Global and China Lithium Iron Phosphate (LiFePO4) and Battery Industry Report, 2016-2020

-

Dec.2016

- Hard Copy

- USD

$2,800

-

- Pages:267

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

CYH055

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,000

-

Lithium iron phosphate (LiFePO4), a lithium battery cathode material, features moderate price, excellent safety performance and high-temperature stability. The material is primarily applied to EV and energy storage, around 80% in the former domestically in China.

Global EV sales reported 549,000 units in 2015, an upsurge of 70.4% from a year ago. Being more vigorously promoted around the globe, the EV market will see an AAGR of about 40% during 2016-2020, reaching 3.32 million units in 2020. Driven by this, global LiFePO4 shipments soared by 136.8% to 49,500 tons in 2015 and it is expected to hit 309,400 tons in 2020.

Global LiFePO4 markets are concentrated in China, Taiwan and other countries/regions with the first accounting for over 60%. China’s shipment of LiFePO4 totaled 32,400 tons in 2015, 65% of the world-wide market, and is expected to attain 236,000 tons in 2020 with the proportion increasing to 76%.

LiFePO4 is directly used for the production of LiFePO4 battery. China shipped 10.97Gwh of LiFePO4 power batteries in 2015, two times higher than the 2014 level. Driven by rapid growth of new energy vehicle market, the LiFePO4 battery market will continue to expand but, affected by the substitution of ternary battery, at a slower rate, an estimated 20% during 2016-2020.

The substitution of ternary material for LiFePO4 is mainly reflected in its high energy density that can fulfill the demand of EV mileage. As a result, electric passenger car and electric special vehicle markets have been encroached on by ternary materials in recent two years. However, as LiFePO4 is safer than ternary materials, the industries that are demanding on safety like electric bus still adopt mainly LiFePO4 battery. The Ministry of Industry and Information Technology (MIIT) suspended the inclusion of ternary lithium battery-powered bus into the catalogue of recommended models for new energy vehicle promotion and application “due to safety concerns” in Jan 2016, thus fueling LiFePO4 battery-powered electric vehicle market. Data show that 61% of electric buses in China in 2016H1 adopted LiFePO4 battery, up 23 percentage points from 37.3% in the same period of 2015.

Overall, LiFePO4 and ternary material will coexist and electric bus and energy storage will be major stimuli to the development of LiFePO4 battery in China over the next five years.

Most of global LiFePO4 producers are located in China and Taiwan, but core technologies are controlled by European and American companies including A123, Valence and Phostech.

More than 100 Chinese local LiFePO4 manufacturers can be classified into: 1) the ones capable of producing power battery, such as BYD, Guoxuan High-Tech, and Wanxiang A123, which achieve self-sufficiency via layout in LiFePo4; 2) professional LiFePo4 producers, such as Pulead Technology Industry Co. Ltd., Shenghua Technology, and Aleees, which have established stable partnership with first-tier LiFePO4 battery companies like CATL, China Aviation Lithium Battery, and OptimumNano.

Global and China Lithium Iron Phosphate (LiFePO4) and Battery Industry Report, 2016-2020 focuses on the following:

Global lithium battery cathode materials and LiFePO4 markets (size, consumption structure, enterprises’ layout, etc.);

Global lithium battery cathode materials and LiFePO4 markets (size, consumption structure, enterprises’ layout, etc.);

Chinese lithium battery cathode materials and LiFePO4 markets (size, import & export, consumption structure, enterprises’ layout, etc.);

Chinese lithium battery cathode materials and LiFePO4 markets (size, import & export, consumption structure, enterprises’ layout, etc.);

Lithium carbonate and iron phosphate, upstream raw materials of LiFePO4 cathode materials;

Lithium carbonate and iron phosphate, upstream raw materials of LiFePO4 cathode materials;

Demand for LiFePO4 battery in seven application markets like electric vehicle, electric bicycle, 3C consumer electronics, and energy storage;

