Global and China Automotive Electric Motor Industry Report, 2016-2020

-

Nov. 2016

- Hard Copy

- USD

$2,400

-

- Pages:109

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZHP049

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

In 2015, the global automotive market continued to grow, with the total sales volume hitting 89.68 million units, up 2.0% year on year. It is anticipated that the numbers will reach 91.3 million units in 2016 and approach 105 million units in 2020. Specifically, China, as the world's largest automobile market, contributed the sales volume of 24.6 million units in 2015, sharing 27.4% of the global total; and the sales figure is expected to rise to 26 million units in 2016, with an estimated AAGR of around 5.0% during 2016-2020.

In 2015, the global automotive electric motor shipments approximated 3.47 billion units, up 6.7% from a year ago; the figure will go up to 3.64 billion units in 2016. With the development of intelligent and new energy vehicles, the global shipments of automotive electric motor are expected to grow at a compound annual rate of around 9.0% during 2016-2020.

By installation position, automotive electric motors can be divided into body motors, chassis motors, and powertrain motors, of which body motors find widest applications, including in power seats, electric windows, and electric rearview mirrors, etc. On average, one car needs about 24 units of body motor. In 2015, the global shipments of automotive body motor totaled 2.16 billion units, accounting for 62.3% of those of automotive electric motor. We project that the figure will rise to 2.31 billion units in 2016 and 3.18 billion units in 2020.

Automotive electric motors mainly fall into small-sized automotive electric motors, automotive starters and alternators according to function.

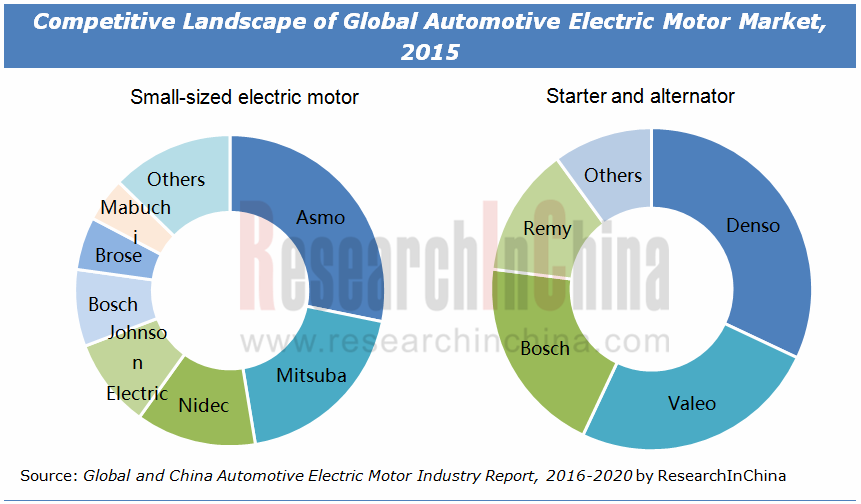

Globally, relatively more competitive manufacturers of small-sized automotive electric motors consist of Japan’s ASMO, Mitsuba, Nidec, Mabuchi, and Denso, etc., and some European and American companies like Valeo and Bosch. Besides, the Chinese player Johnson Electric also enjoys strong competitiveness in the international market, seizing a market share of around 10% in 2015.

As a key manufacturer of small-sized automotive electric motors such as ETC motor, EPS motor, and wiper motor, Mitsuba launched a drive motor for small-sized electric vehicles in January 2016. In April 2016, the company invested EUR13.5 million in expanding production capacity of wiper components at Hungary plant. The expansion is expected to be completed in 2017, when 90% of the capacity will be for export.

As China’s largest manufacturer of small-sized automotive electric motors, Johnson Electric is developing towards smaller and more lightweight products to gradually satisfy the market requirements on the vehicle’s energy saving & emission reduction and fuel efficiency improvement. For instance, the company’s power windows adopt “Curve” motor technology, thus leading to a 30% reduction both in volume and weight.

