China Automotive Glass Industry Report, 2016-2020

-

Dec.2016

- Hard Copy

- USD

$2,200

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

ZJF096

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,200

-

- Hard Copy + Single User License

- USD

$2,400

-

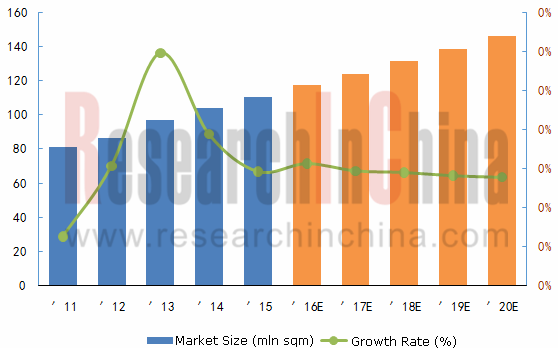

The huge automobile market boosts the demand for automotive glass and other parts constantly. China's automotive glass market size reached 110 million square meters in 2015, with a CAGR of 7.9% compared with 2011. With the slowdown in the automobile market in the future, the automotive glass market will decelerate, at a CAGR of 5.9% in the next five years. By 2020, the market size is expected to reach 146 million square meters.

Automotive Glass Market Demand in China, 2011-2020E

Source: ResearchInChina

Chinese automotive glass market is mainly divided into the supporting market and the maintenance & replacement market. The supporting market shared about 88.3% of the whole automotive glass market in 2015, but the demand herein will decline in the future with the falling automobile output growth; the maintenance & replacement market occupied about 11.7%, while the demand herein will jump with China's rising car ownership and extended car service life.

In terms of products, the current mainstream automotive glass still centers on tempered glass and laminated glass. With higher requirements of drivers and passengers on safety and comfort as well as in-depth applications of optical, mechanical and other technologies in glass products, special function glass has been more and more popular in the market. For example, HUD glass has been assembled in BMW 7 Series, Lexus RX350, Audi, Citroen C6 and other high-end models; Fiat has applied liquid crystal dimmable glass made of PDLC flexible film to windshields and rear window glass; antennas, various electronic components, edge strips, heating wires and other accessories are increasingly integrated into glass to receive signals, provide reverse imaging, waterproof, dustproof and heating functions. In addition, thermal insulation and soundproof glass is used more widely as well.

As for competitive landscape, Chinese auto parts supporting market has entered into a relatively stable stage with high concentration after years of development. Fuyao Glass seized 63% market share exclusively in 2015 and has established relationship with most of major Chinese automakers to support a wide range of passenger cars and commercial vehicles. Asahi Glass (AGC) enjoyed 12% market share in 2015, serving passenger cars under Japanese brands. Saint-Gobain that mainly targets European passenger cars ranked third by market share. The followers -- Xinyi Glass, NSG, Shanghai Yaohua Pilkington Glass and other companies held the respective market share of less than 10%, mainly involved with passenger cars; other manufacturers mainly focus on low-grade commercial vehicle supporting and replacement markets.

The report mainly covers the following:

Overview of China automotive glass industry (including definition, classification, development course, industry chain analysis, industry policies and development trends, etc.);

Overview of China automotive glass industry (including definition, classification, development course, industry chain analysis, industry policies and development trends, etc.);

Analysis on global and China automobile industry (containing output, sales volume, market size, competitive landscape, etc.);

Analysis on global and China automobile industry (containing output, sales volume, market size, competitive landscape, etc.);

Analysis on global and China float glass industry (embracing market size, competitive landscape, development trends, etc.);

Analysis on global and China float glass industry (embracing market size, competitive landscape, development trends, etc.);

Analysis on global and Chinese automotive glass market (comprising market size, market segments, competitive landscape, etc.);

Analysis on global and Chinese automotive glass market (comprising market size, market segments, competitive landscape, etc.);

Analysis on 15 domestic and overseas automotive glass manufacturers such as Asahi Glass, NSG, Fuyao Glass, Shanghai Yaohua Pilkington Glass, Xinyi Glass, Saint-Gobain, Shanxi Lihu Glass, Guangzhou Dongxu Automobile Glass and Changzhou Changjiang Glass (profile, financial status, products, production, marketing, capacity distribution, production bases, R & D, as well as the latest developments).

Analysis on 15 domestic and overseas automotive glass manufacturers such as Asahi Glass, NSG, Fuyao Glass, Shanghai Yaohua Pilkington Glass, Xinyi Glass, Saint-Gobain, Shanxi Lihu Glass, Guangzhou Dongxu Automobile Glass and Changzhou Changjiang Glass (profile, financial status, products, production, marketing, capacity distribution, production bases, R & D, as well as the latest developments).