Demand for LiFePO4 battery in seven application markets like electric vehicle, electric bicycle, 3C consumer electronics, and energy storage;

Market for substitutes of LiFePO4 cathode material including ternary cathode materials, lithium cobalt oxide, and lithium manganese oxide;

Market for substitutes of LiFePO4 cathode material including ternary cathode materials, lithium cobalt oxide, and lithium manganese oxide;

24 global and Chinese LiFePO4producers (operation, development strategy, etc.);

24 global and Chinese LiFePO4producers (operation, development strategy, etc.);

14 major LiFePO4 battery producers (operation, development strategy, etc.)

14 major LiFePO4 battery producers (operation, development strategy, etc.)

1. Overview of LiFePO4 Battery

1.1 Overview

1.1.1 Definition

1.1.2 Merits and Demerits

1.2 Technology

1.2.1 Solid-phase Method

1.2.2 Liquid-phase Method

1.3 Process

1.4 Patent

1.4.1 Major Patentees

1.4.2 Patent Dispute

1.4.3 Patent Cases in China

1.5 Industry Chain

2 Global LiFePO4 Cathode Material Market

2.1 Global Lithium Battery Cathode Material Market

2.1.1 Overview

2.1.2 Market

2.1.3 Consumption Structure

2.1.4 Corporate Landscape

2.2 Global LiFePO4 Cathode Material Market

2.2.1 Market

2.2.2 Corporate Landscape

2.3 Development Trend

3. Chinese LiFePO4 Cathode Material Market

3.1 Chinese Lithium Battery Cathode Material Market

3.1.1 Market Size

3.1.2 Consumption Structure

3.1.3 Price

3.1.4 Corporate Landscape

3.2 Chinese LiFePO4 Cathode Material Market

3.2.1 Market Size

3.2.2 Import & Export

3.2.3 Price

3.2.4 Competition Pattern

3.3 Policy Impact

3.4 Development Trend

4 LiFePO4 Industry Chain

4.1 Upstream Industry

4.1.1 Lithium Carbonate

4.1.2 Iron Phosphate

4.2 LiFePO4 Battery

4.2.1 Market Development

4.2.2 Corporate Landscape

4.2.3 Demand

4.3 EV Market

4.3.1 Global

4.3.2 China

4.3.3 EV’s Demand for LiFePO4 Battery

4.4 3C Consumer Electronics

4.4.1 Global

4.4.2 China

4.5 Energy Storage

4.5.1 Power Energy Storage Technology and Application

4.5.2 Power Chemical Energy Storage Industry Size and Demand for LiFePO4 Battery

4.6 Electric Bicycle

4.6.1 Market

4.6.2 Electric Bicycle’s Demand for LiFePO4 Battery

4.7 Electric Tools

4.8 Communication Industry

4.9 Automotive Start-Stop Battery

5. Major Substitutes of LiFePO4 Cathode Material

5.1 Overview

5.2 Ternary Materials

5.2.1 Global

5.2.2 China

5.2.3 Ternary Materials VS LiFePO4

5.3 Lithium Cobalt Oxide

5.3.1 Overview

5.3.2 Lithium Cobalt Oxide VS LiFePO4

5.4 Lithium Manganese Oxide

6 Global and Chinese LiFePO4 Producers

6.1 A123 Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Subsidiaries in China

6.2 Valence

6.2.1 Profile

6.2.2 Operation

6.2.3 Subsidiaries in China

6.3 Phostech

6.3.1 Profile

