Global and China HD Map Industry Report, 2016

-

Sep.2016

- Hard Copy

- USD

$2,400

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

SK005

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China HD Map Industry Report, 2016 by ResearchInChina is mainly concerned with the following:

Acquisition modes and technical analysis of HD maps;

Acquisition modes and technical analysis of HD maps;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global HD maps, including status quo, layout, and development trends;

Market situation of global HD maps, including status quo, layout, and development trends;

HD map industry chain, involving lidar, cameras, positioning systems, IMU, and algorithms, etc.;

HD map industry chain, involving lidar, cameras, positioning systems, IMU, and algorithms, etc.;

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

At present, there are mainly four types of enterprises that dominate the layout in the HD map field: internet firms, auto makers, sensor vendors, and digital map providers.

I) Internet Firms

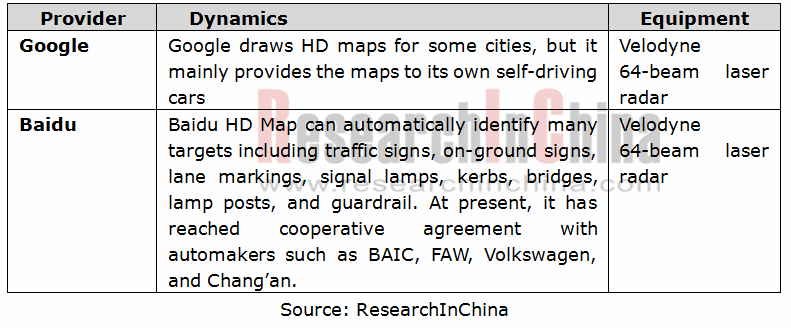

Internet tycoons like Google and UBER have, through acquisitions, obtained map data resources before producing HD maps based on their own algorithms and cloud computing capabilities. Google acquired a large number of digital map providers like Keyhole, Skybox, and Waze. In China, however, ground mapping is a highly confidential sector and therefore sets a higher entry threshold, which gives a big advantage to the Chinese digital map providers and turns away foreign players. Currently, there are 166 internet companies with mapping qualifications in China, and Internet giants like Baidu and Alibaba have through acquisitions occupied an important position in the Chinese map industry. Among them, Baidu purchased RITU and Alibaba bought AutoNavi.

II) Auto Makers

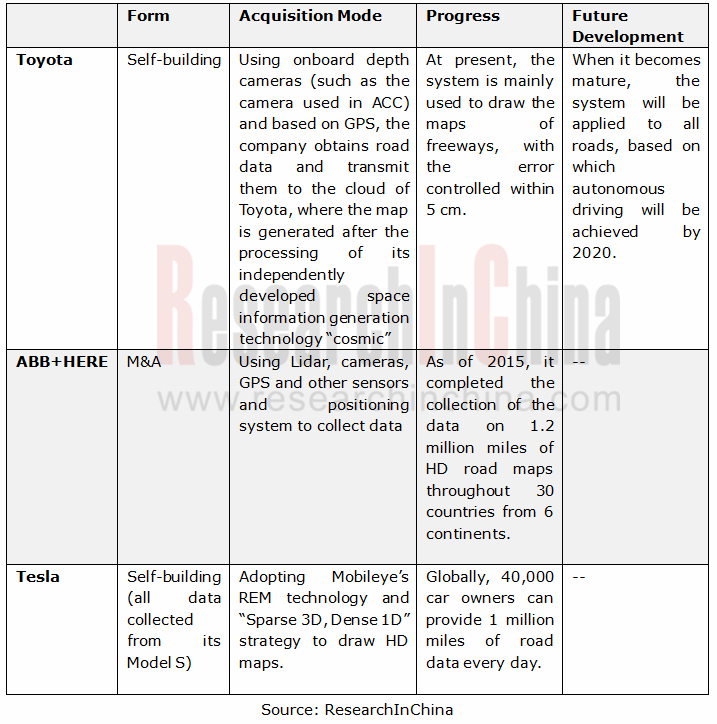

Car makers make their presence in HD maps mainly through M&As and self-building. For example, Toyota adopted onboard camera data to build HD maps via crowdsourcing, while Mercedes-Benz, Audi, and BMW jointly acquired HERE, a map provider under Nokia. Automakers-led layout could help promote the data traffic between HD maps and autonomous driving. Moreover, auto makers can fully open CAN bus port internally, which would bring benefits to the testing of HD map-based autonomous driving scheme.

III) Sensor Vendors

Using camera chips installed in cars, Mobileye is collecting data through crowdsourcing to make 3D maps. Its Road Experience Management software can identify specific road information like road markings. The bandwidth that it needs is only about 10KB per kilometer. Mobileye’s entry into HD map is to provide turnkey autonomous driving solutions for its future development.

