Global and China Tire Pressure Monitoring System (TPMS) Industry Report, 2017-2021

-

Jan.2018

- Hard Copy

- USD

$3,200

-

- Pages:168

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC062

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

As people have become more aware of driving safety and countries like the United States, EU, South Korea and China (Taiwan, Mainland) introduced mandatory standards on TPMS in recent years, global TPMS market, primarily OEM, has grown steadily. Global TPMS OEM market size was about 47.62 million sets with an installation rate of 50.1% in 2016. The figures for 2021 are expected to reach 81.27 million sets and 77.4%.

As mandatory European laws and regulations are implemented, Europe has surpassed the United States as the region with the largest demand worldwide, while China becomes the world’s third largest TPMS market after Europe and the United States by virtue of its enormous automobile market. The three regions seize a market share of 37.1%, 25.4% and 16.1%, respectively.

According to the requirements of China’s mandatory TPMS standard, for M1 auto models, all new certified vehicle must carry TPMS in the Chinese market by 2019 and all vehicles being produced must be compulsorily installed with TPMS in 2020, therefore China will overtake Europe to be the world’s largest TPMS market by 2020. Despite a late starter, China has seen gradual increase in the penetration of TPMS and substantial growth in TPMS market for consumers are more demanding on car safety performance. The installation rate of TPMS was about 27.3% and the TPMS OEM market 7.68 million sets or so in 2016.

Theoretical demand was 24.42 million sets in the Chinese TPMS OEM market in 2016 based on the country’s output of 24.42 million passenger cars, indicating a huge gap but also broad prospects for development. Propelled by the country’s mandatory TPMS standard, the installation rate in the Chinese TPMS OEM market will grow rapidly over the next couple of years, hitting an estimated 74.2% in 2021 on a market size of 23.22 million sets in 2021.

Global TPMS OEM market now is primarily dominated by Schrader, Continental, Pacific, ZF TRW and HUF, the five players holding a combined global market share of nearly 90% by virtue of technological superiority. Schrader, an undisputed bellwether, took an about 54.8% market share worldwide in 2017.

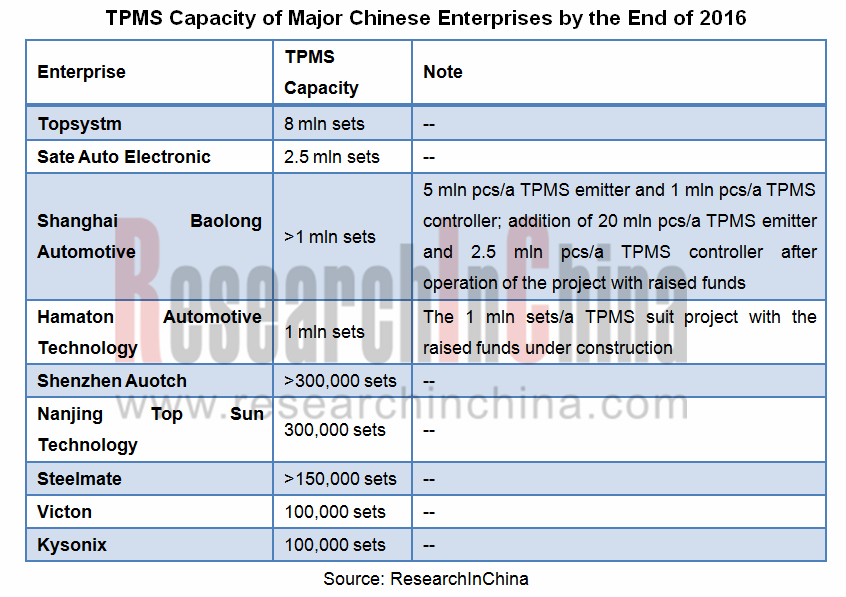

Although there are more than 100 local TPMS enterprises in China, only a dozen ones including Topsystm, Sate Auto Electronic, Shanghai Baolong Automotive and Hamaton Automotive Technology are capable of bulk supply.

For now, the TPMS on JV-branded cars is supplied by multi-national companies represented by Schrader, while local Chinese players gain an upper hand in supply of TPMS on homegrown car brands. However, as Chinese enterprises continue to improve their technologies, the typical company Shanghai Baolong Automotive and some other peers have begun providing TPMS for JV auto brands.