6.3.2 LiFePO4 Business

6.4 Nichia

6.4.1 Profile

6.4.2 Development History

6.4.3 Operation

6.4.4 Output

6.5 Formosa Energy & Material Technology Co., Ltd.

6.5.1 Profile

6.5.2 LiFePO4 Business

6.6 ALeees

6.6.1 Profile

6.6.2 Operation

6.6.3 LiFePO4 Business

6.6.4 Dynamics

6.7 Hirose Tech

6.7.1 Profile

6.7.2 Operation

6.7.3 Competitive Edge

6.8 Tatung Fine Chemicals

6.8.1 Profile

6.8.2 Operation

6.8.3 LiFePO4 Business

6.9 Tianjin STL Energy Technology Co., Ltd.

6.9.1 Profile

6.9.2 LiFePO4 Business

6.10 Pulead Technology Industry Co., Ltd

6.10.1 Profile

6.10.2 Layout in Industry Chain

6.10.3 LiFePO4 Business

6.11 Shenzhen BTR New Energy Material Co., Ltd

6.11.1 Profile

6.11.2 Operation

6.11.3 LiFePO4 Business

6.11.4 Competitive Edge

6.12 Yantai Zhuoneng Battery Material Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.12.3 LiFePO4 Business

6.13 Nanjing Lasting Brilliance New Energy Technology Co., Ltd.

6.13.1 Profile

6.13.2 R&D Project

6.13.3 Development History

6.14 Jiangxi Kingli Technology Co., Ltd.

6.14.1 Profile

6.14.2 Operation

6.14.3 LiFePO4 Business

6.15 Guoxuan High-Tech Co., Ltd.

6.15.1 Profile

6.15.2 Operation

6.15.3 Industry Chain

6.15.4 LiFePO4 and Battery Business

6.16 Shenzhen Tianjiao Technology Development Ltd.

6.16.1 Profile

6.16.2 Operation

6.17 Shenzhen Dynanonic Co., Ltd

6.17.1 Profile

6.17.2 Operation

6.17.3 Nano-LiFePO4 Business

6.18 GuanghanMufu Lithium Power Materials Co., Ltd.

6.18.1 Profile

6.18.2 LiFePO4 Business

6.19 Others

6.19.1 Hunan Shenghua Technology Co., Ltd.

6.19.2 Xinxiang Huaxin Energy Materials Co., Ltd.

6.19.3 Hunan Haorun Technology Co., Ltd.

6.19.4 NanoChem Systems (Suzhou) Co., Ltd.

6.19.5 Xinxiang Chuangjia Power Supply Material Co., Ltd.

6.19.6 Qingdao Qianyun High-tech New Material Co., Ltd.

7. Key LiFePO4 Battery Manufacturers

7.1 BYD

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 LiFePO4 Battery Business

7.2 China BAK Battery, Inc.

7.2.1 Profile

7.2.2 Operation

7.2.3 R&D

7.2.4 LiFePO4 Battery Business

7.2.5 Business Development and Outlook

7.2.6 Customers

7.2.7 Capacity & Output

7.3 Tianjin Lishen Battery Joint-Stock Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 LiFePO4 Battery Business

7.3.4 Business Development and Outlook

7.3.5 Customers

7.3.6 Capacity & Output

7.4 Shenzhen Mottcell Battery Technology Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 LiFePO4 Battery Business

7.4.4 Application

7.5 Wanxiang EV Co., Ltd.

7.5.1 Profile

7.5.2 LiFePO4 Battery Business

7.5.3 Application

7.5.4 Business Development and Outlook

7.5.5 Customers

7.6 Sinopoly Battery Limited

7.6.1 Profile

7.6.2 Battery Technology

7.6.3 Business Development and Outlook

7.6.4 Customers

7.6.5 Capacity & Output

