Global and China Automotive Instrument Cluster and Head-up Display (HUD) Industry Report, 2016-2020

-

May 2017

- Hard Copy

- USD

$2,400

-

- Pages:90

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW232

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China Automotive Instrument Cluster and Head-up Display (HUD) Industry Report, 2016-2020 highlights the following:

1. Global and China automobile market

2. Instrument cluster and HUD market and industry

3. Development trends of instrument cluster and HUD

4. DLP, laser scanning and AR HUDs

5. Key vendors

HUD (Head-up Display) falls into windshield type (W-type) and combined type (C-type). It was initially mounted on GM Corvette in 2001, and then the first color HUD was launched by BMW in 2004. Global OEM HUD market size attained USD560 million in 2016, surging by 33% from a year earlier, and is predicted to leap to USD1,780 million in 2020. Market size and shipments of W-type were roughly USD530 million and 2 million sets respectively in 2016, and will expectedly move up to USD1,715 million and about 7 million sets in 2020; C-type saw market size of around USD30 million and shipments of 600,000 sets in 2016, and the figures are estimated to climb to USD65 million and 1.7 million sets respectively in 2020.

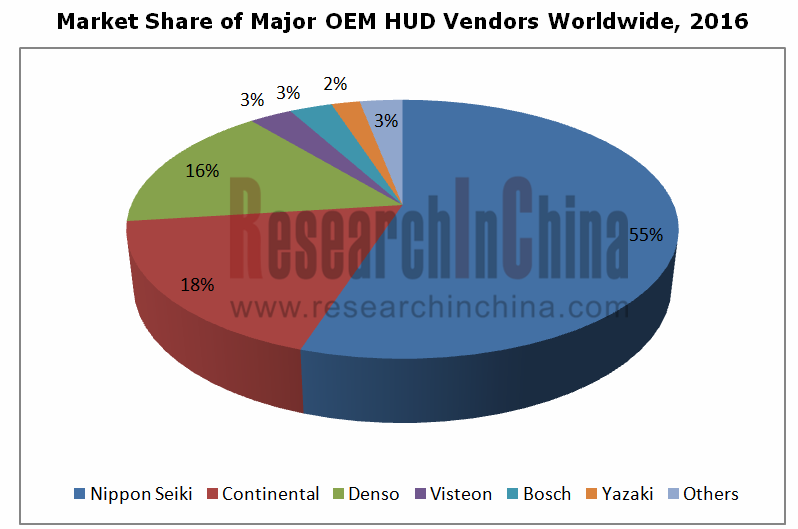

Nippon Seiki under Honda seizes a market share of over 50%. BMW, GM and Audi are the three major clients of Nippon Seiki, and their models including BMW 5 Series, 7 Series, X Series, Audi Q7 and GM Cadillac and Buick all carry Nippon Seiki’s HUDs. The company plans a capacity of 3 million units in 2020, most of which will be W-type. It now has 4 production bases in Japan, North America and the UK, and is building a new one in Miyoshi, Hiroshima Prefecture which is scheduled to come into production next year. Continental’s main clients are Mercedes-Benz, Audi and BMW, and its HUDs find application in Mercedes-Benz C Class, Audi A6 and A7 and BMW 3 Series. In January 2017, Continental and the U.S.-based Digilens reached a strategic cooperation agreement for development of AR-HUD. Denso primarily supports Toyota and Hyundai; Visteon is a supplier of PSA; BMW Mini bears Bosch’s HUD.

In OEM market, C-type will expectedly see a declining market share due to poor user experience, and even Chinese automakers use few HUDs of such type, for example, Geely equips its Borui models with W-type. AR-HUD is the general direction of OEM. To achieve AR (augmented reality) of the true sense, DLP (digital light processing) projection technology is indispensable. AR-HUD will come out in 2018 and be the mainstream in 2021. However, for digital micromirror device (DMD), the core component of DLP projector, and related technologies are monopolized by Texas Instruments, coupled with complicated optical path and much higher price of DMD than TFT-LCD, DLP’s costs will seldom drop despite maturity of the technology for quite a few years. Therefore, laser scanning type HUD is likely to capture the market in the future, hopefully taking a share of 10% in OEM market in 2021, 25-30% in 2025.

As for aftermarket (AM), reflection-type TFT-LCD is dominant as DLP with more complicated optical path and higher internal temperature is unacceptable to AM manufacturers whose technology capabilities are relatively weak. With marked improvement in brightness of OLED, transparent OLED will be the development orientation of AM, but OLED for HUD will not appear in a short time because of little use in AM and monopoly of LG and Samsung in technology and capacity.