Global and China Tire Pressure Monitoring System (TPMS) Industry Report, 2017-2021 highlights the followings:

Global TPMS industry (development environment, status quo, market size/structure, competitive landscape, development in major countries/regions);

Global TPMS industry (development environment, status quo, market size/structure, competitive landscape, development in major countries/regions);

TPMS industry in China (development environment, status quo of technology/development, market demand, market penetration, market structure, competitive landscape, summary);

TPMS industry in China (development environment, status quo of technology/development, market demand, market penetration, market structure, competitive landscape, summary);

8 foreign, 25 Chinese mainland, 6 Taiwanese TPMS vendors and 5 TPMS sensor chip companies.

8 foreign, 25 Chinese mainland, 6 Taiwanese TPMS vendors and 5 TPMS sensor chip companies.

1 Overview of TPMS Industry

1.1 Definition

1.2 Classification

1.3 Function

1.4 System Composition

1.5 Production Process

2 Global TPMS Industry

2.1 Development Environment

2.2 Industry Status

2.3 Market Size

2.4 Market Structure

2.5 Competitive Landscape

2.6 Major Countries

2.6.1 USA

2.6.2 Europe

2.6.3 South Korea

2.6.4 Taiwan

3 China TPMS Industry

3.1 Development Environment

3.2 Technology Status

3.2.1 One-way TPMS

3.2.2 Two-way TPMS

3.2.3 BMBS Technology

3.2.4 Next-generation TPMS

3.3 Industry Status

3.4 Market Demand

3.5 Market Penetration

3.6 Market Structure

3.7 Competition

3.8 Summary

4 Foreign Companies

4.1 Schrader

4.1.1 Profile

4.1.2 TPMS Business

4.1.3 Development in China

4.2 Continental

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 TPMS Business

4.2.5 Development in China

4.3 ZF TRW (Former TRW Automotive)

4.3.1 Profile

4.3.2 Operation

4.3.3 TPMS Business

4.3.4 Business in China

4.4 Huf Group

4.4.1 Profile

4.4.2 TPMS Business

4.5 PressurePro

4.5.1 Profile

4.5.2 TPMS Business

4.6 Omron

4.6.1 Profile

4.6.2 Operation

4.6.3 TPMS Business

4.7 Pacific Industrial

4.7.1 Profile

4.7.2 Operation

4.7.3 TPMS Business

4.8 Denso

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.4 TPMS Business

5 Mainland Chinese Companies

5.1 Kysonix Inc.

5.1.1 Profile

5.1.2 TPMS Business

5.2 Shanghai Baolong Automotive Corporation

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Major Customers

5.2.6 TPMS Business

5.2.7 Development Strategy

5.3 Hamaton Automotive Technology Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Major Customers

5.3.6 TPMS Business

5.3.7 Development Strategy

5.4 Shenzhen Hangsheng Electronics Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 TPMS Business

5.5 Steelmate Co., Ltd.

5.5.1 Profile

5.5.2 TPMS Business

5.6 Shanghai Topsystm Electronic Technology Co., Ltd.

5.6.1 Profile

5.6.2 TPMS Business

5.7 Shenzhen Autotech Co., Ltd.

5.7.1 Profile

5.7.2 TPMS Business

5.8 Sate Auto Electronic Co., Ltd

5.8.1 Profile

5.8.2 TPMS Business

5.9 DIAS Automotive Electronic Systems Co., Ltd.

5.9.1 Profile

5.9.2 TPMS Business

5.10 Nanjing Top Sun Technology Co., Ltd.

5.10.1 Profile

5.10.2 TPMS Business

5.11 Beijing Sincode Science & Technology Co., Ltd.

5.11.1 Profile

5.11.2 TPMS Business

5.12 Shenzhen Autel Technology Co., Ltd.

5.12.1 Profile

5.12.2 Operation

5.12.3 TPMS Business

5.13 Ningbo Fuerda Smartech Co., Ltd

5.13.1 Profile

5.13.2 Operation

5.13.3 TPMS Business

5.14 China Auto Electronics Group Limited (THB Group)

5.14.1 Profile

5.14.2 TPMS Business

5.15 Huizhou Foryou General Electronics Co., Ltd.

5.15.1 Profile

5.15.2 TPMS Business

5.16 Yangzhou Kooan Electronic Technology Co., Ltd.

5.16.1 Profile

5.16.2 TPMS Business

5.17 VICTON Electronic Technology Co., Ltd.

5.17.1 Profile

5.17.2 TPMS Business

5.18 Jiangsu Yunyi Electric Co., Ltd

5.18.1 Profile