7.7 China Aviation Lithium Battery Co., Ltd.

7.7.1 Profile

7.7.2 Battery Technology

7.7.3 R&D

7.7.4 Business Development and Outlook

7.7.5 Customers

7.7.6 Capacity & Output

7.8 CENS Energy-Tech Co., Ltd.

7.8.1 Profile

7.8.2 LiFePO4 Battery Business

7.9 Hipower New Energy Group Co., Ltd.

7.9.1 Profile

7.9.2 LiFePO4 Battery Business

7.10 Suzhou Golden Crown New Energy Co., Ltd.

7.10.1 Profile

7.10.2 LiFePO4 Battery Business

7.11 Pihsiang Energy Technology

7.11.1 Profile

7.11.2 Operation

7.11.3 Competitive Edge

7.11.4 Investment

7.12 Qingdao Hongnai New Energy

7.13 Henan Huanyu Group

7.13.1 Profile

7.13.2 LiFePO4 Battery Business

7.14 Li-Tec & Accumotive

7.14.1 Profile

7.14.2 Battery Technology

7.14.3 Business Development and Outlook

7.14.4 Customers

Classification of Motive Power Battery

Operating Principle of LiFePO4 Battery

Internal Structure of LiFePO4 Battery

Performance Advantages & Disadvantages of LiFePO4

Performance of All Kinds of Lithium Batteries

Manufacturing Procedures of LiFePO4 Battery Cathode Material

Comparison of Major LiFePO4 Production Processes

Major Global LiFePO4 Patentees

Industry Chain of LiFePO4 Battery

Development of Lithium Battery Cathode Materials

Global Cathode Materials (LFP/NCM/LCO/LMO/NCA) Shipments, 2011-2015

Global and Chinese Power Battery Companies and Their Main Products

Market Share of Global Producers of Cathode Materials, 2015

Sales Volume of LiFePo4 and Its Proportion of Cathode Material around the World, 2010-2016

Capacity of Key LiFePo4 Materials Manufacturers in Taiwan, 2015

Global Shipments of Lithium Battery Cathode Materials and LiFePo4 Battery, 2015-2020E

Structure of Cathode Materials (LFP/LCO/LMO/NCM) (EV), 2020E

Structure of Cathode Materials (LFP/LCO/LMO/NCM) (3C Consumer Electronics), 2020E

China’s Output of Lithium Battery Cathode Materials, 2015-2016

Market Share of Cathode Materials in China by Product, 2013-2015

Products, Revenue and Capacity of Major Producers of Cathode Materials in China, 2015

Capacity and Customers of Major Chinese Producers of Cathode Materials, 2016

Main Technical Routes Adopted by Major Global and Chinese Lithium Battery Producers

Sales Volume of LiFePo4 and Its Proportion of Cathode Material in China, 2007-2016

China’s Demand for LiFePO4 Cathode Material, 2013-2018E

China’s Import & Export Volume of LiFePO4, 2012-2016

China’s Import & Export Value of LiFePO4, 2012-2016

Origins of China’s LiFePO4 Imports, 2014-2016

Destinations of China’s LiFePO4 Exports, 2014-2016

LiFePO4 Prices in China, 2011-2016 (RMB10k/t)

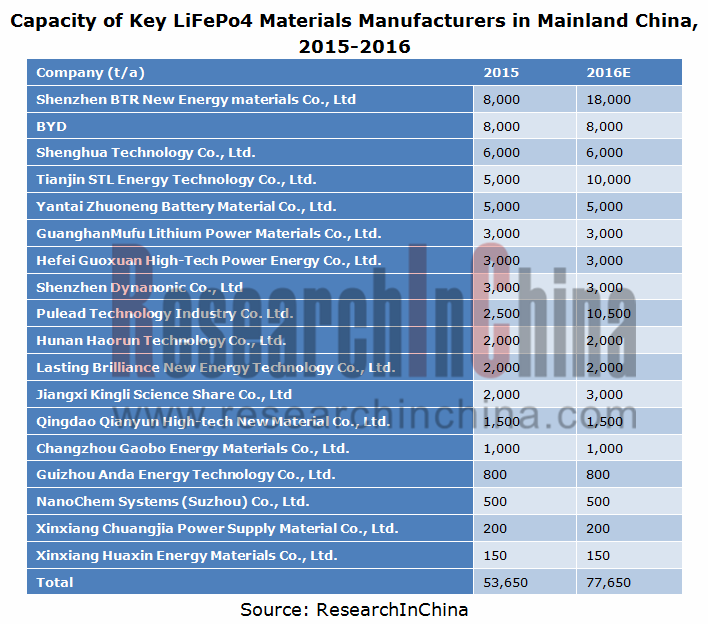

Capacity of Key LiFePo4 Materials Manufacturers in Mainland China, 2015-2016

Capacity of Lithium Iron Phosphate Material Manufacturers in China (including Taiwan), 2014/2018E