Global starters and alternators have higher level of market concentration, and leading producers include Valeo, Denso, Bosch, and Remy, which held an aggregate market share of around 90% in 2015. Among these companies, Valeo's business is concentrated in China and Europe while Denso focuses on the Japanese market.

As one of the major suppliers of automotive starter and alternators, Valeo boasts a market share of about 30%. The company entered China in the 1980s and set up production bases of wiper motors and starters & alternators in Shanghai, with the annual capacity of 1.8 million units and 15 million units, respectively. And the starters and alternators can be used to support cars, light-duty trucks, and diesel engines, etc.

The report is primarily concerned with the following:

Market size, industry landscape, etc. of global and Chinese automobile industry;

Market size, industry landscape, etc. of global and Chinese automobile industry;

Market size, market structure, etc. of automotive electric motor industry;

Market size, market structure, etc. of automotive electric motor industry;

Market size, competitive landscape, etc. of small-sized automotive motors, automotive starters and alternators, as well as motors for new energy vehicles;

Market size, competitive landscape, etc. of small-sized automotive motors, automotive starters and alternators, as well as motors for new energy vehicles;

Operation, automotive electric motor business, etc. of 21 global automotive electric motor manufacturers.

Operation, automotive electric motor business, etc. of 21 global automotive electric motor manufacturers.

