China NVH (System, Parts, Materials) Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,600

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,450

-

- Code:

HK073

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,800

-

NVH stands for noise, vibration, and harshness, and the noise is what the driver and passengers can hear, the vibration is what they can feel and the harshness is how much of an effect thumps, bumps, noise and vibration have on the cabin and its occupants. It is an aggregative indicator with which to measure the quality of automobile manufacturing. As many as one-third vehicle faults are related to the NVH of vehicles.

Automotive NVH parts can fall into shock absorber products and noise reduction products, of which the former includes rubber shock absorber products and spring damping shock absorbers while the latter consists of sound insulation products and sealing products.

1.Rubber Shock Absorber Product Market

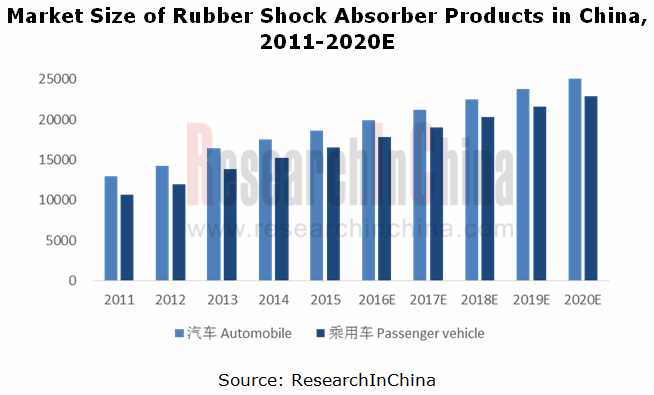

In recent years, with the rapid growth of automobile output in China, the market size of rubber shock absorber products has kept expanding, to reach RMB18.635 billion in 2015; wherein the proportion of OEM market came to 74% and AM market 26%. China’s automobile industry will enter a stage of low-speed growth during 2016-2020, when the growth rate of shock absorber product market will also slow down to around 6%.

At present, there are only 50 or so rubber shock absorber product manufacturers in China that have entered OEM passenger vehicle market. Moreover, few enterprises have the capability of synchronous R&D, system integration and supply, and thus some high-grade rubber shock absorber products have to be imported from overseas. Major enterprises include Tuopu Group, Anhui Zhongding Damping Rubber Technology Co., Ltd., and JX Zhao’s Group Corp.

2.Sound Insulation Products Market

In 2015, the market size of sound insulation products (mainly used in OEM market) in China totaled about RMB22.05 billion. As the output of automobiles grows, the figure is expected to reach RMB 28.31 billion in 2020.

Given the fact that sound insulation products have relatively low technical requirements, the Chinese enterprises can basically meet the supplying demand from domestic automobile manufacturers, with adequate market competition. At present, there are more than 100 sound insulation product producers in China, mainly including Tuopu Group, Changshu Automotive Trim, as well as Shanghai Car Carpet Plant.

It is crucial for Automotive NVH parts manufacturers to have the capacity of synchronous R&D and system integration. Currently, China is relatively weak in system integration, and only a few domestic enterprises such as Tuopu Group,Anhui Zhongding Sealing Parts and Zhuzhou Times New Material Technology have certain competence of development and system integration.

Tuopu Group has more powerful NVH system integration capability, successively participating in the synchronous research and development of auto makers including Shanghai GM, Chrysler, BMW, Audi, Volvo, SAIC, Changan Ford, and Changan Auto. Meanwhile, the company has also established long-term cooperative relationship with world-renowned automotive system integration providers like Valeo, Faurecia, and Benteler.

Zhongding Holding and Zhuzhou Times New Material Technology achieved an increase in value of product and technology by acquiring foreign companies with comparative advantages in automotive NVH. For example, Zhuzhou Times New Material Technology acquired BOGE, the world’s third largest NVH supplier; Anhui Zhongding Sealing Parts has in recent years purchased AB, BRP, MRP, COOPER, KACO, and WEGU.

The report is primarily concerned with the following:

Development, system integration, competitive landscape, and development trend of automotive NVH market in China;

Development, system integration, competitive landscape, and development trend of automotive NVH market in China;

Market size, competitive landscape, and development prospects of automotive NVH market in China, including rubber shock absorber product, sound insulation products, and sealing products;

Market size, competitive landscape, and development prospects of automotive NVH market in China, including rubber shock absorber product, sound insulation products, and sealing products;

Supply and demand, import and export, and price trend of raw materials, including rubber, PU, PP, and PE;

Supply and demand, import and export, and price trend of raw materials, including rubber, PU, PP, and PE;

Development, industry operation, and import and export of downstream auto parts industry;

Development, industry operation, and import and export of downstream auto parts industry;

Output and sales, development trend of downstream automobile industry;

Output and sales, development trend of downstream automobile industry;

Profile, NVH business, supported customers, and operation of 10 automotive NVH parts manufacturers in China.