Gross Margin of Major Producers’ LiFePO4 Cathode Material, 2015

Chinese and Global Lithium Iron Phosphate Sales Volume and Proportion, 2011-2020E

Main Preparation Technologies and Raw Materials for LiFePO4 Cathode Material

Main Raw Materials and Suppliers of LiFePO4

Global Lithium Carbonate Supply, 2012-2020E

Global Lithium Carbonate Demand, 2012-2020E

Global Lithium Carbonate Demand by Sector, 2012-2020E

Global Lithium Carbonate Consumption Structure by Application, 2013

Global Lithium Carbonate Consumption Structure by Application, 2015

China’s Output of Lithium Carbonate, 2009-2020E

China’s Percentage of Global Lithium Carbonate Output, 2012-2020E

Lithium Carbonate Supply-Demand Gap in China, 2009-2020E

Prices of Battery-grade Lithium Carbonate, 2015-End of Sept 2016 (RMB10K/t)

Chinese Iron Phosphate Market Size, 2011-2018E

Competitive Landscape of Chinese Iron Phosphate Enterprises, 2015

Power Battery Shipments by Battery Material, 2015

China’s Lithium Battery Shipments by Material, Jan-Apr 2016

Cost Structure of Lithium Battery

Output and Global Top10 Power Battery Enterprises, 2016H1

Capacity of Major LiFePO4 Battery Producers in China, 2015-2016

Battery Technology and Supporting Manufacturers of Power Lithium Battery Enterprises in China, 2016

China’s Demand for LiFePO4 Battery by Application, 2015-2020E

Global Electric Passenger Car (EV&PHEV) Sales, 2011-2020E

Sales of Global Top20 Electric Passenger Cars, 2015

Sales of Global Top20 Electric Passenger Cars, 2016H1

Global EV Sales, 2010-2050E

EV Sales in United States by Model, 2015

EV Battery Sales in North America, 2015-2016

Ranking of EVs in Europe by Sales, 2015

Ranking of EV Sales in Europe by Model, 2016H1

EV Output & Sales in China, 2010-2015

New Energy Vehicle (EV&PHEV) Output in China, Jan-Dec 2015

Electric Vehicle (EV&PHEV) Sales in China, 2011-2020E

Electric Passenger Vehicle (EV&PHEV) Sales in China, 2011-2020E

New Energy Passenger Vehicle (EV&PHEV) Sales in China, Jan-Dec 2015

New Energy Vehicle (EV&PHEV) Sales in China, Jan-Sept 2016

New Energy Commercial Vehicle Output in China, Jan-Dec 2015

EV Promotion Plans in China, 2014-2015

New Energy Bus Output in China, Jan-Dec 2015

Battery Electric Truck Output in China, Jan-Dec 2015

Electric Commercial Vehicle (EV&PHEV) Sales, 2011-2020E

China’s Output of New Energy Vehicles by Category, 2015-2020E

Capacity of Power Lithium Batteries for New Energy Vehicles

Proportion of LiFePO4 Battery for Electric Bus in China, 2015

Proportion of LiFePO4 Battery for Electric Passenger Car in China, 2015

Proportion of LiFePO4 Battery for Electric Special Vehicle in China, 2015

Cathode Materials Adopted by the World’s Major EV Makers

Major Producers of Batteries for New Energy Bus in China, 2016H1

Major Battery Suppliers for Electric Logistics Vehicle and Installation of LiFePO4 Battery, 2015

