China Heavy Truck Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,300

-

- Pages:100

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZJF089

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

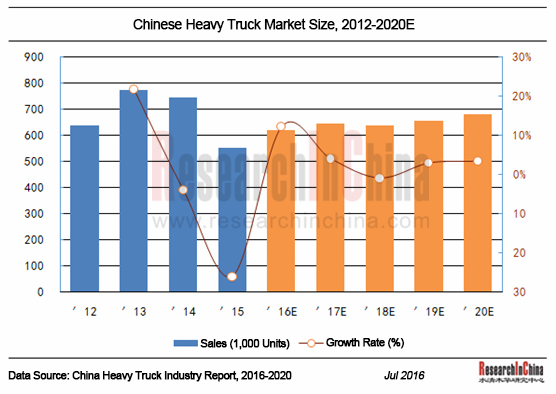

As China’s economic development now has entered the new normal, downward pressure on economy builds up and growth in fixed-asset investment slows, leading to a decline in the demand for construction heavy trucks whose sales came to 536,100 units in 2015, down 25.9% from a year earlier. A recovery of property sector in China from the beginning of 2016 drove up the demand for heavy trucks. 338,000 heavy trucks were sold in the first half of 2016, up 14% from a year ago. Full-year sales are expected to reach 618,000, a year-on-year rise of 12.2%.

Due to mixed factors of infrastructure investment increase, energy conservation & emission reduction, logistics transportation business growth and rising downside risks to the economy, China’s heavy truck industry will expand slightly during 2017-2020.

?

Chinese heavy truck market is highly concentrated with the top3 companies holding a combined market share of over 50%, top5 enterprises more than 80%, and top10 players around 97%. FAW Jiefang, China National Heavy Duty Truck Group (Sinotruk), and Dongfeng Motor are three leading companies in the Chinese heavy truck market with each having a more than 15% market share. FAW Jiefang has long been a champion in the semi-trailer tractor market, while Sinotruk and Dongfeng Motor hold the lion’s share of complete and incomplete heavy truck markets.

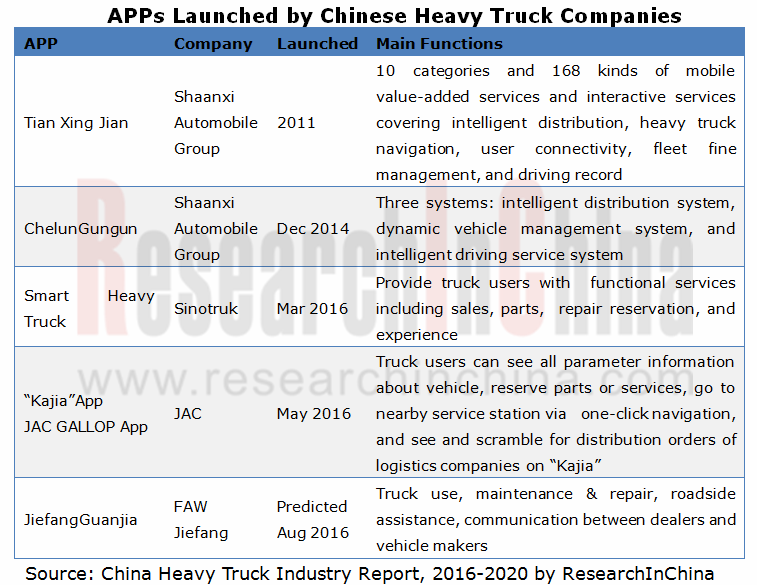

Heavy trucks will become larger and more intelligent in China: 13L large displacement and 500HP-above high-end tractors became available on the market in 2015 and will be the leading products over the next five years, such as X3000 golden version of Shaanxi Automobile, J6 series of FAW Jiefang, and flagship Tianlong of Dongfeng Motor. On the other hand, mainstream heavy truck manufacturers have come up with the concepts of “Internet+” and intelligent driving, put them into practice, delivering good social and economic benefits, like Sinotruk’s “Smart Heavy Truck” APP, FAW Jiefang’s “JiefangGuanjia” APP, and Mercedes-Benz’ first application of self driving in heavy truck. As market competition intensifies, heavy truck manufacturers will increase their input to differentiated products.