5.18.2 TPMS Business

5.19 Shanghai Aero-Care Electronic Technology Co., Ltd.

5.19.1 Profile

5.19.2 TPMS Business

5.20 Shenzhen Shenyongtong Industrial Co., Ltd.

5.20.1 Profile

5.20.2 TPMS Business

5.21 Others

5.21.1 Anhui Zhonghong Electronic Technology Co., Ltd.

5.21.2 Dongguan Saftire Automotive Safety Technology Co., Ltd.

5.21.3 LeTu Electronics Co., Ltd.

5.21.4 Guangdong LFF Technology Co., Ltd.

5.21.5 Shenzhen Careud Security Equipment Company Limited

6 Taiwanese Companies

6.1 Orange Electronic

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 TPMS Business

6.1.5 Development Strategy

6.2 Cub Elecparts Inc

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 TPMS Business

6.2.5 Development Strategy

6.3 TungThih Electronic

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 TPMS Business

6.3.5 Development Strategy

6.4 Mobiletron

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 TPMS Business

6.5 Luhai Holding Corp.

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 TPMS Business

6.6 E-Lead Electronic

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 TPMS Business

7 Sensor Chip Suppliers

7.1 Market Overview

7.1.1 MEMS Market

7.1.2 TPMS Sensor Market

7.2 GE

7.2.1 Profile

7.2.2 Operation

7.2.3 TPMS Solution

7.2.4 Business in China

7.3 Infineon

7.3.1 Profile

7.3.2 Operation

7.3.3 TPMS Solution

7.3.4 Business in China

7.4 NXP

7.4.1 Profile

7.4.2 Operation

7.4.3 TPMS Solution

7.5 Guangdong Hiway Integrated Circuit Technology Co., Ltd.

7.5.1 Profile

7.5.2 TPMS Solution

Relationship between Tire Pressure and Fuel Consumption

Automotive TPMS Manufacturing Process

Global Automobile Output and YoY Growth, 2010-2021E

Global Automobile Output by Region, 2010-2016

Global TOP20 Countries by Automobile Output, 2016

Regulations for Mandatory Installation of TPMS in Major Countries/Regions

Global TPMS OEM Market Size and Assembly Rate, 2010-2017E

Global TPMS OEM Market Size and Assembly Rate, 2016-2021E

TPMS Market Structure in Major Countries/Regions, 2017

Global TPMS OEM Demand Structure by Region, 2016&2021E

Competition Pattern of Global TPMS OEM Market, 2017

Supply Relationship between World’s Major TPMS Vendors and Automakers

TPMS OEM Market Size in the United States, 2010-2021E

TPMS OEM Market Size in EU, 2010-2021E

TPMS OEM Market Size in South Korea, 2010-2021E

TPMS OEM Market Size in Taiwan, 2010-2021E

Automobile Output and YoY Growth in China, 2011-2017

Automobile Sales and YoY Growth in China, 2011-2017

Automobile Output and Sales in China, 2016-2021E

Passenger Car Output and YoY Growth in China, 2011-2017

Passenger Car Sales and YoY Growth in China, 2011-2017

Passenger Car Output and Sales, 2016-2021E

Development History of China TPMS Industry

Evolution of Chinese TPMS Standards

Theoretical Demand for Passenger Car OEM TPMS in China, 2016-2021E

Theoretical Demand for Passenger Car OEM TPMS Emitter in China, 2016-2021E

Coverage of Automotive TPMS (by Price) in China, as of Oct.2017

Coverage of Automotive TPMS (by Grade) in China, as of Oct.2017

Coverage of Automotive TPMS (by Brand) in China, as of Oct.2017

Assembly Rate of OEM TPMS in China, 2011-2021E

TPMS OEM Market Size in China, 2011-2021E

TPMS Types of Major Global and Chinese Companies

TPMS Market Structure in China, 2015&2020E

Foreign Companies’ Layout of TPMS in China

TPMS Capacity of Major Chinese Enterprises, by End-2016

Supply Relationship between TPMS Vendors and Automakers in China

Comparison of Product Prices of Major Chinese TPMS Vendors

Global TPMS OEM Market Size by Country/Region, 2016-2021E

Global and Chinese Assembly Rate of OEM TPMS, 2016-2021E

Schrader’s Main Clients

Automakers and Their Models Supported by Schrader’s TPMS Products

Schrader’s Production Bases

Continental’s Global Presence, 2016