China’s Demand for EV LiFePO4 Battery, 2015-2020E

Global Demand for CE Lithium Battery and Growth Rate, 2013-2020E

Global Mobile Phone Sales and Demand for Lithium Battery, 2012-2020E

Global Tablet PC Sales and Demand for Lithium Battery, 2012-2020E

Competitive Landscape of Global Tablet PC Market, 2014-2015

Global Laptop Computer Sales and Demand for Lithium Battery, 2012-2020E

Global E-cigarette Sales and Proportion, 2012-2020E

China’s Demand for CE Lithium Battery and Growth Rate, 2014-2020E

Market Size of Consumer Lithium Batteries in China, 2009-2020E

Classification of Common Energy Storage Methods

Corresponding Energy Storage Capacity and Discharging Time of Different Energy Storage Technologies

Installed Capacity of Various Electrochemical Energy Storage Technologies Worldwide

Application Proportion of Different Electrochemical Energy Storage Technologies in Different Countries

Usages of Electronic Energy Storage

Application of Energy Storage in Renewable Energy Field

Application of Energy Storage in Distributed Energy Field

Application of Energy Storage in V2G/V2H System Field

Cost of Different Energy Storage Technologies in Chinese Market

Cost of Different Energy Storage Technologies in U.S. Market

Policies on Energy Storage in China

Accumulative Installed Capacity of Global Electrochemical Energy Storage, 2009-2015

Market Share of Main Technical Routes of Global Energy Storage Systems, 2015

Accumulative Installed Capacity of Electrochemical Energy Storage in China, 2010-2015

China’s Lithium Battery-based Energy Storage Size, 2011-2018E

Performance and Cost Comparison of Three Mainstream Electrochemical Energy Storage Technologies, 2015

China’s Electric Bicycle Output by Type of Battery, 2010-2018E

Permeability of Lead-acid and Lithium Battery Bicycles in China, 2010-2018E

Ownership of Electric Bicycles in China, 2010-2020E

Output of Electric Bicycles (by Region) in China, Jan-May 2016

China’s Electric Bicycle Sales and Market Size, 2010-2020E

Price Table of Major Batteries for Electric Bicycles, 2015

China’s Demand for LiFePO4 Battery for Electric Bicycles, 2015-2020E

China’s Power Tool Output, 2009-2020E

China’s Demand for LiFePO4 Battery for Electric Tools, 2015-2020E

Fixed Asset Investments of Telecommunication Industry in China, 2010-2015

Construction of Mobile Phone Base Stations in China, 2010-2015

Schematic Diagram of Vehicle Start-stop System

Shipments and Penetration of Vehicle Start-stop Battery System in China, 2013-2018E