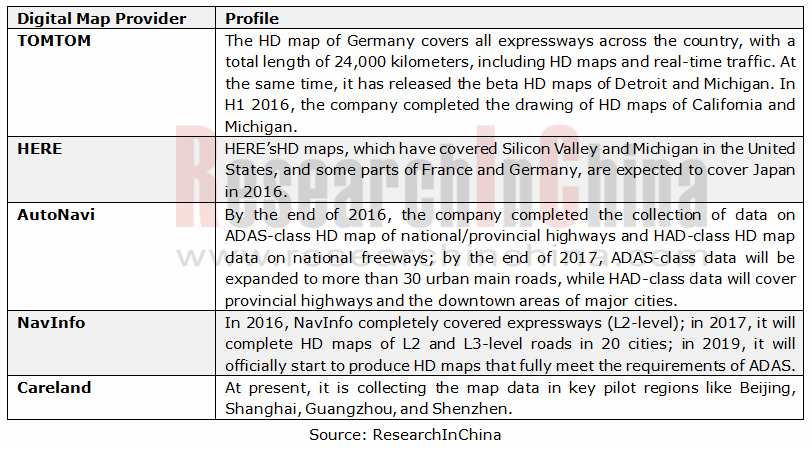

IV) Digital Map Providers

Digital map providers, including foreign companies like Apple and TomTom and domestic ones such as Tencent, NavInfo, Xiaomi, and Careland, can complement each other's advantages at a minimum cost.

Overall, autonomous driving is now dominated by automakers, and they will not completely open their underlying data on vehicles to HD map providers. Thus, many auto makers (like Audi, Mercedes-Benz, and BMW), obtain HD map data sources by acquiring digital map providers. In contrast, due to a lack of experience in fault tolerance and underlying data of vehicles, Internet companies end up cooperating with automakers.

1 Overview of HD Map

1.1 Definition

1.2 Composition

1.3 Features

1.4 Merits

1.5 Classification

2 Map Acquisition Schemes

2.1 Acquisition Modes of General Map

2.1.1 Collection by Walking

2.1.2 Collection by Backpack

2.1.3 Collection by Bicycle

2.1.4 Other Collection Means

2.2 Acquisition Modes of HD Map

2.2.1 Collection by Special Vehicle

2.2.2 Collection by Crowdsourcing

3 Global HD Map Market

3.1 Overview of Autonomous Driving

3.1.1 Definition and Overview

3.1.2 Development Trend of Autonomous Driving in the World

3.2 Development of HD Map in the World and China

3.2.1 Global

3.2.2 China

3.3 Development Trend

4 Upstream Industry Chain of HD Map

4.1 Lidar

4.1.1 Operating Principle

4.1.2 Composition

4.1.3 Application in HD Map

4.1.4 Market Size

4.2 Camera

4.2.1 Operating Principle

4.2.2 Application in HD Map

4.2.3 Market Size

4.3 Positioning System

4.3.1 Operating Principle

4.3.2 Application in HD Map

4.4 Inertial Navigation System

4.4.1 Operating Principle

4.4.2 Application in HD Map

4.4.3 Market Size

4.5 Algorithms

4.5.1 Path Planning Algorithm

4.5.2 SLAM Algorithm

5 Major Foreign HD Map Providers

5.1 Google

5.1.1 Profile

5.1.2 Operation

5.1.3 Google’s Self-Driving Cars

5.1.4 HD Map Business

5.2 TomTom

5.2.1 Profile

5.2.2 Operation

5.2.3 HD Map Business

5.2.4 HD Map Acquisition Vehicle

5.3 HERE

5.3.1 Profile

5.3.2 Operation

5.3.3 HD Map Business

5.4 Mobileye

5.4.1 Profile

5.4.2 Operation

5.4.3 Products

5.4.4 HD Map Business

6 Key HD Map Providers in China

6.1 Baidu

6.1.1 Profile

6.1.2 Operation

6.1.3 Products

6.1.4 HD Map Business

6.2 AutoNavi

6.2.1 Profile

6.2.2 HD Map Business

6.3 NavInfo

6.3.1 Profile

6.3.2 Operation

6.3.3 Products

6.3.4 HD Map Business

6.3.5 Core Competitiveness

Map-Matching Function of HD Map

Composition Structure and Functions of HD Map

Features of HD Map

Difference between ADAS-level and HAD-level HD Maps

Way of Collection by Backpack

Backpack-mode Collection Equipment

Way of Collection by Bicycle

Interface of AutoNaviTaojin (Original Autonavi gxdtaojin)

