Global and China Automotive Millimeter Wave (MMW) Radar Industry Report, 2016-2021

-

Sep.2017

- Hard Copy

- USD

$2,900

-

- Pages:170

- Single User License

(PDF Unprintable)

- USD

$2,700

-

- Code:

YSJ102

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$3,100

-

In comparison with lidar, MMW (millimeter wave) radar has more mature technology, wider application and lower costs; its accuracy and stability are also better than camera, and price gap between them is narrowing. Accordingly, it has a big room to grow in ADAS and automated driving fields.

In 2016, global shipments of MMW radar surged by 27.5% to 31.5 million units from a year ago, and the figure is projected to climb to 84 million units in 2021, with an AAGR of 21.7%. As major countries pose higher requirements on use of ADAS functions in their new car assessment program (NCAP), ADAS penetration will rise rapidly, directly driving demand for MMW radar. It is predicted that global MMW radar market size will hit nearly USD6 billion in 2021.

In 2016, China saw pre-installation of MMW radar reach 1.05 million sets, of which 24GHz radars accounted for 63.8%, and 77GHz 36.2%. 24GHz radar is now mainly applied in blind spot detection (BSD), and market demand for it will be Chinese brand models with little installation of BSD; 77GHz radar finds application in adaptive cruise control system (ACC), and some companies also use it in forward collision warning (FCW) and automatic emergency braking (AEB). According to C-NCAP (China-New Car Assessment Program), AEBS will be included in bonus-point system in 2018, in favor of larger demand for 77GHz radars. Additionally, 77GHz radar with smaller size and longer detection range, will squeeze market space of 24GHz radar in the future.

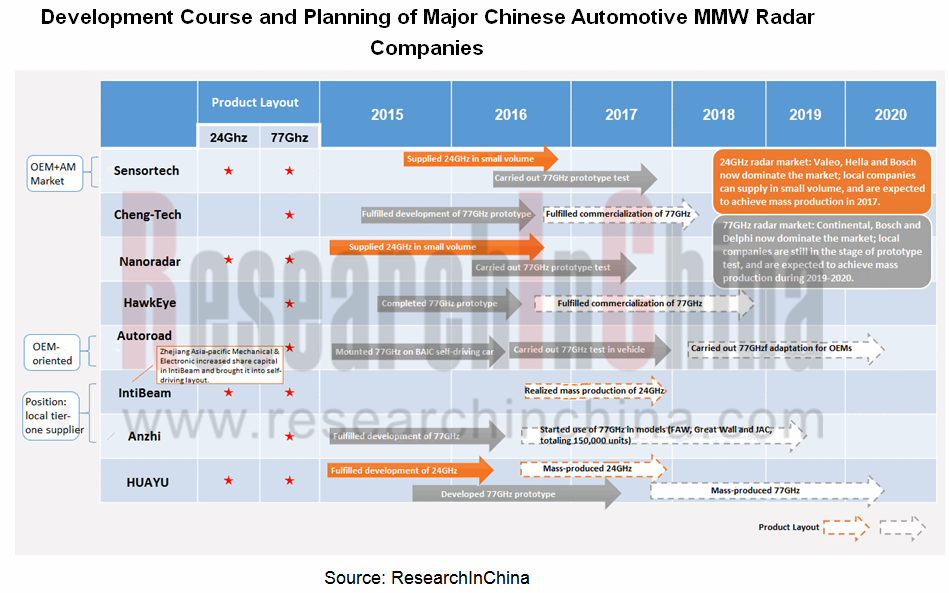

From competition pattern, global MMW radar market is carved up by Bosch, Continental, TRW, Valeo, Hella, Delphi, Denso, Autoliv and Fujitsu Ten, and Chinese market looks like a miniature of global competition. In China, the 24GHz radar market is dominated by Valeo, Hella and Bosch, with a joint share of above 60% in total shipments; the 77GHz radar market is seized by Continental, Bosch and Delphi, together sweeping roughly 80% of total shipments.

Chinese MMW radar companies have made breakthroughs, and Sensortech, IntiBeam and HUAYU Automotive Systems have realized small-volume production, of which HUAYU plans mass production of some 24GHz products in 2017. Sensortech, Cheng-Tech, Nanoradar, HawkEye, Autoroad, Anzhi Automotive Parts and HUAYU have carried out 77GHz prototype test, and some of them are expected to realize mass production during 2019-2020. Nevertheless, besides price, OEMs also stress such technical parameters of products as stability and select suppliers with discretion. Hence, Chinese companies still have a long way to go.