Proportion of Vehicle Brands Loading Start-stop Batteries in China

Performance Comparison of Main Cathode Materials

Global Shipments of Ternary Cathode Materials (NCA/NCM), 2011-2015

Global Shipments of Ternary Cathode Materials (NCA/NCM), 2009-2020E

Global Price Trend of Ternary Cathode Materials, 2010-2020E

China’s Shipments of Ternary Cathode Materials (NCM), 2011-2015

Domestic Shipments of Ternary Cathode Materials (NCM/NCA), 2015-2020E

Capacity of Major Chinese Producers of Ternary Cathode Materials

Capacity of Major Chinese Ternary Lithium Battery Producers, 2015-2017E

Market Share of Major Chinese Producers of Ternary Cathode Materials, 2015

China’s Lithium Cobalt Oxide Output, 2009-2017E

LiFePO4 VS Lithium Manganese Oxide

History of A123 Systems

Revenue and Gross Profit of A123 Systems, FY2007- FY2012

Revenue and Net Profit of Valence, FY2008-FY2012

Operation of Valence’s Subsidiaries in China

History of Phostech

Development History of Nichia

Revenue of Nichia, 2009-2014

Nichia’s Output of Cathode Materials, 2012&2013

Organizational Structure of Formosa Lithium Iron Oxide

Aleees’ Revenue and Net Income, 2011-2016

Aleees’ Revenue Breakdown by Product, 2012-2016

Aleees’ Revenue Structure by Product, 2012-2016

Aleees’ Revenue Breakdown by Region, 2012-2015

Aleees’ Revenue Structure by Region, 2012-2015

Procurement of Aleees from Main Suppliers and Percentage, 2014-2016

Main Applications of Aleees’s LiFePO4 Cathode Material

Main Performance of Aleees’s Mass-produced LiFePO4 Cathode Material

Aleees’s LiFePO4 Battery Cathode Material R&D Projects

LiFePO4 Material Capacity and Output of Aleees, 2012-2015

LiFePO4 Material Sales Volume of Aleees, 2012-2015

Aleees’s Suppliers of Core Materials for LiFePO4 Cathode Material

Aleees’s Development Goals

Hirose’s Financial Condition, 2009-2014

R&D History of Hirose’s LiFePO4 Technology

Performance of Shandong Hongchen Battery Material’s LiFePO4

Revenue and Net Income of Tatung Fine Chemicals, 2009-2016

Revenue Structure of Tatung Fine Chemicals by Product, 2015

History of LiFePo4 R&D of Tatung Fine Chemicals Co., Ltd.

Development History of Tianjin STL Energy Technology

LiFePO4 Capacity of Tianjin STL Energy Technology, 2007-2018E

Major Production Bases of Shenzhen BTR

Revenue and Net Income of Shenzhen BTR, 2012-2016

Revenue Structure of BTR by Product, 2014-2016

Operating Revenue Structure of BTR by Region, 2013-2015

LiFePo4 Development of BTR

LiFePO4 Revenue and % of BTR, 2013-2016

BTR’s Presence in Industry Chain

Revenue and Net Income of Yantai Zhuoneng Battery Material, 2013-2016

LiFePO4 Revenue Structure of Yantai Zhuoneng Battery Material by Model, 2013-2015

Operating Cost and Gross Margin of Yantai Zhuoneng Battery Material’s LiFePO4 by Model, 2013-2015

LiFePO4 Capacity of Yantai Zhuoneng Battery Material, 2011-2017

Major Customers of Yantai Zhuoneng Battery Material

Development History of Lasting Brilliance New Energy

Revenue and Net Income of Kingli Technology, 2013-2016

Revenue Structure of Kingli Technology by Region, 2013-2016

LiFePO4 Capacity of Kingli Technology, 2015-2020E

Development History of Guoxuan High-Tech

Organizational Structure of Guoxuan High-Tech

Marketing of Guoxuan High-Tech’s Major Products

Major Operating Data of Guoxuan High-Tech, 2015-2016

Revenue Structure of Guoxuan High-Tech by Product, 2015-2016

Lithium Battery Capacity and Major Projects of Guoxuan High-Tech

Lithium Battery R&D Industry Chain of Guoxuan High-Tech

Distribution of Guoxuan High-Tech’s Research Institute

Industrial Eco-map of Guoxuan High-Tech

Lithium Battery Material Developmental Paths of Guoxuan High-Tech

LiFePO4 Revenue, Operating Costs and Gross Margin of Guoxuan High-Tech, 2015-2016