Profile, NVH business, supported customers, and operation of 10 automotive NVH parts manufacturers in China.

1 Overview of NVH

1.1 Definition

1.2 Classification

1.3 Production Technology

1.3.1 Shock Absorber Products

1.3.2 Sound Insulation Products

1.4 Industry Chain

2 Overview of NVH Market

2.1 Industry Policy

2.2 Development

2.3 System Integration

2.3.1 Global Market

2.3.2 Chinese Market

2.4 Competitive Landscape

2.5 Industry Barrier

2.6 Development Trend

3 NVH Parts Market

3.1 Rubber Shock Absorber Products

3.1.1 Overview

3.1.2 Market Size

3.1.3 Competitive Landscape

3.2 Sound Insulation Products

3.2.1 Overview

3.2.2 Market Size

3.2.3 Competitive Landscape

3.2.4 Development Trend

3.3 Seal Products

3.3.1 Market Size

3.3.2 Competitive Landscape

4 Upstream Raw Material Market

4.1 Rubber

4.1.1 Rubber Products

4.1.2 Natural Rubber

4.1.3 Synthetic Rubber

4.2 Polyurethane

4.2.1 Global Market

4.2.2 Chinese Market

4.3 Polypropylene

4.4 Polyethylene

5 Downstream Demand Market

5.1 Auto Parts Market

5.1.1 Industry Characteristics

5.1.2 Development

5.1.3 Industry Operation

5.1.4 Import and Export

5.2 Automobile Market

5.2.1 Global

5.2.2 China

6 Key Chinese NVH Enterprises

6.1 Tuopu Group

6.1.1 Profile

6.1.2 Industrial Layout

6.1.3 Products, Technologies, and Solutions

6.1.4 NVH Business

6.1.5 Supported Customers

6.1.6 Suppliers

6.1.7 R&D

6.1.8 Product Production and Sales

6.1.9 Core Competitiveness

6.1.10 Operation

6.2 Anhui Zhongding Sealing Parts Co., Ltd.

6.2.1 Profile

6.2.2 Industrial Layout

6.2.3 R&D

6.2.4 Denotative Expansion

6.2.5 Zhongding Damping Rubber Technology Co., Ltd..

6.2.6 Operation

6.3 Zhuzhou Times New Material Technology Co., Ltd.

6.3.1 Profile

6.3.2 Industrial Layout

6.3.3 Products, Technologies, and Solutions

6.3.4 Customers

6.3.5 NVH Business

6.3.6 Operation

6.4 Wuhu Yuefei Sound-absorbing New Materials Co., Ltd.

6.4.1 Profile

6.4.2 Industrial Layout

6.4.3 Products, Technologies, and Solutions

6.4.4 R&D

6.4.5 Supported Customers

6.4.6 Suppliers

6.4.7 NVH Business

6.4.8 Operation

6.5 Changshu Automotive Trim Co., Ltd.

6.5.1 Profile

6.5.2 Industrial Layout

6.5.3 Product and Supported Customers

6.5.4 Operation

6.6 ASIMCO NVH Technologies Co., Ltd. (Anhui)

6.6.1 Profile

6.6.2 Industrial Layout

6.6.3 Supported Customers

6.7 JX Zhao’s Group Corp.

6.7.1 Profile

6.7.2 Development History

6.7.3 Product and Supported Customers

6.8 Shanghai Car Carpet Plant Co., Ltd.

6.8.1 Profile

6.8.2 Industrial Layout

6.8.3 Product and Supported Customers

6.8.4 Operation

6.9 Huayu-Cooper Standard Sealing Systems Co., Ltd.

6.9.1 Profile

6.9.2 Product and Supported Customers

6.10 Beijing Wanyuan-Henniges Sealing Systems Co., Ltd.

6.10.1 Profile

6.10.2 Supported Customers

Transfer Path of Automotive Noise and Vibration

Classification of Automotive NVH Parts

NVH Industry Chain

Policies on Automotive NVH Industry in China

Development of NVH at Home and Abroad

NVH Development of Auto Makers in China

Revenue of Global Top 10 Auto Parts Manufacturers, 2015

Automotive Rubber Shock Absorber Products

OEM Market Capacity of NVH Rubber Shock Absorber Products in China, 2011-2020E

AM Market Capacity of NVH Rubber Shock Absorber Products in China, 2011-2020E

Market Size of Rubber Shock Absorber Products in China, 2011-2020E