1 Overview of Automotive Glass

1.1 Properties

1.2 Production

1.3 Industrial Chain

1.4 Policies

2 Overview of Flat (Float) Glass Industry

2.1 Global Float Glass Industry

2.2 China’s Flat (Float) Glass Industry

2.2.1 Capacity and Output

2.2.2 Demand

2.2.3 Price

2.2.4 Competitive Landscape

3 Global and Chinese Automobile Markets

3.1 Global Automobile Output

3.1.1 Total Output

3.1.2 Regional Markets

3.1.3 Competition Pattern

3.2 Chinese Automobile Market

3.2.1 Output

3.2.2 Ownership of Automobiles

3.2.3 Market Pattern

3.3 Developments of Chinese Automobile Market in 2016

4 Automotive Glass Industry

4.1 Global Market

4.1.1 Market Size

4.1.2 Market Segments

4.1.3 Competitive Landscape

4.1.4 Development Trend

4.2 Chinese Market

4.2.1 Market Size

4.2.2 Market Segments

4.2.3 Supply Relation

4.2.4 Competitive Landscape

5 Automotive Glass Manufacturers

5.1 AGC

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Glass Business

5.1.5 Strategy

5.1.6 Development in China

5.1.7 Production Bases

5.2 NSG

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Automotive Glass Business

5.2.5 Global Footprint

5.2.6 Strategy

5.2.7 Strongholds in China

5.3 Shanghai Yaohua Pilkington Glass Group Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Major Products

5.3.6 SYP Kangqiao Autoglass Co., Ltd.

5.3.7 Dynamics

5.4 Xinyi Glass Holdings Limited

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Major Products

5.4.6 Production Bases

5.4.7 Dynamics

5.5 Fuyao Glass Industry Group Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Major Products

5.5.6 R&D

5.5.7 Production Bases

5.5.8 Capacity Analysis

5.5.9 Dynamics

5.6 Saint-Gobain

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Automotive Glass Business

5.6.5 Business in China

5.7 Shanxi Lihu Glass (Group) Co., Ltd.

5.7.1 Profile

5.7.2 Major Products

5.8 Guangzhou Dongxu Automobile Glass Co., Ltd.

5.8.1 Profile

5.8.2 Major Products

5.8.3 Nanjing Yunhai Automobile Glass & Equipment Manufacturing Co., Ltd.

5.9 Changzhou Changjiang Glass Co., Ltd.

5.9.1 Profile

5.9.2 Major Products

5.10 Hebei Tongyong Glass Industrial Co., Ltd.

5.10.1 Profile

5.10.2 Major Products

5.10.3 Marketing Network

5.11 Jiangsu Tiemao Glass Co., Ltd.

5.11.1 Profile

5.11.2 Major Products

5.11.3 Dynamics

5.12 Ming Chi Glass Co., Ltd.

5.12.1 Profile

5.12.2 Major Products

5.13 BSG Auto Glass Co., Ltd.

5.13.1 Profile

5.13.2 Major Products

5.14 Shandong Jinjing Science & Technology Stock Co., Ltd.

5.14.1 Profile

5.14.2 Automotive Glass Business

5.15 Taiwan Glass Ind. Corp.

5.15.1 Profile

5.15.2 Major Products & Customers

5.15.3 Production & Sales

5.15.4 Business in Chinese Mainland

Main Components of Float Glass

Cost Structure of Float Glass

Cost Structure of Automotive Glass (e.g. Laminated Glass)

Key Production Processes for Laminated Glass

Key Production Processes for Tempered Glass

Glass Industry Chain

Value Chain of Auto Glass Industry

Policies on Glass Industry in China, 2006-2016

Global Output of Float Glass, 2011-2020E

Distribution of Sheet (Float) Glass Output in the World, 2015

Production Capacity of Float Glass in China, 2011-2020E

Float Glass Output and Capacity Utilization in China, 2011-2020E

Existing Production Lines and In-production Ones for Float Glass in China, 2014-2016

Float Glass Demand in China, 2011-2020E

Main Applied Markets of Float Glass, 2015

Price Trend of Float Glass in China, 2014-2016

Market Share of Major Float Glass Manufacturers in China, 2015

Global Automobile Output, 2011-2020E

Automobile Output (by Model) in Major Countries, 2015

Automobile Output (by Model) in Major Countries, 2016H1

Market Shares of Major Automobile Manufacturers, 2015

Automobile Output in China, 2010-2020E

Ownership of Automobiles in China, 2007-2020E

Ranking of Top 10 Automobile Manufacturers in China, Jan-Oct 2016

Ranking of Top 10 Passenger Car Brands by Output in China, Jan-Oct 2016

Ranking of Top 10 Commercial Vehicle Manufacturers by Output in China, Jan-Oct 2016