LiFePO4 Capacity of Guoxuan High-Tech, 2014-2020E

History of Tianjiao Technology

The Main Products Capacity of Tianjiao Technology, 2015

Revenue and Net Income of Tiaojiao Technology, 2012-2016

Tianjiao Technology’s Output and Sales of Cathode Materials, 2012-2015

Subsidiaries of Shenzhen Dynanonic

Product Development History of Shenzhen Dynanonic

Operating Data of Shenzhen Dynanonic, 2013-2016

Revenue Structure of Shenzhen Dynanonic by Product, 2013-2016

Nano-LiFePO4 Output, Sales and Capacity of Shenzhen Dynanonic, 2013-2016

Capacity of Main Products of Xinxiang Huaxin

Partners of Hunan Haorun Technology

Development History of BYD

BYD’s Revenue and Net Income, 2010-2015

Main Production Bases of BYD

Revenue of BYD by Product, 2012-2016

Lithium/Nickel Battery Revenue of BYD, 2013-2015

Revenue Breakdown of BYD by Product, 2014-2016

Revenue of BYD by Region, 2012-2016

Revenue Breakdown of BYD by Region, 2012-2016

Goss Margin of BYD’s Leading Products, 2012-2016

Revenue and Net Income of Shenzhen BAK Battery, FY2011-FY2016

Revenue of Shenzhen BAK Battery by Product,FY2009-FY2015

Revenue of Shenzhen BAK Battery by Region,FY2009-FY2013

R&D Costs and % of Total Revenue of Shenzhen BAK Battery, FY2010-FY2015

Technical Parameters of Shenzhen BAK Battery’s Power Cell

Profile of BAK International (Tianjin)

Profile of Dalian BAK Power Battery

Power Battery Sales of Shenzhen BAK Battery, 2009-2015H1

Power Battery Investment Projects of Shenzhen BAK Battery, 2013-2015

Tianjin Lishen’s Products

Development History of Tianjin Lishen

Revenue of Tianjin Lishen, 2008-2016

Tianjin Lishen’s Power Cell Technology Roadmap

Tianjin Lishen’s Power Battery Pack Technology Roadmap

Performance Parameters of Tianjin Lishen’s Spiral Wound Power Cell

Performance Parameters of Tianjin Lishen’s Stacked Power Cell

Performance Parameters of Tianjin Lishen’s Polymer Power Cell

Technical Parameters of Tianjin Lishen’s Power Cell

Power Battery Customers of Tianjin Lishen

Performance Parameters of Tianjin Lishen’s Power Battery Pack

Lithium Battery Capacity of Tianjin Lishen

Power Battery Investment Plans of Tianjin Lishen, 2012-2016

Main Products and Applications of Shenzhen Mottcell Battery Technology

Revenue and Net Income of Shenzhen Mottcell Battery Technology, 2014-2016

Revenue Structure of Shenzhen Mottcell Battery Technology by Region, 2014-2015

Shenzhen Mottcell Battery Technology’s Procurement from Top5 Suppliers, Products Purchased and Percentage, 2015

Patents of Shenzhen Mottcell Battery Technology

Operating Data of Wanxiang A123 Systems, 2014-2015

Revenue and Gross Margin of Sinopoly Battery, 2011-2015H1

Net Income of Sinopoly Battery, 2011-2015H1

Technical Parameters of Sinopoly Battery’s Power Cell

Equity Structure of China Aviation Lithium Battery, 2014

Business Performance of China Aviation Lithium Battery, 2010-2015

EV BMS of China Aviation Lithium Battery

Lithium Battery Certification of China Aviation Lithium Battery

Global Sales Network of China Aviation Lithium Battery

Major Customers of China Aviation Lithium Battery

LiFePo4 Battery Application of CENS Energy-Tech

HiPower New Energy Group

Development History of LiFePo4 Battery Business of Pihsiang Energy Technology

Revenue and Net Income of Pihsiang Energy Technology, 2010-2016

Revenue Structure of Pihsiang Energy Technology by Region, 2013-2015

Capacity, Output and Output Value of Pihsiang Energy Technology by Product, 2013-2015

Sales Volume/Value of Pihsiang Energy Technology by Product, 2013-2015

R&D Costs and % of Total Revenue of Pihsiang Energy Technology, 2011-2015

Main Raw Materials Needed by and Core Suppliers of Pihsiang Energy Technology

Development History of Henan Huanyu Group

Major Carmakers and Auto Models Using Li-Tec’s Power Batteries

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...