehicle Inspection Service Regulators

1.3.3 Laws and Regulations

1.3.4 Industrial Policies

1.3.5 Standards

2 AutomobileIndustry

2.1 Output & Sales Volume

2.2 Car Ownership

3. Vehicle Inspection System Market

3.1 Market Size

3.2 Competitive Landscape

3.3 Trend

4. Vehicle Inspection Service Market

4.1 Market Size

4.2 Competitive Landscape

4.3 Trend

5. Vehicle Inspection System Enterprises

5.1 Launch Tech

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 golo Car Cloud-based Diagnostic System

5.2 Nanhua Instruments

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 R&D Costs

5.2.6 Output and Sales

5.2.7 Vehicle Inspection System and Equipment

5.2.9 Development Prospects

5.3 Chengdu Chengbao Development

5.3.1 Profile

5.3.2 Vehicle Safety Inspection System

5.3.3 Vehicle Emission Monitoring System

5.3.4 Competitiveness

5.4 Shijiazhuang Huayan Traffic Technology

5.4.1 Profile

5.4.2 Operation

5.4.3 Main Products

5.4.4 Competitiveness

5.4.5 Latest Developments

5.5 Shenzhen Anche Technologies

5.5.1 Profile

5.5.2 Main Products

5.5.3 Major Customers

5.6 Bosch Diagnostics

5.6.1 Profile

5.6.2 Main Products

5.7 Zhejiang Jiangxi Auto Inspection Equipment

5.7.1 Profile

5.7.2 Main Products

5.8 Cosber

5.8.1 Profile

5.8.2 Main Products

5.8.3 Latest Developments

5.9 Qingdao Hongsheng Automobile Testing Equipment

5.9.1 Profile

5.9.2 Main Products

5.9.3 Marketing Network

5.10 Chengdu Iyasaka Technology Development

5.10.1 Profile

5.10.2 Main Products

6. Vehicle Inspection Service Agencies

6.1 Guangdong Automotive Test Center Co., Ltd.

6.1.1 Profile

6.1.2 Inspection Capability

6.1.3 Vehicle Inspection

6.1.4 Emission and Energy Conservation Inspection

6.1.5 Collision Safety Inspection

6.1.6 Parts Inspection

6.2 Shanghai Motor Vehicle Inspection Center

6.2.1 Profile

6.2.2 Inspection Capability

6.2.3 Vehicle Inspection

6.2.4 Emission Inspection

6.2.5 Passive Safety

6.2.6 Parts Inspection

6.2.7 New Energy Vehicle Inspection

6.3 XiangyangDa’an Automobile Test Center

6.3.1 Profile

6.3.2 Inspection Capability and Qualifications

6.3.3 Inspection Items

6.4 National Motor Vehicle Quality Supervision and Inspection Center (Chongqing)

6.4.1 Profile

6.4.2 Inspection Capability and Qualifications

6.4.3 Inspection Items

6.5 Hangzhou Automobile General Performance Testing Center Co., Ltd.

6.5.1 Profile

6.5.2 Inspection Capability and Qualifications

6.5.3 Inspection Business

6.6 Anhui Xiayang Motor Vehicle Inspection

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Qualifications

6.6.5 Inspection Items

6.6.6 Major Inspection Stations

6.7 Jiangsu Jiecheng Motor Vehicle Inspection

6.7.1 Profile

6.7.2 Operation

6.7.3 Inspection Capability and Qualifications

6.8 Tangshan Jingdong Grand Health

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Qualifications

6.8.5 Main Inspection Lines

Diagram of Motor Vehicle Inspection System

Classification of Motor Vehicle Inspection Systems

Diagram of Motor Vehicle Safety Inspection System

Technological Evolution in Motor Vehicle Inspection Industry

Laws and Regulations on Motor Vehicle Inspection

Policies on Motor Vehicle Inspection

China’s Automobile Output, 2010-2020E

China’s Automobile Ownership, 2007-2020E

Chinese Vehicle Inspection System Market Size, 2010-2015

Competition among Major Vehicle Inspection System Enterprises in China

Number of Inspection Agencies for Per 10k Vehicles Worldwide

Chinese Vehicle Inspection System Market Size, 2016-2020E

Requirement on Vehicle Inspection Frequency in China

Chinese Vehicle Inspection Service Market Size, 2008-2015

Chinese Vehicle Inspection Service Market Size, 2016-2020E

Revenue and Net Income of LAUNCH TECH, 2011-2015

LAUNCH TECH’s Revenue from Main Businesses, 2014-2015

Concept of Golo Car Cloud Platform

Golo Car Cloud Platform

Golo Remote Diagnostic System

Revenue and Net Income of Nanhua Instruments, 2011-2015

Nanhua Instruments’ Revenue from Main Products, 2011-2015

Gross Margin of Nanhua Instruments’ Main Products, 2011-2015

Nanhua Instruments’ R&D Costs and Growth Rate, 2011-2015

Output, Sales Volume and Inventory of Nanhua Instruments’ Main Products, 2014-2015

Nanhua Instruments’ Main Motor Vehicle Emission Inspection Instruments

Nanhua Instruments’ Main Motor Vehicle Emission Inspection Systems

Nanhua Instruments’ Main Headlight Inspection Instruments

Nanhua Instruments’ Typical Motor Vehicle Safety Inspection System (NHST-03)

Operating Revenue and Net Income of Nanhua Instruments, 2015-2020E

Specifications of Motorcycle Inspection System of Chengdu Chengbao Development

Specifications of Free Cylinder of Chengdu Chengbao Development

Specifications of Vehicle Corrector of Chengdu Chengbao Development

Specifications of Suspension Steering and Clearance Tester of Chengdu Chengbao Development

