China Passenger Car Telematics Industry Report, 2016-2020

-

Aug.2016

- Hard Copy

- USD

$2,400

-

- Pages:187

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LKE001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

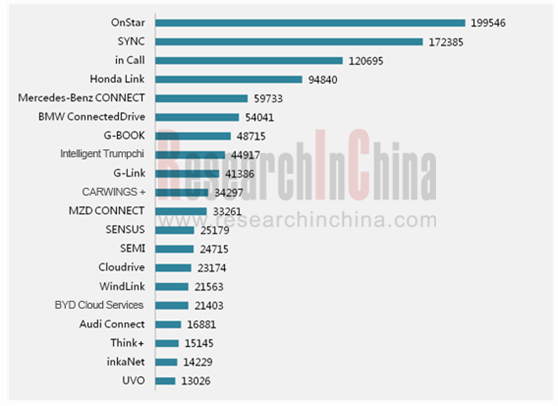

Telematics pre-installations on passenger cars totaled 1.15 million units in China during Jan-May 2016, up 27.8% compared with the same period of the previous year and representing a penetration rate of 12.54%. OnStar rank first with a share of 17.4%, followed by SYNC and In Call. It is worth noting that Chang’anIn Call joined the top three as a self-owned brand, seizing a share of 10.4%. Pre-installations are expected to amount to 2.2 million vehicles in the Chinese market in 2016, creating a market size of over RMB20 billion and marking a penetration rate of 14%. The Chinese Telematics market is expected to exceed RMB50 billion with a penetration rate of above 30% in 2020.

Pre-installations of Major Telematics Brands in the Chinese Passenger Car Market, Jan-May 2016

Source: China Passenger Car Telematics Industry Report, 2015-2018

In 2016, along with Chinese passenger car OEMs’ stepped-up efforts for marketing of Telematics system, wider use of mobile connect (Carplay, Carlife, Android Auto) and 4G LTE technologies and continuous addition & optimization of Telematics entertainment and internet connection deliver better customer experience. Interactive speech/HUD projection and active safety ADAS will find more and more infused applications on in-vehicle terminals; large-screen rearview mirror (transition from mainstream 5-inch to 8/10-inch) and large (vertical)-screen dashboard are increasingly favored by customers; mobile connect functions like social apps, navigation, games, entertainment are reflected more and more in in-vehicle terminal system.

Although the Chinese Telematics market has grown at a CAGR of over 25% in recent years, there are still a lot of problems, such as vague Telematics profit model and low renewal rate of consumer terminals for OEM TSP and attempts of transformation by relying on original OEM business by PATEO and China TSP and continuous searching for consumers’ pain points in Afertermark by LAUNCH and Carsmart.

China Passenger Car Telematics Industry Report, 2016-2020 focuses on the followings:

Overview of Telematics (national policies, favorable factors and obstacles, the Chinese Telematics market size, structure of industrial chain, market value chain, market participants, major solutions, etc.);

Overview of Telematics (national policies, favorable factors and obstacles, the Chinese Telematics market size, structure of industrial chain, market value chain, market participants, major solutions, etc.);

Chinese Telematics market (Telematics (by price/auto model/OEM/Telematics brand) pre-installations and penetration on passenger cars, auto makers and models supported by major Telematics brands, major Telematics brands (safety, navigation, connect/entertainment, charges), etc.);

Chinese Telematics market (Telematics (by price/auto model/OEM/Telematics brand) pre-installations and penetration on passenger cars, auto makers and models supported by major Telematics brands, major Telematics brands (safety, navigation, connect/entertainment, charges), etc.);

China-based JV OEMs’ Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC-GMOnStar/MyLink, Toyota G-BOOK, HondaLink/Honda CONNECT, Volvo SENSUS/Volvo On Call, Chang’an Ford SYNC, Dongfeng Nissan CARWINGS+/Nismo Watch, DongfengYueda KiaUVO, Dongfeng Citro?n Connect, Dongfeng PeugeotBlue-i, Beijing Mercedes-Benz CONNECT, Beijing Hyundai BlueLink, and BMW BrillianceConnectedDrive);

China-based JV OEMs’ Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC-GMOnStar/MyLink, Toyota G-BOOK, HondaLink/Honda CONNECT, Volvo SENSUS/Volvo On Call, Chang’an Ford SYNC, Dongfeng Nissan CARWINGS+/Nismo Watch, DongfengYueda KiaUVO, Dongfeng Citro?n Connect, Dongfeng PeugeotBlue-i, Beijing Mercedes-Benz CONNECT, Beijing Hyundai BlueLink, and BMW BrillianceConnectedDrive);

Local Chinese OEMs’Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC MotorinkaNet, Chang’an In Call, Geely AutomobileG-Netlink/G-Link, and Chery AutomobileCloudrive);

Local Chinese OEMs’Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC MotorinkaNet, Chang’an In Call, Geely AutomobileG-Netlink/G-Link, and Chery AutomobileCloudrive);

Chinese Telematics companies (customers, revenue, revenue structure, and product areas of Navinfo, LAUNCH, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Carsmart, Beijing YESWAY Information Technology, and AutoNavi, etc.)