China Heavy Truck Industry Report, 2016-2020 by ResearchInChina focuses on the followings:

Overview of heavy truck industry in China (definition & classification, development trends, technology, industrial standards, etc.);

Overview of heavy truck industry in China (definition & classification, development trends, technology, industrial standards, etc.);

Chinese heavy truck market size (ownership, output & sales, import & export, competitive landscape, etc.);

Chinese heavy truck market size (ownership, output & sales, import & export, competitive landscape, etc.);

Market segments including complete/incomplete heavy truck and semi-trailer tractor (market size, competitive landscape, development trends, etc.);

Market segments including complete/incomplete heavy truck and semi-trailer tractor (market size, competitive landscape, development trends, etc.);

Related industrial chains (industrial chains, upstream raw materials, downstream investment & property development, etc.);

Related industrial chains (industrial chains, upstream raw materials, downstream investment & property development, etc.);

FAW Jiefang, Dongfeng Motor,Sinotruk, Foton Motor, Shaanxi Automobile, JAC, Hualing Automobile, Qingling Motors, Dayun Automobile, BEIBEN Trucks, SAIC-IVECO Hongyan, Tri-Ring Special Vehicle, Xugong Automobile, GAC Hino Motors, Feidie Automobile (profile, business performance, revenue structure, heavy truck business, development strategy, etc.)

FAW Jiefang, Dongfeng Motor,Sinotruk, Foton Motor, Shaanxi Automobile, JAC, Hualing Automobile, Qingling Motors, Dayun Automobile, BEIBEN Trucks, SAIC-IVECO Hongyan, Tri-Ring Special Vehicle, Xugong Automobile, GAC Hino Motors, Feidie Automobile (profile, business performance, revenue structure, heavy truck business, development strategy, etc.)

1 Overview of Heavy Truck Industry

1.1 Definition and Classification

1.2 Technology Introduction

1.3 Emission Standards

1.4 Product Trends

1.5 Self-driving and Telematics

1.5.1 Self-driving Truck

1.5.2 Truck Telematics

2 Overall Heavy Truck Market

2.1 Ownership

2.2 Output and Sales

2.2.1 Output

2.2.2 Sales

2.3 Market Structure

2.4 Competitive Landscape

2.5 Natural Gas Heavy Truck

2.5.1 Sales

2.5.2 Competitive Landscape

2.6 High-end Heavy Truck

3 Heavy Truck Market Segments

3.1 Complete Heavy Truck

3.1.1 Output and Sales

3.1.2 Import & Export

3.1.3 Competitive Landscape

3.2 Incomplete Heavy Truck

3.2.1 Output and Sales

3.2.2 Import & Export

3.2.3 Competitive Landscape

3.3 Semi-trailer Tractor

3.3.1 Output and Sales

3.3.2 Import & Export

3.3.3 Competitive Landscape

3.3.4 Market Segments

4 Heavy Truck Industry Chain

4.1 Overview

4.2 Key Components

4.2.1 Cost Structure

4.2.2 Supporting

4.3 Raw Materials Market

4.3.1 Steel Market

4.3.2 Rubber Market

4.4 Downstream Market

4.4.1 Infrastructure Construction

4.4.2 Property Development

4.4.3 Highway Freight

5 Key Companies

5.1 FAW Jiefang Automotive Company, Ltd.

5.1.1 Profile

5.1.2 Output and Sales

5.1.3 Launch of New Products

5.1.4 Production Bases

5.2 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK)