Specifications of Vehicle Suspension Inspection Bench of Chengdu Chengbao Development

Chengdu Chengbao Development’s DCG-10DA Driving-mode Vehicle Emission Test System

Chengdu Chengbao Development’s DCG-10DV Driving-mode Vehicle Emission Test System

Specifications of Chengdu Chengbao Development’s Driving-mode Vehicle Emission Test System (Heavy-duty Diesel Vehicle)

Chengdu Chengbao Development’s DCG-10DB riving-mode Vehicle Emission Test System

Revenue and Net Income of Shijiazhuang Huayan Traffic Technology, 2011-2015

Performance Parameters of Main Chassis Dynamometers of Shijiazhuang Huayan Traffic Technology

Shijiazhuang Huayan Traffic Technology’s Vehicle Dimension Measurement System

Specifications of Shijiazhuang Huayan Traffic Technology’s Vehicle Chassis Clearance Inspection Benches

Shijiazhuang Huayan Traffic Technology’s Roller Reaction-force Brake Inspection Bench

Specifications of Shijiazhuang Huayan Traffic Technology’s Power Absorption Device

Specifications of Shijiazhuang Huayan Traffic Technology’s Exhaust Analyzers

Specifications of Shijiazhuang Huayan Traffic Technology’s Opacimeters

Specifications of Shijiazhuang Huayan Traffic Technology’s Flow Analyzers

Main Products of Shenzhen Anche Technologies

Diagram of Shenzhen Anche Technologies’ Networked Monitoring System

Key Parts of Shenzhen Anche Technologies’ Vehicle Inspection System

Products and Customers of Shenzhen Anche Technologies

Main Products of Bosch Diagnostics

Main Products of Zhejiang Jiangxi Auto Inspection Equipment

Main Inspection Products of Cosber

Safety and General Performance Inspection Lines of Cosber

Cosber’s Pollutant Inspection System

Cosber’s KLFT Vehicle Off-Assembly-Line Inspection Series for Vehicle Manufacturing Plants

Main Vehicle Inspection Systems of Qingdao Hongsheng Automobile Testing Equipment

Major Domestic Marketing Offices of Qingdao Hongsheng Automobile Testing Equipment

Vehicle Inspection Products of Chengdu Iyasaka Technology Development

Main Equipment in Guangdong Automotive Test Center’s Vehicle Inspection Lab

Main Equipment in Guangdong Automotive Test Center’s Emission Inspection Lab

Main Equipment in Guangdong Automotive Test Center’s Parts Inspection Lab

Authorized Qualifications of Shanghai Motor Vehicle Inspection Center

Vehicle Inspection Contents of Shanghai Motor Vehicle Inspection Center

Main Equipment and Systems in Shanghai Motor Vehicle Inspection Center’s Vehicle Emission Lab

Main Equipment and Systems in Shanghai Motor Vehicle Inspection Center’s Engine Emission Lab

Main Inspection Systems in Shanghai Motor Vehicle Inspection Center’s Heavy-duty Vehicle Emission Lab

Emission Inspection Contents of Shanghai Motor Vehicle Inspection Center

Passive Safety Inspection Contents of Shanghai Motor Vehicle Inspection Center

Vehicle Parts Inspection Contents of Shanghai Motor Vehicle Inspection Center

New Energy Vehicle Inspection Contents of Shanghai Motor Vehicle Inspection Center

Major Inspection Qualifications of XiangyangDa’an Automobile Test Center

Major Test Sites of XiangyangDa’an Automobile Test Center

Compulsory Inspection Items Announcement of XiangyangDa’an Automobile Test Center

Inspection Items of National Motor Vehicle Quality Supervision and Inspection Center (Chongqing)

Qualifications of Hangzhou Automobile General Performance Testing Center

Main Inspection Businesses of Hangzhou Automobile General Performance Testing Center

Revenue and Net Income of Anhui Xiayang Motor Vehicle Inspection, 2012-2015

Revenue Structure of Anhui Xiayang Motor Vehicle Inspection by Business, 2012-2015

Revenue Structure of Anhui Xiayang Motor Vehicle Inspection by Region, 2014-2015

Major Safety Inspection Qualifications of Anhui Xiayang Motor Vehicle Inspection

Major Environmental Inspection Qualifications of Anhui Xiayang Motor Vehicle Inspection

Major Motor Vehicle Safety Inspection Items of Anhui Xiayang Motor Vehicle Inspection

Major Motor Vehicle Environmental Inspection Items of Anhui Xiayang Motor Vehicle Inspection

Revenue and Profit of Major Inspection Stations of Anhui Xiayang Motor Vehicle Inspection, 2015

Revenue and Net Income of Jiangsu Jiecheng Motor Vehicle Inspection, 2013-2015

Major Safety Inspection Qualifications of Jiangsu Jiecheng Motor Vehicle Inspection

Main Inspection Equipment of Jiangsu Jiecheng Motor Vehicle Inspection

Revenue and Net Income of Tangshan Jingdong Grand Health, 2013-2015

Revenue Structure of Tangshan Jingdong Grand Health by Business, 2013-2015

Major Safety Inspection Qualifications of Tangshan Jingdong Grand Health

Major Environmental Inspection Qualifications of Tangshan Jingdong Grand Health

Main Manufacturing Equipment and Inspection Lines of Tangshan Jingdong Grand Health

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...