1. Global and Chinese Automobile Markets

1.1 Global

1.1.1 Total

1.1.2 Major Countries/Regions

1.2 Global Pattern of Automobile Industry

1.2.1 Passenger Car

1.2.2 Commercial Vehicle

2. Chinese Automobile Market

2.1 Overview

2.2 Recent Developments

2.3 Chinese Passenger Car Market

2.3.1 Market Size

2.3.2 Market Pattern

2.4 Chinese Commercial Vehicle Market

2.4.1 Scale

2.4.2 Landscape

2.5 Automobile Industrial Pattern in China

3. Auto Motor Market

3.1 Auto Motor Market

3.1.1 Overview

3.1.2 Market Size

3.1.3 Market Structure

3.2 Overview of Auto Compact Motor

3.3 Auto Compact Motor Market

3.4 Industrial Pattern of Auto Compact Motor

3.4.1 Electric Power Steering Motor

3.4.2 Electronic Throttle Control

3.4.3 Body System Motor

3.5 Auto Starter and Generator Industry Pattern

3.6 XEV Motor

3.6.1 Introduction to HEV/PHEV/EV

3.6.2 Bottleneck of HEV/PHEV/EV

3.6.3 HEV/PHEV/EV

3.6.4 XEV-use Motor Market

4. Major Automotive Motor Manufacturers

4.1 Nidec

4.1.1 Profile

4.1.2 Operation

4.1.3 Automotive Motor Business

4.2 Mabuchi

4.2.1 Profile

4.2.2 Operation

4.2.3 Automotive Motor Business

4.3 Johnson Electric

4.3.1 Profile

4.3.2 Operation

4.3.3 Automotive Motor Business

4.4 Mitsuba

4.4.1 Profile

4.4.2 Operation

4.4.3 Automotive Motor Business

4.5 ASMO

4.5.1 Profile

4.5.2 Operation

4.5.3 Automotive Motor Business

4.6 BorgWarner

4.6.1 Profile

4.6.2 Operation

4.6.3 Automotive Motor Business

4.7 Valeo

4.7.1 Profile

4.7.2 Shanghai Valeo Automotive Electrical Systems Co., Ltd.

4.7.3 Shanghai Valeo Automotive Motor & Wiper Systems Co., Ltd.

4.7.4 Taizhou ValeoWenling Automotive Systems Co., Ltd.

4.8 DENSO Corporation

4.8.1 Profile

4.8.2 Operation

4.8.3 Automotive Motor Business

4.9 BOSCH

4.9.1 Profile

4.9.2 Operation

4.9.3 Automotive Motor Business

4.10 Ningbo Yunsheng

4.10.1 Profile

4.10.2 Operation

4.10.3 Automotive Motor Business

4.11 Others

4.11.1 Brose

4.11.2 Shihlin Electric

4.11.3 Jinzhou Halla Electrical Equipment Co., Ltd.

4.11.4 Chengdu Huachuan Electric Parts

4.11.5 Hubei Shendian Auto Motor Co., Ltd.

4.11.6 Prestolite Electric (Beijing) Limited

4.11.7 Zhejiang Dehong Automotive Electronic & Electrical Co., Ltd.

4.11.8 Chongqing Bright Industry Group Co., Ltd.

4.11.9 Minxian Vehicle Electric Equipment

4.11.10 Buhler Motor

4.11.11 Mitsubishi Electric

Global Automobile Production, 2010-2020E

Global Automobile Sales, 2010-2020E

Global Automobile Production by Region, 2010-2015

Global Top 20 Countries by Automobile Production, 2015

Global Automobile Sales by Region, 2010-2015

Global Top10 Countries by Automobile Sales, 2010-2015

Global Automobile Production Structure, 2010-2015

Global Top10 Auto Brands by Sales, 2014-2015

Global Top10 Auto Brands by Growth Rate, 2015

Global Passenger Car Production by Region, 2010-2015

Global Passenger Car Sales by Region, 2010-2015

Global Top10 Countries by Passenger Car Sales, 2010-2015

Global Commercial Vehicle Production by Region, 2010-2015

Global Commercial Vehicle Sales by Region, 2010-2015

Global Top10 Countries by Commercial Vehicle Sales, 2010-2015

Sales Volume and YoY of Chinese Automotive Market, 2010-2020

Sales Volume of Passenger Car Market in China, 2010-2016

Sales Volume of Sedan Markets in China, 2011-2016

Sales Volume of SUV Market in China, 2011-2016

Sales Volume of MPV Market in China, 2011-2016

Top 10 Besting-Selling Passenger Car Manufacturers in China, H1 2016

Top10 Best-Selling Passenger Cars (by Vehicle Model) in China, H1 2016

Sales Volume of Commercial Vehicle in China, 2010-2016

Output and Sales Volume of Bus in China, 2005-2020E

Sales Volume of Large-sized Bus and Chassis in China, 2005-2020E

Output of Medium-sized Bus and Chassis in China, 2005-2020E

Output of Light Bus and Chassis in China, 2005-2020E

Top10 Commercial Vehicle Manufacturers by Sales Volume in China, 2016H1

Sales Volume of Foreign Brands in China and % of Their Global Total, 2015

Sales Volume Structure of Passenger Vehicle in China by Country, Jan.-Sept. 2016

Sales Volume and YoY Growth of Bus in China by Region, 2016H1

Application of Auto Motor

Market Size of Global Auto Motor, 2011-2020

Global Shipments of Auto Motor, 2011-2020

Use of Car Body Motor

Shipments of Car Body Motor Worldwide, 2011-2020