5.2.1 Profile

5.2.2 Operation

5.2.3 Heavy Truck Business

5.3 Dongfeng Motor Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Heavy Truck Business

5.3.4 Joint Venture between Dongfeng Motor and Volvo

5.3.5 Release of New Vehicles

5.4 BeiqiFoton Motor Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Heavy Truck Business

5.4.4 Production Capacity

5.4.5 Launch of Internet Super Heavy Truck

5.5 Shaanxi Automobile Group Co., Ltd.

5.5.1 Profile

5.5.2 Main Products

5.5.3 Heavy Truck Business

5.5.4 New Natural Gas Heavy Trucks

5.6 Anhui Jianghuai Automobile Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Heavy Truck Business

5.6.4 Launch of Intelligent APP for Heavy Truck

5.7 Anhui Hualing Automobile Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Heavy Truck Business

5.8 Qingling Motors (Group) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Heavy Truck Business

5.9 Chengdu Dayun Automobile Manufacturing Co., Ltd

5.9.1 Profile

5.9.2 Heavy Truck Business

5.10 BEIBEN Trucks Group Co., Ltd.

5.10.1 Profile

5.10.2 Heavy Truck Business

5.11 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd.

5.11.1 Profile

5.11.2 Heavy Truck Business

5.11.3 Sales Goal for 2016

5.12 Hubei Tri-ring Special Vehicle Co., Ltd.

5.12.1 Profile

5.12.2 Heavy Truck Business

5.12.3 Launch of High-end Intelligent Heavy Truck

5.13 Nanjing Xugong Automobile Manufacturing Co., Ltd.

5.13.1 Profile

5.13.2 Heavy Truck Business

5.13.3 Operation of Xuzhou Base

5.14 GAC Hino Motors Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Heavy Truck Business

5.15 Zhejiang Feidie Automobile Manufacturing Co., Ltd.

5.15.1 Profile

5.15.2 Heavy Truck Business

6 Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Competitive Landscape

6.4 Trends

Classification of Heavy Truck Industry

Technology Introduction of Key Heavy Truck Manufacturers in China

Schedule for Implementation of China’s Motor Vehicle National V Emission Standards

Comparison of China’s National IV and V Emission Standards

Policies and Regulations on Commercial Vehicle Telematics

Survey on Truck Telematics at Home and Abroad

China's Heavy Truck Ownership, 2005-2020E

China's Heavy Truck Output, 2005-2020E

China's Heavy Truck Sales Volume, 2005-2020E

China's Heavy Truck Output and Growth Rate by Product,2014-2016

China's Heavy Truck Sales Volume and Growth Rate by Product, 2014-2016

Sales Volume and Market Share of Top 10 Heavy Truck Enterprises in China, 2015-2016

Sales Volume of Natural Gas Heavy Trucks in China, 2014-2020E

Major Natural Gas Heavy Truck Manufacturers in China

High-end Heavy Truck Products Launched by Enterprises in China

China's Complete Heavy Truck Output and Sales Volume, 2005-2020E

China's Complete Heavy Truck Import Volume and Value, 2009-2016

China's Complete Heavy Truck Export Volume and Value, 2009-2016

Sales Volume and Market Share of Top 10 Complete Heavy Truck Manufacturers in China, 2015-2016

China's Incomplete Heavy Truck Output and Sales Volume, 2005-2020E

China's Incomplete Heavy Truck Import and Export Volume and Value, 2009-2016

Sales Volume and Market Share of Top 10 Incomplete Heavy Truck Enterprises in China, 2015-2016

China's Semi-trailer Towing Vehicle Output and Sales Volume, 2005-2020E

China's Semi-trailer Towing Vehicle Import and Export Volume and Value, 2009-2016

Sales Volume and Market Share of Top 10 Semi-trailer Towing VehicleManufacturers in China, 2015-2016

Market Structure of Semi-trailer Towing Vehicles in China, 2005-2020E

Output and Sales Volume of Semi-trailer Towing Vehicles (≤25 Tonnage)in China, 2005-2020E

Sales Volume and Market Share of Top 5 Semi-trailer Towing Vehicle (≤25 Tonnage) Manufacturers in China, 2015-2016

Output and Sales Volume of Semi-trailer Towing Vehicles (25-40 Tonnage) in China, 2005-2020E

Sales Volume and Market Share of Top 5 Semi-trailer Towing Vehicle (25-40 Tonnage) Manufacturers in China, 2015-2016