Global and China Automotive Millimeter Wave (MMW) Radar Industry Report, 2016-2021 highlights the following:

Overview of MMW radar industry (including product features, working mode, applications and development trend);

Overview of MMW radar industry (including product features, working mode, applications and development trend);

Global ADAS and automated driving market (including policy environment, market size, and application and comparison of mainstream sensors);

Global ADAS and automated driving market (including policy environment, market size, and application and comparison of mainstream sensors);

Global MMW radar market (including shipments, market size, competition pattern and supply relationship);

Global MMW radar market (including shipments, market size, competition pattern and supply relationship);

China ADAS and automated driving market (including policy environment, market size, pre-installation, penetration, and application of mainstream sensors);

China ADAS and automated driving market (including policy environment, market size, pre-installation, penetration, and application of mainstream sensors);

China MMW radar market (including pre-installation, market size, competition pattern, supply relationship and development trend);

China MMW radar market (including pre-installation, market size, competition pattern, supply relationship and development trend);

Global and Chinese MMW radar companies (including operation, main product types, technology roadmap, product characteristics, etc.).

Global and Chinese MMW radar companies (including operation, main product types, technology roadmap, product characteristics, etc.).

1 Overview of MMW Radar Industry

1.1 Overview

1.2 Frequency Division

1.2.1 Development History

1.2.2 Status Quo

1.3 Operation Mode

1.3.1 Working System

1.3.2 Working Path

1.3.3 Core Process

1.4 Applications

1.5 Development Trend

2 Global ADAS and Automated Driving Market

2.1 Policy Environment

2.2 Current Situation

2.3 Market Size

2.4 Industry Chain

2.5 Key Sensors

2.6 MMW Radar Application Solutions

3 Global Automotive MMW Radar Market

3.1 Shipments

3.2 Market Size

3.3 Supply Relationship

3.4 Competitive Landscape

4 Chinese ADAS and Automated Driving Market

4.1 Status Quo

4.2 Policy Climate

4.3 Penetration

4.3.1 ADAS as a Whole

4.3.2 DA/PA/CA

4.4 Pre-installations

4.5 Market Size

4.6 Sensor Market

4.7 Mainstream MMW Radar Solutions

5 Chinese Automotive MMW Radar Market

5.1 Overall Market

5.2 24GHZ Radar Market

5.2.1 Pre-installations

5.2.2 Market Size and Prices

5.2.3 Competitive Landscape

5.3 77GHZ Radar Market

5.3.1 Pre-installations

5.3.2 Market Size and Prices

5.3.3 Competitive Landscape

5.4 Supply Relationship

5.5 Development of Major Enterprises

5.6 R&D of Core Parts

5.7 Development Trend

6 Key Global Automotive MMW Radar Companies

6.1 BOSCH

6.1.1 Profile

6.1.2 Operation

6.1.3 Major Products

6.1.4 Technology Roadmap

6.1.5 R&D Team

6.1.6 Customers Supported

6.1.7 Strategy for Automated Driving

6.1.8 Partner with NVIDIA

6.1.9 Cooperation with Chinese Map Firms

6.2 Continental

6.2.1 Profile

6.2.2 Operation

6.2.3 Major Products

6.2.4 Technology Roadmap

6.2.5 R&D Team

6.2.6 Customers Supported

6.2.7 Strategy for Automated Driving

6.2.8 Partner with Baidu

6.3 ZF TRW

6.3.1 Profile

6.3.2 Operation

6.3.3 Major Products

6.3.4 Technology Roadmap

6.3.5 Customers Supported

6.3.6 Strategy for Automated Driving

6.3.7 ProAI In-vehicle System

6.3.8 Acquisition of Ibeo’s Equities

6.3.9 Acquisition of Astyx’s Equities