Major Rubber Shock Absorber Product Manufacturers in China, 2015

Auto Body Parts Equipped with Sound Insulation Products

Classification of Automotive Sound Insulation Products

Introduction to Main Automotive Sound Insulation Products

Comparison of Commonly-used Automotive Sound Insulation Materials

OEM Market Capacity of NVH Sound Insulation Products in China, 2011-2020E

Major Sound Insulation Products Manufacturers in China, 2015

Market Capacity of NVH sealing products in China, 2011-2020E

Major Chinese Seal Manufacturers and Their Supported Customers, 2015

Classification of Rubber Products

Overview of Main Automotive Non-tire Rubber Products

Global Top10 Non-tire Rubber Product Manufacturers and Their Sales, 2014

Output and Consumption of Natural Rubber in China, 2009-2015

Market Price of Natural Rubber (Standard Rubber and SCRWF) in China, 2015-2016

Output and Apparent Consumption of Synthetic Rubber in China, 2009-2015

China’s Synthetic Rubber Import and Export Volume, 2009-2015

Polyurethane Products and Their Raw Materials and Applications

Global Polyurethane Product Demand, 2010-2015

Global Product Mix of Polyurethane Products by Demand, 2015

Global Regional Distribution of Polyurethane Products by Output, 2015

Global Automotive PolyurethaneMarket Size, 2010-2015

China’s Polyurethane Product Demand and YoY Growth, 2009-2015

Product Mix of Polyurethane Products in China by Demand, 2015

Market Size of Automotive Polyurethane in China, 2010-2015

Import and Export Volume of Polyurethane Resin in China, 2010-2015

Capacity of PP Facilities in China, 2006-2015

PP Output and Apparent Consumption in China, 2009-2015

China’s PP Import and Export Volume, 2009-2015

Market Price for PP (T30S) in China, 2014-2016

PE Output and Apparent Consumption in China, 2009-2015

China’s PE Import and Export Volume, 2009-2015

Market Price for PE in China, 2014-2016

Classification of Auto Parts

Difference Between OEM and AM Markets

OEM Auto Parts Supplier System

Supported Parts for Different Auto Brands

Operating Revenue and Growth Rate of Auto Parts in China, 2006-2015

Total Profits and Growth Rate of Auto Parts in China, 2006-2015

Import and Export Value of Auto Parts in China, 2013-2015

Global Automobile Output and Sales Volume, 2009-2015

China’s Automobile Output and Sales Volume, 2009-2015

Passenger Vehicle Ownership in China per Thousand Persons, 2009-2015

Tuopu’s Industrial Layout Worldwide

Tuopu’s Member Enterprises and Production Capacity

Tuopu’s Major Subsidiaries, 2015

Revenue and Net Income of Tuopu’s Major Subsidiaries, 2015

Distribution of Tuopu’s Automotive Rubber Shock Absorber Products in Vehicles

Distribution of Tuopu’s Automotive Sound Insulation Products in Vehicles

Revenue of Tuopu by Product, 2014-2015

Revenue Structure of Tuopu by Product, 2014-2015

Revenue of Tuopu by Region, 2013-2015

Revenue Structure of Tuopu by Region, 2013-2015

Gross Margin of Tuopu by Product, 2014-2015

Tuopu’s Major Customers

Tuopu’s Market Distribution and Supported Customers in China

Tuopu’s Global Market Distribution and Supported Customers

Tuopu’s Revenue from Top 5 Customers and % of Total Revenue, 2013-2015

Name List and Revenue Contribution of Tuopu’s Top 5 Customers, 2014

Name List and Revenue Contribution of Tuopu’s Top 5 Customers by Rubber Shock Absorber Products, 2014