Output and Sales Volume of Semi-trailer Towing Vehicles (>40 Tonnage) in China, 2005-2020E

Sales Volume and Market Share of Semi-trailer Towing Vehicles (>40 Tonnage) in China by Enterprise, 2015-2016

Automotive Industry Chain

Cost Structure of Heavy Truck Industry

Transmission Supply of Major Heavy Truck Manufacturers in China

China's Galvanized Sheet (Strip) Output and Sales Volume, 2005-2016

China's (Shanghai) Galvanized Coil Price, 2013-2016

China's Cold-rolled Thin Sheet Output and Sales Volume, 2005-2016

China's (Shanghai) Cold-rolled Coil Price, 2013-2016

China's Natural Rubber Spot and Future Price, 2013-2016

China's Investment in Fixed Assets, 2005-2016

China's Investment in Real Estate Development, 2005-2016

China's New Housing Start Area and Sales Area, 2005-2016

China's Highway Freight Volume and Turnover, 2005-2016

FAW Jiefang’s Heavy Truck Output and Sales Volume, 2009-2016

Sinotruk’s Revenue and Net Income, 2010-2016

Sinotruk’s Gross Margin, 2010-2016

Sinotruk’s Revenue Structure by Business, 2015

Sinotruk’s Heavy Truck Product Family Genealogy

Sinotruk’s Main Product Configuration

Sinotruk's Heavy Truck Output and Sales Volume,2009-2016

Dongfeng Motor's Revenue and Net Income, 2010-2016

Dongfeng Motor's Gross Margin, 2010-2016

Dongfeng Motor's Revenue from Major Regions, 2013-2015

Dongfeng Motor's Heavy Truck Output and Sales Volume, 2009-2016

Foton's Revenue and Net Income, 2010-2016

Foton's Gross Margin, 2010-2016

Foton's Revenue and Gross Margin by Business, 2013-2015

Foton's Heavy Truck Output and Sales Volume, 2009-2016

Capacity of Beijing Foton Daimler, 2015

Main Heavy Trucks of Shaanxi Automobile Group

Shaanxi Automobile Group’s Heavy Truck Output and Sales Volume, 2009-2016

JAC’s Revenue and Net Income, 2010-2016

JAC’s Gross Margin, 2010-2016

JAC's Overseas Revenue and % of Total Revenue, 2009-2015

JAC’s Heavy Truck Output and Sales Volume, 2009-2016

Hualing Automobile’s Assets and Net Income, 2012-2015

CAMC’s Products Series

Hualing Automobile’s Heavy Truck Output and Sales Volume, 2014-2016

Qingling Motors’ Revenue and Net Income, 2010-2015

Qingling Motors’ Gross Margin, 2010-2015

Qingling Motors’ Heavy Truck Output and Sales Volume, 2009-2016

Dayun Automobile’s Heavy Truck Output and Sales Volume, 2009-2016

BEIBEN Trucks’ Heavy Truck Output and Sales Volume, 2009-2016

SAIC-IVECO Hongyan’s Heavy Truck Output and Sales Volume, 2009-2016

SAIC-IVECO Hongyan’s Sales Target, 2016

Schedule for Launch of New Heavy Trucks of SAIC-IVECO Hongyan

Main Heavy Truck Products of Tri-Ring Special Vehicle

Tri-Ring Special Vehicle’s Heavy Truck Output and Sales Volume, 2009-2016

Xugong Automobile’s Heavy Truck Output and Sales Volume, 2009-2016

GAC Hino Motors’s Assets, Liabilities, and Revenue, 2012-2015

GAC Hino Motors’s Heavy Truck Output and Sales Volume, 2009-2016

Feidie Automobile’s Heavy Truck Output and Sales Volume, 2009-2016

Growth Rate of Heavy Truck Sales in China, 2006-2020E

China's Heavy Truck Market Structure, 2005-2020E

China's Heavy Truck Market Concentration, 2009-2016

Market Share of Major Heavy Truck Manufacturers in China, 2009-2016

Intelligent Application System of Some Chinese Heavy Truck Manufacturers

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...