Shipments Structure of Auto Motor Worldwide by Category, 2011/2015

Global Auto Compact Motor Shipments, 2015-2020E

Competitive Landscape of Global Auto Compact Motor Market, 2015

Global Automotive Steering System Market Structure, 2015

Classification of EPS

Global EPS Motor Shipments, 2011-2020E

EPS Motor Shipments in China, 2011-2020E

Penetration of EPS for Passenger Vehicles in China, 2011-2020E

Competitive Landscape of Global EPS Motor Market, 2015

Competitive Landscape of Japanese EPS Motor Market, 2015

EPS Motor Suppliers of Toyota

EPS Motor Suppliers of Nissan

EPS Motor Suppliers of Honda

EPS Motor Suppliers of Mazda

EPS Motor Suppliers of Mitsubishi

EPS Motor Suppliers of Subaru

EPS Motor Suppliers of Haobc

EPS Motor Suppliers of Suzuki

Structure of ETC

Global ETC Motor Shipments, 2008-2020E

Competitive Landscape of Global ETC Motor Market, 2015

Competitive Landscape of Japanese ETC Market, 2015

ETC Suppliers of Main Automobile Manufacturers in China

Auto Adaptive Seat System and Used Motor

Global Auto Power Seat Shipments, 2011-2020E

Global Auto Power Seat Motor Shipments, 2011-2020E

Competitive Landscape of Global Auto Seat Motor Market, 2015

Competitive Landscape of Global Auto Power Door Lock Market, 2015

Competitive Landscape of Global Auto Power Door and Window Motor Market, 2015

Competitive Landscape of Global Auto Windshield Wiper Motor Market, 2015

Global Auto Starter and Generator Market Competition Pattern, 2015

Global Passenger Car Starter and Generator Market Competition Pattern, 2015

Competition Pattern of OE Vehicle Starter Market in China, 2015

Competition Pattern of Vehicle Generator Market in Japan, 2015

Competition Pattern of OE Vehicle Generator Market in China, 2015

Major Passenger Car Generator Manufacturers and Supporting Market in China

Major Commercial Vehicle Generator Manufacturers and Supporting Market in China

Main New Energy Vehicle Models and Drive Modes

Technical Bottleneck of New Energy Vehicle Battery

Output Value of Power Lithium-ion Batteries in China, 2013-2016

Number of Power Battery Suppliers in China, 2013-2016

Consumers’ Driving Mileage Per Week in Major Countries

Consumers' Psychological Orientation for HEV/PHEV Price in Major Countries

Roadmap for NECO’s Lithium Battery Performance

Global Electric Passenger Car Sales in Major Countries/Regions, 2013-2015

Global Monthly Sales of New Energy Vehicles (EV&PHEV), 2014-2015

Sales of Global Top20 Electric Passenger Vehicles, 2013-2015

Global Electric Passenger Cars (EV&PHEV) Sales, 2011-2020E

EV Output & Sales in China, 2010-2015

Electric Vehicles (EV&PHEV) Output in China, Jan-Dec 2015

Electric Vehicles (EV&PHEV) Sales in China, 2011-2020E

Conventional Hybrid Vehicle (HEV) Sales in China, 2012-2020E

Electric Commercial Vehicle Output in China, Jan-Dec 2015

EV Promotion Plans in China, 2014-2015

Electric Bus Output in China, Jan-Dec 2015

Battery Electric Truck Output in China, Jan-Dec 2015

Electric Commercial Vehicles (EV&PHEV) Sales in China, 2011-2020E

Global xEV-use Motor Shipment, 2010-2016

Manufacturer Structure of New Energy Vehicle-use Drive Motors in China, 2016

Installed Capacity and Market Share of Main New Energy Vehicle-use Drive Motor Manufacturers in China, Jan-Jul 2016

Shipment and Market Share of Traditional Motor Enterprises in New Energy Vehicle-use Drive Motors in China, Jan-Jul 2016

Nidec’s Business Structure

Net Sales of Nidec, FY 2006- FY 2015

Net Sales of Nidec by Product, FY 2006- FY 2015

Revenue Structure of Nidec by Region, FY 2013- FY 2015

Nidec’s Main Automotive Motor R & D Bases

Application of Nidec’s Motors in Automobiles

Nidec's Main Production Bases

EPS Motor Shipment of Nidec Automobile Motor (Zhejiang), 2009/2015

Revenue and Operating Income of Nidec's Automotive and Industrial Applications Division, FY2014- FY2015

Mabuchi’s Main Motor Products

Mabuchi’s Global Presence

Revenue and Operating Income of Mabuchi, 2006-2015

Development Plan of Mabuchi, 2006-2018

Revenue Structure of Mabuchi by Product, 2011-2015

Revenue Structure of Mabuchi by Region, 2011-2015

Application of Mabuchi’s Micromotors in Automotive Electronics

Application of Mabuchi’s Micromotors in Automotive AV

Mabuchi’s Revenue Structure of Micromotors for Automobiles (by Product), 2014-2015