Tuopu’s Sound Insulation Products and Supply Relationship, 2014

Tuopu’s New Orders from Shanghai GM, 2015-2017

Tuopu’s Production Cost Structure of Rubber Shock Absorber Products, 2012-2014

Tuopu’s Production Cost Structure of Sound Insulation Products, 2012-2014

Tuopu’s Procurement from Top 5 Suppliers and % of Total Procurement,2013-2015

Tuopu’s Top 5 Suppliers

Name List and Procurement of Tuopu’s Top 5 Suppliers and % of Total Procurement, 2014

Tuopu’s R&D Costs and % of Total Revenue, 2013-2015

NVH Product Market Share of Tuopu, 2012-2014

Tuopu’s Rubber Shock Absorber Product Capacity and Output, 2012-2014

Tuopu’s Sound Insulation Products Capacity and Output, 2012-2014

Output, Sales Volume, and Growth Rate of Tuopu’s Main Products, 2015

Average Prices of Tuopu’s Rubber Shock Absorber Products and Sound Insulation Products, 2012-2014

Revenue and Net Income of Tuopu, 2011-2015

R&D Costs and % of Total Revenue of Anhui Zhongding Sealing Parts, 2013-2015

Denotative Expansion of Anhui Zhongding Sealing Parts, 2008-2015

Revenue and Net Income of Zhongding Damping Rubber Technology, 2011-2015

Revenue and Net Income of Anhui Zhongding Sealing Parts, 2011-2015

Revenue Structure of Anhui Zhongding Sealing Parts by Product, 2013-2015

Revenue Structure of Anhui Zhongding Sealing Parts by Region, 2013-2015

Main Production Bases and Capacity of Zhuzhou Times New Material Technology, 2015

Major Automotive Products of Zhuzhou Times New Material Technology

Main Business Segments and Customers of Zhuzhou Times New Material Technology

Automobile Revenue of Zhuzhou Times New Material Technology, 2013-2015

Revenue and Net Income of Zhuzhou Times New Material Technology, 2011-2015

Revenue Structure of Zhuzhou Times New Material Technology by Product, 2013-2015

Revenue Structure of Zhuzhou Times New Material Technology by Region, 2013-2015

Industrial Layout of Wuhu Yuefei Sound-absorbing New Materials

Subsidiaries of Wuhu Yuefei Sound-absorbing New Materials, 2015

Revenue and Net Income of Subsidiaries of Wuhu Yuefei Sound-absorbing New Materials, 2015

Wuhu Yuefei Sound-absorbing New Materials’ Two-component Sound-absorbing Cotton Application in Automobile

Wuhu Yuefei Sound-absorbing New Materials’ PET Upright Cotton Application in Automobile PET

Foamed Polyethylene Insulation Pad Products of Wuhu Yuefei Sound-absorbing New Materials

R&D Costs and % of Total Revenue of Wuhu Yuefei Sound-absorbing New Materials, 2013-2015

Revenue from Top 5 Customers and % of Total Revenue of Wuhu Yuefei Sound-absorbing New Materials, 2013-2015

Name List and Revenue Contribution of Top 5 Customers of Wuhu Yuefei Sound-absorbing New Materials, 2015

Wuhu Yuefei Sound-absorbing New Materials’ Procurement from Top 5 Suppliers and % of Total Procurement, 2013-2015

Name List and Procurement of Wuhu Yuefei Sound-absorbing New Materials’ Top 5 Suppliers and % of Total Procurement, 2015

Revenue of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue Structure of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue of Wuhu Yuefei Sound-absorbing New Materials by Region, 2013-2015

Revenue Structure of Wuhu Yuefei Sound-absorbing New Materials by Region, 2013-2015

Gross Margin of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue and Net Income of Wuhu Yuefei Sound-absorbing New Materials, 2013-2015

Main Products of Changshu Automotive Trim

Major Customers of Changshu Automotive Trim

Revenue and Net Income of Changshu Automotive Trim, 2013-2015

Revenue Structure of Changshu Automotive Trim by Product, 2013-2015

Global Industrial Layout of ASIMCO

Development History of JX Zhao’s Group

Supported Auto Makers of JX Zhao’s Group

Parts Integrators of JX Zhao’s Group

Production Base Distribution of Shanghai Car Carpet Plant

Joint Venture Distribution of Shanghai Car Carpet Plant

Main Product Range of Shanghai Car Carpet Plant

Total assets and Net income of Shanghai Car Carpet Plant, 2013-2015

Major Customers and Their Vehicle Models of Beijing Wanyuan-Henniges Sealing Systems

Customer Distribution of Beijing Wanyuan-Henniges Sealing Systems

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...