Research on ADAS and Telematics of SAIC Motor Passenger Vehicle Company, 2017

SAIC Motor Passenger Vehicle Company, the object of study in this report, is a wholly-owned subsidiary of SAIC Motor Corporation Limited and undertakes R&D, manufacturing and sales of self-owned brands. The company now has two brands, namely ROEWE and MG. It began implementing the strategy of going electric, intelligently-connected, sharing and global in 2017 with more efforts for driver assistance functions and telematics functions, a move that drove annual sales up 62% to 522,000 units.

In telematics field, SAIC Motor Passenger Vehicle has advanced aggressively, seeing 389,123 units installed with telematics system in 2017, a year-on-year surge of 160.97%, far higher than overall growth rate of 33.60% in the Chinese telematics market, on an installation rate of 81.2%, well above the overall level (24.1%) in the country, with market share rising by 3.70 percentage points over 2016.

One of the biggest highlights of the Internet car is that the independent in-vehicle operating system- AliOS (previously YunOS for Car) is co-developed with Alibaba. Sales of the Internet cars carrying AliOS exceeded 200,000 units in 2017, becoming a major engine for sales growth in recent years. There are 10 SAIC models with AliOS, delivering 4G, OTA, voice interaction, in-vehicle payment, driver talkback and access to peripherals (camera and UAV), and also integrating with Alibaba payment (smart refueling, smart parking), navigation (big data-based active navigation), mobility (Fliggy), and entertainment (Xiami Music and Qingting FM).

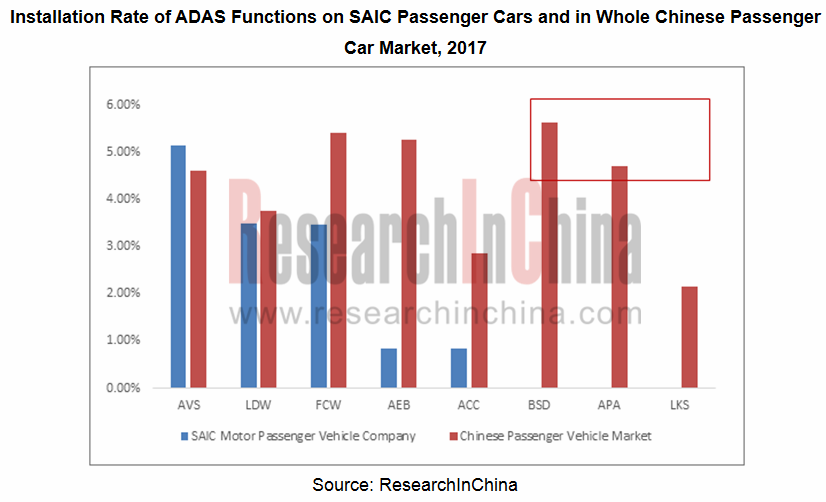

With regard to ADAS, warning functions prevail, mainly LDW and FCW. Newly-unveiled AEB and ACC are largely seen on top-of-the-line models with few installations. Camera supports realization of these functions: LDW, LKS, AEB and ACC are based on monocular camera and around-view parking system (AVS) relies on four surround-view cameras.

SAIC Motor Passenger Vehicle started from Level-3 in the autonomous driving field, aiming to realize fully automated driving on expressways in 2020 and make autonomous driving in complex environment come true in 2030. The company began road test in 2015 and has so far run a test mileage of more than 20,000 km cumulatively.

Prototype car tested: MG GS;

Main hardware: 16-beam LiDAR, MMW radar;

Key functions: automatic steering, automatic turnaround, automatic navigation, automatic parking, intersection traffic, Stop&Go, etc.;

Test sites: Shanghai (China), California (USA)

SAIC Motor was granted with permits for road test in California in June 2017 and in Shanghai in March 2018, making for its autonomous driving and telematics test & development in the future.

SAIC Motor Passenger Vehicle is now developing towards fusion of electrification, connection, intelligentization and sharing, and will increase AliOS installations as concerns telematics and seek for a deeper integration with Alibaba’s ecosystem. Also, the Company will collaborate with Huawei and China Mobile in 5G field. In respect of ADAS development, priorities will be given to AEB, ACC and APA. MMW radar is anticipated to be used for advances in autonomous driving.

Research on ADAS and Telematics of SAIC Motor Passenger Vehicle Company, 2017 by ResearchInChina highlights the followings:

ADAS configurations, system installation rate, the rate of models with ADAS, market share, major partners;

ADAS configurations, system installation rate, the rate of models with ADAS, market share, major partners;

Progress in the road test of autonomous driving and development planning;

Progress in the road test of autonomous driving and development planning;

Telematics overview, features, installations, installation rate, market share;

Telematics overview, features, installations, installation rate, market share;

DCM installations, installation rate, market share, development characteristics;

DCM installations, installation rate, market share, development characteristics;

Installations, installation rate, market share and features of cellphone-vehicle interconnected function;

Installations, installation rate, market share and features of cellphone-vehicle interconnected function;

Partners in ADAS, autonomous driving and telematics.

Partners in ADAS, autonomous driving and telematics.

Note: Similar reports are listed below:

- Research on ADAS and Telematics of Changan Automobile, 2017

- Research on ADAS and Telematics of GAC, 2017

- Research on ADAS and Telematics of BYD, 2017

- Research on ADAS and Telematics of Audi, 2017

- Research on ADAS and Telematics of BMW, 2017

- Research on ADAS and Telematics of GM, 2017

- Research on ADAS and Telematics of Hyundai, 2017

- Research on ADAS and Telematics of BAIC, 2017

- Research on ADAS and Telematics of Toyota, 2017

- Research on ADAS and Telematics of Honda, 2017

- Research on ADAS and Telematics of Dongfeng Motor, 2017

- Research on ADAS and Telematics of Geely, 2017

- Research on ADAS and Telematics of Ford, 2017

- Research on ADAS and Telematics of Great Wall Motors, 2017

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...