Table of Automobile Production and Sales in China, Oct 2016

Automobile Output Structure (%) by Type in China, Jan-Oct 2016

Automobile Sales Volume Structure (%) by Type in China, Jan-Oct 2016

Table of Passenger Car Production and Sales in China, Jan-Oct 2016

Diagram of Sedan Production and Sales in China, Jan-Oct 2016

Diagram of MPV Production and Sales in China, Jan-Oct 2016

Diagram of Cross Passenger Car Production and Sales in China, Jan-Oct 2016

Diagram of SUV Production and Sales in China, Jan-Oct 2016

Table of Commercial Vehicle Production and Sales in China, Jan-Oct 2016

Diagram of Truck Production and Sales in China, Jan-Oct 2016

Diagram of Bus Production and Sales in China, Jan-Oct 2016

Global Automotive Glass Market Size, 2011-2020E

Auto Glass OEM Market Size in China, 2011-2020E

Auto Glass ARG (Aftermarket Replacement Glass) Market Size in China, 2011-2020E

Shares of Auto Glass Market Segments in China, 2015

Geographical Distribution of Key Automakers and Auto Glass Producers in China

Market Share of World’s Major Automotive Glass Manufacturers, 2015

Sketch Map of Insulating Glass

HUD Display Glass

Sketch Map of Hydrophobic Glass

Sketch Map of Muffled Automotive Glass

Sketch Map of Antenna Automotive Glass

Sketch Map of Windshield Heating Glass with Metal Threads

Structure of Automotive Glass with Electrothermal Film

Auto Glass Market Size in China, 2011-2020E

Auto Glass OEM Market Size in China, 2011-2020E

Auto Glass ARG Market Size in China, 2011-2020E

Market Shares of Auto Glass Market Segments in China, 2015

Supply Relation between Top 3 Auto Glass Manufacturers and Automakers in China

Geographical Distribution of Key Automakers and Automotive Glass Makers in China

Market Share of Major Automotive Glass Manufacturers in China, 2015

Comparison of Leading Automotive Glass Manufacturers in China

Supporting (by Manufacturer) of China Auto Glass Industry

AGC’s Operations in Three Major Regions

Revenue of AGC, FY2012-FY2016

Operating Income and Profit Margin of AGC, FY2012-FY2016

Net Income and ROE of AGC, FY2012-FY2016

Quarterly Operational Indicators of AGC’s Main Business, 2015-2016

Quarterly Operational Indicators of AGC in Major Regions, 2015-2016

Glass Business Revenue of AGC, 2012-2016

Core Strategy “Vision 2025” of AGC

AGC’s Intensified Strategy for Its Core Business

Future Strategic Business of AGC

Progress of AGC’s Mid-term Management Planning

Main Strongholds of AGC in China

Profile of AGC Autoglass (China) Co., Ltd.

Profile of AGC Autoglass (Foshan) Co., Ltd.

Profile of AGC Flat Glass (Dalian) Co., Ltd.

Profile of AGC Autoglass (Suzhou) Co., Ltd.

Revenue and Net Income of NSG, FY2013-FY2016

Revenue and Net Income of NSG, FY2017H1

Revenue (by Division) of NSG, FY2013-FY2017

Operating Income (by Division) of NSG, FY2013-FY2016

Revenue (by Region) of NSG, FY2016

Revenue (by Division) of NSG, FY2016

Revenue (by Division) of NSG, FY2017H1

General Overview of NSG’s Automotive Glass Business

Selected Financial Indicators of NSG’s Automotive Glass Business, FY2015-FY2016

NSG’s Revenue from Automotive Glass Business by Region, FY2016

Distribution of NSG’s Float Glass Production Lines in the World

Distribution of NSG’s Automotive Glass Production Lines in the World

NSG’s Strategies for Its Three Stages of Development

Key Means of Implementing Strategies for Various Operations of NSG

Glass Production Lines of NSG in China

Profile of Guilin Pilkington Safety Glass Co., Ltd.

Revenue and Net Income of Shanghai Yaohua Pilkington Glass Group, 2011-2016

Revenue (by Product) of Shanghai Yaohua Pilkington Glass Group, 2015-2016

Revenue (by Region) of Shanghai Yaohua Pilkington Glass Group, 2015-2016

Gross Margin (by Product) of Shanghai Yaohua Pilkington Glass Group, 2014-2016

Main Automotive Glass Products of Shanghai Yaohua Pilkington Glass Group

Output, Sales Volume and Inventory of Main Products of Shanghai Yaohua Pilkington Glass Group, 2015

Automotive Glass Capacity of Shanghai Yaohua Pilkington Glass Group, 2014-2018

Profile of SYP Kangqiao Autoglass

Revenue and Net Income of SYP Kangqiao Autoglass, 2014-2016

Revenue and Net Income of Xinyi Glass, 2011-2016

Revenue (by Product) of Xinyi Glass, 2014-2016

Revenue (by Region) of Xinyi Glass, 2014-2016

Gross Profits and Gross Margin of Xinyi Glass, 2011-2016

Major Auto Glass Products of Xinyi Glass

Overview of Enterprises Supported by Auto Glass of Xinyi Glass

Main Auto Glass Manufacturing Bases of Xinyi Glass

Profile of Dongguan Benson Automobile Glass Co., Ltd.