6.4 Delphi

6.4.1 Profile

6.4.2 Operation

6.4.3 Major Products

6.4.4 Customers Supported

6.4.5 Strategy for Automated Driving

6.4.6 CSLP System

6.4.7 Automated Driving Partners

6.5 Hella

6.5.1 Profile

6.5.2 Operation

6.5.3 Major Products

6.5.4 Customers Supported

6.5.5 ADAS Strategy

6.6 Denso

6.6.1 Profile

6.6.2 Operation

6.6.3 Major Products

6.6.4 Customers Supported

6.6.5 Strategy for Automated Driving

6.7 Autoliv

6.7.1 Profile

6.7.2 Operation

6.7.3 Major Products

6.7.4 Customers Supported

6.7.5 Strategy for Automated Driving

6.8 Valeo

6.8.1 Profile

6.8.2 Operation

6.8.3 Major Products

6.8.4 Technology Roadmap

6.8.5 Customers Supported

6.8.6 Strategy for Automated Driving

6.8.7 Partners

7 Major Chinese Automotive MMW Radar Companies

7.1 Wuhu Sensor Technology Co., Ltd.(Sensortech)

7.1.1 Profile

7.1.2 Operation

7.1.3 Major Products

7.1.4 Development Features

7.2 Cheng-Tech

7.2.1 Profile

7.2.2 Operation

7.2.3 Major Products

7.2.4 Development Features

7.3 Hunan Nanoradar Science & Technology Co., Ltd. (Nanoradar)

7.3.1 Profile

7.3.2 Development Course

7.3.3 Major Products

7.3.4 ADAS Solutions

7.3.5 Development Layout

7.3.6 Development Features

7.4 HawkEye Technology Co., Ltd.

7.4.1 Profile

7.4.2 Major Products

7.4.3 Development Plan

7.4.4 Development Features

7.5 Beijing Autoroad Tech Co., Ltd. (Autoroad)

7.5.1 Profile

7.5.2 Operation

7.5.3 Major Products

7.5.4 Development Features

7.6 Hangzhou IntiBeam Technology Co., Ltd. (IntiBeam)

7.6.1 Profile

7.6.2 Operation

7.6.3 Major Products

7.6.4 Development Features

7.7 Anzhi Automotive Parts Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Major Products

7.8 HUAYU Automotive Systems Co., Ltd.

7.9 Shenzhen RoadKing Electronic Technology Co., Ltd. (RoadKing Tech)

Main Purposes of Radars by Wavelength

History of Automotive MMW Radar Band Division by Country

Automotive Radar Frequency Distribution in Europe, Japan and the United States

Contrast between Narrowband Radar and Broadband Radar

Working Path of MMW Radar in ADAS

Principle of MMW Radar Automotive Collision Avoidance System

Applications of Various Sensors in ADAS

Applications of Short-distance and Long-distance MMW Radar in ADAS

Demand of Different Detection Distances for Sensors in Automotive ADAS

MMW Radar Development Trend

ADAS-related Laws, Regulations and Industry Standards Developed by Major Countries

Prediction for Development Stages of Global Automated Driving

ADAS Development Process in Major Countries / Regions

Automated Driving Vehicle Launch Schedule of Global Major Companies

Global ADAS Market Size, 2015-2021E

Global ADAS Market Structure, 2016 vs 2021E

Automated Driving Industry Chain

Performance Comparison between Main Recognition Sensors of Automated Driving

7 MMW Radars ("1 LRR + 6SRR") of Mercedes-Benz S-Class

MMW Radar Application Solutions of Typical Automated Driving Vehicle Models Worldwide

Global Automotive MMW Radar Shipment, 2014-2021E

Global Automotive MMW Radar Market Size, 2014-2021E

Supply Relationship between Major Automotive MMW Radar Vendors and OEMs Worldwide

Market Share of Global Major Automotive Radar Vendors, 2015

Automated Driving Levels in China

Number of Vehicle Models Equipped with ADAS Function in China, 2015-2016

Technology Roadmap of Automotive MMW Radar in China

Construction Roadmap of Intelligent Connected Vehicle Standard System in China

Penetration Rate of ADAS Function for Low, Medium and High Configuration Vehicle Models in China, 2016