Mabuchi’s Revenue Structure of Automotive Medium-sized Motors (by Product), 2014-2015

Mabuchi’s Revenue from Automotive Medium-sized Motors, 2012-2016

Mabuchi’s Major Micro Motor Production Bases in China and Their Output

Distribution of Johnson Electric’s Global Production Bases

Revenue and Gross Profit of Johnson Electric, FY2011- FY2017

Revenue of Johnson Electric (by Business), FY2011-FY2016

Revenue Structure of Johnson Electric (by Region), FY2016

Production Strategy of Johnson Electric

Main Automotive Motor Products of Johnson Electric

Mitsuba’s Operation, FY2011- FY2016

Mitsuba’s Revenue Structure (by Business), FY2016

Mitsuba’s Revenue (by Region), FY2014- FY2016

Application of Mitsuba’s Automotive Motors

Mitsuba’s Main Automotive Motor Products

ASMO’s Overseas Layout

ASMO’s Net Sales and Operating Income, 2012-2016

Application of ASMO’s Motors in Automobiles

BorgWarner’s Revenue, 2011-2015

BorgWarner’s Product Structure, 2015

BorgWarner’s Engine Revenue, 2011-2015

BorgWarner’s Drivetrain Revenue, 2011-2015

BorgWarner’s Customer Structure, 2015

BorgWarner’s Revenue Structure by Customer, 2013-2015

Global Layout of Remy International

Equity Structure of Valeo, 2016

Global Presence of Valeo

Order Intake and Sales of Valeo, 2013-2015

Sales Structure (by Business) of Valeo, 2015

Operation Result (by Region) of Valeo, 2015

Main Products of S.Valeo

Major Customers of S.Valeo

Development History of DENSO

Equity Structure of DENSO, 2016

Revenue and Operating Profit of DENSO, FY2012-FY2016

Revenue Structure (by Product) of DENSO, FY2016

Revenue Breakdown (by Region) of DENSO, FY2014-FY2016

Sales Breakdown (by Customer) of DENSO, FY2010-FY2014

Customer Structure of DENSO, FY2013-FY2014

Revenue of DENSO’s Motor Business, FY2015-FY2016

Revenue from DENSO’s Powertrain Control Business, FY2014-FY2016

Main Product Category of DENSO’s Powertrain Control Business

Revenue of DENSO’s Small Motor, FY2014-FY2016

Main Small Motor Products of DENSO

Number of Employees of Bosch, 2010-2015

Revenue and EBIT of Bosch, 2010-2015

R&D Costs and % of Total Revenue of Bosch, 2011-2015

Revenue Breakdown of Bosch by Business, 2014-2015

Revenue Breakdown of Bosch by Region, 2014-2015

Sales of Bosch by Country, 2012-2014

Sales and EBIT of Mobility Solutions of Bosch, 2012-2015

Automotive Motor Products of Bosch

Equity Structure of Ningbo Yunsheng, 2016

Revenue and Net Income of Ningbo Yunsheng, 2008-2016

Revenue Breakdown of Ningbo Yunsheng by Product, 2010-2016

Revenue Breakdown of Ningbo Yunsheng by Region, 2010-2016

Gross Margin of Ningbo Yunsheng by Product, 2010-2016

Servo Motor Output and Sales Volume of Ningbo Yunsheng, 2014-2015

Main Products of Shihlin Electric’s Automobile Equipment

Main Products of Chengdu Huachuan Electric Parts

Marketing Network of Chengdu Huachuan Electric Parts

Profile of Buhler Motor

Global Presence of Buhler Motor

Selected Financial Indicators of Mitsubishi Electric, FY2010-FY2015

Sales of Mitsubishi Electric by Business Segment, FY2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...