Chinese Telematics companies (customers, revenue, revenue structure, and product areas of Navinfo, LAUNCH, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Carsmart, Beijing YESWAY Information Technology, and AutoNavi, etc.)

1 Overview of Telematics

1.1 National Policies for Developing Telematics

1.2 Obstacles and Stimuli to China’s Telematics Industry

1.3 Development Trends in the Chinese Telematics

1.4 Three Major Trends of Onboard Terminals

1.5 China’s Telematics Industry Scale Expected to Reach RMB21 Billion in 2016

1.6 China’s Telematics Penetration Expected to Exceed 14% in 2016

1.7 China’s Telematics Industry Chain and Market Participants

1.8 Structure of Telematics Industry Chain

1.8.1 Telematics Industry Chain-Automobile Manufacturing

1.8.2 Telematics Industry Chain-Automotive Semiconductor

1.8.3 Telematics Industry Chain-Onboard Electronics

1.8.4 Telematics Industry Chain - Software, Applications and Services

1.9 Telematics System Architecture

1.10 Value Chain of Telematics Market

1.11 Major Telematics Market Participants

1.12 Main Solutions for Telematics

1.13 Main Solutions for OEM Telematics

2 Development of China’s Telematics Market

2.1 Cumulative Pre-installation and Penetration of Passenger Car Telematics in China, 2016

2.2 Monthly Connected Pre-installation (units) and Penetration of Passenger Car Telematics in China, 2016

2.3 Installation Rate of Telematics Installed in New Passenger Cars in China, 2016

2.4 Installation Rate of Telematics Installed in Vehicles for Sale in China as of May 2016

2.5 Number of All Models for Sale in China Equipped with Telematics as of May 2016

2.6 Percentage of Models for Sale in China Equipped with Telematics by Price as of May 2016

2.7 Pre-installation of Telematics System in China, 2016-2020E

2.8 Installation Rate of New Vehicles Released in China by Price in the First Five Months of 2016

2.9 Installation Rate of New Vehicles Released in China by OEM in the First Five Months of 2016

2.10 Cumulative Pre-installation of Major Telematics Brands in China in the First Five Months of 2016

2.11 Supporting of Telematics Brands in the Chinese Automobile Market

2.12 Main Telematics Brands

2.12.1 Comparison: Safety Protection Functions

2.12.2 Comparison: Navigation Functions

2.12.3 Comparison: Interconnection and Entertainment Functions

2.12.4 Comparison: Charge Packages

3 Research on Telematics of Joint-ventured OEMs in China

3.1 SAIC-GM

3.1.1 Development History of GM Onstar

3.1.2 Introduction to Onstar Services

3.1.3 Onstar Charge Packages

3.1.4 Technology Roadmap for Onstar

3.1.5 Functions and Parameters of MyLink 2.0

3.1.6 New Onstar Users in Chinses Passenger Car Market, Jan.-May 2016

3.2 Toyota

3.2.1 Comparison of Mobile Phone Connected G-BOOK and DCM Connected G-BOOK

3.2.2 New G-BOOK Users in China, Jan.-May 2016

3.3 Honda

3.3.1 Functions and Services of HondaLink

3.3.2 Honda’s New-Generation Telematics Honda CONNECT

3.3.3 New Honda CONNECT Users in China, Jan.-May 2016

3.3.4 New HondaLink Users in China, Jan.-May 2016

3.4 Volvo

3.4.1 Functions and Services of Sensus Connect

3.4.2 Functions and Services of Volvo On Call

3.4.3 New Sensus Users in China, Jan.-May 2016

3.5 Chang'an Ford

3.5.1 Functions and Services of SYNC

3.5.2 New SYNC Users in China, Jan.-May 2016

3.6 Dongfeng Nissan

3.6.1 Functions and Services of CARWINGS Zhixing+

3.6.2 Functions and Parameters of Nismo Watch

3.6.3 New CARWINGS Zhixing+ Users in China, Jan.-May 2016

3.7 DongfengYuedaKia

3.7.1 UVO System Services

3.7.2 UVO Packages

3.7.3 New UVO Users in China, Jan.-May 2016

3.8 Dongfeng Citro?n

3.8.1 Functions and Services of Citro?n Connect

3.8.2 New Citro?n Connect Users in China, Jan.-May 2016

3.9 Dongfeng Peugeot