HERE’s HD Map Acquisition Vehicle

Mobileye’s HD Map Crowdsourcing Collection Scheme

Grades of Autonomous Driving

Development Stages (Predicted) of Autonomous Driving

Two Technology Roadmaps of Autonomous Driving System

Autonomous Driving Modes of Traditional Automakers, Parts Suppliers and Internet Firms

Autonomous Vehicle Development of Major Overseas Companies

Popularization (Predicted) of Autonomous Driving

Global HD Map Providers and Their Maps

Dominant Role of Internet Firms in HD Map Field

Automakers’ Presence in HD Map Field

Cooperative Modes of HD Map Providers

Chinese HD Map Providers and Their Maps

Future Evolution of HD Map

Composition of Lidar and Functions of Components

Emergence of Point Cloud Data

China Lidar Market Size, 2020E

Global In-vehicle Cameras Market Size, 2016-2020E

In-vehicle Camera OEM Market Size in China, 2016-2020E

Global Shipments of In-vehicle Cameras, 2016-2020E

Parameters of Four Major Positioning Systems

Positioning Means of Four Major Positioning Systems (Civil Use)

Illustrative Diagram of GPS Point Positioning

Illustrative Diagram of Differential GPS

BDStar Navigation N280 Receiver and GPS-700 Series Antennas and Performance Parameters

Principle of Inertial Navigation System

Global Inertial Navigation System Market Size, 2016-2020E

Google’s Development History

Google Self-driving Car

Google’s Operation, 2011-2014

Google’s Tuned Prius

Google's Prototype Configuration

GoogleCar 3D Model

TomTom’s Services

TomTom’s Development History

TomTom’s Revenue, 2011-2015

TomTom’s Revenue by Business Segments, 2015

TomTom’s Revenue by Region, 2015

TomTomHD Map

ADAS Function of TomTom HD Map

Functions and Advantages of TomTom

Mapping Vehicle for TomTomHD Map

Data Processing Equipment for TomTom HD Map

TomTom’sRoadDNA Technology

HERE’s Revenue, 2013-2015

HERE HD Map

Characteristics of HERE HD Map

Composition Structure of HERE HD Map

Evolution of Mobileye Camera Sensor

Mobileye’s Solutions for Autonomous Driving

Mobileye’s Operation, 2011-2015

Mobileye’s Revenue by Market, 2013-2015

Mobileye’s Revenue by Region, 2015

Mobileye 560 and Its Parameters

Functions of Mobileye 5 Series Products

Functions of Mobileye 5 Series Display Unit

Mobileye’s Smartphone App Interface

Functions of Various Generations of Mobileye Sensors

Mobileye’s Isomeric Architecture

Mobileye’s EyeQ5 Chip Architecture

Mobileye’s HD Map Technology (REM)

REM System Identification for Feasible Paths

Mobileye’s Roadbook Strategy

Layout of Baidu Telematics

Ecological Architecture of Baidu Telematics

Baidu’s Operation, 2011-2015

Main Functions of Baidu CarLife

Cooperative Auto Enterprises of CarLife

Baidu MyCar Architecture

Four Features of Baidu MyCar

Six Advantages of Baidu Speech System

Self-Driving Cars Developed by Baidu and BMW

Velodyne HDL-64E Structure Chart

VelodyneHDL-64E Parameters

HD Map Data Acquisition Vehicles Developed by Baidu and Changan

Velodyne HDL-32E Structure Chart

Velodyne HDL-32E Parameters

AutoNavi’s HD Map Production Plan

ADAS-level Acquisition Vehicle

HAD-level Acquisition Vehicle

VMX-450 Composition

Riegl VMX-450 System Architecture

VQ-450 Laser Scanner Structure

VQ-450 Performance Parameters

VMX-450-CS6 Camera

VMX-450-CS6 Parameters

Hierarchical Acquisition System of AutoNavi HD Map

NavInfo’s Navigation Electronic Map Product Diagram

NavInfo’s Vehicle Navigation Customers

NavInfo’s Operation, 2011-2015

Development of NavInfo’s Main Business, 2011-2015

NavInfo’s Layout in Telematics, 2011-2015

NavInfo’s Strategic Planning

NavInfo’sNavigation Electronic Map Compiling Products

Dynamic Traffic Information Service Diagram

WeDrive3.0 Eco-platform

NavInfoTraffic Index Platform

NavInfo’s Industry Application Products

NavInfo’s HD Map Diagram

NavInfo’sHD Map Test Vehicle

Typical Scenarios and Contents of HD Map

NavInfo’s HD Map Development Paths

NavInfo’s HD Map Solutions

NavInfo’s HD Map Data Specification

NavInfo’s HD Map and Location Sensing Product Series

NavInfo’s HD Map Product Roadmap

WeDrive 3.0 Cloud Service Platform for Autonomous Driving

NavInfo’s R&D Costs, 2011-2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...