Continental’s Revenue and Net Income, 2013-2017

Continental’s Revenue Breakdown by Division, 2013-2017

Automakers and Their Models Supported by Continental’s TPMS Products

ZF’s Key Financial Indicators, 2015-2016

ZF’s Revenue Structure, 2016

Automakers and Their Models Supported by ZF TRW’s TPMS Products

Auto Models Supported by TPMS of TRW Auto Parts (Shanghai), 2015

Huf Group’s Main Clients

Huf Group’s Main OE TPMS Sensors and Application

Huf Group’s General-purpose TPMS Sensors and Application

PressurePro’s TPMS Sensors

PressurePro’s Milestones, 2014-2017

Omron’s Revenue, FY2014-FY2017

Omron’s Revenue by Division, FY2012-FY2016

Omron’s Revenue by Region, FY2012-FY2016

Automakers and Their Models Supported by Omron’s TPMS Products

Pacific Industrial’s Revenue and Operating Income, 2008-2017

Pacific Industrial’s Revenue by Region, FY2013-FY2017

Automakers and Their Models Supported by Pacific Industrial’s TPMS Products

Denso’s Revenue and Net Income, FY2014-FY2018

Denso’s Revenue by Region, FY2013-FY2017

Denso’s Revenue by Product, FY2016-FY2018

Denso’s Revenue by Region, FY2017-FY2018

Denso’s Revenue Structure by Client, FY2016-FY2018

Automakers and Their Models Supported by Denso’s TPMS Products

Equity Structure of Kysonix

Application of Main Products of Shanghai Baolong Automotive in Automobiles

Revenue and Net Income of Shanghai Baolong Automotive, 2014-2017

Revenue of Shanghai Baolong Automotive from Main Products, 2014-2017

Revenue Percentage of Shanghai Baolong Automotive by Product, 2014-2017

Operating Revenue of Shanghai Baolong Automotive (by Region), 2014-2016

Operating Revenue of Shanghai Baolong Automotive (by Market), 2014-2016

Revenue Structure of Shanghai Baolong Automotive (by Market), 2017H1

Gross Margin of Shanghai Baolong Automotive, 2014-2016

Gross Profit and Gross Margin of Shanghai Baolong Automotive (by Product), 2014-2016

Shanghai Baolong Automotive’s Revenue from Top 5 Customers and % of Total Revenue, 2014-2016

Homemade TPMS Product Testing and Certification of Shanghai Baolong Automotive

TPMS Revenue of Shanghai Baolong Automotive and % of Total Revenue, 2014-2017

TPMS Revenue of Shanghai Baolong Automotive (by Product), 2014-2016

TPMS Capacity, Output, Sales Volume and Average Price of Shanghai Baolong Automotive, 2014-2016

TPMS Transmitter Sales Volume of Shanghai Baolong Automotive, 2014-2016

TPMS Transmitter Unit Price of Shanghai Baolong Automotive, 2014-2016

Purposes of Funds Raised by Shanghai Baolong Automotive via IPO

Revenue and Net Income of Hamaton Automotive Technology, 2014-2017

Revenue of Hamaton Automotive Technology from Main Products, 2014-2017

Revenue Structure of Hamaton Automotive Technology by Product, 2014-2017

Operating Revenue of Hamaton Automotive Technology (by Region), 2014-2016

Operating Revenue of Hamaton Automotive Technology (by Market), 2014-2016

Operating Revenue Structure of Hamaton Automotive Technology (by Market), 2014-2016

Hamaton Automotive Technology’s Revenue from Independent Brands and OEM Production, 2014-2016

Product Categories, Sales Areas and Major Customers involved with OEM Production of Hamaton Automotive Technology

Gross Margin of Hamaton Automotive Technology (by Product), 2014-2017

Hamaton Automotive Technology’s Revenue from Top 5 Customers and % of Total Revenue, 2014-2016

TPMS Product Revenue as a Percentage of Total Revenue of Hamaton Automotive Technology, 2014-2017

TPMS Unit Price of Hamaton Automotive Technology, 2014-2016

TPMS Capacity, Output, Sales Volume, Capacity Utilization and Sales-Output Ratio of Hamaton Automotive Technology, 2014-2016

Ongoing R & D Projects and Progress of Hamaton Automotive Technology, as of the end of 2016

Purposes of Funds Raised by Hamaton Automotive Technology via IPO, 2017

Major Customers of Shenzhen Hangsheng Electronics Co., Ltd.