3.9.1 Functions and Services of Blue-i System

3.9.2 New Blue-i Users in China, Jan.-May 2016

3.10 Beijing Benz

3.10.1 Functions and Services of Mercedes-Benz CONNECT

3.10.2 New Mercedes-Benz CONNECT Users in China, Jan.-May 2016

3.11 Beijing Hyundai

3.11.1 BlueLink Charge Packages

3.11.2 Services of Blue Link System

3.11.3 New Blue Link Users in China, Jan.-May 2016

3.12 BMW Brilliance

3.12.1 Functions and Services of ConnectedDrive

3.12.2 New ConnectedDrive Users in China, Jan.-May 2016

4 Research on OEM Telematics in China

4.1 SAIC Motor

4.1.1 Functions and Services of inkaNet

4.1.2 inkaNet Charge Packages

4.1.3 New inkaNet Users in China, Jan.-May 2016

4.2 Changan Automobile

4.2.1 Functions and Services of In Call

4.2.2 Models Supported by In Call System and Charge Packages

4.2.3 New In Call Users in China, Jan.-May 2016

4.3 Geely Automobile

4.3.1 Functions and Services of G-Netlink and G-Link

4.3.2 Growth of G-Netlink/ G-Link Users in China

4.4 Chery Automobile

4.4.1 Profile of Cloudrive

4.4.2 Growth of Cloudrive Users in China

5. Chinese Telematics Companies

5.1 NavInfo Co., Ltd.

5.1.1Operating Results, 2014-2015

5.1.2 Operating Results by Sector, 2014-2015

5.1.3 Research and Analysis -- R & D Investment

5.1.4 Top 5 Customers

5.1.5 Top 5 Suppliers

5.1.6 Research and Analysis -- Acquisition Modes of Geographic Information Resources

5.1.7 Subsidiary: Beijing Mapbar Science and Technology Co., Ltd.

5.1.8 Subsidiary: China Satellite Navigation and Communications Co., Ltd.

5.1.9 Product Analysis -- Aerohuanyou Vehicle information Comprehensive Service Platform

5.1.10 Product Analysis -- WeDrive3.0

5.1.11 Strategic Cooperation Framework Agreement with Neusoft

5.1.12 Research and Analysis -- Product Analysis: Chip Optimization - WeLink Program

5.2 LAUNCH Tech Company Limited

5.2.1 Revenue and YoY Growth, 2009-2015

5.2.2 Net Income and YoY Growth, 2009-2015

5.2.3 Revenue Structure (by Product), 2009-2015

5.2.4 R&D Costs and % of Total Revenue, 2009-2015

5.2.5 Latest News

5.3 PATEO

5.3.1 Related Companies

5.3.2 Business Positioning

5.3.3 Product Platform System

5.3.4 Core Technologies and Architecture

5.3.5 Product HMI Features

5.3.6 Telematics Business

5.3.7 Application Cases

5.3.8 Latest News

5.4 WirelessCar

5.4.1 Application Case -Volvo On Call

5.4.2 Application Case - Nissan Infiniti InTouch and new Nissan Connect

5.4.3 Application Case - QorosQloud

5.5 China TSP

5.5.1 Product Structure

5.5.2 Product Application

5.5.3 Application Cases

5.6 TimaNetworks

5.6.1 Three Functions of CarNet Telematics Solutions in Aftermarket

5.6.2 Comparison with Counterpart Telematics System Products

5.6.3 Product Application Structure

5.6.4 Main Function Modules of Products

5.7 Careland

5.7.1 Revenue and Net Income, 2012-2015

5.7.2 R & D Investment, 2012-2015

5.7.3 Revenue Distribution, 2014 & 2015

5.7.4 M330 Networked Intelligent Rearview Mirror Navigation

5.8 Beijing Carsmart Technology Co., Ltd

5.8.1 Revenue and YoY Growth, 2010-2015

5.8.2 Revenue Structure (by Business), 2011-2015

5.8.3 Autofun and UBI Business

5.8.4 Autofun

5.9 YESWAY

5.9.1 Customers

5.9.2 Revenue and YoY Growth, 2011-2015

5.9.3 Net Income and YoY Growth, 2011-2015

5.9.4 OEM Telematics Services

5.9.5 Aftermarket Telematics Services

5.9.6 Intelligent Driving Services

5.9.7 Revenue Structure (by Business), 2011-2015

5.9.8 Gross Margin and R & D Investment, 2011-2015

5.9.9 Revenue from Top 5 Customers, 2013-2015

5.9.10 Latest News

5.9.11 Y-CONNECT is Intelligent Driving Interconnected System

5.10 AutoNavi

5.10.1 R & D Investment in FY2007-FY2014

5.10.2 Revenue by Product, FY2008-FY2014

5.10.3 Operating Results, FY2007-FY2014

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...