Profile of Xinyi Automobile Glass (Shenzhen) Co., Ltd.

Profile of Xinyi Automobile Parts (Wuhu) Co., Ltd.

Profile of Xinyi Energy-saving Glass (Sichuan) Co., Ltd.

Profile of Xinyi Automobile Parts (Tianjin) Co., Ltd.

Revenue and Net Income of Fuyao Glass Industry Group, 2013-2016

Revenue (by Product) of Fuyao Glass Industry Group, 2013-2016

Revenue (by Region) of Fuyao Glass Industry Group, 2013-2016

Gross Profits and Gross Margin (by Product) of Fuyao Glass Industry Group, 2013-2016

Major Auto Glass Products of Fuyao Glass Industry Group

Auto Glass Supporting Services of Fuyao Glass Industry Group

Production and Sales of Fuyao Glass Industry Group, 2014-2015

R&D Course of Fuyao Glass Industry Group

Main R&D Orientations of Fuyao Glass Industry Group in Future

R&D Expenditure of Fuyao Glass Industry Group in Future, 2015

Major Auto Glass Manufacturing Bases of Fuyao Glass Industry Group and the Enterprises Supported

Footprint of Fuyao Glass Industry Group in China

Float Glass Capacity Distribution of Fuyao Glass Industry Group

Financial Indicators of Main Subsidiaries Held by Fuyao Glass Industry Group, 2015

Fuyao Glass’ Subsidiaries Producing Auto Glass

Float Glass Capacity of Fuyao Glass Industry Group, 2013-2018

Auto Glass Capacity of Fuyao Glass Industry Group, 2013-2018

Revenue and Net Income of Saint-Gobain, 2013-2016

Revenue (by Business) of Saint-Gobain, 2014-2016

Revenue (by Region) of Saint-Gobain, 2014-2016

Profile of SEKURIT

Automotive Glass Production Layout of Saint-Gobain Worldwide

Global Automotive Glass R&D Center of Saint-Gobain

Major Brands Supported by Automotive Glass of Saint-Gobain

Saint-Gobain’s Revenue in China, 2013-2015

Number of Employees of Saint-Gobain in China, 2013-2015

Profile of Saint-Gobain HanGlas Sekurit (Shanghai) Co., Ltd.

Profile of Saint-Gobain Safety Glass (Shanghai) Co., Ltd.

Profile of Shanxi Lihu Glass (Group)

Main Automotive Glass of Shanxi Lihu Glass (Group)

Profile of Guangzhou Dongxu Automobile Glass

Main Automotive Glass Products of Guangzhou Dongxu Automobile Glass

Some Brands of Automotive Glass Replacements Provided by Guangzhou Dongxu Automobile Glass

Profile of Nanjing Yunhai Automobile Glass & Equipment Manufacturing Co., Ltd.

Profile of Changzhou Changjiang Glass

Sketch Map of Bus Insulating Glass of Changzhou Changjiang Glass

Profile of Hebei Tongyong Glass Industrial

Main Automotive Glass Products of Hebei Tongyong Glass Industrial

Overseas Marketing Network of Hebei Tongyong Glass Industrial

Profile of Jiangsu Tiemao Glass

Main Automotive Glass Products of Jiangsu Tiemao Glass

Major Customers of Jiangsu Tiemao Glass

Profile of Ming Chi Glass

Main Automotive Glass Products of Ming Chi Glass

Profile of BSG Auto Glass Co., Ltd.

Main Automotive Glass Products of BSG Auto Glass Co., Ltd.

Profile of Shandong Jinjing Science & Technology Stock Co., Ltd.

Profile of Shandong PGW Jinjing Automotive Glass Co., Ltd.

Profile of Taiwan Glass Ind. Corp.

Major Customers of Taiwan Glass Ind. Corp.

Output of Taiwan Glass Ind. Corp in Main Producing Areas, 2014-2015

Sales Volume of Taiwan Glass Ind. Corp. in Main Producing Areas, 2014-2015

Taiwan Glass Ind. Corp’s Production Layout of Main Products in Chinese Mainland

Profile of TG Yueda Autoglass Co., Ltd.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...