ADAS Penetration in China, 2016-2020E

Penetration Rate of Each ADAS Function in China, 2016

DA/PA/CA Penetration in China, 2016-2020E

ADAS Pre-installations in China, 2016-2020E

DA/PA/CA Pre-installations in China, 2016-2020E

ADAS Market Size in China, 2016-2021E

Market Share of ADAS Sensors in China, 2016-2021E

Life Cycle of ADAS Sensors in China, 2015-2030E

MMW Radar Installation Solutions of OEMs in China

Pre-installations of Automotive MMW Radar in China, 2016-2021E

Automotive MMW Radar Market Size in China, 2016-2021E

Pre-installations of Automotive 24GHz MMW Radar in China, 2016-2021E

Automotive 24GHz MMW Radar Market Size in China, 2016-2021E

Unit Price of 24GHz MMW Radar in China, 2016-2021E

Market Share of Major Automotive 24GHz MMW Radar Companies in China, 2016

Pre-installations of Automotive 77GHz MMW Radar in China, 2016-2021E

Automotive 77GHz MMW Radar Market Size in China, 2016-2021E

Unit Price of 77GHz MMW Radar in China, 2016-2021E

Market Share of Major Automotive 77GHz MMW Radar Companies in China, 2016

Automotive MMW Radar Suppliers of OEMs in China

MMW Radar Business Development of Major Companies in China

MMIC System Diagram of Infineon’s 24GHz MMW Radar

MMIC System Diagram of Infineon’s 76/77GHz MMW Radar

Structure of Radar Antenna High-frequency PCB

Bosch’s Global Sales, Staff and R&D Expenses, 2012-2016

Bosch’s Main MMW Radar and Camera Products

Bosch’s Main ADAS Products

Bosch’s Braking ADAS Technology Roadmap

Bosch’s MMW Radar Customers in China

Continental’s Sales and Profit, 2015-2016

Continental’s Sales and Profit, H1 2017

Continental’s Sales Structure (by Division and Region), 2016

Continental’s Sales Structure (by Division and Region), 2012-2016

Sales Growth of Continental’s Main Divisions, H1 2017

Continental’s Automotive Product Layout

Continental’s Main ADAS Products

Continental’s AEB Technology Roadmap

Continental’s Footprints in China

Continental’s Global Sensor Customers

Continental’s MMW Radar Customers in China

Sales, Profit and Staff of ZF TRW, 2015-2016

Sales Structure of ZF TRW (by Division and Region), 2016

Features of ZF TRW’s MMW Radar

Technology Roadmap of ZF TRW’s Braking ADAS

MMW Radar Customers of ZF TRW in China

Delphi’s Sales and Net Income, 2012-2016

Delphi’s Orders, 2011-2017

Delphi’s Global Customer Structure, 2016

MMW Radar Customers of ZF TRW in China

Six Levels of Delphi’s Automated Driving

Delphi’s Automated Driving Roadmap

Delphi’s Automated Driving Partners

Hella’s Sales and Profit, FY2015-FY2017

Hella’s R&D Expenses, FY2014-FY2017

Hella’s Automotive Sales, FY2014-FY2017

Hella’s Automotive Safety Products

Hella’s MMW Radar Customers in China

Denso’s Revenue, FY2013- FY2017

Denso’s Operating Income, FY2013- FY2017

Denso’s MMW Radar Customers in China

Denso’s Automated Driving Layout

Autoliv’s Sales and Operating Income, 2015-2017

Autoliv’s Growth by Business, 2016

Autoliv’s Delivery by Product, 2016

Global Passive Safety System Competition Pattern, 2016

Autoliv’s MMW Radar Customers in China

Development Path of Autoliv’s Automated Driving

Autoliv’s Development History in the Field of Automated Driving

Autoliv’s ADAS Layout

Valeo’s Sales and Operating Income, 2014-2017

Valeo’s Orders, 2005-2017

Valeo’s R&D Expenses, 2014-2016

Valeo’s Main ADAS Products

Valeo’s Technical Solutions for ADAS Products

Valeo’s MMW Radar Customers in China

Valeo’s Key Partners

Sensortech’s Performance, 2015-2016

Sensortech’s Main Products

Applications of Sensortech’s Main Products

Sensortech’s Main Patents

Cheng-Tech’s Performance, 2015

Cheng-Tech’s Integrated Radar Product Plan

Cheng-Tech’s Product Patents

Nanoradar’s Development History

Applications of Nanoradar’s MMW Radar

Nanoradar’s Main Products

Main Parameters of Nanoradar’s CAR70

Main Parameters of Nanoradar’s CAR150

Main Parameters of Nanoradar’s CAR200

Product Planning of HawkEye Technology

Performance of Beijing Autoroad Tech, 2015

Main MMW Radar Products of Beijing Autoroad Tech

Intibeam’s Performance, 2015-2016

Performance of Suzhou Anzhi, 2015-2016

Development Progress of 77GHz MMW Radar

Chip Mass-production System Architecture of Suzhou Anzhi

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...