TPMS Series of Shanghai Topsystm Electronic Technology Co., Ltd.

Main Configurations of TPMS of Shanghai Topsystm Electronic Technology Co., Ltd.

Indexes of TPMS Product of Shenzhen Autotech Co., Ltd.

Technical Parameters of TPMS of United Automotive Electronic Systems

Development Course of Nanjing Top Sun Technology

Revenue of Shenzhen Autel Technology (by Product), 2013-2015

Output and Sales Volume of Shenzhen Autel Technology, 2013-2015

TPMS Series of Shenzhen Autel Technology

TPMS Specifications of Shenzhen Autel Technology

Branches of Ningbo Fuerda Smartech

Major Customers of Ningbo Fuerda Smartech

Revenue and Net Income of Ningbo Fuerda Smartech, 2016-2017

Main Business and Production Bases of China Auto Electronics Group Limited

Global Presence of China Auto Electronics Group Limited

Business of Huizhou Foryou General Electronics Co., Ltd.

Main Configurations of TPMS of Huizhou Foryou General Electronics Co., Ltd.

Main Configurations of TPMS of Yangzhou Kooan Electronic Technology Co., Ltd.

TPMS Products of VICTON Electronic Technology Co., Ltd.

TPMS Products of Shanghai Aero-Care Electronic Technology

Main TPMS Products of Shenzhen Shenyongtong Industrial

Main Parameters of TPMS Sensor of Shenzhen Shenyongtong Industrial

Main TPMS Products of Anhui Zhonghong Electronic Technology

Main TPMS Products of Dongguan Saftire Automotive Safety Technology

Key Partners of Dongguan Saftire Automotive Safety Technology

Revenue and Net Income of Orange Electronic, 2013-2017

Revenue of Orange Electronic (by Region), 2015-2016

Revenue of Orange Electronic (by Customer), 2015-2016

Sales Volume and Revenue of Orange Electronic (by Product), 2015-2016

Main TPMS Products and Applications of Orange Electronic

Capacity, Output and Output Value of Orange Electronic (by Product), 2015-2016

Revenue and Net Income of Cub Elecparts Inc, 2013-2017

Revenue Structure of Cub Elecparts Inc (by Product), 2015-2016

Revenue Structure of Cub Elecparts Inc (by Region), 2015-2016

Revenue Structure of Cub Elecparts Inc (by Customer), 2015-2017

Capacity, Output and Output Value of Cub Elecparts Inc (by Product), 2015-2016

Sales Volume and Revenue of Cub Elecparts Inc (by Product), 2015-2016

TPMS Capacity, Output and Sales Volume of Cub Elecparts Inc, 2015-2016

Revenue and Net Income of TungThih Electronic, 2013-2017

Revenue Structure of TungThih Electronic (by Region), 2015-2016

Production Bases of TungThih Electronic

Revenue and Net Income of Mobiletron, 2013-2017

Revenue Structure of Mobiletron (by Region), 2015-2016

Revenue and Net Income of Luhai Holding Corp., 2013-2017

Revenue Structure of Luhai Holding Corp. (by Application), 2015-2016

Revenue Structure of Luhai Holding Corp. (by Region), 2015-2016

Revenue and Net Income of E-Lead Electronic, 2013-2017

Revenue Structure of E-Lead Electronic (by Region), 2015-2016

Global Market Size of Automotive MEMS Sensors, 2014-2022E

Ranking of Top 10 Automotive MEMS Suppliers Worldwide, 2014-2015

Financial Data of GE, 2014-2016

Revenue Structure of GE (by Region / Division), 2016

Major Customers of Infineon

Operating Results of Infineon, FY2016- FY2017

WPG Holdings Silicon Application Corp. Group’s TPMS Solutions Based on Infineon SP37

NXP’s Revenue and Gross Profit, 2013-2016

NXP’s Revenue Structure (by Division), 2016

TPMS Chip Specifications of Guangdong Hiway Integrated Circuit Technology

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...