1 Global and Chinese Automobile Markets

Global Sales of Light Vehicles, 2010-2020E

Global Sales of Light Vehicles by Region, 2014-2017

Automobile Sales in China, 2005-2017

Overview of Chinese Automobile Market, 2016

2 Automotive HUD and Instrument Cluster Market

OEM Market Size of Automotive HUD, 2015-2021E

Automotive HUD Shipments, 2016-2021E

Aftermarket HUD Shipments Worldwide, 2016-2021E

Distribution of OEM HUD Types by Technology, 2016-2025E

Distribution of Aftermarket HUD Types by Technology, 2016-2025E

Market Share of Major OEM HUD Vendors in the World, 2016

Global Automotive Instrument Cluster Market Size, 2016-2022E

Market Share of Major Automotive Instrument Cluster Makers in the World, 2016

Market Distribution of World’s Automotive Instrument Clusters by Type, 2016-2020E

Automotive Display Market

Market Share of World’s Key TFT-LCD On-board Display Vendors (by Shipment), 2016

Market Share of World’s Key TFT-LCD On-board Display Vendors (by Value), 2016

AMOLED On-board Display

3 Profile of HUD

HUD Falls into Windshield Type and Combined Type

Structure of W-type HUD

Light Path of W-type HUD

Structure of C-type HUD

Parameters of Typical C-type HUD

Cheapest HUD

HUD of Audi A7

Anatomy of Audi A7 HUD

Exceedingly High Technical Threshold

Extreme Difficulty in Production

4 DLP HUD

HUD Basics -- VID

Obvious Superiority of DLP Performance

Problem about Resolution

Interpupillary Distance (IPD)

Comparison of HUD Technologies

DLP is the Most Mature Technology with Best Performance Currently

Light Path of DLP-Type HUD

5 Laser Scanning HUD

PicoP Laser Beam Scan Engine of Microvision

MicroPicoP is Most Typical Laser Scanning

Pocket Projector Celluon PicoPro

Mitsubishi’s and Pioneer’s Laser Scanning HUDs Adopt the Patents of MicroVision

Laser Scanning HUD of Intersil

Laser Scanning HUD of Panasonic

DLP HUD of Panasonic

Jaguar’s First Use of OEM Laser Scanning HUD

Maxim’s Laser Scanning HUD 8-channel DAC and Bridged SoC

1st-generation Navdy DLP Hud is Priced at USD499

Analysis of Navdy

6 AR HUD

HUD Trend – Perfect Fusion of AR (Augmented Reality) with ADAS

Augmented Reality Head-Up Display

Augmented Reality Head-Up Display ACC

AR HUD (of Continental) to be Used on KIA K9

AR HUD Requires Two to Three Display Layers

Continental Adopts Double-Layer Display as well

7 HUD and Instrument Cluster Vendors

Profile of Visteon

Quarterly Revenue and Gross Margin of Visteon for Successive 12 Quarters

Revenue Breakdown of Visteon by Product, 2015-2016

Revenue Breakdown of Visteon by Region/Customer, 2013-2016

More Balanced Distribution of Visteon’s Customers, 2017

HUD Roadmap of Visteon

HUD Orders of Visteon

Profile of Nippon Seiki

Revenue Breakdown of Nippon Seiki by Business, FY2013-FY2017

Revenue Breakdown of Nippon SeikiE by Region, FY2014-FY2017

Revenue Breakdown of Nippon Seiki by Customer, Q2/FY2016/2017

Technology Roadmap of Nippon Seiki

HUD Production Capacity of Nippon Seiki, FY2013-FY2021E

Production Bases of Nippon Seiki

Profile of Shanghai Nissei Display System Co., Ltd.

HUD Subordinate to Instrumentation&Driver HMI Segment under Interior Business

Global Footprints of Instrumentation & Driver HMI (ID)

International Setup for HUDs

Use Example of Continental’s HUD

Typical HUD Parameters of Continental

Introduction to Pioneer SPX-HUD100

Pioneer LaserScan HUD

Bosch HUD for Mini

Profile of Microvision

Revenue Breakdown of Microvision by Business, 2013-2016

Gross Margin of Microvision, Q1 2015 - Q3 2016

Products Adopting Microvision’s Patents

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...